UTAR Centre for Corporate and Community Development (CCCD) organised a

webinar titled “How to reduce individual taxpayers’ income tax burden for

the year of assessment

2021 (tax filed in 2022) in Malaysia” on 15 April 2021.

Dr Tan during the talk

The webinar, conducted via Zoom and Facebook Live, was delivered by Faculty

of Business and Finance (FBF) Department of Commerce and Accountancy Dr Tan

Swee Kiow. In her talk, Dr Tan first shared the criteria for individuals to

be considered as tax resident under Section 7(1). According to her, the

residence status for tax purposes is determined based on the number of

physical presence of that individual in Malaysia in a basis period for a

year of assessment instead of their nationality or citizenship. She

presented the scale rates of tax that was applied to the chargeable income

of resident individual taxpayers and shared some strategies on how to

mitigate tax abilities.

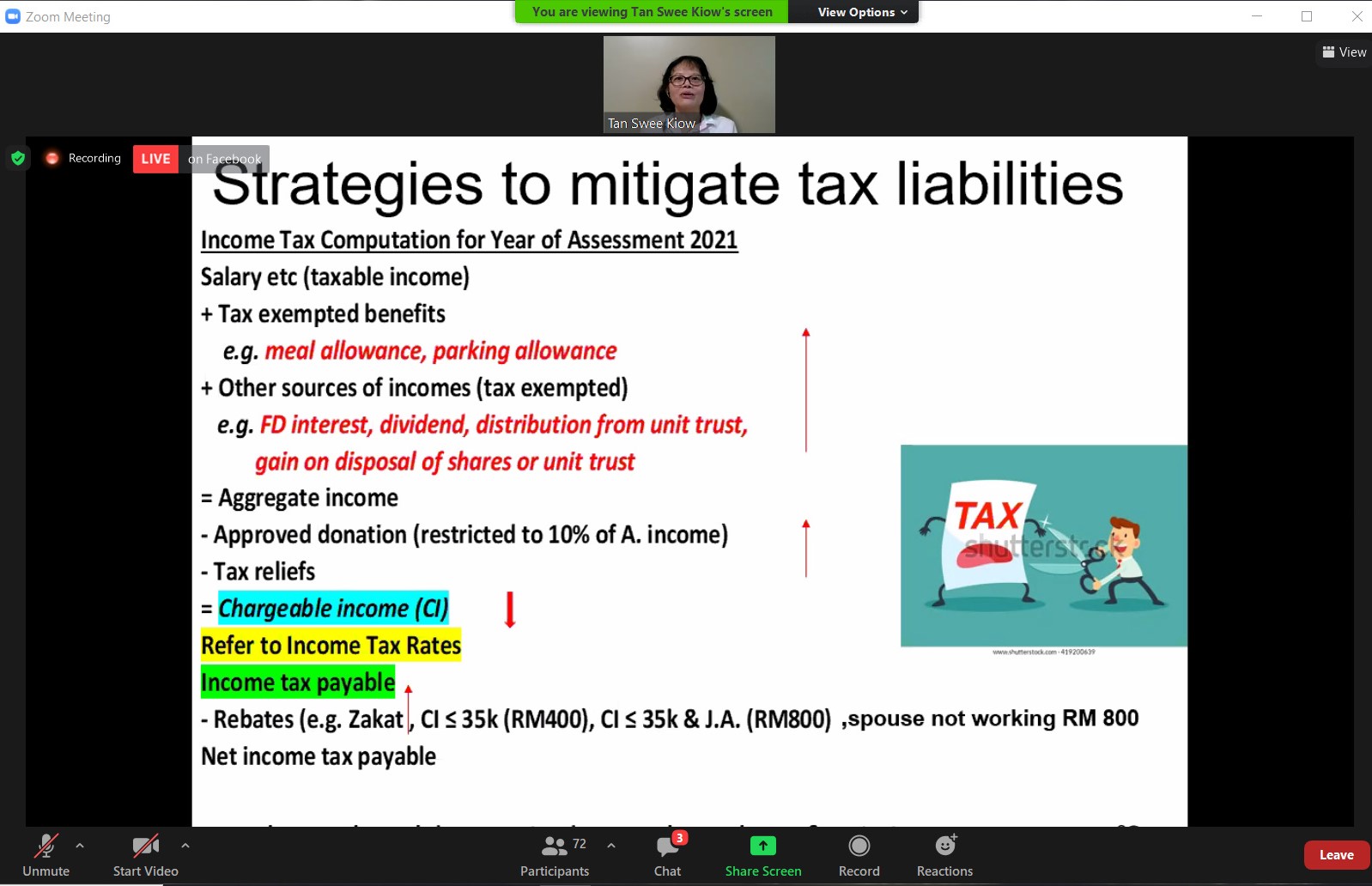

Dr Tan sharing some strategies that could minimise tax liabilities in a legal and efficient manner

She then explained tax relief and said, “Tax relief is a way to reduce your

chargeable income. It is categorised into fixed relief and non-fixed relief.

