With the aim to shed light on the importance of wealth management as well as to provide basic financial knowledge to students, UTAR Centre for Foundation Studies (CFS) of Kampar Campus conducted a webinar titled “Millionaire Baby Workshop” via Zoom on 28 August 2020.

The webinar was moderated by CFS lecturer Tan Chi Hau and delivered by CFS Department of Management and Accountancy lecturer Chan Wan Ling. Before joining UTAR as a lecturer, Chan worked as a trainer in a training consultancy and was involved in many trainings such as Soft Skills for Youth, Entrepreneurship and Financial Literacy Programme.

In her talk, Chan touched on the definition of money, financial planning, saving tips and saving habits as well as how to do investment. She said, “Being a millionaire is not only determined by luck. You also need to have some financial knowledge and good attitude when it comes to managing wealth. Recently, a lot of young people got themselves into trouble when they were labelled bankrupt for not paying their credit card debts. So, it is important to do financial planning. Give priorities to settling your monthly bills, loan repayments and miscellaneous expenses. Setting aside a certain amount of money each month will also help you to build up your savings. And always remember to stop spending once you have reached the maximum capacity for each month.”

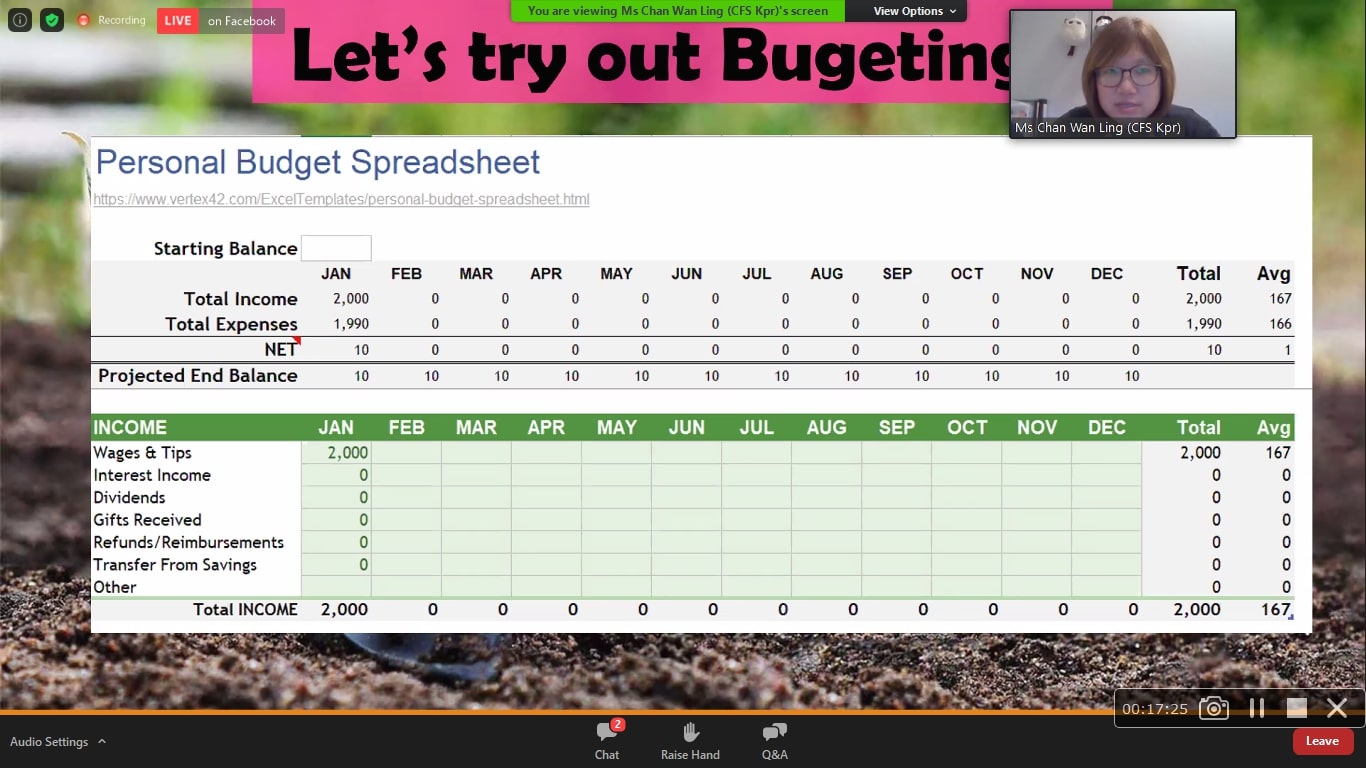

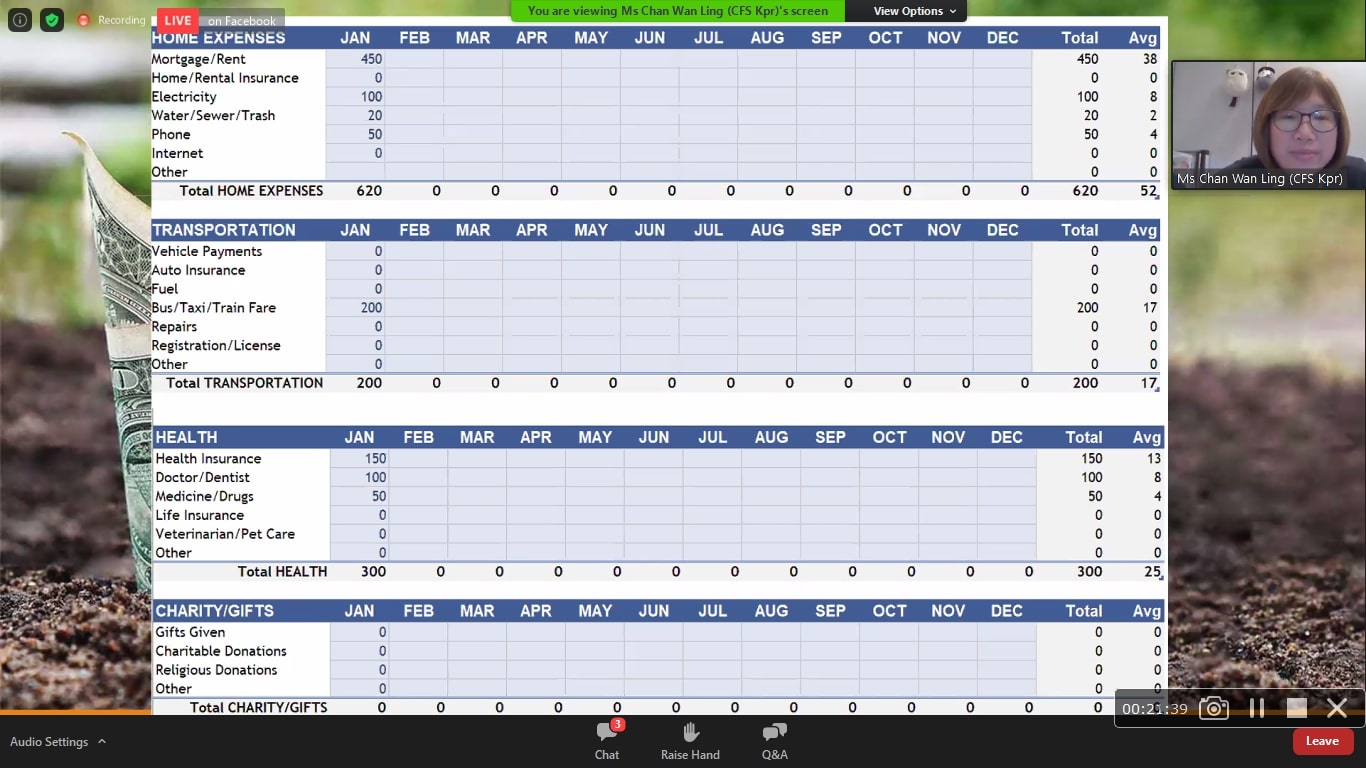

Speaking about financial planning, Chan advised, “You could start your financial planning by doing budgeting and expenses tracking. Budgeting means you do not spend more than you could afford,” she said and then continued, “There are four steps in preparing a budget. The steps include estimating the income, planning savings, estimating expenses and balancing the budget.”

