To ensure students and staff continue to gain knowledge during the conditional movement control order (CMCO), UTAR Centre for Corporate and Community Development (CCCD) conducted a virtual talk titled “Setting up will is not the finale but the beginning” on 27 May 2020 and 3 June 2020. The talk aimed to enhance the awareness of one’s mortality and the need to prepare for the unexpected.

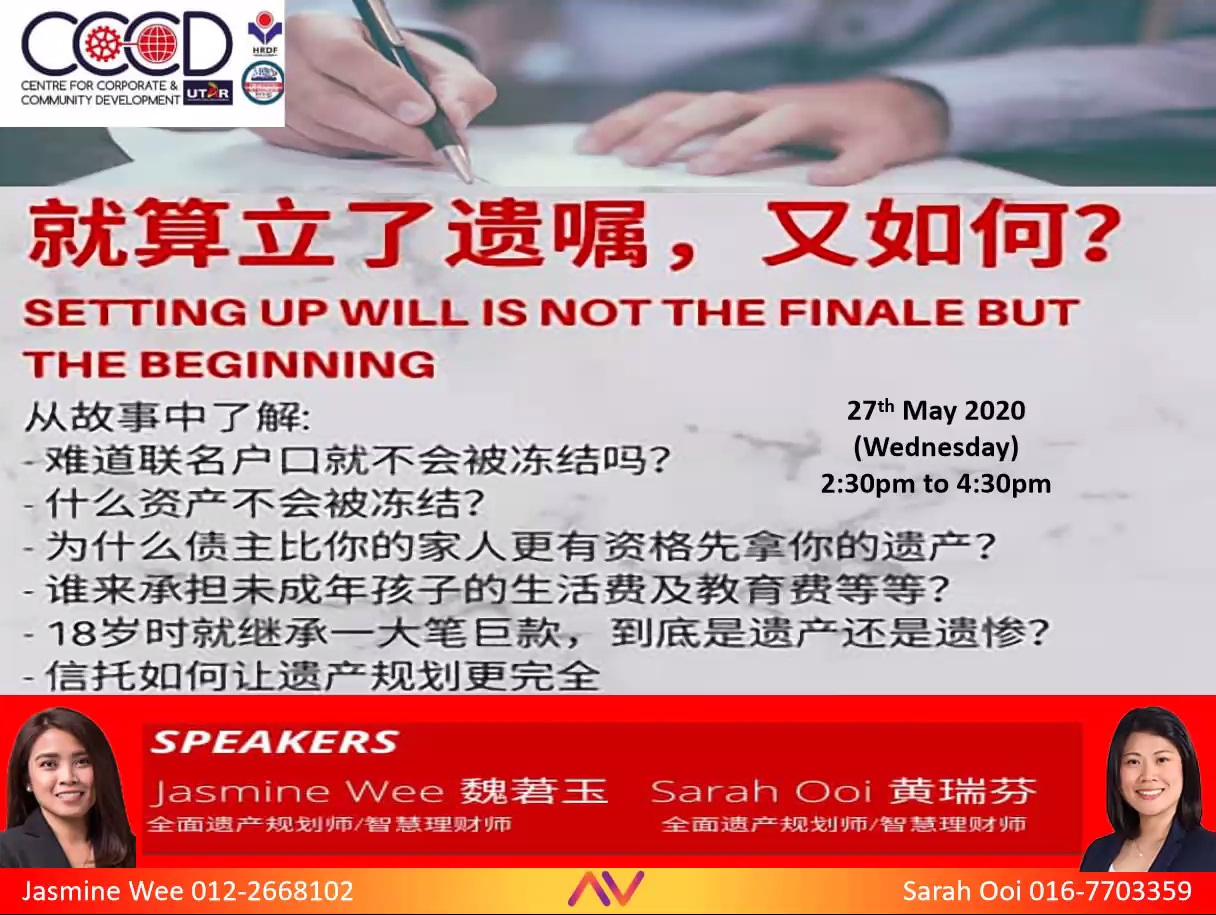

From left: Jasmine Wee and Sarah Ooi during the talk

The speakers for the talk were holistic estate planners Jasmine Wee and Sarah Ooi. Jasmine started the talk by highlighting the importance of understanding estate planning. She said, “It is more secure if knowing your affairs are in order, in case something happens.” She presented the difference between having a will and not having one, and explained that one has to go through the probate process either according to the decedent’s will or intestacy laws defaults which apply if they left without a will. Making a will can ensure the inheritance is distributed based on the wish of the deceased, and it can also speed up the entire claiming process. Without a will, the distribution process will be longer.

According to her, the assets of the deceased will be frozen after death and the frozen assets are normally comprised of immovable assets such as a house, shop lot, land, plantation and factory, as well as moveable assets such as car, stock or share, investment, unit trust, cash and bank. “What it does not include is EPF and life insurance because the monies will go to whoever you have nominated in your respective EPF account and insurance policies,” she explained. She then advised, “In order to distribute your estate to intended beneficiaries, you should make a proper and a valid will. Make sure your estate planning is able to protect your family and preserve your will.”

Jasmine shared that, as of February 2016, there were estates of deceased people worth RM60billion left unclaimed by their heirs. There were also more than RM300million worth of unclaimed insurance benefits. “The complicated procedure of applying for a division of property is one of the reasons why estates are left unclaimed,” she explained. She also stated that the wealth distribution will be used to clear outstanding debts first before it goes to the beneficiaries.

Furthermore, she stated that children under the age of 18 cannot inherit the inheritance. She said, “It is inappropriate to leave all your estates directly to your children even if they are 18 years old. They may still have no enough maturity to manage a large amount of money. This is why some parents in their estate planning establish trusts that their children cannot touch until they are older.” She also explained how to appoint a guardian to help protect the interests of children who are still minors and illustrated certain situations a guardian may be called upon when both parents are not dead.

Sarah, on the other hand, explained the benefits of establishing a trust. “A trust is created to manage your estate and dictate how your assets will be distributed after your death,” she said. According to her, there are two types of trust, which are testamentary trust and family trust or business trust. She also revealed the main differences between a will and a trust, saying that each provides exclusive protection and benefits. “You can use both in your estate plan,” she added.

She explained, “Rather than the deceased person’s assets going directly to beneficiaries, a trust can protect the assets by limiting beneficiaries’ access to the assets. For example, it is suitable for beneficiaries who could be easily deceived, bad at managing their finances or have an addiction that could cause them to squander the money.” She shared some real-alife stories of spendthrift beneficiaries, highlighting that tragedies can be avoided by establishing trust.

She also presented a quick comparison of will, without a will, testamentary trust and family trust, and emphasised the need of having a trust. “With a trust, the distribution will be faster. You need not go through a long probate process upon death, total permanent disability, mental incapacity, comatose, or disappearance,” she said. She also explained the role of executor for an estate and shared the process of appointing an executor. “You can choose anyone aged 18 or above to be your executor,” she said.

![]()

Wholly owned by UTAR Education Foundation Co. No. 578227-M LEGAL STATEMENT TERM OF USAGE PRIVACY NOTICE