Faculty of Accountancy and Management (FAM) and Centre for Sustainable Development & Corporate Social Responsibility (CSDCSR) organised a talk titled “Role of Financial Sector Development in the FDI-Growth Nexus in Pacific Islands: A Case Study of Fiji” at Sungai Long Campus on 7 August 2017.

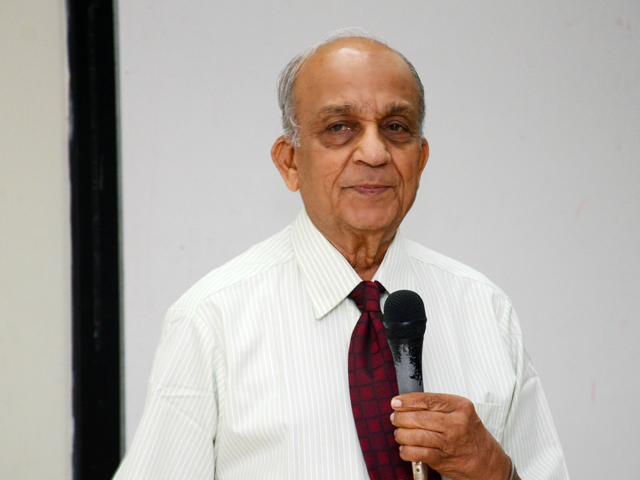

Invited to deliver the talk was Professor Dr Tiru K. Jayaraman, professor in the School of Economics, Banking and Finance, Fiji National University (FNU), Nasinu Campus, Suva, Fiji Islands.

Prof Tiru remarked, “Foreign Direct Investment (FDI) helps reducing risks faced by imitating domestic firms, while Financial Sector Development (FSD) promotes FDI absorptive capacity of the host country. Research shows that positive growth exists when FSD (as percentage of GDP) exceeds a threshold. FDI supplements domestic savings and management capacities through the transfer of skills. FSD reduces risks involved in investment decisions by domestic investors who innovate along the lines of foreign entrepreneurs through imitation.”

He also said, “Amongst non-debt external capital inflows, FDI is the most constructive one. It is also less volatile and less prone to sudden withdrawal, unlike hot money. FDI seeks long term returns and helps the transfer of new technology.”

“Our finding said FDI has compensated for the inefficiency of FSD because it is a funding source for investment. We also found that FDI and quasi-money are positively associated with growth. An interaction term turn out with a negative sign indicating that the marginal impact of FDI on growth is decreasing with financial development level. Since it is found statistically significant, the conclusion is beyond doubt that FDI and quasi-money act as substitutes in the growth nexus and that there is no complementary relationship between them. Thus, FSD in Fiji is shallow, despite considerable progress made in recent years under the financial inclusion efforts launched by the government,” he added.

He is a Professor in the School of Economics, Banking and Finance, Fiji National University (FNU), Nasinu Campus, Suva, Fiji Islands. Before joining FNU, he taught at the University of the South Pacific (USP), Suva, Fiji Island for about 14 years until August 2012. Earlier, he was a Post-Doctoral Research Scholar Macmillan Brown Centre for Pacific Studies, University of Canterbury, Christchurch, New Zealand. (Aug 1997-June 1998) and a Senior Economist at the Manila-based Asian Development Bank (ADB) for more than 15 years. He holds Master of Arts and Doctor of Philosophy from University of Hawaii, Hawaii. His research paper on Determinants of Foreign Direct Investment in the South Pacific Island Countries: a case study in Fiji was adjudged the Best Conference Paper at the Second Conference on Globalization, Technology and Development, held at the University of Arab Emirates, Al Ain, December 2005. His article on Economic Integration in the Pacific: A Review of Past Efforts and Future Prospects won the Vice-Chancellor's (Inaugural) 2008 Prize for Best Staff Research Publication. He has to his credit of more than 100 published papers, analytical articles and newspaper columns on Monetary Economics, Economic Integration, Single and Common Currency for the Pacific and Regional Integration. He was a Visiting Lecturer for MBA program, The University of the South Pacific (1997) and Visiting Lecturer, University of Hawaii, Honolulu, Hawaii (Summer 1996, 1997, 1998, Spring 2002 and Summer 2003). He is now holding association as International Collaborative Partner, Global Research Network Program, UTAR, Malaysia, and associations in University of Hawaii and Reserve Bank of Fiji.

Prof Tiru

FAM R&D and Postgraduate Programmes Deputy Dean Assoc Prof Dr Kevin Low Lock Teng (right) presenting a token of appreciation to Prof Tiru

© 2019 UNIVERSITI TUNKU ABDUL RAHMAN DU012(A).

Wholly owned by UTAR Education Foundation Co. No. 578227-M LEGAL STATEMENT TERM OF USAGE PRIVACY NOTICE