The role of Bank Negara in ensuring a conducive financing environment amid Covid-19 pandemic

The Department of Economics and Centre for Economic Studies (CES) under the Faculty of Business and Finance (FBF) organised a webinar titled “The Impact of Covid-19 on Businesses and Role of BNM in Ensuring a Conducive Financing Environment” on 4 September 2020 via Zoom and Facebook live (Utar4U).

Speaking at the webinar was Bank Negara Malaysia (BNM) Office Regional Head in Pulau Pinang Hasjun Hashim. The objective of the webinar was to share the real situation of the financial markets due to the Covid-19 pandemic and the role of policymakers in ensuring the conducive environment.

The session was moderated by Department of Economics lecturer Assoc Prof Dr Wong Chin Yoong. Dr Wong began the session by briefly explaining the financial issues that occurred during the pandemic and steps taken by BNM to overcome the issues. He also promoted the Bachelor of Economics (Honours) Financial Economics to the attendees and provided information regarding the programme.

Dr Wong speaking about the financial issues that occurred during the Covid-19 pandemic

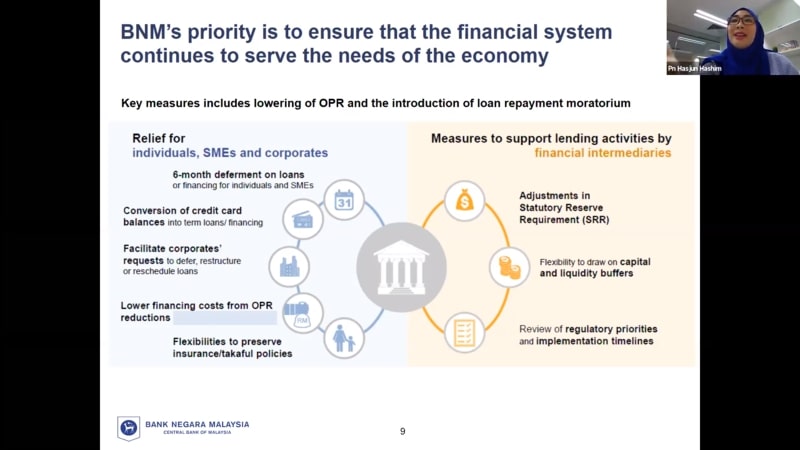

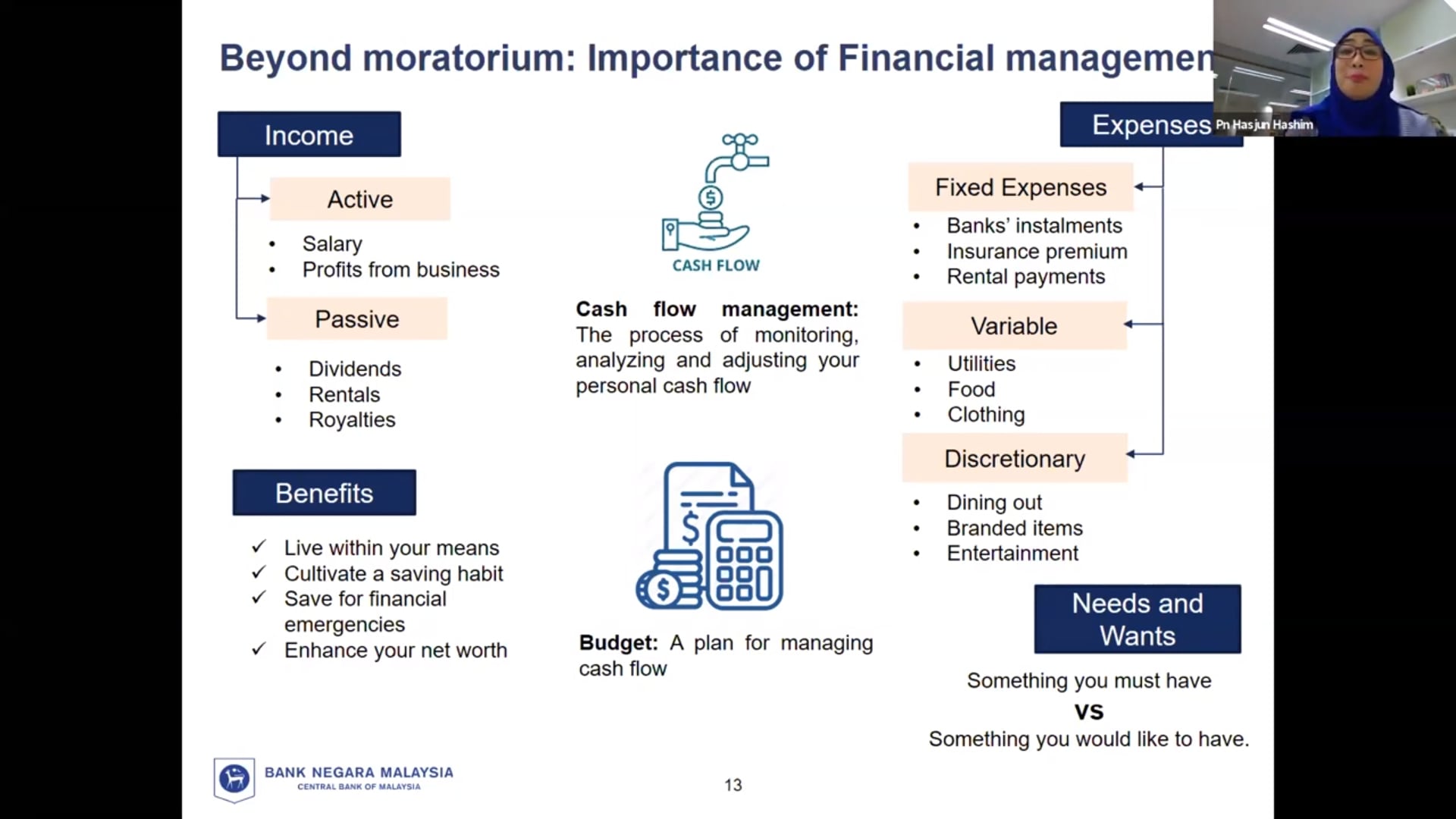

A total of four topics were discussed in the webinar. Among the topics covered were “The Impact of Covid-19 on Businesses in Malaysia (The winners and losers of Covid-19)”, “Policy Measured by the Government to Support the Economy, namely Pakej Rangsangan Ekonomi Prihatin Rakyat 2020”, “The Role of BNM via Monetary Policy (ensure effective financial intermediation)” and “Beyond the Moratorium: What’s next? (The importance of finance education and management)”.

In her talk, Hasjun also shared a lot of valuable insight based on her knowledge and experience with the current situation of the pandemic. Speaking of her working experience in BNM, she told the attendees that she faced a lot of challenges while trying to help the people who came for help. “We have almost 