With the aim to enlighten participants on tax incentives, company taxation, personal taxation, and significant non-tax related matters, a talk on Budget 2019 was organised by Centre for Extension Education (CEE) on 21 November 2018 at Kampar Campus. The invited speakers were Faculty of Business and Finance (FBF) academics from the Department of Commerce and Accountancy Tan Swee Kiow and Wong Tai Seng.

Tan highlighting the focus of Budget 2019

Tan, the first speaker at the talk, gave a brief introduction about Budget 2019 and mentioned that the focuses of Budget 2019 are to implement institutional reforms, to ensure the socio-economic well-being of Malaysian and to foster an entrepreneurial state.

She also elucidated to the participants on the Ministry of Health’s initiatives to fix a target of a “Smoke-free Malaysia” by year the 2045. She explained that the Ministry will expand the number of locations where smoking will be prohibited including restaurants or eateries, starting 1 January 2019.

Under health, participants were also informed of the RM10.8billion allocation to provide medicine, and to upgrade the facilities of hospitals. RM20million will also be allocated for women’s check-up, which includes free mammogram, HPV and Pap smear tests. RM50million will be allocated for the specific purpose of treating rare diseases such as Hepatitis C, addressing stunting among children, and providing more haemodialysis screenings and treatments.

Tan also mentioned that the education sector received the highest allocation, with the purpose to provide food, books and for the maintenance of schools. She also highlighted that, for the first time, RM12million will be allocated to Chinese private secondary schools.

Wong explaining about income tax

The second speaker, Wong spoke on income tax. He started with the reduction in corporate tax rate for Small Medium Enterprises (SMEs) from 18% to 17% for the first RM500,000 of chargeable income. The balance will continue to be taxed at 24%. He continued explaining about the timeline to unutilised business, capital, allowance and various incentive allowances which has now been limited to seven years of assessment.

He also mentioned about the tax incentives for employers who employ senior citizens and ex-convicts, as well as for employers who repay employees’ PTPTN loans. Wong pointed out that there will be an increase in tax relief for savings in SSPN from RM6,000 to RM8,000, and review of income tax relief on contributions to unapproved provident fund, takaful or life insurance premiums.

Another point highlighted by Wong was the investigation into unexplained extraordinary wealth, whereby the IRB will take necessary measure permitted by the law to recover such monies, whether in the form of additional taxes, penalties or fines. Wong shared with the participants on the tax deduction for contribution to social enterprises as well as the changes to the real property gains tax rates, which was the increase in stamp duty exemption for the purchase of first residential home.

The other aspect covered by Wong was service tax, which included information on the treatment of service tax on imported services for the purpose of increasing government’s income and maintaining local business competitiveness. The few last points brought up by Wong were the abolishment of the flat tax election under LBATA, sugar-sweetened beverage duty and Airport departure levies. The airport departure levies will be imposed on all outbound travellers by air, at the proposed rates of RM20 for outbound travellers to ASEAN countries and RM40 to countries other than ASEAN.

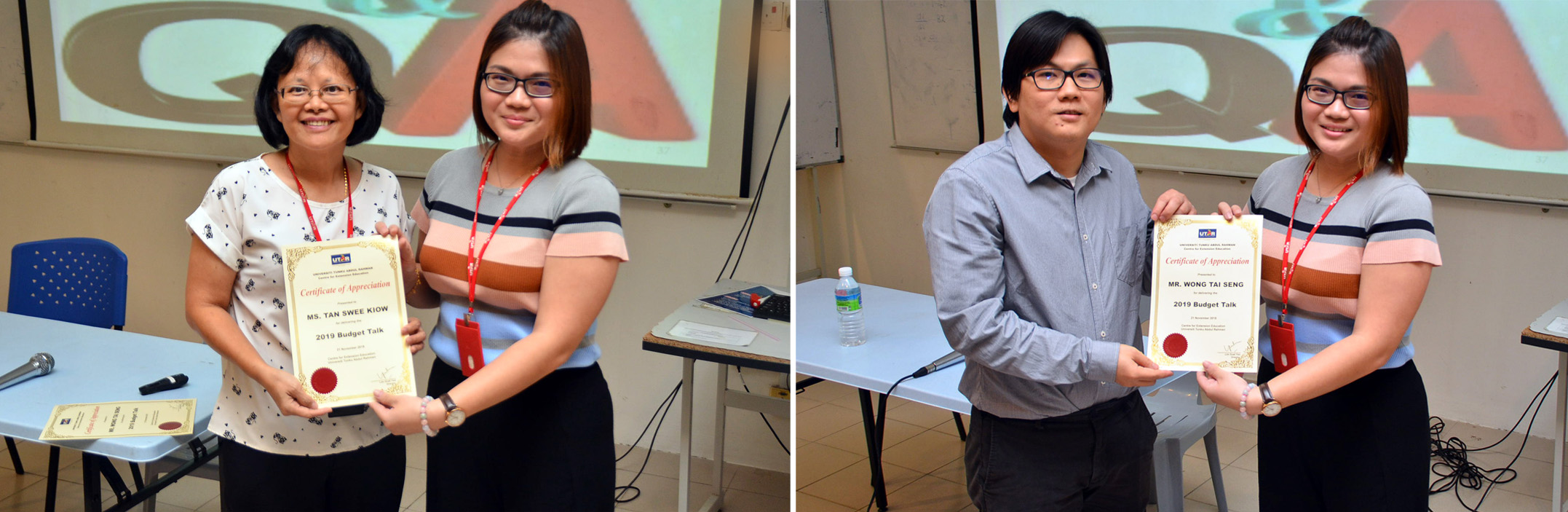

From left: CEE Ho Mei Kei, representing CEE Kampar Head Mohd Faizul bin Ahmad, presenting the certificates to Tan and Wong

© 2019 UNIVERSITI TUNKU ABDUL RAHMAN DU012(A).

Wholly owned by UTAR Education Foundation Co. No. 578227-M LEGAL STATEMENT TERM OF USAGE PRIVACY NOTICE