The application of IFRS in financial reporting during the times of Covid-19 pandemic

UTAR Centre for Accounting, Banking and Finance parked under the Faculty of Business and Finance (FBF) organised a webinar titled “Financial Reporting in Times of the Pandemic: The Application of IFRS and its Respective Challenges” on 12 November 2020 via Microsoft Teams. The webinar was conducted by Universitas Padjadjaran Assoc Prof Dr Ersa Tri Wahyuni and moderated by FBF Department of Commerce and Accountancy lecturer Che Siti Lazrina binti Md Lazim.

The main objective of the webinar was to provide the latest updates in financial reporting, specifically on the application of the relevant International Financial Reporting Standards (IFRS) during this Covid-19 pandemic. The webinar saw 196 participants, including 52 UTAR staff, 135 students and nine guests from other universities in Malaysia and Indonesia.

After Che Siti initiated the talk, Dr Ersa took the virtual stage by focusing on several topics, namely “The impact of Covid-19 on ASEAN economy and company’s financials in Malaysia”, “The impact of Covid-19 on the Inventories (IAS 2)”, “The impact of Covid-19 on the PPE depreciation (IAS 16)”, “The impact of Covid-19 on the application of IFRS 9 Financial Instruments”, and “The impact of Covid-19 to the application of IFRS 16 Leases”.

