An insightful discussion on “Malaysian budget 2021: A

Rakyat –Centric Budget during the Pandemic?”

Budget 2021, unveiled on 6 November 2020 by the

Finance Minister Tengku Datuk Seri Zafrul Tengku Abdul Aziz, was undoubtedly

an expansionary budget that aimed to revitalise the economy and help

Malaysian tide over the difficulties of COVID-19 pandemic. Budget 2021 was

indeed expansionary as it came with an allocation of RM322.5billion, the

highest in Malaysia’s history. It also saw an increase of 8.6% compared to

Budget 2020 which was RM297billion.

Themed ‘Resilient as One, Together We Triumph’,

Budget 2021 was formulated based on three integral goals, namely Rakyat’s

wellbeing, Business Continuity and Economic Resilience. The Budget 2021 was

also said to be a Rakyat-centric budget that strived to achieve a balance by

managing the government’s financial sustainability, ensuring social

well-being, and reviving the economy.

In view of this matter,

UTAR

Institute of Management

and Leadership Development (IMLD), Belt and Road Strategic Research Centre

(BRSRC) and the Department of Economics jointly organised a forum titled

“Malaysian budget 2021: A Rakyat –Centric Budget during the Pandemic?” on 13

November 2020.

The forum saw around 140 participants and it was

conducted via Zoom. The speakers were Deloitte Tax Services Sdn Bhd

Executive Director Stefanie Low Geok Ping and SME Association Malaysia

National Vice President Chin Chee Seong. It was moderated by Faculty of

Accountancy and Management lecturer Prof Dato' Dr Tai Shzee Yew. The forum

saw the two panellists, Stefanie Low and Chin highlighting the key measures

of Budget 2021 and sharing their thoughts on how the budget benefitted the

rakyat.

Stefanie Low presenting the budget’s

allocations and salient tax –centric proposals

Stefanie Low said, “The budget is presented annually

at the end of October or November and it is tabled under the supply bill.

The legislation such as the Income Tax Act and Companies Act needs to pass

the Parliament; the same goes to budget, it needs to be presented and

debated. Once the members of the Parliament vote, it will become law and

effective. As far as I know, the budget will normally pass but it will

require some modification.”

