Gaining insights into the global economic outlook

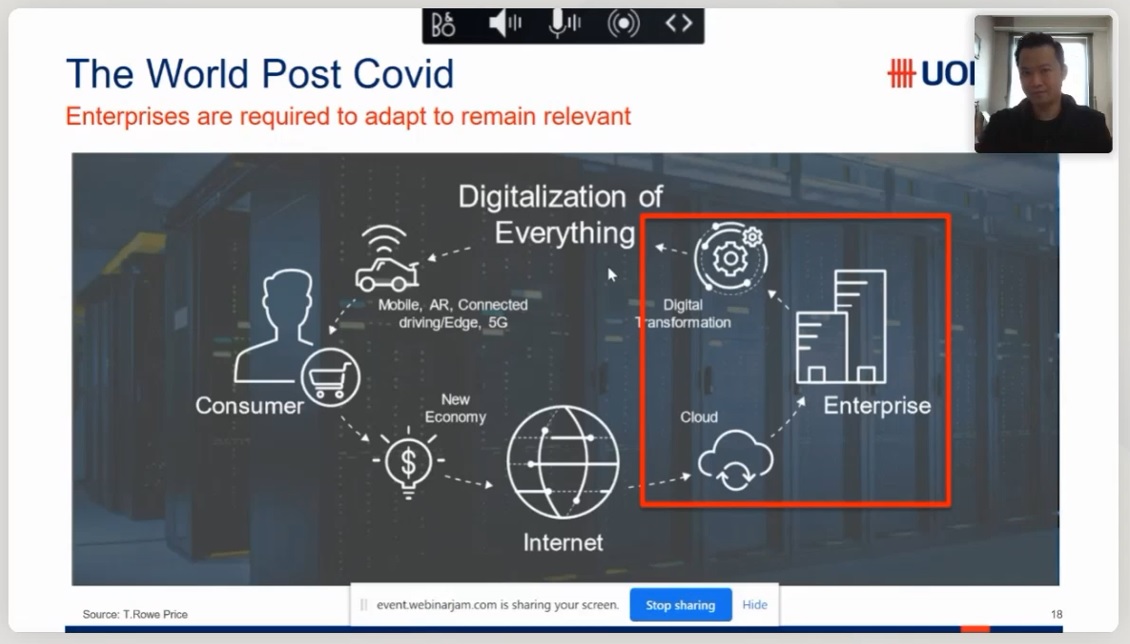

Economies across the country are facing challenges due to the Covid-19 outbreak. The pandemic has spread with alarming speed, and it appears that no industry is immune to it.

In the webinar titled “3+1R v2.0”, Chief Marketing Officer (CMO) and Senior Director of UOB Asset Management Edwin Lee Wai Kidd was invited again to share his views and insights after his talk on the outlook of the world economy and investment strategies in the second quarter of 2021 on 8 May 2021.

Edwin Lee during the webinar

The webinar was organised by UTAR Faculty of Accountancy and Management (FAM), Centre for Entrepreneurial Sustainability (CENTS) and UOB Asset Management (Malaysia) (UOBAM) via Webinar Jam on 17 July 2021.

The first R that Edwin Lee talked about was “resurgence vs reopening”. He said, “Most parts of the world are seeing a resurgence. It looks very depressing in terms of the resurgence of the new cases. We also heard from many experts, even the WHO saying the only way out for us through this pandemic is having everyone vaccinated.”

He mentioned that the number of vaccination percentages is growing very fast. “The good news is that we are seeing more and more countries getting their population vaccinated, and Malaysia is included,” he said, adding that more new vaccines are coming up and at least 18 vaccines are in the third phase of clinical trials. “They are expecting more vaccines to come into the market. That will actually help to speed up the production of the existing vaccine and the new vaccine will also come to fill up for the population of the entire world,” he said.

According to Edwin Lee, the second R was “reflation or inflation”. “Reflation is a situation where the government tries to stabilise the economy and prevents it from going into a recession,” he said. He explained that the inflation in the country is expected to creep up, however it will not be a stubborn situation that it will not go down. He then further explained the third and the last R—“reporting season” and “rebalancing”.

