BRI: Discussing the rise in bilateral trade and investment

Tun Tan Cheng Lock Centre for Social and Policy Studies (TCLC) organised a webinar titled “Belt and Road initiatives: Rise in Bilateral Trade and Investment Transforming Malaysia” on 15 May 2020 via Microsoft Teams. The one-hour talk saw more than 50 participants. It was delivered by UTAR Faculty of Business and Finance (FBF) Dean Dr Au Yong Hui Nee.

“Since the commencement of the Belt and Road initiatives (BRI), there has been a big flow in the Foreign Direct Investment (FDI) from China. China has become Malaysia’s biggest trading partner in the last decade. This webinar, therefore, aims to elaborate on the economic relationship between Malaysia and China; historical ties between Malaysia and China; trade figures as well as FDI figures. It also aims to provide a platform for discussion,” said Dr Au Yong.

Dr Au Yong kick-started the webinar by displaying a chart obtained from the “Tradingeconomics.com”. The chart showed the ranking of Malaysia in “East of Doing Business” from 2009 to 2020. The chart also showed that the business in Malaysia had gone down from being the Top 6 in the world in 2013 to the Top 24 in 2017. However, a remarkable improvement was observed in the last two years when the ranking of Malaysia went up to Top 15 and Top 12 in 2018 and 2019 respectively.

Dr Au Yong explained, “Overall, the business environment in Malaysia is quite encouraging. Many have linked this to the political factor. When foreign investors consider to invest in Malaysia, they look into the achievements of business growth in Malaysia. For the past ten years, Malaysia, as the Top 24 countries in the world ranking has shown its potential for multi-national upgrade.”

“East of Doing Business: Malaysia, Overall Ranking 2009-2020” obtained from Tradingeconomics.com.