She added, “The supply bill refers to the spending of

the government. In addition to that, there is also a finance bill that needs

to be debated. Wherever the budget is presented, the finance bill will come

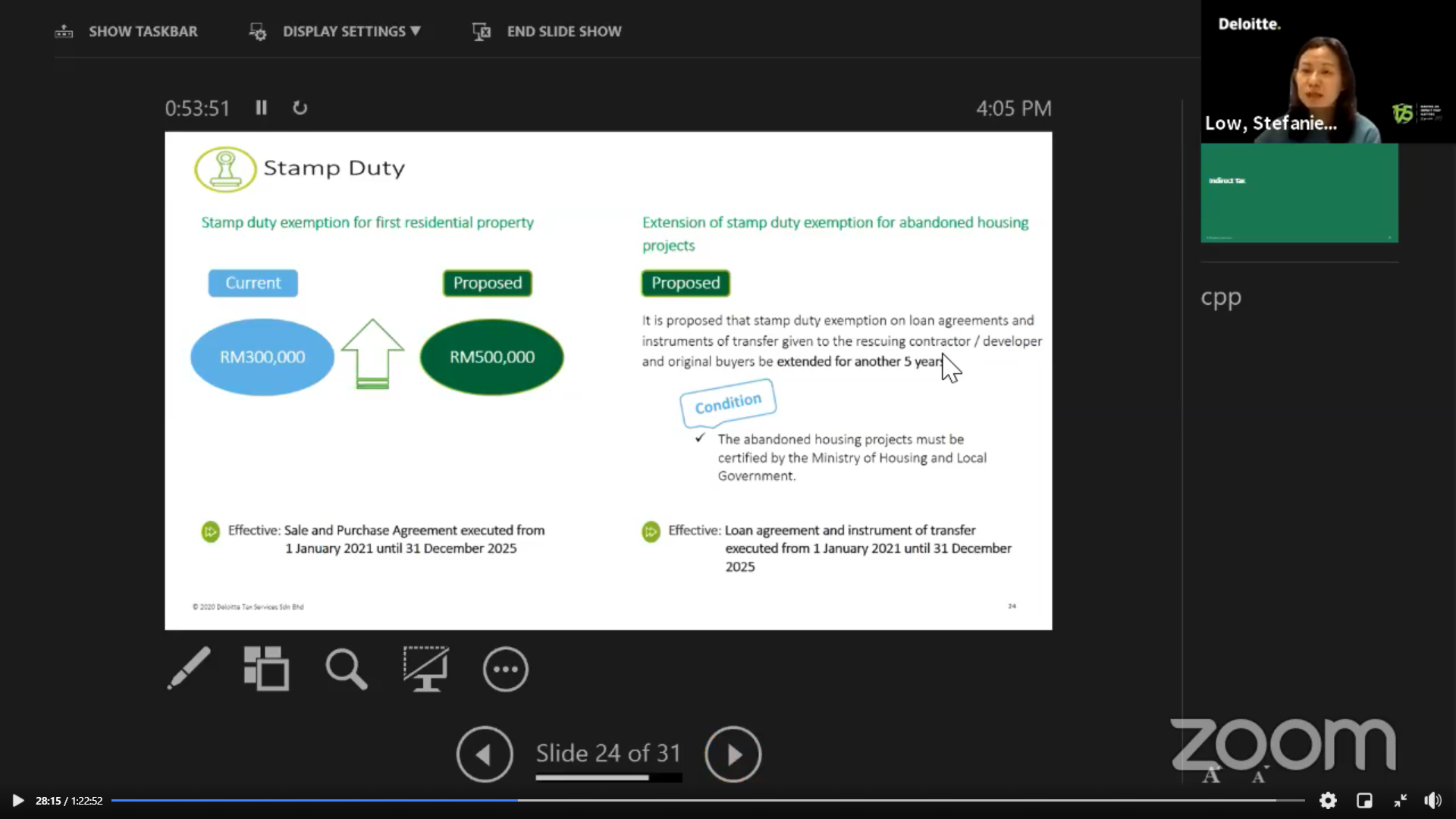

along. The finance bill will make an amendment to the Income Tax Act 1967

(ITA), Real Property Gains Tax (RPGT), Stamp Act 1949, Sales and Services

Tax to either tighten the rules or deny deduction on the increased revenue

of the country.”

