The event poster

It is no secret that fresh

graduates would often have financial problems as they tend to spend lavishly

instead of being frugal. This occurs especially after they receive their

first paycheck; enticed by the huge amount of money they get, young people

tend to splash their cash on expensive things immediately, rather than

saving it. This is a third-world problem for most fresh graduates in

Malaysia, which is why UTAR Faculty of

Accountancy and Management (FAM) and the Centre for Sustainable Development

and Corporate Social Responsibility in Business (CSDCSR) in collaboration

with Private Pension Administration Malaysia (PPA), the central

administrator for the Private Retirement Schemes (PRS) co-organised a

financial education webinar on 3 September 2020 via Zoom.

The talk, titled

"YOLO: You Only Live (Longer) Once – Want to Have

Enough When the Time Comes?",

was given by PPA PRS Learning and Engagement

Manager Farith Jamal. The webinar aimed to help the students and staff

recognise the importance of money management and retirement planning and

learn personal finance concepts applicable to savings and investing. Not

only that, the participants also had a deeper understanding of the framework

and features of PRS and its benefits for young adults, not to mention they

become increasingly familiar with PPA’s PRS online service.

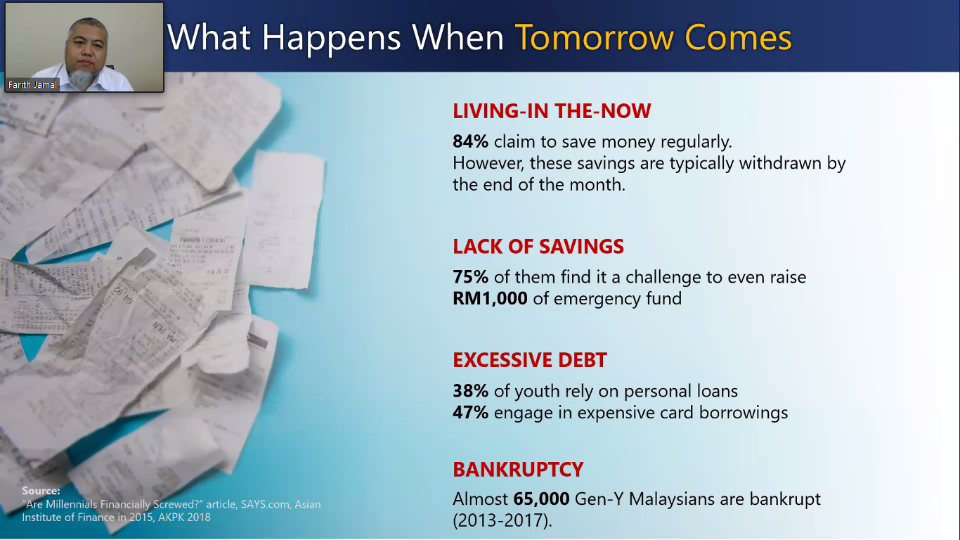

Farith began the talk by defining

“YOLO” using a video clip, where it stated, “You Only Live Once”. “A lot of

young people like to live this way, as they believe that you should live in

the moment. They spend money on designer shoes, handbags, travel, the latest

phones and others. While this can be a good mindset to have, living like

this has proven to cause money stress. This is seen, as 84% of young people

claim to save money but these savings are regularly withdrawn at the end of

the month. Not only that, a lack of saving means that they constantly have

money problems, with a statistic showing that 75% of them find it difficult

to even raise RM1,000 for an emergency fund. Additionally, they tend to face

massive debts due to their reliance on personal loans and expensive card

borrowings. Worst of all, almost 65,000 Generation Y Malaysians are bankrupt

from 2013 to 2017 due to the lack of financial education,” lamented Farith.

Farith sharing the

problems faced by students

He pointed out that to ensure

money is not simply spent, one should understand their needs and wants. He

said, “One financial planning tip for youths to save money is by knowing

their wants and needs. The needs, more often than not, outweighs the wants,

as a person’s needs consist of basic necessities like food, water and

shelter. On the other hand, the wants are materialistic things that not

necessarily help a person in living, for instance, your videogames,

jewellery and travel. Nevertheless, lots of young people might accidentally

allow their wants to take over their needs, which is where their money is

wasted.” Farith then spoke about the two types of financial planning; short

and medium financial planning, which should be done by youths so that they

can save money. “When it comes to short-term financial planning, making a

budget would be the wisest option. A budget is a process of creating a plan

to spend money. Why is it good to have a budget in the short-term? It helps

to monitor your cash flow while ensuring your financial goals are on track.