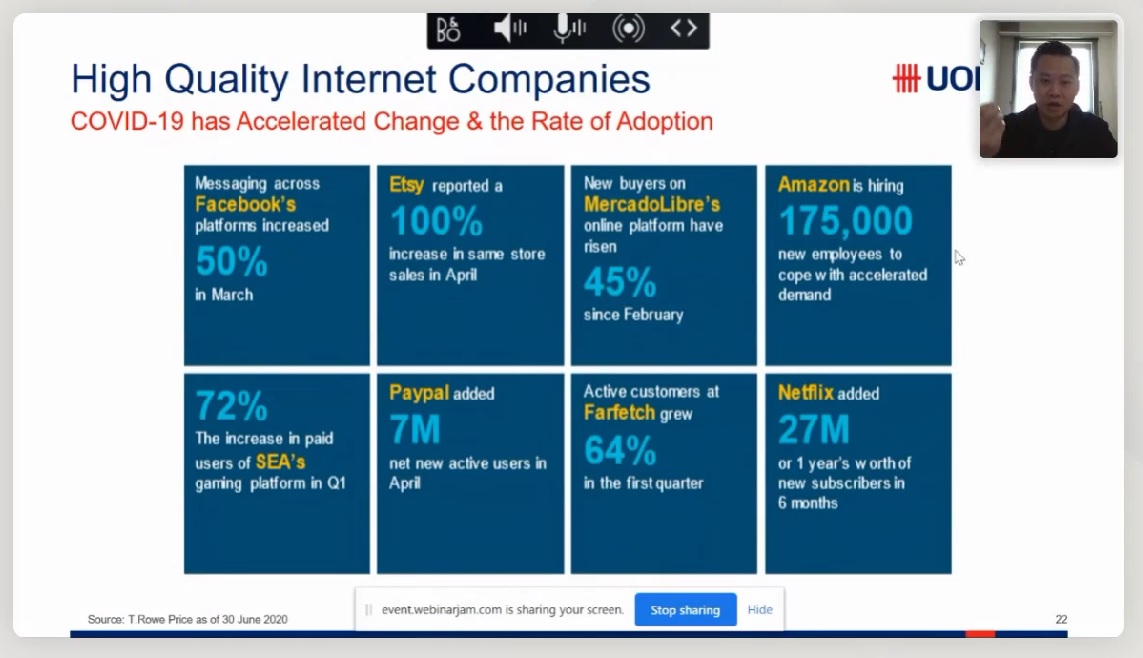

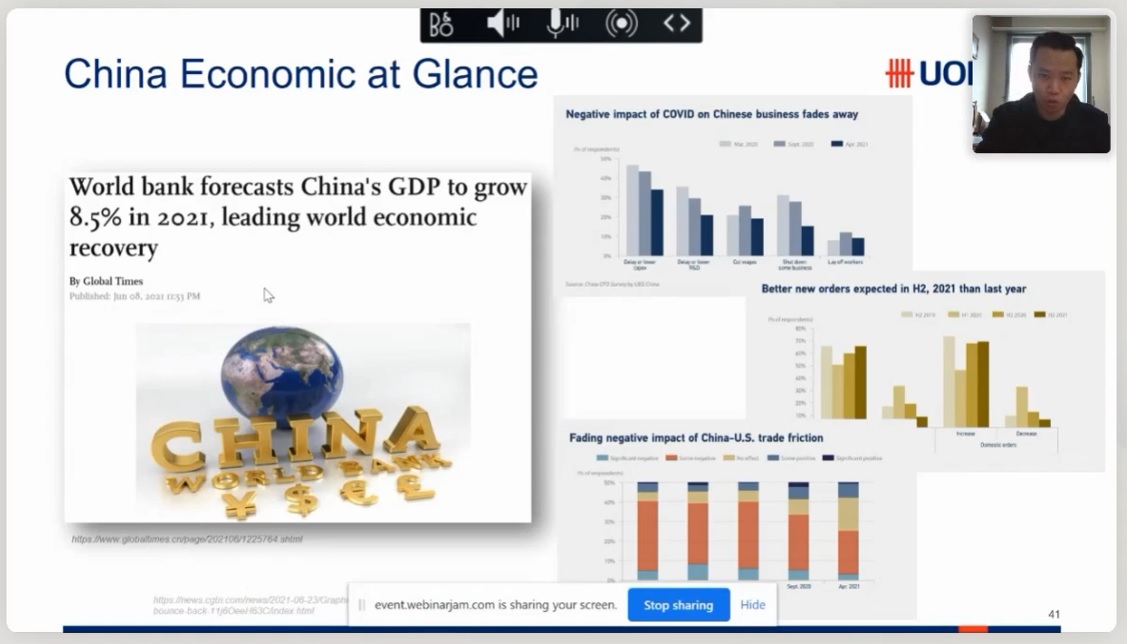

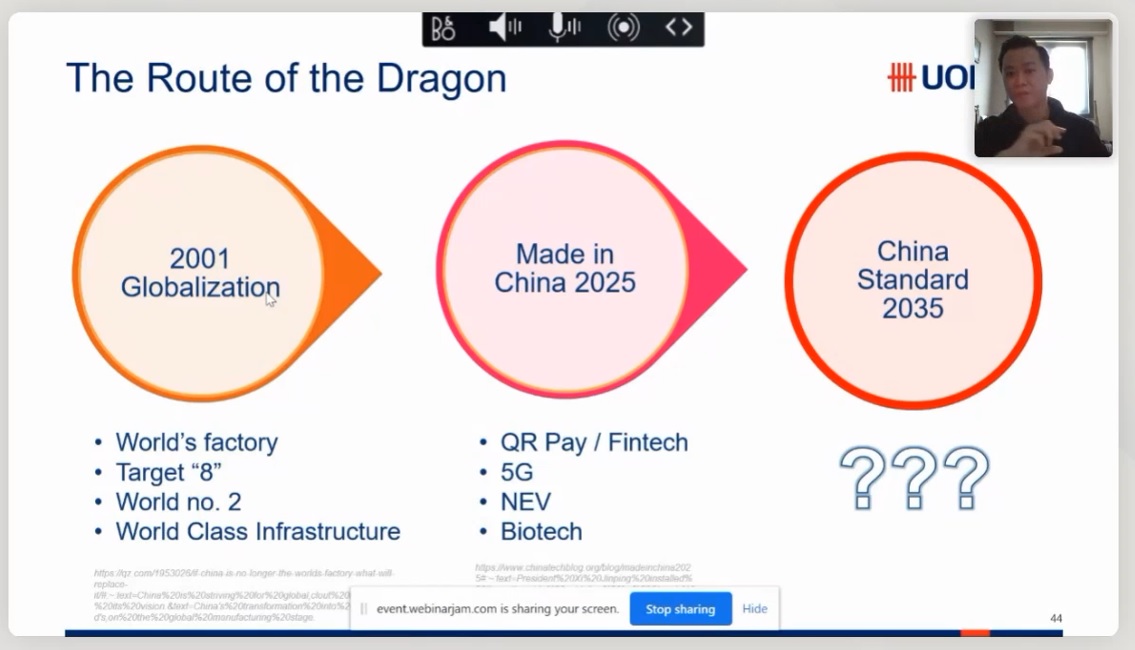

He shared his fund recommendation, which included United Global Technology Fund, United Malaysia Fund, and United Great Dragon Fund. He presented the performance of the technology fund and explained why he is more convinced on tech in the third quarter as compared to the first two quarters early this year. He mentioned that, despite Malaysia’s market not performing well, it has good companies that do not depend on the country’s economy. He also shared the economic situation in China and explained what China is going to do beyond “Made in China 2025”.

Edwin Lee explaining why he shifted his attention to technology investment

Edwin Lee shared that most of the strong EPS growth comes from the technology sector

Edwin Lee sharing his concern on anti-monopoly tactics aimed at curbing the power of big tech companies like FAANG

(Facebook, Amazon, Apple, Netflix, Google)

Explaining China Standards 2035, he said, “China is currently the world’s second-largest payer of licensing fees. With China Standards 2035, it will reverse the relationship. China could be a net recipient of licensing fees.” He explained that China is trying to focus on the next industrial revolution such as automation and green technology as they have lost the opportunity to shape standards for products such as smartphones and software. As more and more people started to invest in the healthcare sector, he also explained what is next for the healthcare sector after the pandemic. The talk then ended with a Q&A session.

Figures showing China's economy that continues to rebound

Edwin Lee explaining what China want to achieve in 2035 with China Standards 2035

© 2021 UNIVERSITI TUNKU ABDUL RAHMAN DU012(A).

Wholly owned by UTAR Education Foundation (200201010564(578227-M)) LEGAL STATEMENT TERM OF USAGE PRIVACY NOTICE