The Centre for Accounting, Banking and Finance (CABF) parked under the Faculty of Business and Finance (FBF) organised a talk titled “GST to SST v2.0: The New Mechanism and Transitional Issues” on 28 August 2018 at Kampar Campus.

The talk was jointly delivered by lecturers from FBF Department of Commerce and Accountancy, Theresa Wong Lai Har, Tan Swee Kiow and Wong Tai Seng.

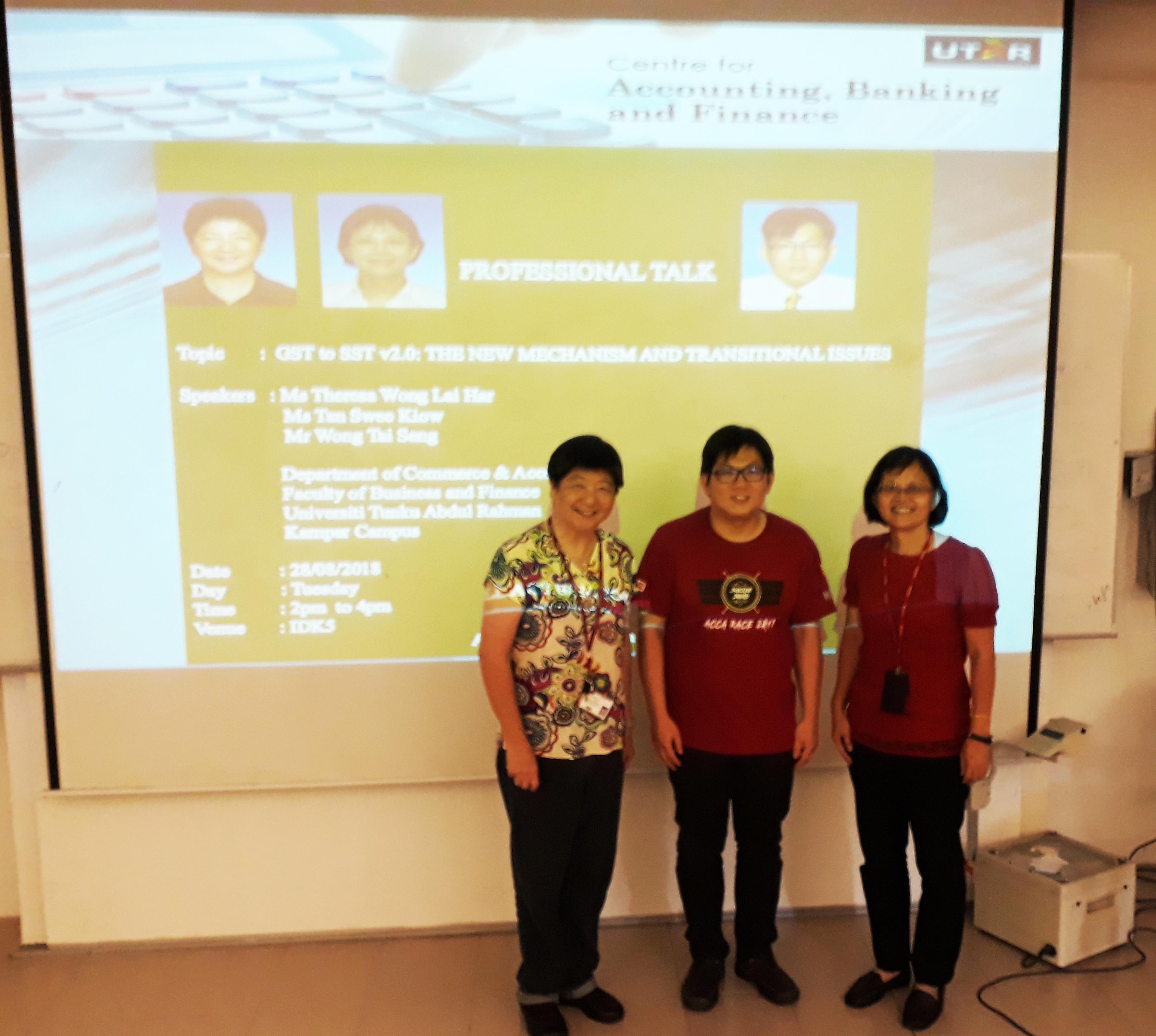

Speakers (from left) Lai Har, Tai Seng and Tan

Lai Har started the talk by highlighting the key features of Sales and Service Tax (SST) and its impact on consumers. She mentioned, “The re-introduction of SST takes effect on 1 September 2018 and replaces the six percent Goods and Services Tax (GST). SST is governed by two legislations which are the Sales Tax Act 2018 and Service Tax Act 2018. Sales tax of five percent or 10 percent is imposed on selected goods manufactured in Malaysia or imported into Malaysia while service tax of six percent is imposed on selected services.”

She explained that as sales tax is embedded into the price of goods, it has the inherent weakness of the cascading and compounding tax effects which were absent in GST. For service tax, one of the more ubiquitous services consists of food and beverage. She commented that operators with less than RM1million turnover would not charge service tax. This would give consumers the option whether to eat at places that do charge service tax.

Overall, Lai Har found that GST resulted in higher costs for individuals and companies alike. Companies which were GST registrants incurred expenditure on equipment and software to be GST compliant. For individuals, she provided a comparison showing that before GST, individual taxes (from income tax and SST) made up 19 percent of the Federal Government Revenue. This amount increased to 28 percent in 2015 when the GST was implemented in April 2015. Tax revenue from individuals was further increased to 35 percent and 36 percent for 2016 and first half of 2017 respectively when GST was fully implemented. However, income tax revenue collected from companies steadily decreased from 30 percent in 2014 to 27 percent by the second half of 2017. She concluded her presentation with highlights of GST closure stating that audits will be conducted to ensure that GST is collected before de-registering the GST registrants.

The next speaker, Tan explained some terminology relating to sales tax. A sales tax rate of five percent or 10 percent is imposed on manufactured goods. She explained that the term “manufacture” consists of the conversion of inorganic materials to the final product and that it includes the assembly of parts into the final product but excludes installation of equipment for the purpose of construction. Tan mentioned that the sales threshold for manufacturers to be registered and charge sales tax is RM500,000. For goods exempted from sales tax, Tan highlighted items that would be of interest to students at the talk. These exempt items include motorcycle below 250cc and e-bikes. Books, medicines and food items such as rice, cooking oil, coffee and bread are also exempted from sales tax.

Last but not least, Tai Seng presented the details to mechanisms on service tax. According to him, service tax of six percent is charged on the provision of taxable services and these services do not include imported and exported services. He explained that service providers providing taxable services exceeding the threshold of RM500,000 are liable to be registered. For the provision of food and beverage services, the threshold is RM1,000,000. For the issuing of credit cards, service tax at a specific rate of RM25.

The informative talk was followed by a lively Q&A session and ended with a group photography session.

Front row, from left: CABF Chairperson Dr Krishna Moorthy Manicka Nadar, Lai Har, Tai Seng and Tan with participants

© 2019 UNIVERSITI TUNKU ABDUL RAHMAN DU012(A).

Wholly owned by UTAR Education Foundation Co. No. 578227-M LEGAL STATEMENT TERM OF USAGE PRIVACY NOTICE