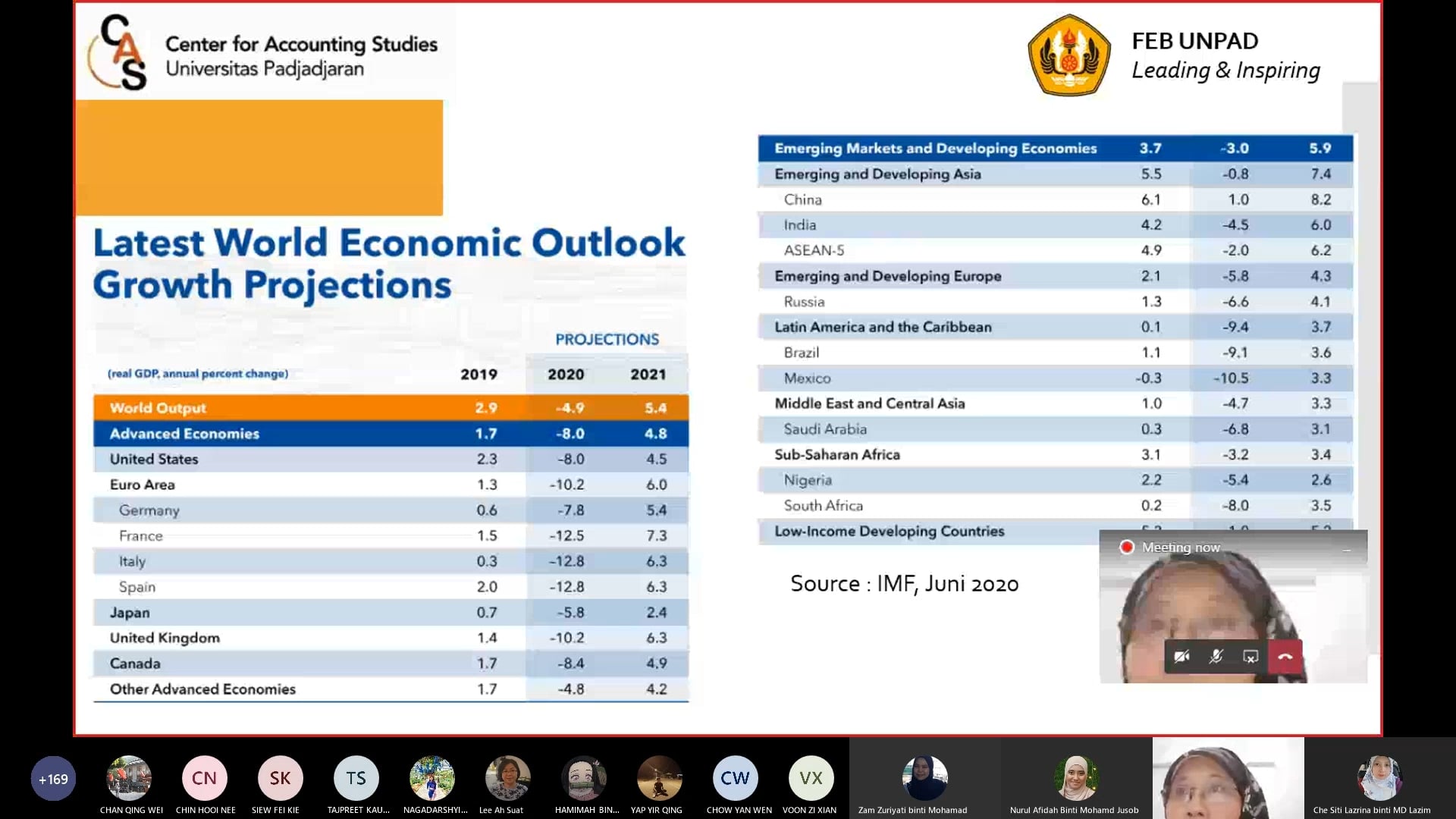

During the webinar, Dr Ersa first presented the source of International Monetary Fund (IMF) of the latest World Economic Outlook Growth Projection. The figure showed that Covid-19 had an impact on the Gross Domestic Product (GDP) growth of many countries. The businesses were facing several challenges including cash flow, liquidity, delays in receivables and declines in revenue. Nearly half of all companies surveyed indicated that cost-cutting measure was the priority. They have also taken other moves to reduce loss, such as cash flow management, re-prioritising of business activities, investment, adjusting wages or applying for wage subsidies. The government has also launched some initiatives to help the local businesses in reducing financial burdens and provide relief for loans and obligations.

Dr Ersa explaining the impact of Covid-19 on the latest World Economic Outlook Growth Projections

Due to the pandemic outbreak, many factories were closed and some have to operate with lower capacity. As a result, the inventories and raw materials were piled up when the demand in the market decreased. On the other hand, inventory impairment also increased, especially for those goods that easily became obsolete.

“According to the (IAS 16), the depreciation cannot be stopped just because the assets were not in use during the pandemic. However, when assets are temporarily not in use, this could make the economic life become longer, then entities could prolong the economic life of the assets so that depreciation expense could be minimised,” Dr Ersa explained.

She also told the participants that (IAS 23) indicates that borrowing cost should be temporarily expensed, not capitalised to the Property, Plant, and Equipment (PPE) if the construction stop. For the property and land, (IAS 36) indicates a pandemic may make property market decline which may trigger impairment test.

“The International Accounting Standards Board (IASB) and the Malaysian Accounting Standards Board (MASB) have issued a list of guidelines on how to apply IFRS 9 during the pandemic. The guidelines also suggested IFRS 9 to use Expected Credit Loss (ECL) method in loss allowance measurement,” Dr Ersa said.

Speaking of the impact of Covid-19 on the lessee, Dr Ersa suggested the lessor to reduce payment or give payment relief in a form of payment holiday. According to Dr Ersa, the IASB has issued amendments of IFRS 16 to simplify the modification so that Covid-19 will be recognised in profit and loss.

