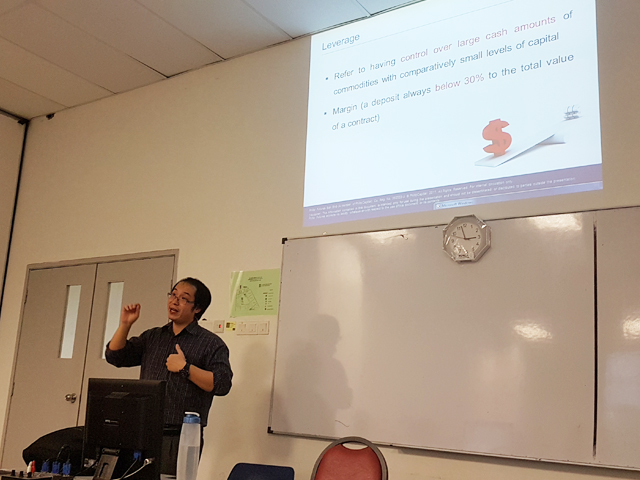

Ng explaining the leverage of Future contracts

The Centre for Mathematical Sciences (CMS) parked under the Lee Kong Chian Faculty of Engineering and Science (LKC FES) organised two phases of talk, one titled “Derivatives Overview and Investor Awareness”, the other “Practical Aspects of Derivatives” at Sungai Long Campus on 7 August 2017.

This talk was designated to give the participants an insight into developing their own set of perception and angles in an overviewed interpretation of the financial trading industry while at the same time, educate the participants on the use of derivatives by financial traders.

Present at the talk were CMS Chairperson Dr Goh Yong Kheng and LKC FES Dr Lai An Chow, along with lecturers, staff and students.

“Furthermore, this talk is also aimed for participants who are just starting out in learning how to analyse and review financial-industry related case studies. In order to review these case studies, it is a requirement that they know the basics of the trading derivatives within the trading market. Without the basics, they are likely to be confused while reviewing those case studies,” said Dr Goh.

The speaker who conducted the two-hour informative talk was David Ng Heng Soon. He earned his Bachelor's degree in Economics and Social Sciences from the University of Manchester and is currently a Senior Derivatives Product Specialist at Phillip Futures Sdn Bhd, the first futures contract brokingcompany in Malaysia to provide an online trading platform on Bursa Malaysia Derivatives Exchange and Foreign Specified Exchanges products. His main objective for the participants was to truly understand the concept of how derivatives work within the futures market.

Ng during the talk

David Ng began his talk by giving the participants a rundown on “futures”, a financial term that normally refers to a form of derivative contract or financial contract that normally involves two parties (the buyer and the seller) that have reached an agreement to transact any specific type of asset, which normally involve a form of physical commodity or financial instrument at a predetermined future date and price. He then broadens the subject by briefing the types of “futures” commonly used by traders before explaining what they need to be aware of before entering a “futures” contract.

“When you look at the leverage of a contract, leverage becomes the stepping stone for anyone before they approach the market. It gives you the insight as to which marketing approach will work positively for anyone’s benefit, turning it from a good trade into great trades. However, if you don’t know how to use it, it will give you a bad trade. This is why leverage must be used cautiously,” said Ng.

Following phase two of the talk, he illustrated the factors that influence the “futures” and options market through his slides. He also pointed out the positive and negative signs that will be apparent in the future markets and brought awareness of its benefits and risk by comparing the differences between the “futures” market and the stock market.

“In Malaysia’s stock market, short selling in the contract is out of the question. In “futures” market, the options for both parties is limitless. It allows you to sell low, and buy low, or even the option of selling low to gain profit. This is the most important aspect about “futures”. The agreement between both parties can be negotiated and tailored in the contract, to a certain degree both parties are satisfied with the outcome.” he explained.

The talk ended with a Q&A session, followed by the presentation of the token of appreciation to the speaker Ng by Dr Lai.

Ng (left) receiving token of appreciation from Dr Lai (right)

© 2019 UNIVERSITI TUNKU ABDUL RAHMAN DU012(A).

Wholly owned by UTAR Education Foundation Co. No. 578227-M LEGAL STATEMENT TERM OF USAGE PRIVACY NOTICE