Chan showing some templates of personal budget spreadsheet

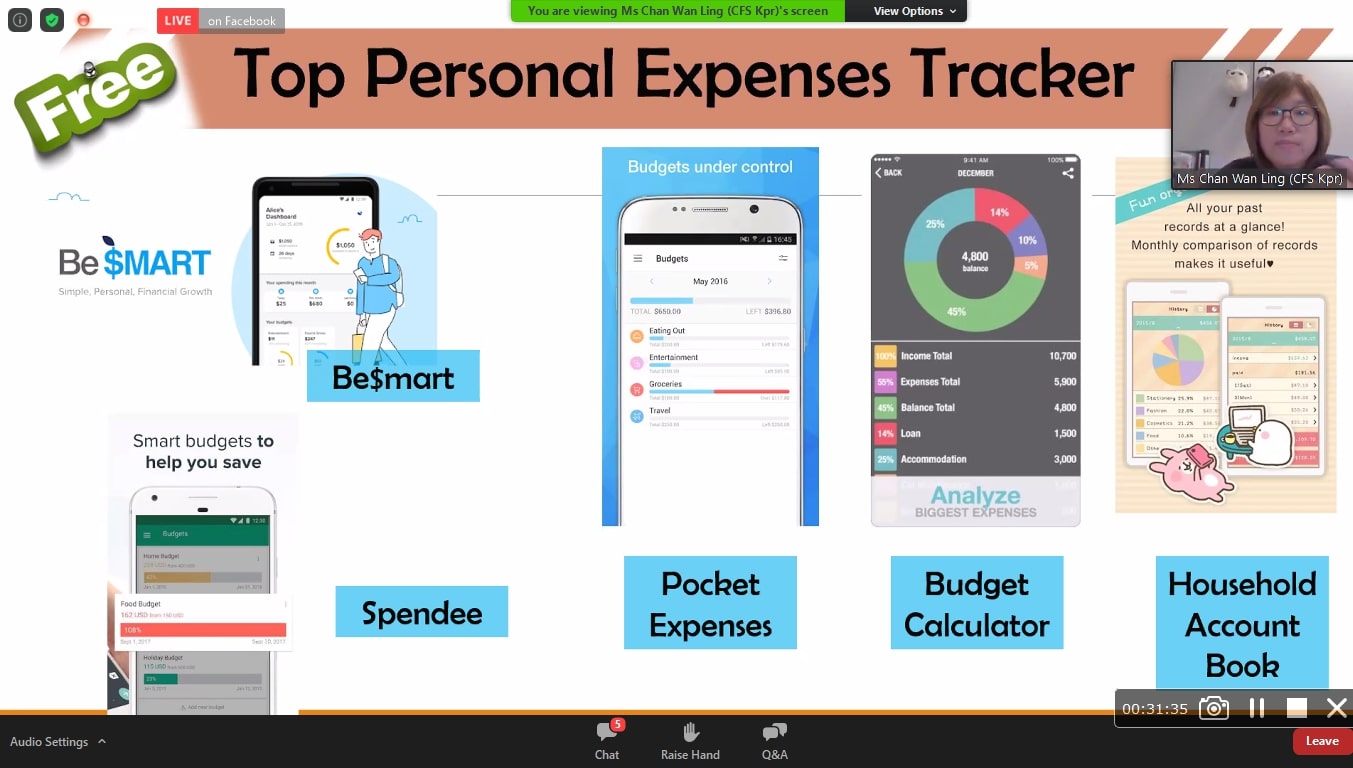

Chan also encouraged participants to note down their income and expenses using the free personal budget spreadsheet template that could be downloaded from Google. “You are encouraged to start tracking your expenses every day using electronic tools or a notebook. For the personal budget spreadsheet in Excel, you can find those formulas on the Internet but it requires a fee. If you do not want to use the Excel or the notebook, you could record using personal expenses tracker apps that can be downloaded through the apps store,” she said.

