Top 10 in Asia Student Paper Competition (ASPC) 2022

Two students from Lee Kong Chian Faculty of Engineering and Science (LKC FES) won the top 10 places in the Asia Student Paper Competition (ASPC) 2022, organised by Universitas Islam Indonesia, via Zoom on 23 July 2022.

Bachelor of Science (Honours) Actuarial Science student She Kah May won third place, RM300 cash prize, and a certificate. She enthused, “Joining the competition was certainly a step out of my comfort zone but I focused on sharing my research findings which I believe was a factor in winning the judges’ hearts. I am grateful to my supervisor for the guidance and support I received. I am also thankful to be given this opportunity, and to UTAR for their constant encouragement for students to participate in these competitions to enhance our learning. It was truly a rewarding experience and the values I gained have also motivated me to explore further from my comfort zone.”

She’s award certificate

Her award-winning research was titled Portfolio Analysis Using Malaysia Stock Market Data: Before and During Covid-19 Pandemic. She explained, “This study attempts to evaluate Malaysia’s stock performance before and during COVID-19 across all sectors by using the Sharpe ratio and Sortino ratio with risk measured by standard deviation. We developed an algorithm for stock selection to construct the portfolio investment. In our study, we applied the Sharpe ratio, Treynor ratio and Jensen’s alpha to identify the optimal portfolio. The result showed that the portfolio with stock selection based on the Top 20 Sortino ratio from all stocks is superior to stock selection based on the Top 3 Sortino ratio for each sector. The daily adjusted closing stock prices were collected from 1March 2019 to 31 December 2021. The result of this study indicates that several sectors were not affected during the COVID-19 pandemic. The sectors include Technology, Industrial, Consumer Products and Services and Property. Hence, investors were suggested to form an optimal portfolio investment based on these sectors. Stock analysts were recommended to imply various risk-adjusted measures to evaluate the portfolio performance with a comprehensive perspective to support the outcome analysis.”

Her research also aimed to get better insights into investment knowledge by studying how investment is done and how the returns are calculated. With financial literacy in investment, decisions on budgets, debts and investing can be done more confidently. It protects one from falling into investment fraud.

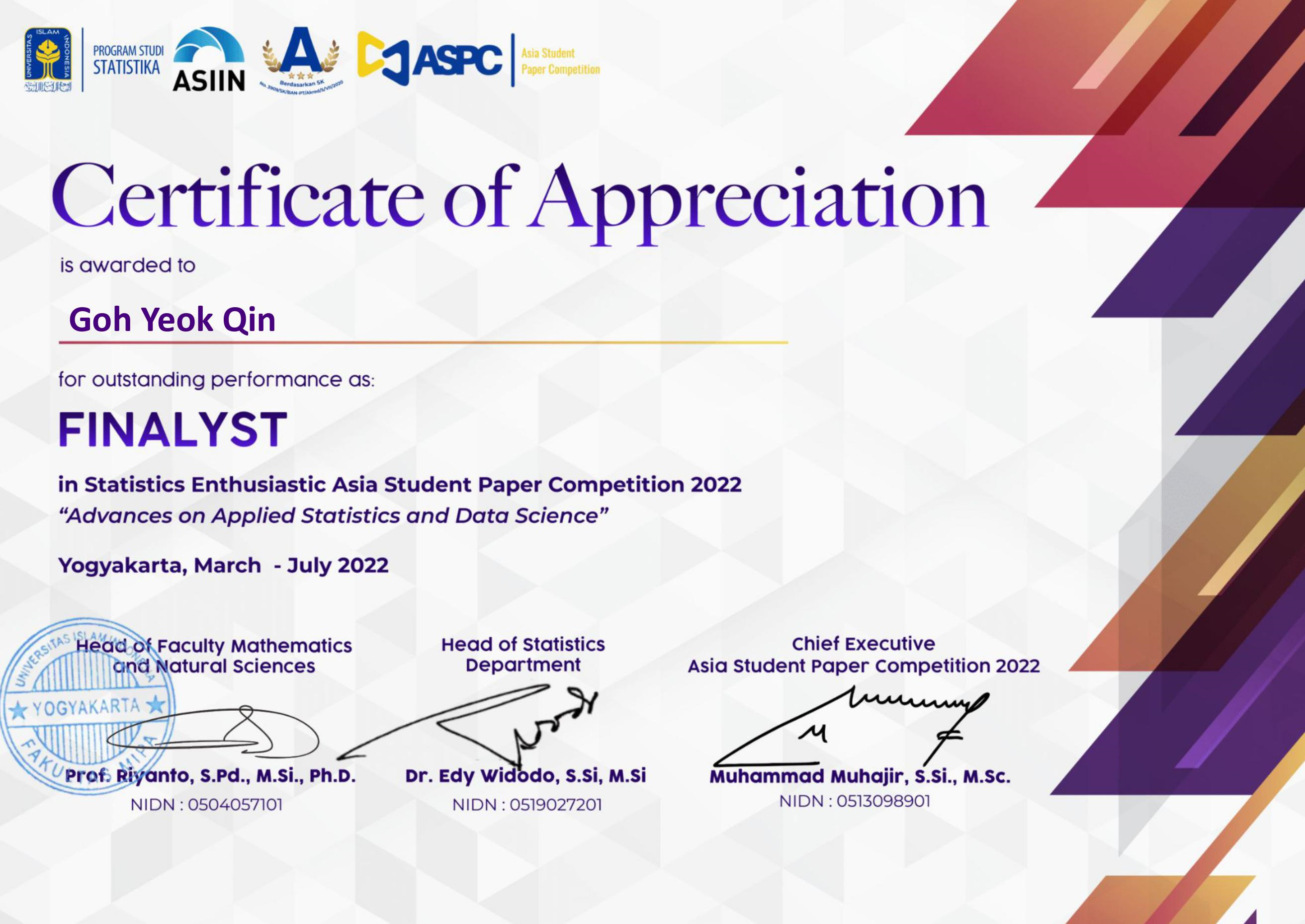

Goh’s certificate

Meanwhile, Bachelor of Science (Honours) Actuarial Science student Goh Yeok Qin won the honourable prize of RM200 and a certificate for securing her place as the top 10 finalists. Her research was titled Performance of Three-Parameters Dirichlet Universal Portfolio during COVID-19 Pandemic.

She explained “In this paper, we study the performance of the three-parameters Dirichlet universal portfolio on selected stocks during the COVID-19 pandemic. Some empirical results were obtained based on some selected data sets from the local stock exchange. The period of trading of the stocks was selected from 2nd January 2020 to 18 August 2021. It consisted of 400 trading days. The empirical results seemed to indicate that the three-parameter Dirichlet universal portfolio performed well during the COVID-19 pandemic by a proper choice of parameters. Also, this study provides evidence that the capital achievement at the end of the 400th trading day was influenced by the arrangement of the stocks within each selected data set. Besides, the performance of the homogeneous datasets, particularly, the main data set from the healthcare sector, is better than heterogeneous datasets during the COVID-19 pandemic.”

Her research aimed to investigate whether this investment strategy could help investors to earn profits or prevent substantial financial losses during the COVID-19 outbreak when the financial market is not stable and fluctuates all the time.

© 2022 UNIVERSITI TUNKU ABDUL RAHMAN DU012(A).

Wholly owned by UTAR Education Foundation (200201010564(578227-M)) LEGAL STATEMENT TERM OF USAGE PRIVACY NOTICE