Advice on effective money management and debt by AKPK

The Centre for Accounting, Banking and Finance (CABF) and the Department of Finance parked under the Faculty of Business and Finance (FBF) successfully organised a talk titled “Managing Debt” via Microsoft Teams on 14 September 2020. Joined by more than 100 participants, the talk was presented by Financial Education Department of Agensi Kaunseling & Pengurusan Kredit (AKPK) Manager M. S. Nirmala.

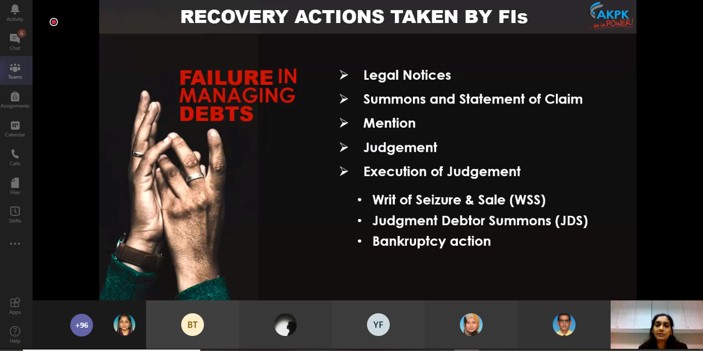

Nirmala commenced the talk by discussing the signs of individuals who face financial difficulties. The signs include individuals not having enough money for spending, individuals facing legal action for debt recovery, or receiving calls and reminders for overdue bills, and individuals receiving summons and statement of claim, judgement and execution of the judgement. With the execution of the judgement, the individual’s items would be auctioned under the writ of seizure and sale and subsequently, he or she would face bankruptcy action.

She explained, “The loan balance threshold for bankruptcy action is RM100,000. Once a person is declared bankrupt, the case would then be referred to the Insolvency Department where a plan would be put in place for the individual to settle his debts based on his resources. According to the current statistics, personal and hire purchase loans are the main contributors to bankruptcy, especially when these loans were for long tenures. The statistics also show that the majority of bankrupt individuals are between 35 to 45 years old.”

She added, “Once declared bankrupt, one of the implications that the individual would face is restrictions on leaving the country where he or she would require prior permission from the Director General of Insolvency or the Court. Additionally, the individual’s assets and bank account will be frozen.” On a positive note, however, Nirmala emphasised that bankruptcy is not a life sentence and that the bankrupt individual is automatically discharged after three years upon achieving a target settlement for his or her debts and fulfilling other criteria.

Nirmala said that the role of AKPK is to assist the individuals to negotiate and restructure an affordable payment plan which is acceptable to the financiers. A majority of individuals who approach AKPK for assistance are those from 35 to 50 years old age bracket. It is in this age bracket that the borrowers face huge financial commitments for a growing family and ageing parents. Thus, she advised that financial planning should start early so that individuals can prepare themselves financially when these commitments reach their peak.

In addition to financial planning, the speaker also highlighted some factors leading to bankruptcy. These are greed, lifestyle, lack of awareness and unavoidable circumstances such as loss of employment and illness. To avoid greed, she advised to invest in knowledge and to control one’s emotion when investing. For lifestyle, she suggested to only take up productive loans where the assets will bear financial fruits in the future. Other advice includes managing the debt level to reduce borrowing cost as well as reducing expenditure in a sustainable manner.

The insightful talk was concluded with an equally interesting Q&A session.

Some screenshots of the participants while engaging in the talk with the speaker

© 2020 UNIVERSITI TUNKU ABDUL RAHMAN DU012(A).

Wholly owned by UTAR Education Foundation Co. No. 578227-M LEGAL STATEMENT TERM OF USAGE PRIVACY NOTICE