Front row: Lim (middle) and Dr Au Yong (second from left) with UTAR staff and students

Faculty of Business and Finance (FBF) together with Unovate Centre, parked under the Department of Consultancy and Commercialisation (DCC), jointly organised an entrepreneurial talk titled “Investment Banking and Case Studies” on 4 April 2019 at UTAR Kampar Campus.

Present at the talk were FBF Dean Dr Au Yong Hui Nee, DCC Assistant Manager Esther Thien Pik Kim, academics, staff and students. Invited to deliver the talk was Tony Lim Tong Lee. Lim is currently the chairman of the Audit Committee and ESOS Committee in LBS Bina Group Berhad. Lim is also a Fellow Member of Association of Chartered Certified Accountants, United Kingdom and a member of Malaysian Institute of Accountants and Malaysian Institute of Certified Public Accountants.

At the talk, Lim shared his personal career experiences of 30 years. He mainly focused on auditing, corporate finances, private equity and listed company directors and investors’ area. He also clarified the difference between a commercial bank and an investment bank, and also wholesale banking. He said “The commercial banks comprised of current accounts, savings accounts, fixed deposits, remittance, SME loans, housing loans, car loans and credit cards. Some of the banks that manage these processes in Malaysia are Maybank, CIMB Bank and Public Bank Berhad.”

In addition, he briefed about the investment banks, the corporate finance sector, debt capital market, corporate loans, fund management, private equity, venture capital, stock broking, equity research and private banking. Lim also listed the investment banks in Malaysia, namely JP Morgan, Morgan Stanley and Ambank. He then explained that the roles of the corporate finance were categorised into initial public offer (IPO), merger and acquisitions, fundraising and asset valuation.

Lim added, “The purpose of equity research is to support the stockbroking business and fund management as well as analysing the stock.” He then enlightened the participants on appropriate private banking for high network and how to invest in equity, bonds and property trust. He also advised the students to build a good relationship with the investors by having good media publicity, meet research analyst for discussion and meet potential investors for good funding purpose.

Thien said that the talk provided the students with new insights into investment banking and exposed them to other alternatives of career choices. She said, “The students gained knowledge on how the stock market works in Malaysia. I hope the sharing session will benefit the students and staff and will enable them to gain extra industrial knowledge apart from textbooks.”

The talk then ended with Q&A session followed by the presentation of token of appreciation by Dr Au Yong to Lim.

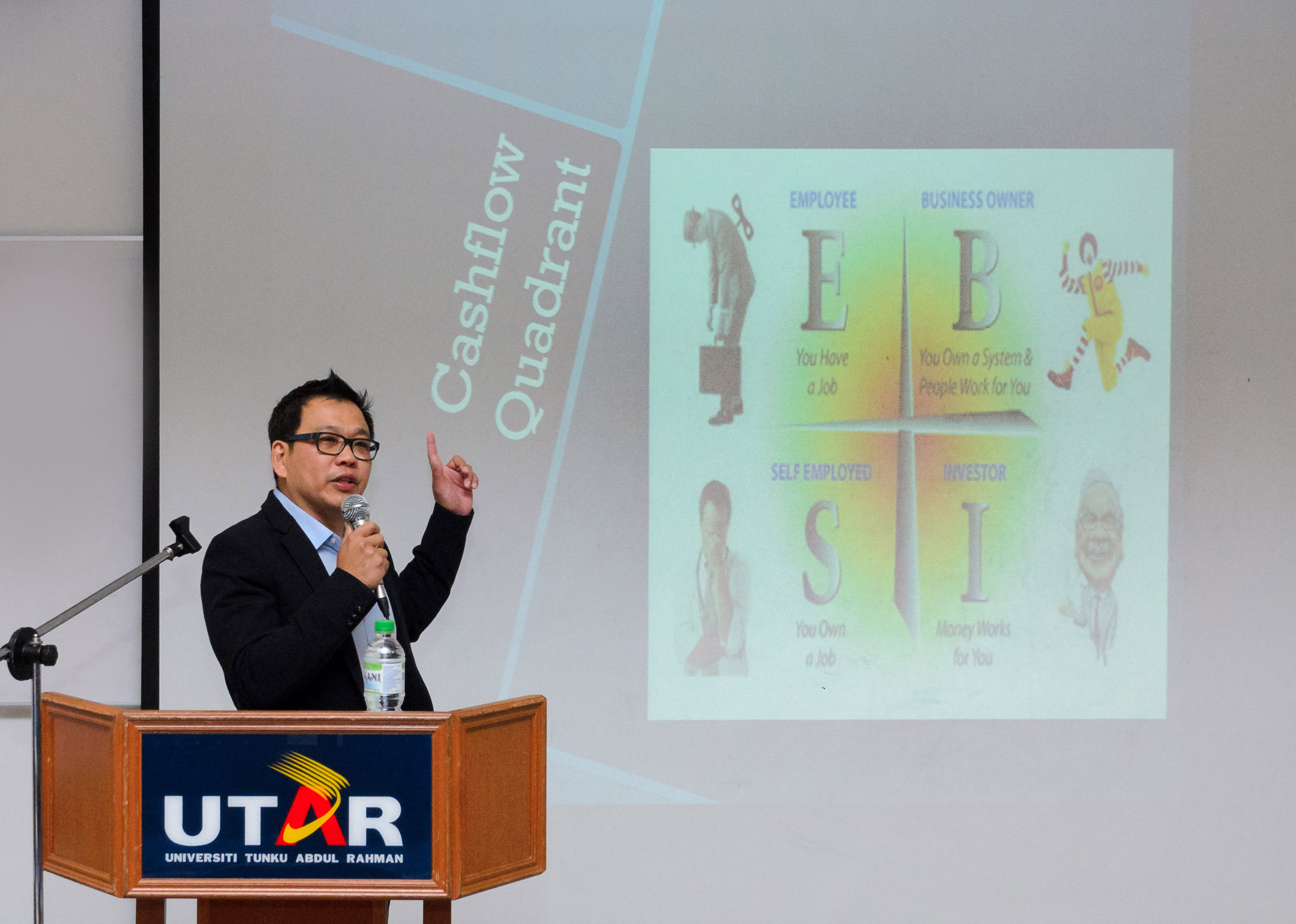

Lim explaining cash flow quadrant

Participants listening attentively

Q&A session in progress

Dr Au Yong (left) presenting the token of appreciation to Lim

© 2019 UNIVERSITI TUNKU ABDUL RAHMAN DU012(A).

Wholly owned by UTAR Education Foundation Co. No. 578227-M LEGAL STATEMENT TERM OF USAGE PRIVACY NOTICE