The talk highlighted the importance of

retirement savings

UTAR

Centre for Corporate and Community

Development (CCCD) and Centre

for Sustainable Development and Corporate Social Responsibility in Business

(CSDCSR), in

collaboration with Private Pension

Administrator Malaysia (PPA), the central administrator for the Private

Retirement Schemes (PRS),

organised a webinar titled “Start Small. Start Now: Grow Your

Retirement Savings”

in support of Financial Education Network (FEN)

on 11 November.

The webinar, conducted via Zoom, was delivered by PPA Marketing Events and

Promotion Manager Wong Mew Sum and Corporate Engagement and Management

Manager Ma Kam Kwan. In the webinar, Wong and Ma first explained PRS and

its objectives as well as the

key considerations

to meet the

retirement needs.

“We suggest, starting from now,

you save 1/3 of your monthly salary so that you will

have 2/3 replacement

income when you retire,” said Wong. She advised that people must make

sure they have enough

money to maintain their current lifestyle

during retirement. “Inflation

will increase your cost of living and erode your

purchasing power.

You should start saving

now for your

retirement as

there will definitely be a rise in the cost of living in the future,”

she said.

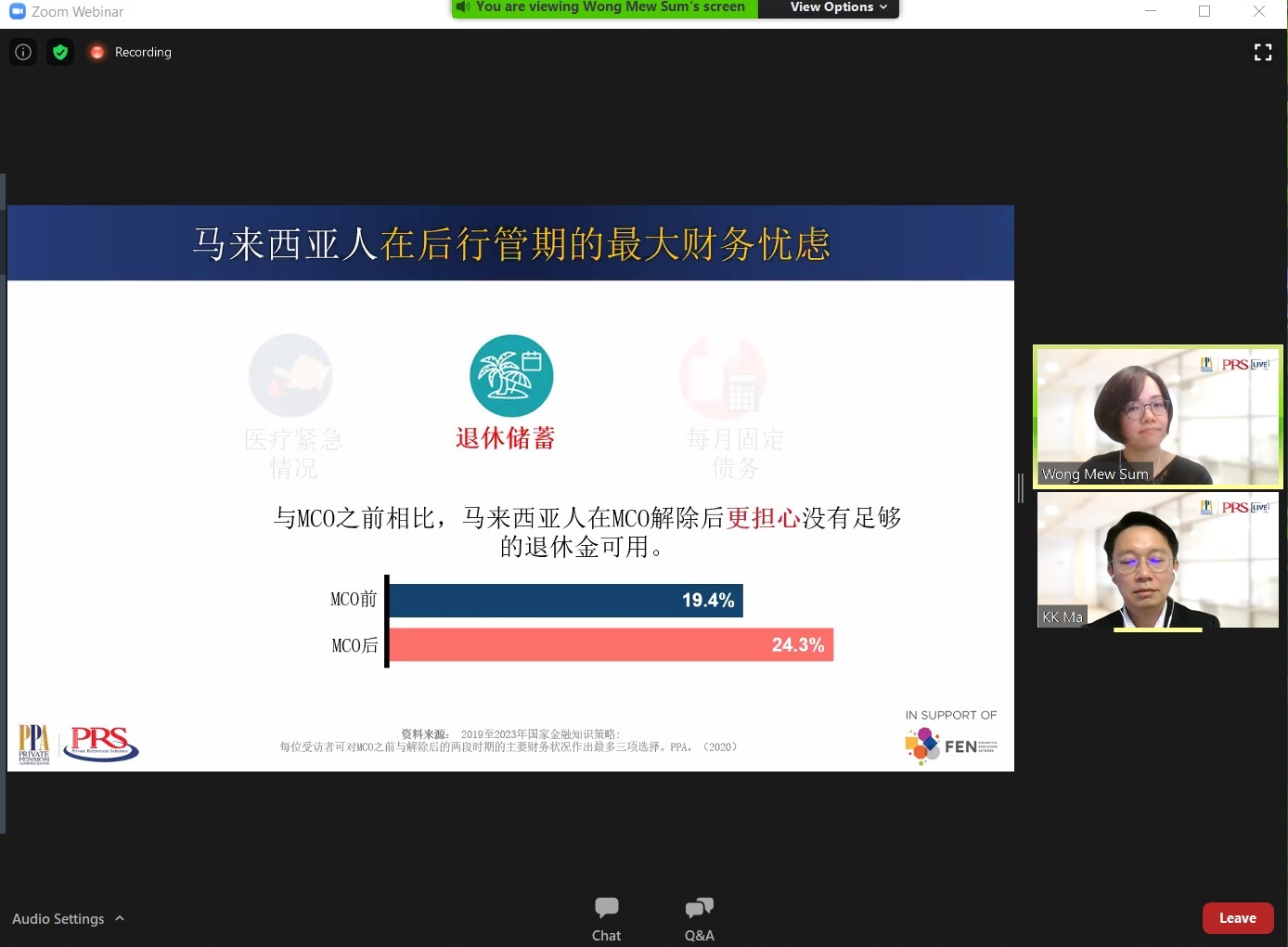

She also talked about how the implementation of the

Movement Control Order (MCO) affected Malaysian’s retirement plan. She said,

“According to a survey, apart from medical emergencies and monthly fixed

debts, retirement savings is one of Malaysians’ biggest financial worries.