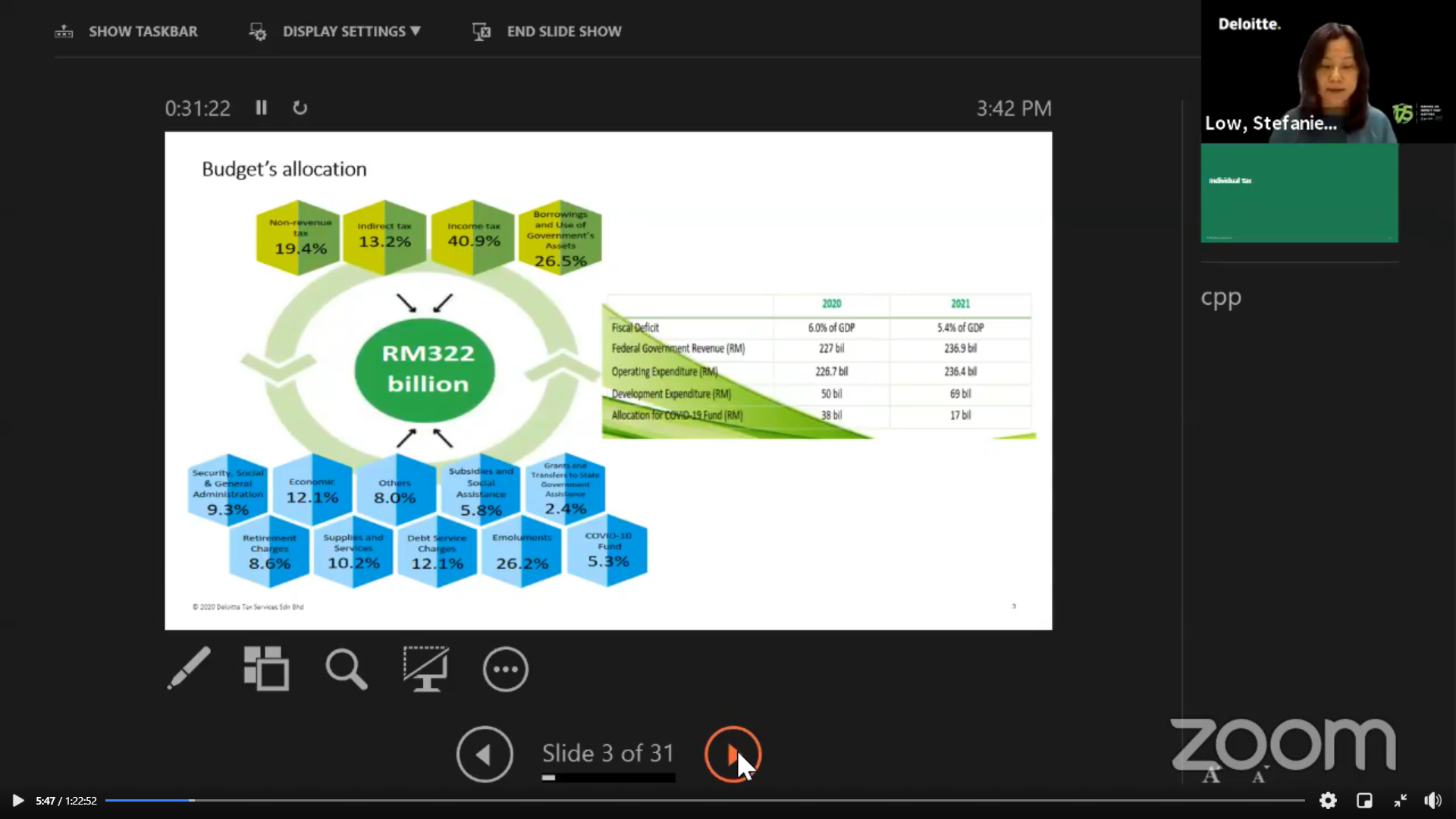

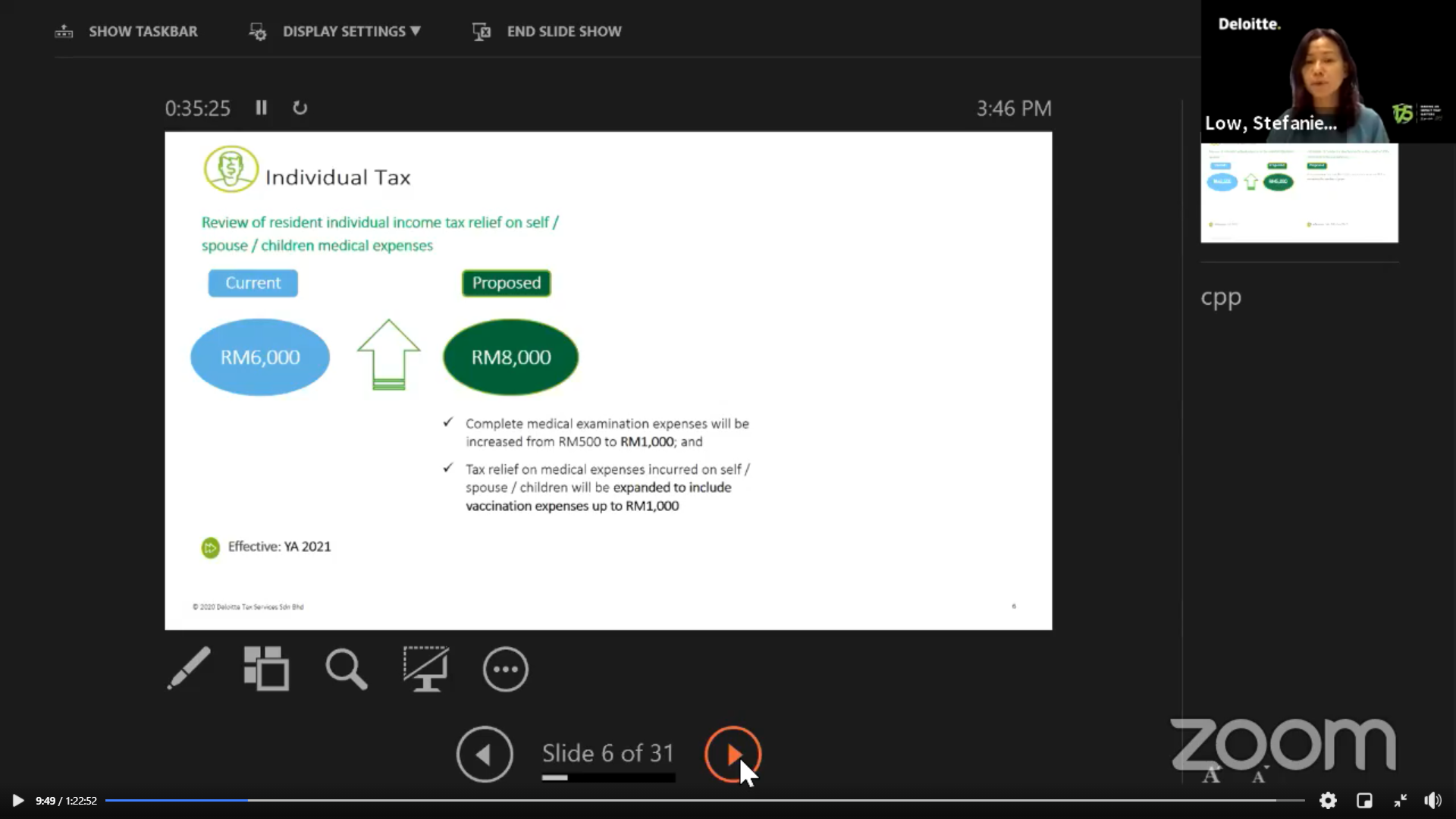

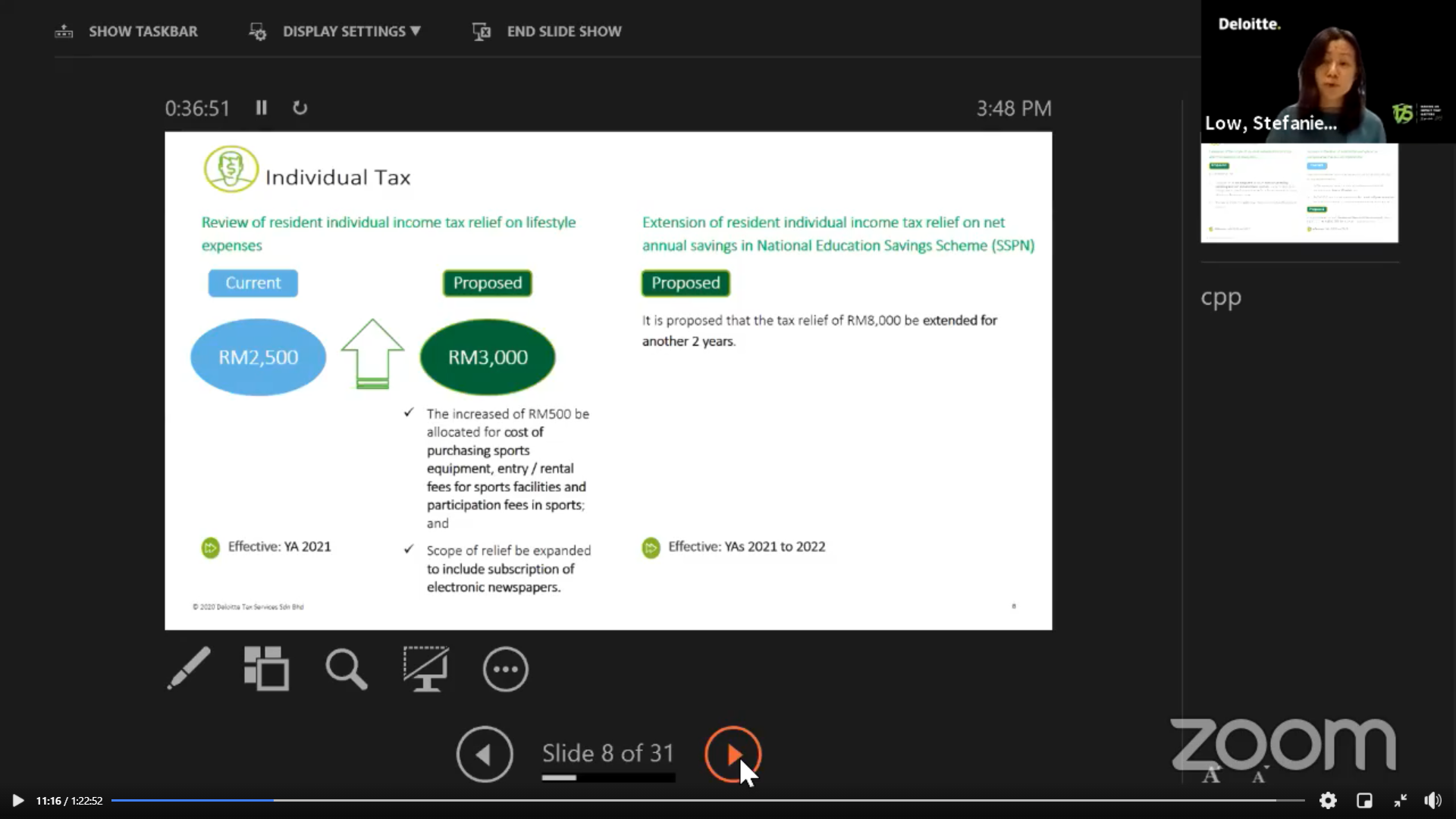

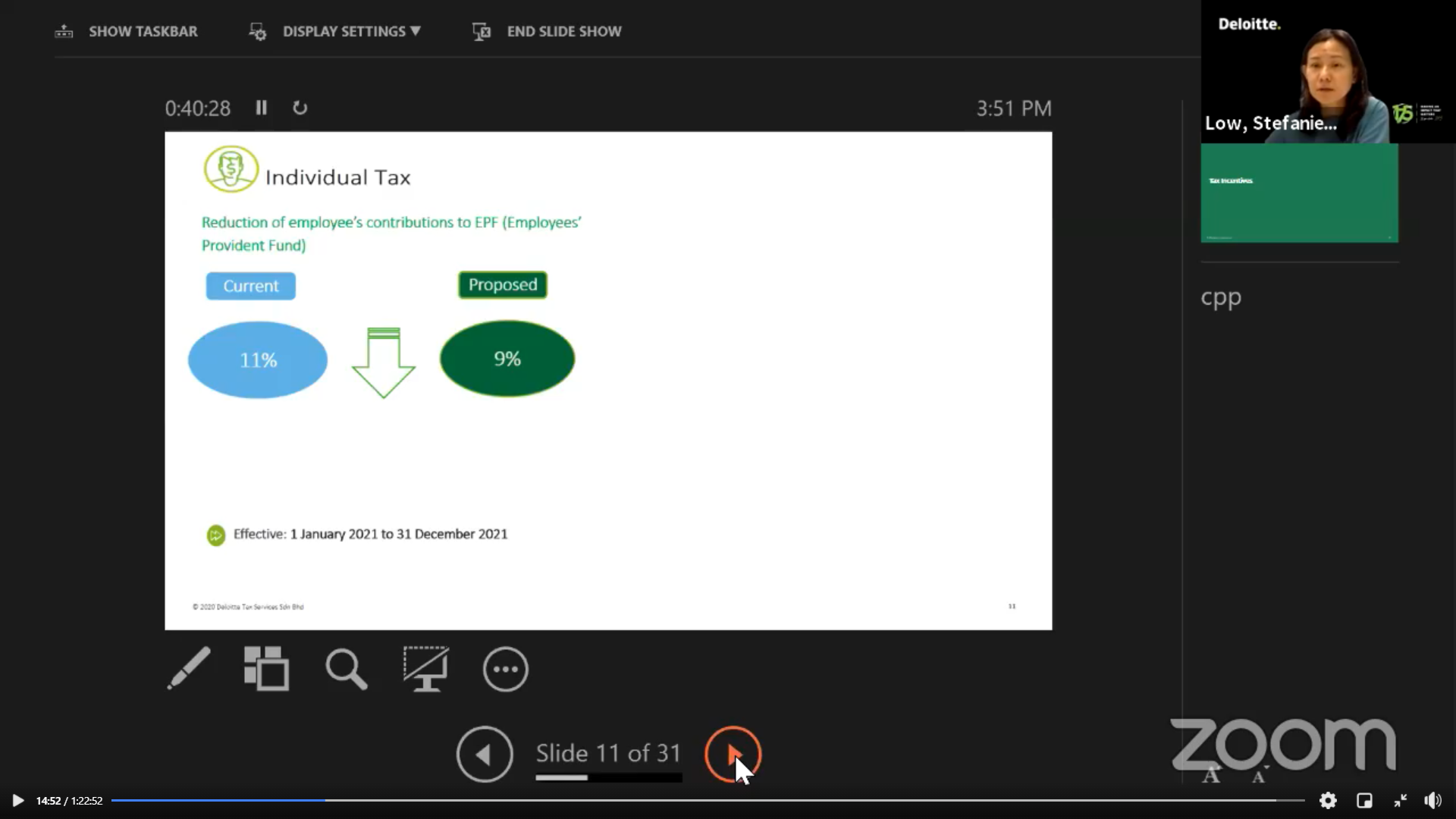

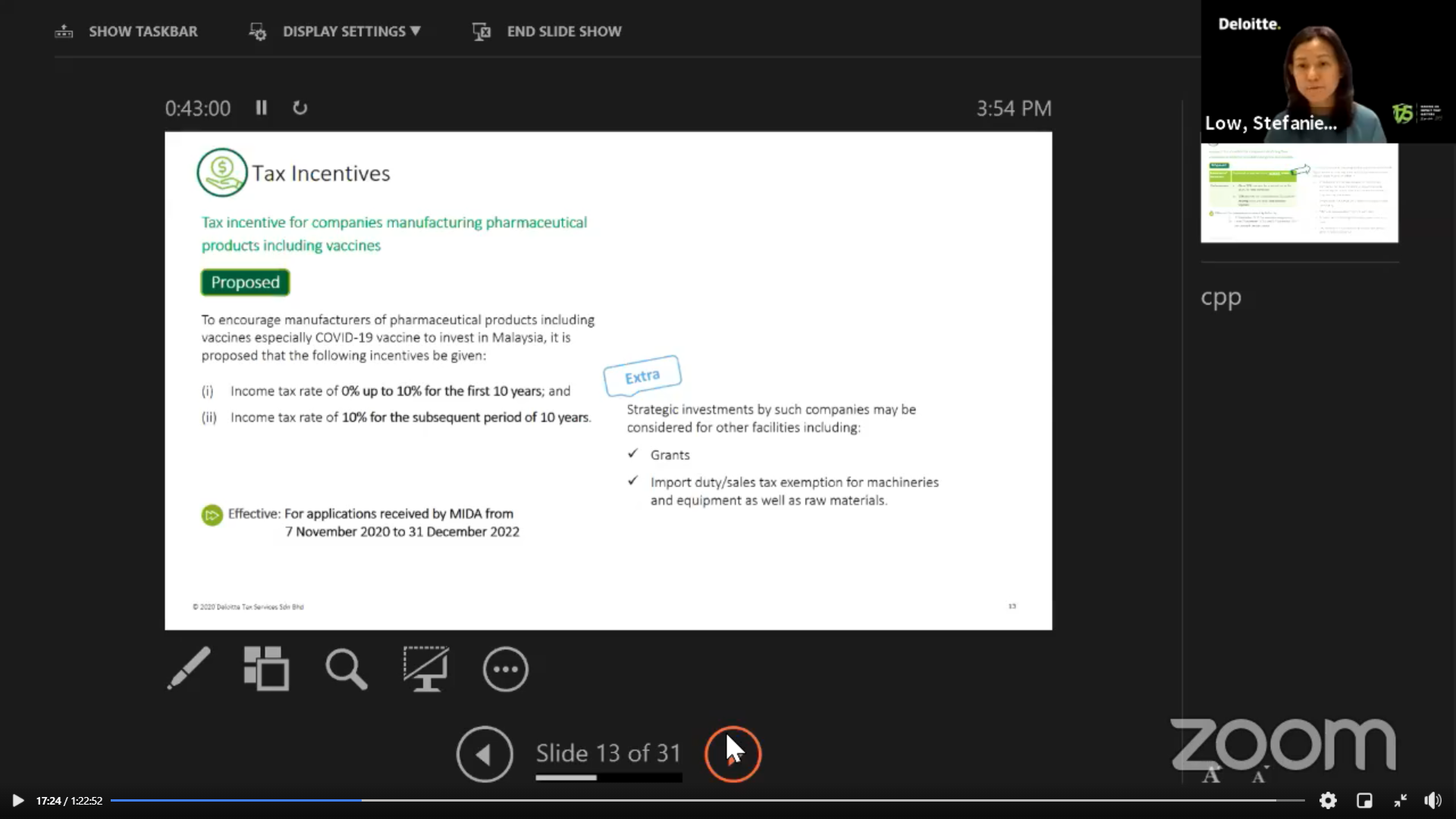