With fixed relief, you are able to deduct a certain amount no matter how

much it incurred; Non-fixed relief depends on the amount incurred and it is

restricted to a maximum amount.”

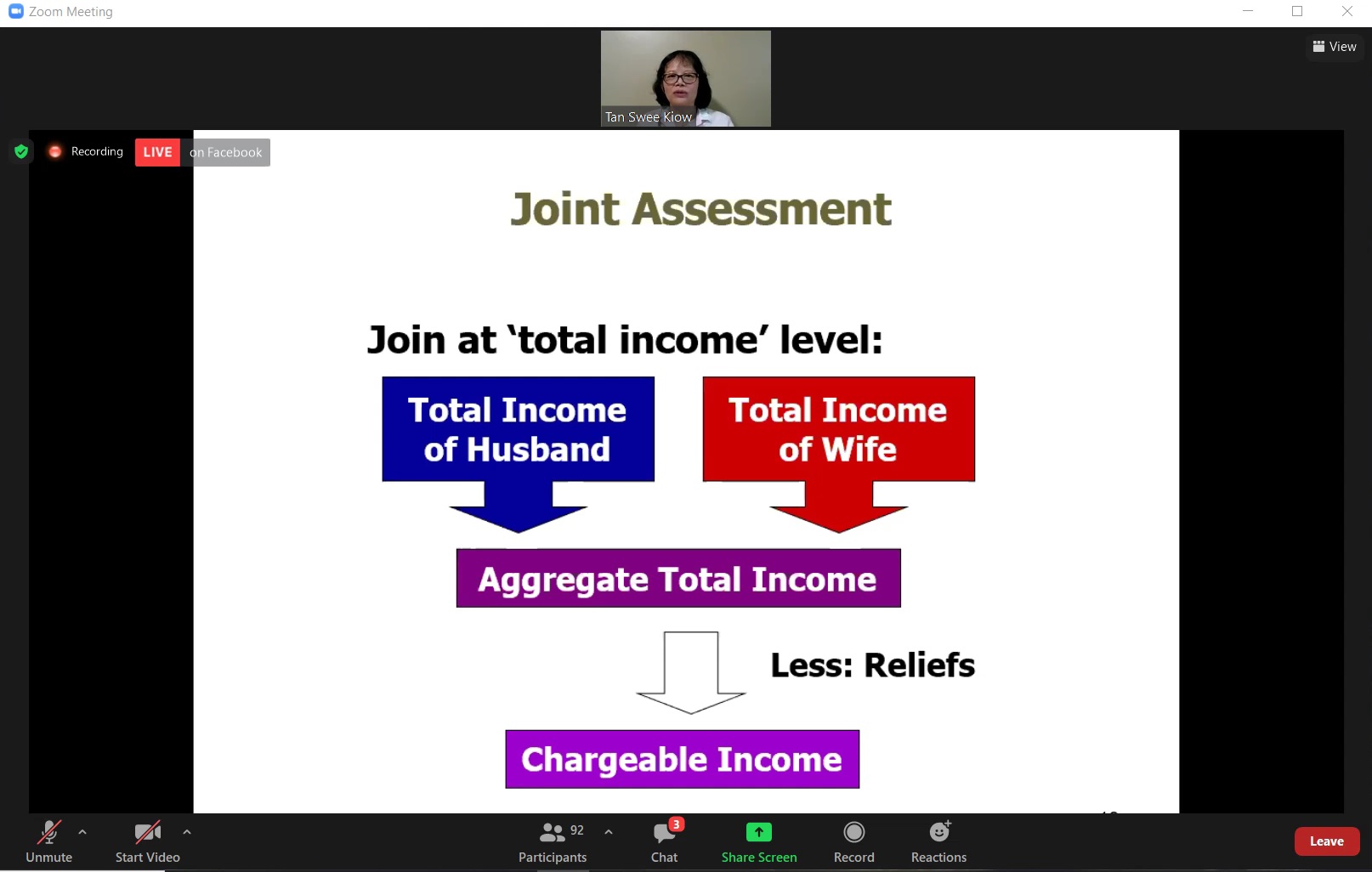

Dr Tan further explained how a married couple should make decisions related

to taxes—whether to file for separate or joint assessment. She stated that

married people are treated as separate individuals automatically unless they

choose otherwise. She mentioned that married couples should elect for joint

assessment if the spouse’s income is substantially less due to lower taxable

income or business loss. “A married couple should fulfil three conditions if

they want to choose joint assessment. Firstly, husband and wife must live

together. Secondly, both must have a total income to be aggregated. If the

husband or wife is a non-resident, then he or she must be a resident before

they apply for the joint assessment,” she said. She also provided some

examples in order to better understand the difference between joint

assessment and separate assessment. The webinar then ended with a Q&A

session.