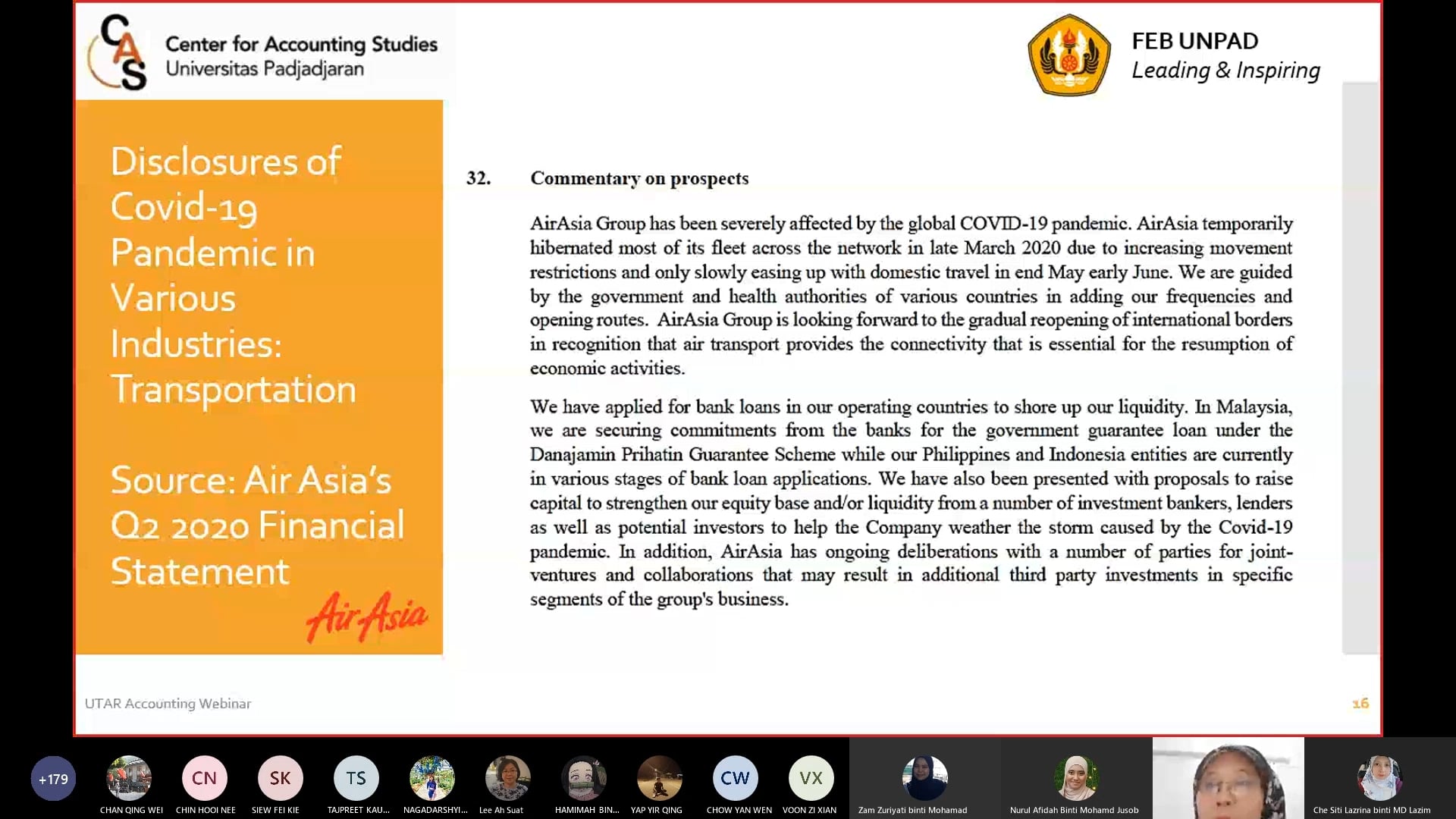

Towards the end of the webinar, Dr Ersa also presented some example of disclosures regarding the impact of the pandemic on some Malaysian companies. The talk concluded with an extensive yet insightful Q&A session.

Dr Ersa is currently working as a lecturer and researcher at Universitas Padjadjaran in Bandung, Indonesia. She was the Technical Advisor of IAI placed in the United Kingdom. In addition, Dr Ersa is an IFRS Trainer and Consultant, the Research Manager of Inovasi Kemitraan FEB UNPAD as well as a member of DSAK-IA. She has been writing books and articles regarding IFRS and Financial Accounting.

Dr Ersa (top middle) with the participants

Dr Ersa taking AirAsia as an example of a company that has been affected by the Covid-19 pandemic

![]()

![]()

© 2020 UNIVERSITI TUNKU ABDUL RAHMAN DU012(A).

Wholly owned by UTAR Education Foundation Co. No. 578227-M LEGAL STATEMENT TERM OF USAGE PRIVACY NOTICE