It can also build good credit and help a person avoid debt. When making a

budget, one should also avoid inflate spending when beginning to work. For

medium-term financial planning, debt management is the best method to use.

There are two types of debt we can create, good and bad debt. The former is

a type of debt that can bring profits to us, like buying a house and renting

it to other people to use, while the latter refers to debts that cause the

value of the item to depreciate and generate high interest. I can tell you

five simple ways to avoid debt; firstly, review your budget, and next, start

an emergency fund that can help to pay debts and avoid interest. Also, do

not overdo it with credit cards and remember to pay on time. Last but not

least, do not take loans you do not need,” said Farith, when explaining the

types of financial planning.

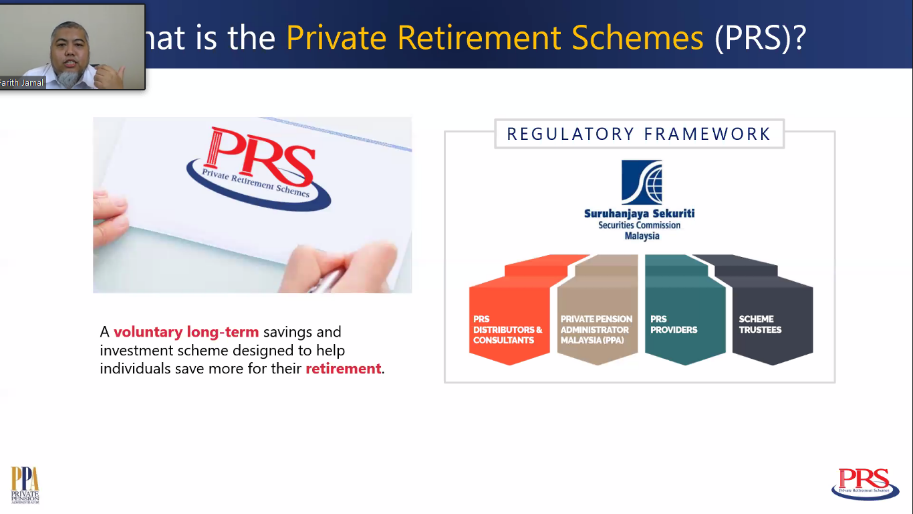

Farith explaining

PRS

Moving on, Farith pointed out

another type of financial planning, which is long-term planning. For this

type of planning, he noted that a person should plan his or her budget for

their retirement. In order to have enough savings for the inevitable

retirement, he stated that a person needs at least 2/3 of their income, and

to get this amount, 1/3 of their monthly salary should be saved. Farith also

shared some tips with the participants on saving retirement money.

Afterwards, he touched on the most important aspect of the webinar, which is

the Private Retirement Schemes (PRS). “Private Retirement Schemes, or PRS,

can be defined as voluntary long-term savings and investment schemes that

are designed to help people save more for their future retirement, and it

even has its own regulatory framework. This framework comprises of five

parties; PRS distributors, PRS consultants, PPA, PRS providers and scheme

trustees. In the PRS account structure, your contributions will go into

either sub-account A or B. Seventy per cent of your contribution goes into A

and can be withdrawn upon reaching the legal retirement age, while the other

30% is transferred into sub-account B, and the money in it can be taken out

annually,” said Farith. He wrapped up the talk by explaining several other

details regarding PRS, including the ways Malaysians can fund retirement

savings and PRS can help close retirement savings gap, the eight types of

PRS providers, default option funds and others. He also taught the

participants the method to enrol into PRS online so that they too can start

saving for their retirement.

The Q&A session in

progress

The webinar ended with a brief Q&A

session.

Wholly owned by UTAR Education Foundation Co. No. 578227-M LEGAL STATEMENT TERM OF USAGE PRIVACY NOTICE