2,000 people engaging with Bank Negara every day. Even during the pandemic, many people still called and walked into the centre to get advice and solution from our financial service teams. Based on our observation, many people encountered problems with their business during the pandemic period,” she said.

Hasjun said, “The BNM is trying to protect and assist the public by giving education on financial knowledge and information as it is concerned about the people. We have been sending our staff around to give speeches as well as education on consumers’ rights as a financial consumer. You are considered a financial consumer when you have a bank account and insurance. As a financial consumer, you should keep yourself protected by knowing your right and responsibility.”

Ever since the standard operating procedure (SOP) was implemented by the government, one of the trending topics that concerned the bank was the usage of e-payment. “We are now actively promoting e-payment, especially to students because the youngsters are very much into the latest technology,” said Hasjun while encouraging participants to employ e-payment. “Actually, the cost of cash management is very expensive, but the e-payment system is more efficient and it saves cost,” explained Hasjun.

During the Q&A session, Hasjun answered a lot of questions regarding banking system, the digitalisation of bank in Malaysia in the future, as well as internship opportunities for UTAR students in BNM.

As of 24 September 2020, there have been a total of 357 views on Utar4u (Facebook). Approximately 474 people have taken part in the webinar live on Facebook and Zoom.

Hasjun at the end of the webinar

One of the roles of BNM is to ensure the financial system can continually serve the needs of the economy

Hasjun explaining the importance of financial management

![]()

![]()

![]()

© 2020 UNIVERSITI TUNKU ABDUL RAHMAN DU012(A).

Wholly owned by UTAR Education Foundation Co. No. 578227-M LEGAL STATEMENT TERM OF USAGE PRIVACY NOTICE