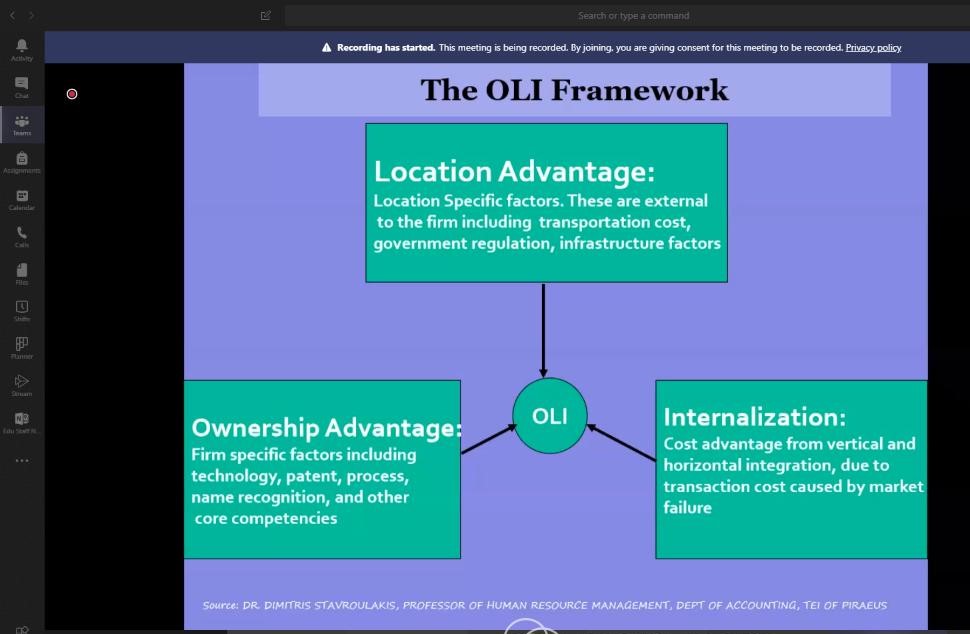

In addition to the different factors for investors to invest in the host country, Dr Au Yong also introduced the OLI framework. One of the motivations for businesses to go overseas and to invest FDI in a particular host country is dependent on the ownership advantage which the businesses could apply in the host country, such as firm-specific factors including technology, patent, process, name recognition and other core competencies. Another advantage is the location of the host country, such as the transportation cost, government regulation or infrastructure factors. In other words, if the host country could provide an advantage to save on logistic costs or the government is transparent and has a better infrastructure in road transportations and seaports, the host country will attract investors. The last consideration to invest in overseas is the internalisation factor or cost advantage from vertical and horizontal integration. The vertical integration refers to the supply chain to customers, whilst the latter, the integration of companies that have similar ecology systems.

The OLI Framework on the motivation for businesses to invest in the host country

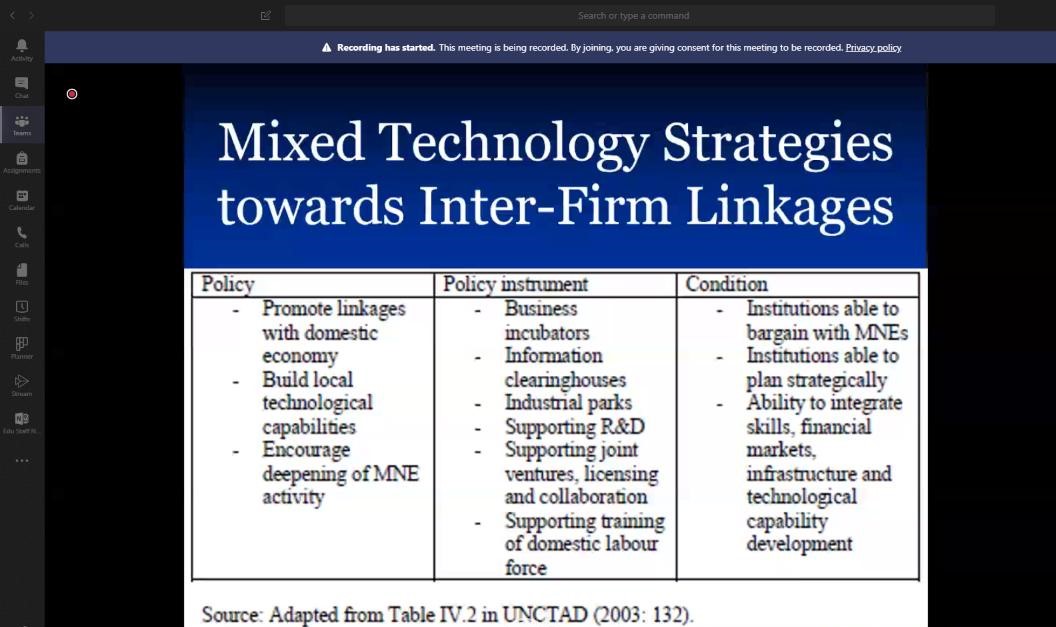

Dr Au Yong also listed out some strategies given by the United Nations in the United Nations Conference on Trade and Development (UNCTAD) to the host country. She also explained how the locals could take advantage of the FDI.

“When FDI comes to a country, the country must have some policies to protect the local traders as well as promote a better linkage between the local and the overseas enterprises,” said Dr Au Yong.

The Mixed Technology Strategies towards the linkage between the local and overseas enterprises

Speaking of Malaysia and China’s relationship, Dr Au Yong told the audience that Malaysia was the first Southeast Asian nation to establish diplomatic relation with China since 1974.

“Malaysia is on the list of countries under BRI’s China-Indochina corridor. It is an active corridor which is expected to boost China’s cooperation with the ASEAN countries. The ASEAN countries have plans to invest in the region’s railway and highway network under the China-Indochina corridor. This land bridge comprises China, the Indochina Peninsula, Malaysia, Laos, Vietnam, Cambodia, Myanmar and Thailand,” she said.