Dr Tan presenting a format to compute joint assessment

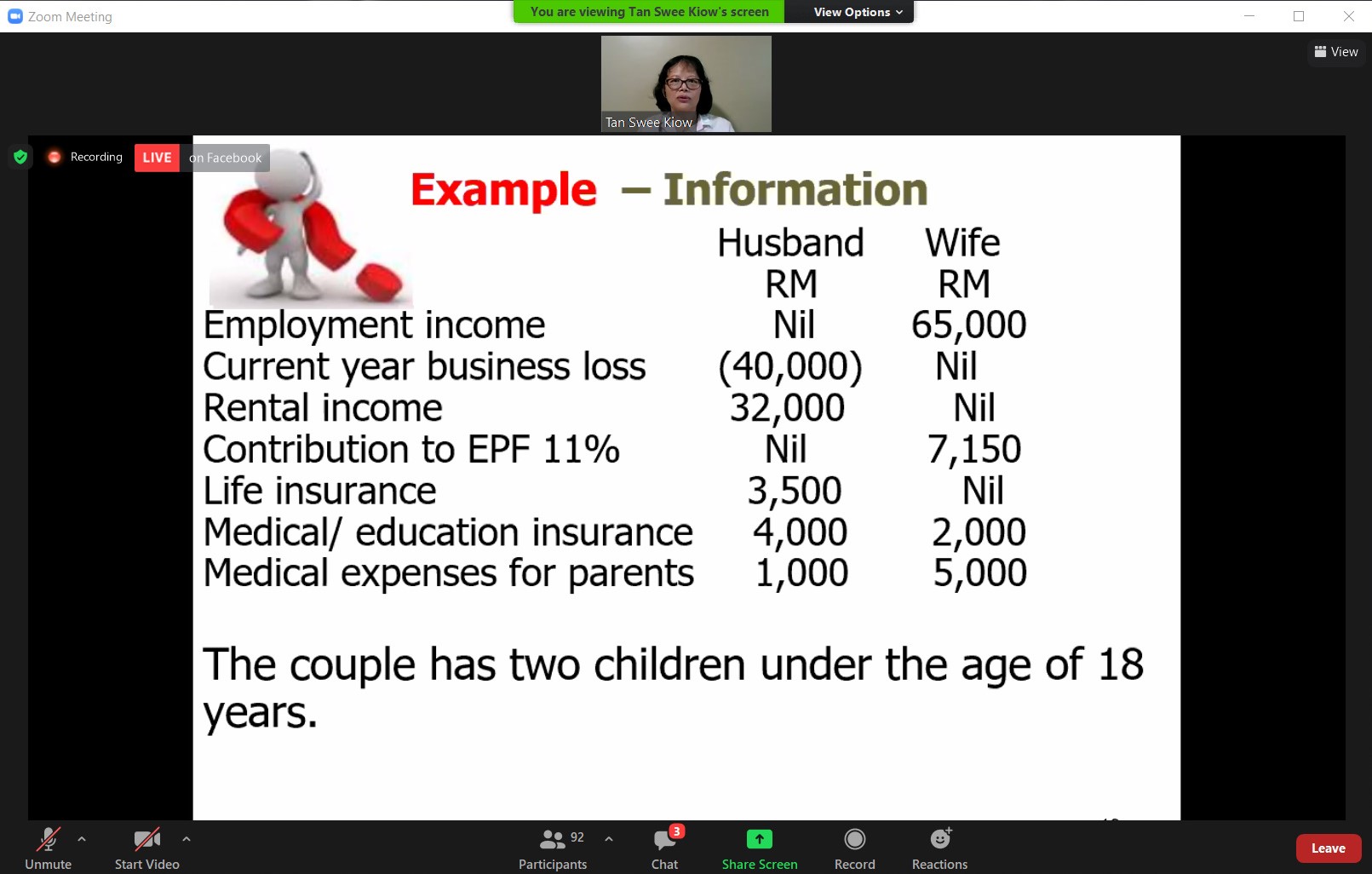

Dr Tan giving an example on how to compute the tax payable under separate

and joint assessment

Wholly owned by UTAR Education Foundation Co. No. 578227-M LEGAL STATEMENT TERM OF USAGE PRIVACY NOTICE