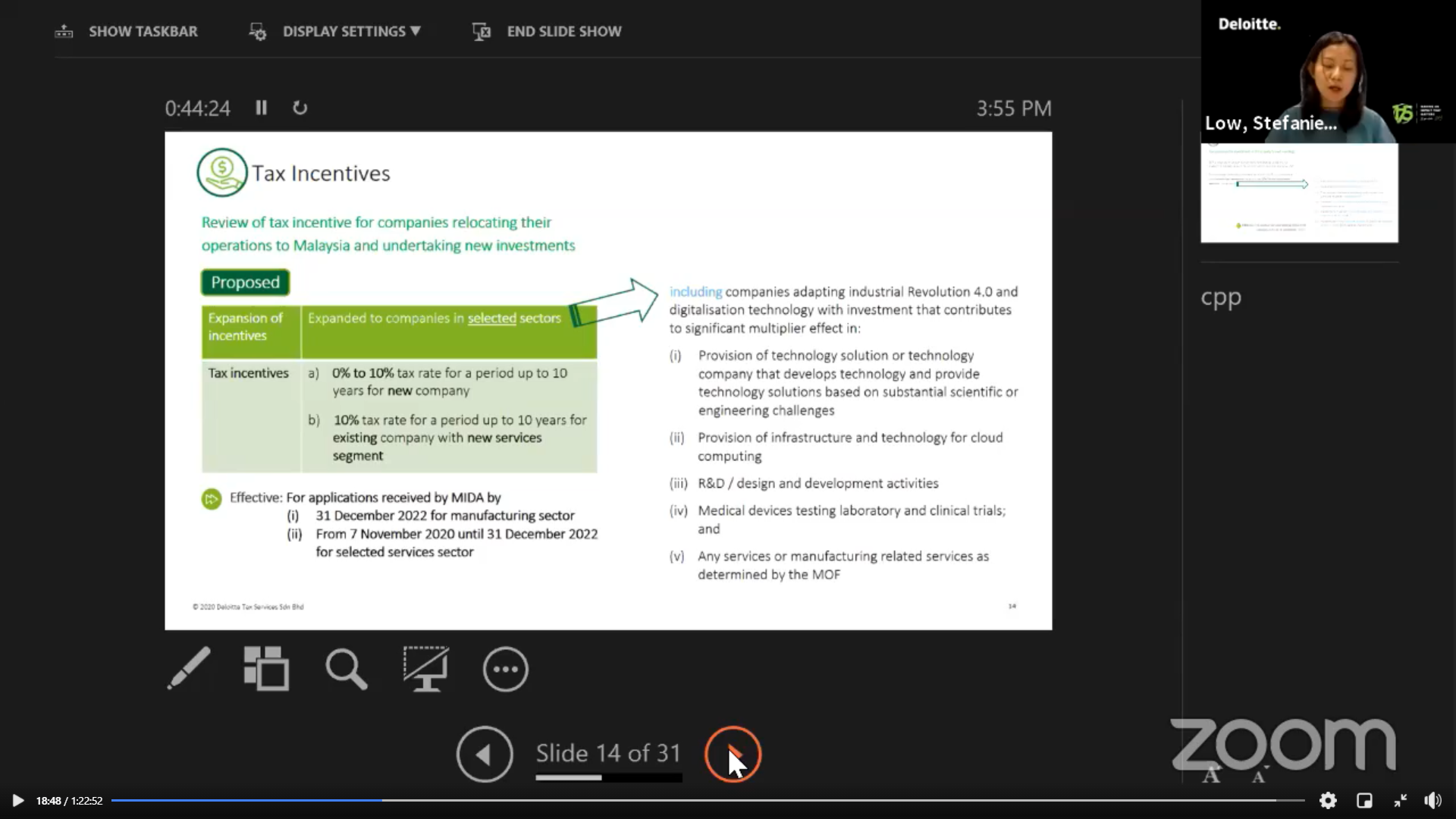

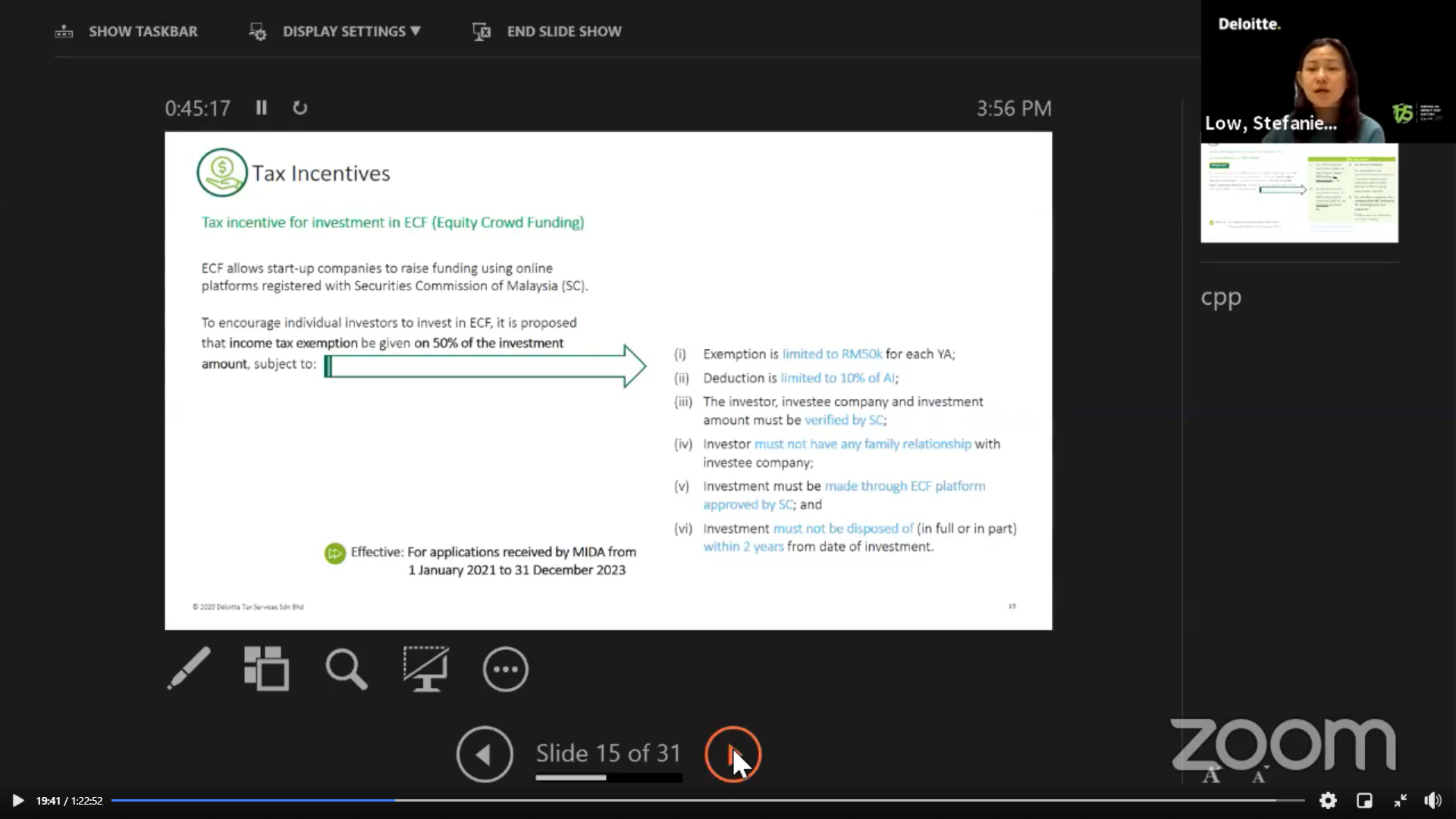

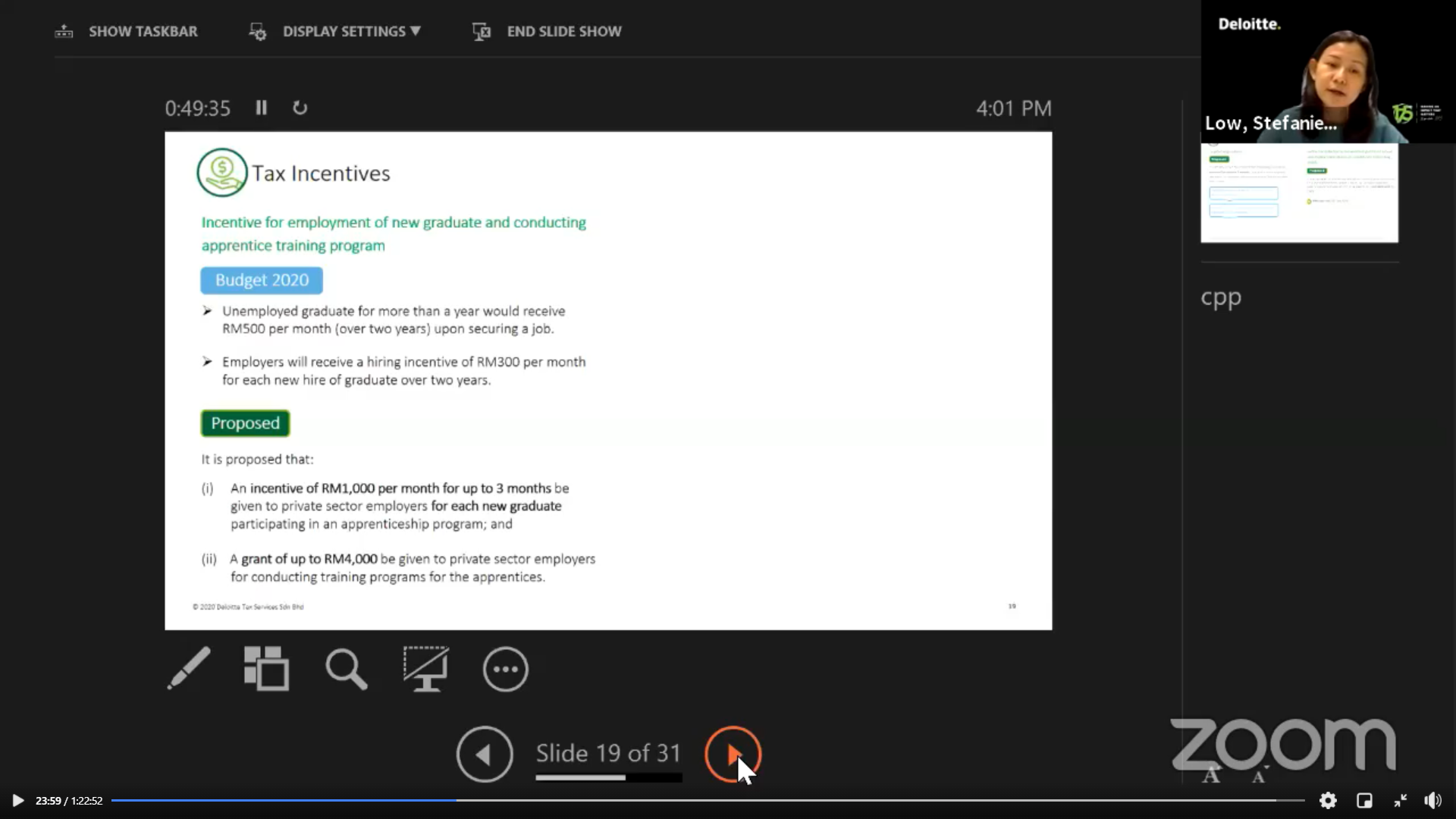

Stefanie Low also talked about the budget

allocations; Salient tax-centric proposals, namely individual tax, tax

incentives, stamp duty and indirect tax. Speaking of the budget allocations,

she said, “Our government expected to raise RM236.9billion for income but

the expenditure allocated was RM322.5billion. Hence, we are running a

deficit, our expenditure is more than our income by 5.4%, and it is a

deficit in profit and loss.”

Stephanie Low breaks down the key to

various segments of the budget’s allocation

“The key revenue of the country is taxation. The

revenue comes from income tax and indirect tax. Income tax is the tax of

earning and the profit of a company or individual. Indirect tax, on the

other hand, comes from sales and service tax,” she explained.