The BRI began in the year 2013. The statistics showed that China exports to the BRI countries were generally higher compared to the imports from BRI countries from 2013 to 2016. Dr Au Yong highlighted this as it raised concerns from other BRI countries due to the rise of China suppliers which may affect the local enterprises.

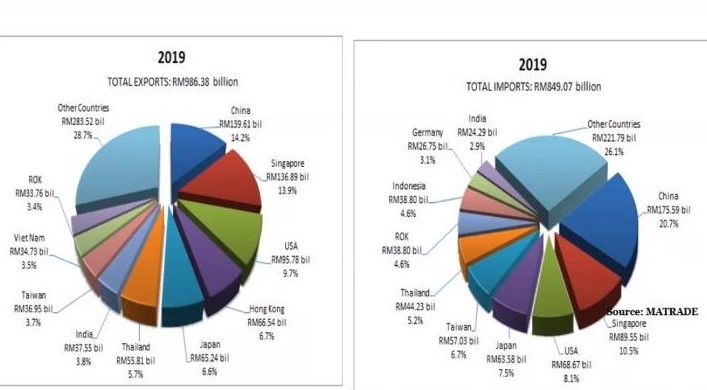

“According to the trading statistics of Malaysia, the year 2019 was a changing point for Malaysia. For the first time in ten years, China became the largest export destination country for Malaysia. Although China was the largest trading partner of Malaysia over the last ten years, Malaysia had always imported the most from China compared to exports,” added Dr Au Yong.

Top 10 Major Export and Import Countries in 2019

Dr Au Yong further explained, “China was the largest FDI contributor for the last four years, from 2016 to 2019.” She then said, “Recently, the Chinese investment and projects in Malaysia included East Coast Rail Line, Edra Power Holdings Sdn Bhd, Melaka Gateway, Forest City Project, Danga Bay, R&F Princess Cove project, Medini Iskandar, Kuantan Port and Malaysia-China Kuantan Industrial Park.”

“Malaysia has big projects which are conducted by contractors from China such as Tun Razak Exchange (TRX), the Bandar Malaysia which will be the future hub to further attract high-impact global multinationals, as well as the CRRC investment on train transport.”

According to Dr Au Yong, the situation changed when China proposed a future economy plan which enables Malaysia as an export gateway to other countries. They hired local people for manufacturing such as China Railway Rolling Stock Corp (CRRC) and Geely Auto. CRRC is a company of China located in Batu Gajah; 85 per cent of their workers are local. Geerly Auto, on the other hand, partnered with Proton to sell Proton and Geerly cars to countries like Pakistan.

“Chinese investors in Malaysia are also involved in an array of sectors including solar manufacturing such as JinKo Solar and JA Solar; health care industry such as Taiji Group Zhejiang Dongfang Pharmaceutical, Integral and Surgimed Medical Supplies; banking industry such as China Construction Bank (CCB) and Industrial and Commercial Bank of China (ICBC).”

“There is also an agreement between Malaysia and China on the currency swaps. Malaysia uses Renminbi (RMB) as the transaction value for any China-Malaysia trade without using the US Dollar (USD). This shows a close collaboration between the Malaysian and the Chinese governments,” explained by Dr Au Yong.

The webinar also touched on Huawei ICT innovation hub and E-commerce from China to provide opportunities for Malaysian in upgrading their ICT skills and knowledge, as well as the opportunities of trading from Malaysia to China through the E-commerce platform.

At the end of the talk, Dr Au Yong stressed on several matters, “Malaysia is trying to seek a balance between the two big powers of the world, namely the United States and China. Besides, policies that could protect local enterprises should be considered by the government to ensure the participation of the locals so that Malaysians could benefit from the FDI.”

The webinar ended with a Q&A session.

© 2020 UNIVERSITI TUNKU ABDUL RAHMAN DU012(A).

Wholly owned by UTAR Education Foundation Co. No. 578227-M LEGAL STATEMENT TERM OF USAGE PRIVACY NOTICE