From left: Liang, Appadu, Goy and Nalini with the participants

The Centre for Foundation Studies (CFS) organised a talk titled “Goods and Services Tax (GST): Is it good or bad for Malaysia?” on 7 July 2017 at Sungai Long Campus.

The talk was presented by Appadu Santhariah, a former official of Bank Negara and Customs. Present at the talk were Department of Management and Accountancy Head Goy Ling Ling, CFS lecturers Nalini Panneer Selvan, Liang Chooi Ling, UTAR staff and students.

The talk aimed to highlight the importance of GST to Malaysian Economy by deepening the students understanding of the structure and the design of GST as well as to address the major current issues businesses perceive as key challenges in preparing for the GST.

Appadu began the talk by explaining the definition of GST which is also known as Value Added Tax (VAT) in other countries. He said, “The abbreviation GST stands for ‘Goods and Service Tax’. Goods are anything that is tangible. Services on the other hand, are intangible. When you go to a hotel and they serve you, that’s called service. In some countries, like in Europe, it is called VAT. This is because when the goods move from the manufacturing company to another place, it keeps adding value, hence it’s called VAT.”

To give a better illustration of what GST is, also how and why it came about, Appadu divided the audience into two groups, one larger than the other. The smaller group of audience represented the ‘income tax people’ whereas the larger one represented the ‘GST people’. Referring to the smaller group of audience, he said, “The income tax people are the minority group and the Government was not raising enough revenue from them. To increase the revenue of the country, the Government introduced GST. It is not only happening here in Malaysia but all over the world.”

He also emphasised that GST is not the only reason for price hike-up. “There are various reasons to why prices increase but GST is merely one of the reasons, not the sole reason,” said Appadu. He went on to explain that the revenue collected from GST will be used to build schools, increase the facilities of the hospitals, provide incentives and many more which will eventually enhance the lives of all Malaysian citizens.

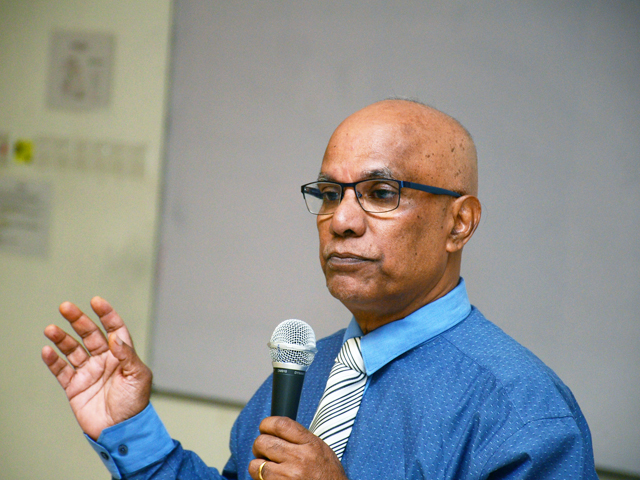

Appadu

“The talk was very beneficial for the students as it revolves around their daily expenditure. The presenter's knowledge and information were shared very precisely with the audience and everyone enjoyed listening to the info given. I believe now they would have understood the importance of GST and the opportunities it has to offer,” said Nalini.

Appadu has given various presentations previously with topics related to Malaysian GST. Some of the topics covered were “GST fraud due to the implementation of GST in Malaysia”, “Potential issues due to the implementation of GST in Malaysia” and “GST issues based on research findings of Masters in Taxation Degree UNSW, Sydney”, just to name a few. He spent the last 30 years working as a Financial Controller in Malaysia, United Kingdom, New Zealand and Australia where he was actively involved in the implementation of VAT and GST.

The talk ended with a brief Q&A session.

Goy (left) presenting a token of appreciation to Appadu (right)

© 2019 UNIVERSITI TUNKU ABDUL RAHMAN DU012(A).

Wholly owned by UTAR Education Foundation Co. No. 578227-M LEGAL STATEMENT TERM OF USAGE PRIVACY NOTICE