Low (top left),

Chong (bottom left) and Woo (far right) during the webinar

The Chartered Tax Institute of

Malaysia (CTIM) held a webinar on tax education career talk for more than

150 UTAR Accounting and Economics

undergraduate students as well as lecturers on 4 November 2020 via Microsoft

Teams.

Speaking at the webinar were CTIM

Chairman of the Education Committee-cum-Deloitte Tax Services Sdn Bhd

Executive Director Stefanie Low, CTIM Chairman of the Examinations

Committee-cum-Crowe KL Tax Sdn Bhd Executive Director Chong Mun Yew and

Member of the Education Committee-cum-Grant Thorton Malaysia Executive

Director Daniel Woo.

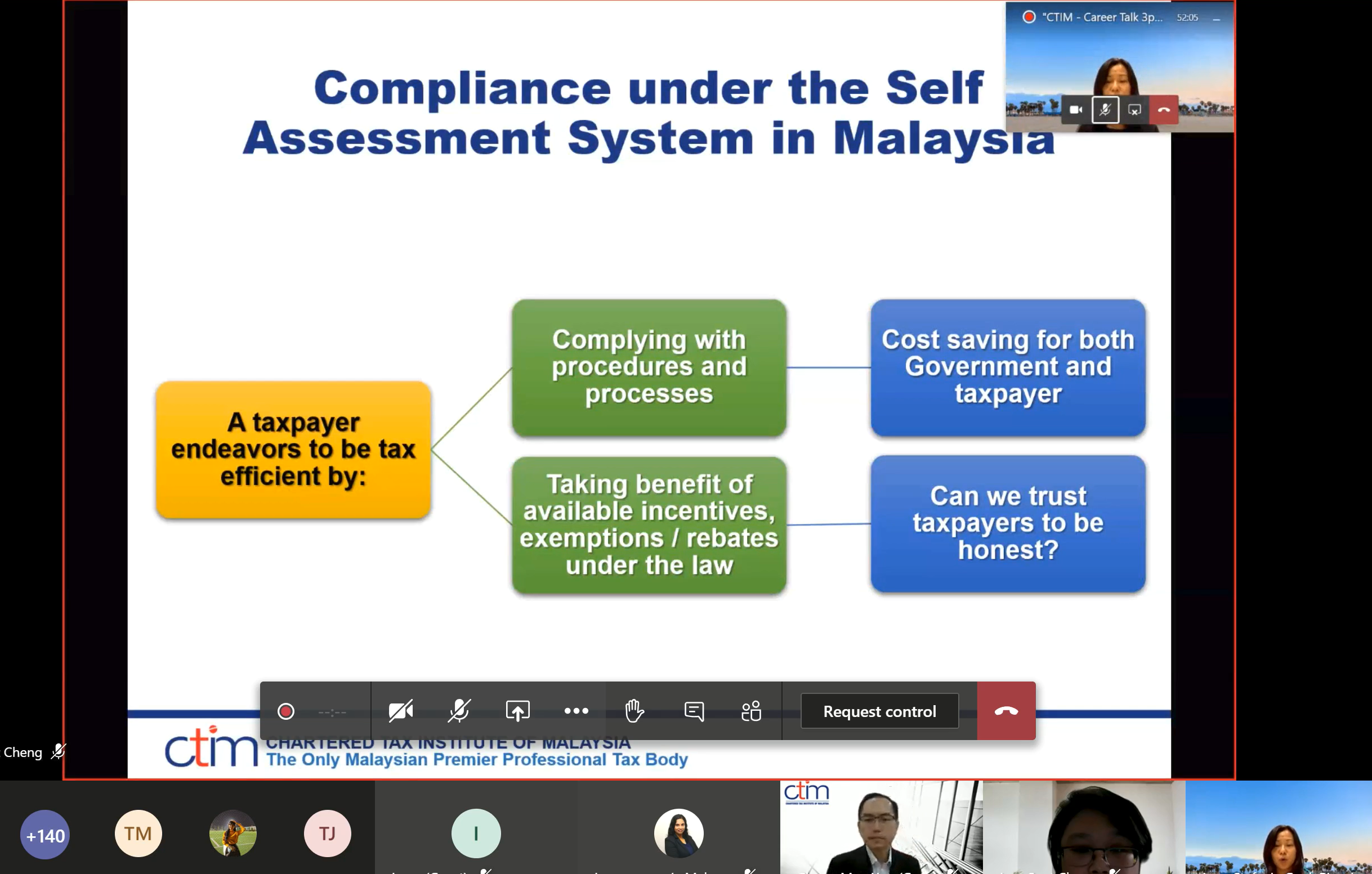

In “Taxation as a Career”, Low

spoke about the basic concept of taxation, types of taxes, the differences

between tax planning, tax avoidance and tax evasion, compliance under the

self-assessment system in Malaysia and the overview of CTIM as well as its

activities to support the profession in taxation.

“Taxation is an income to the government. The taxes collected allow for redistribution of wealth in different areas such as welfare, education, defence, transport, infrastructure and others. Tax is a financial charge exacted under the legislative authority and failure to pay is punishable by law. Indirect tax is known as consumption tax whereby in Malaysia, we have sales tax and service tax. Direct tax involves around income tax, real property gains tax and stamp duty. Taxpayers are allowed to plan their transactions in a legal manner to find the best outcome for themselves,” said Low.

Low sharing the

self-assessment system in Malaysia

She added, “When you consider

taxation as a career, bear in mind, taxation is not something you do in

isolation. To be an effective tax professional, you will need to understand

the transaction or the business itself. Apart from that, it is also

important to understand the mechanic of income and expenses before applying

the tax law to the situation. At the same time, you will also develop

critical thinking skills by doing taxation. Some of the areas of

opportunities in taxation are such as tax advisory, transfer pricing, global

employer services, international tax, tax audit and investigation, indirect

tax and incentives.”

Chong explained the CTIM

qualification and exam whereby CITM conducts professional taxation

examination in Malaysia and it is held bi-annually in June and December. In

his session, he spoke about the intermediate papers, final papers and the

paper exemptions. He said, “The intermediate papers are such as personal

taxation, economics, financial accounting, business taxation while the final

papers are revenue law, company and business law, advance taxation. The

scope we cover is wider so that you have a strong foundation in theory.”

Chong explaining

the exemption of papers according to the qualifications

Meanwhile, Woo who shared his 20

years of experience in tax profession said, “Generally, the qualifications

to embark in tax is to have a bachelor degree in either business, finance,

economics or law. However, a non-financial degree is also possible if you

have an interest in tax. Tax profession is a rewarding and fulfilling career

if you have a passion for it. It is important to have a strong foundation in

tax compliance to build a successful career.”

“Ranks vary depending on the

accounting firm that you are joining. Larger firms tend to have more levels

compared to mid-size firms. Most importantly, you have to be hardworking,

willing to learn and apply your tax knowledge to your work, it won’t take

long to become a manager in about four to five years. Do act in your

clients’ best interest by applying the right tax principles and law while

avoiding to be in a position that may create a conflict of interest. Bring

tax reforms to the country’s tax system by contributing your tax knowledge,

experience with your peers, business community and to the tax authorities,”

he said while explaining the progression in the tax profession.

The webinar was followed by a Q&A

session among participants and the speakers.

Wholly owned by UTAR Education Foundation Co. No. 578227-M LEGAL STATEMENT TERM OF USAGE PRIVACY NOTICE