Malaysians become more worried for not having enough retirement savings

after the MCO.” She further explained how PRS works and provided helpful

guidelines on how to choose the fund options.

Ma, on the other hand, pointed out that the minimum

retirement age of an employee in Malaysia is 60 and the average life

expectancy is 74.9 years. “We

are living longer now,

so we need enough

retirement savings

to last through

at least 20 years of

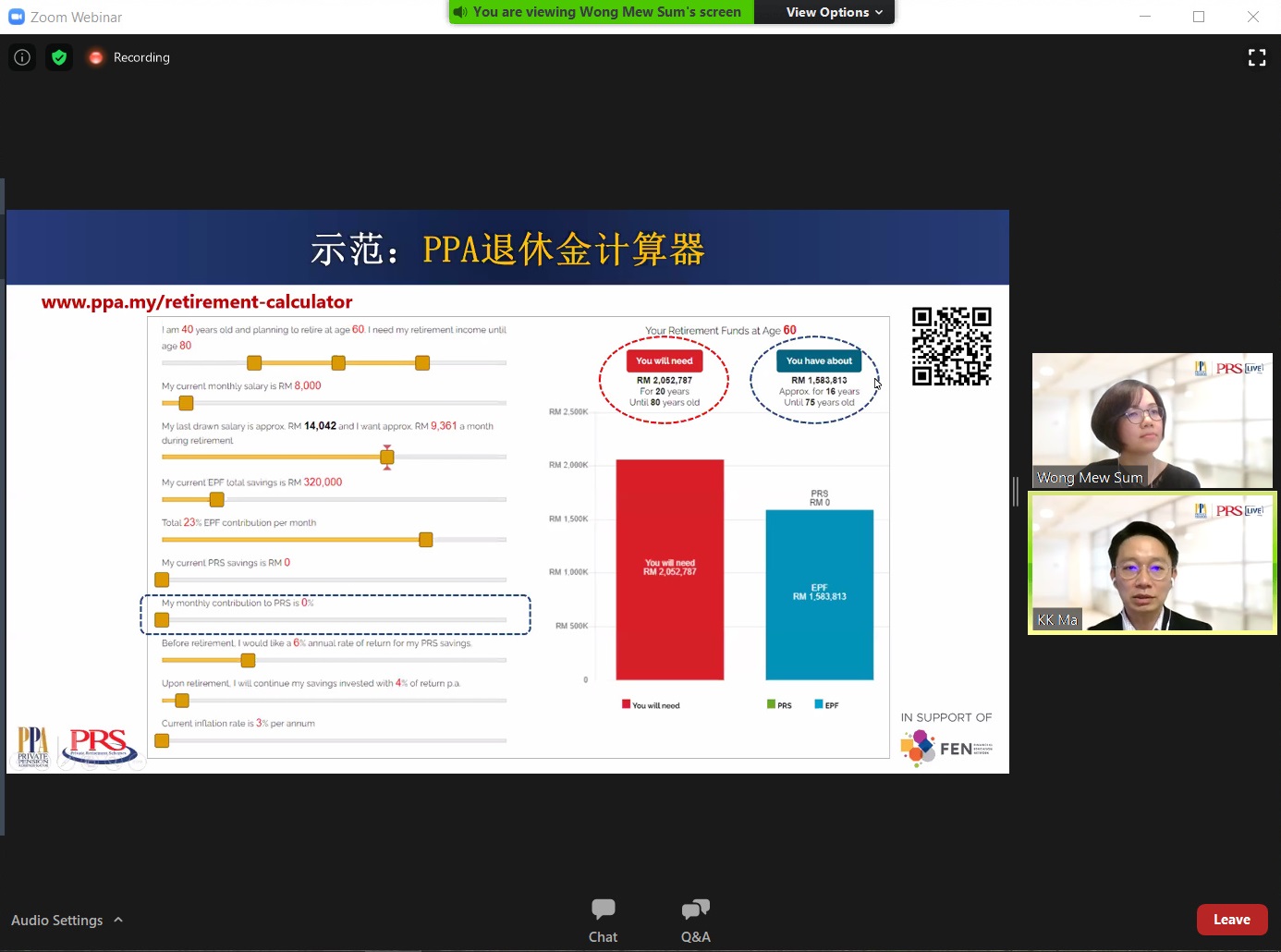

retirement,” he said. In order to have a better understanding of the

future financial situation, Ma provided a guideline on how to use the

retirement calculators to estimate how much one will need to save for their

retirement and how long their money will last.

Besides, Ma

presented the PRS

framework and explained that PRS is supervised by the Securities Commission

Malaysia through four intermediaries, namely PRS Distributors and

Consultants, PPA, PRS Providers and Scheme Trustee. He also provided

an overview on the performance of the PRS funds and said, “Past performance

cannot guarantee future returns. However, PRS funds have been performing

well even in the recent volatile market.” The talk ended after a Q&A

session.

Wong presenting a survey which stated respondents' worries about not having enough money for retirement after the MCO

Wong explaining the default options and self-selected fund options offered by PRS

Ma demonstrating how to use the

retirement calculator

Wholly owned by UTAR Education Foundation Co. No. 578227-M LEGAL STATEMENT TERM OF USAGE PRIVACY NOTICE