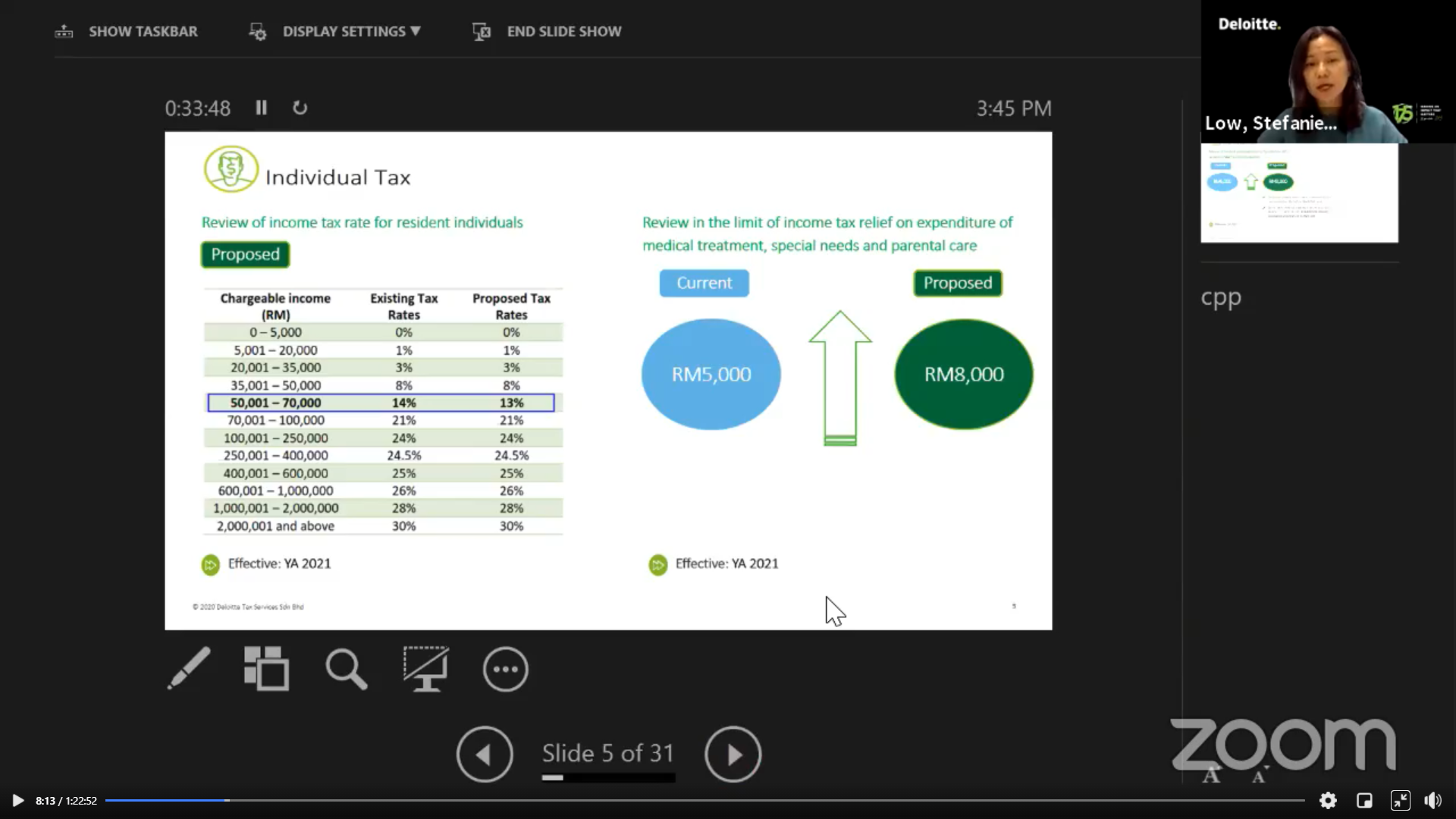

Review of the income tax rate for

resident individual

Chin sharing the challenges faced by

the SMEs

Chin, on the other hand, commented on budget 2021

from the perspective of small and medium-sized enterprises (SMEs). He said,

“This overall budget is the largest budget allocation. It looks big but when

we drill down to the details, we can barely see how the budget benefits the

SMEs. In my opinion, the government should provide direct incentives for

various programmes. We want a targeted fund or effort that would help SMEs

to grow and survive. And we would also like to bring attention to the

government that the incentives given need to reach on time in order to

support the operations of the SMEs and for them to survive. The SME

Association Malaysia also constantly engaged with the government especially

during this pandemic situation to understand how the grants can bring

benefit to all the SMEs.”

He also emphasised on the press statement given by

SME Association Malaysia President Datuk Michael Kang, “Datuk Michael Kang

said that 100,000 small and medium enterprises (SMEs) may have closed down

since March. The figure mentioned was three times the statistics reported by

the Companies Commission of Malaysia’s (SSM), which showed 32,469 SMEs have

wound up between March and September. The SSM provided official statistics

but the unofficial number is much higher as many SMEs have some loose ends

to tie up after pulling down their shutters before submitting the documents

to SSM.”

Chin highlighted the challenging situation faced by

the SMEs, “Many SMEs in the food and beverage businesses have closed their

shops for the time being following the implementation of the conditional MCO

in a number of states in the Peninsula because there are no customers. For

the retailers, especially those who are doing business in malls, they had

gone through too much owing to the recent rise in cases. The SMEs are still

struggling with cash flow up till today; there are bills to pay while sales

haven’t fully recovered for some of them.”

“We will strongly engage with the government to let

them know what is actually happening on the ground and what the SMEs are

facing. We do hope the budget with whatever amount will quickly pass and

will be quickly implemented to help the SMEs,” he concluded his thought.

The one-hour discussion then saw an active interaction between the speakers and the participants. The talk was concluded with an extensive yet insightful Q&A session.

![]()

![]()

![]()

Wholly owned by UTAR Education Foundation Co. No. 578227-M LEGAL STATEMENT TERM OF USAGE PRIVACY NOTICE