Chan recommending some apps to track personal expenses

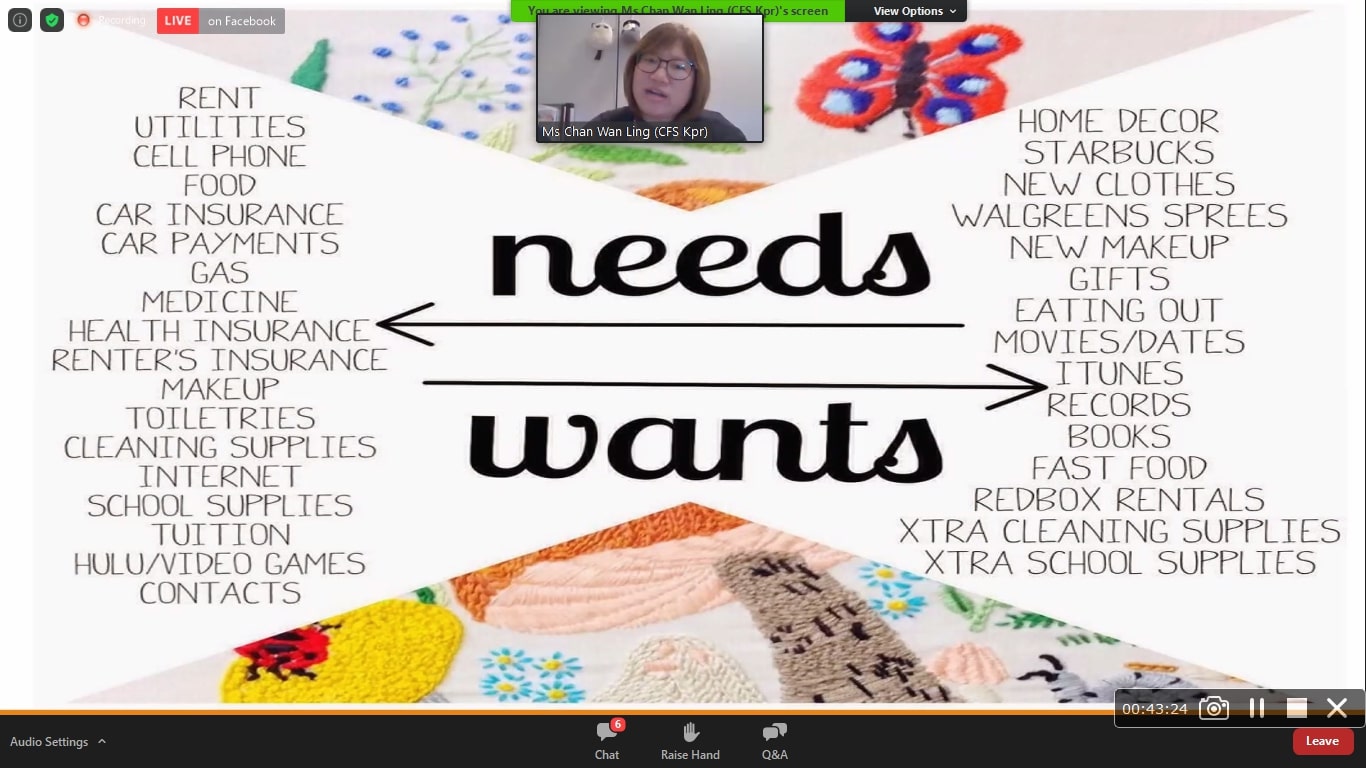

Chan also shared how to make saving and investment. According to Chan, saving is meant to cut expenses while investment is meant to increase income. “Some high-income earners might have higher expenses. Therefore, having a low income does not mean you cannot save more money. Rich people can be invisible because they live a simple lifestyle,” she explained.

She said, “You need to identify the things you want and the things you need. You only spend on things you need and not for the things you want.”

Chan explaining the differences between “needs” and “wants”

Explaining how to do financial planning using bank services, Chan said, “You can open four bank accounts to help manage your financial planning. The four bank accounts must have different uses; one for the basic transaction and the rest for buffer, personal goal and investment respectively.”

“Buffer is an emergency fund and it is very important. You pick out the amount that you need to spend every month. If you save up to six-month buffer, you will be safe. You must at least have three months buffer,” Chan advised.

Lastly, Chan explained the different types of investments which included cash investment, bonds, stocks, mutual funds, ETF and REITS (real estate). Chan also reminded participants not to change their lifestyle even if they have more income in the future. “Over-upgrade lifestyle could make us become an over-spending person,” she said.

A Q&A session followed after the talk where the participants were given an opportunity to raise their questions and feedback.

Chan recommending several financial channels to financial knowledge

![]()

© 2020 UNIVERSITI TUNKU ABDUL RAHMAN DU012(A).

Wholly owned by UTAR Education Foundation Co. No. 578227-M LEGAL STATEMENT TERM OF USAGE PRIVACY NOTICE