.jpg)

UTAR Faculty of Accountancy and

Management (FAM) organised a webinar titled "Impact of Major

Infrastructure on Residential Property Markets: Melbourne Airport Case

Study" on 24 February 2021 via Microsoft Teams with the attendance of 112

participants.

The invited speaker was UTAR

Bachelor of Building and Property Management (BBP) (Honours) external

examiner Prof Dr Alfred Christopher Eves. He is the associate dean for

Research and Innovation of School of Property of Construction and Project

Management at RMIT University. Moderating the webinar was FAM Head of

Building and Property Management Department Low Chin Kian.

Prof Alfred is the

external examiner for UTAR Bachelor of Building and Property Management

(Honours)

After Low initiated the talk, Prof

Alfred took the virtual stage and introduced the background of the Melbourne

Airport Case Study, “My interest stemmed from a project I initially started

in 2013 as I was approached by Brisbane Airport Corporation when I was in

Queensland University of Technology, Australia. They were actually planning

to put in a second runway with a parallel runway system.”

He highlighted, “The Brisbane

Airport Corporation realised that some of the public was going to be quite

negative about the new runway, therefore they wanted to know what would be

the possible impact when the new flight paths come in. When people talk

about major infrastructure programme, like the new development of railway,

airport and etc, one concern is about the impact of house prices. Therefore,

I started the case study by analysing the performance of a range of suburbs

across Brisbane, the movements in the median and average house prices and

the subsequent investment performance relative to the location of the flight

paths and the potential aircraft noise from 1988 to 2019.”

Prof Alfred explained, “When we

talk about the impact of major infrastructure, it is usually the impact of

noises that people are concerned about, for example, the increase of

movement, noise pollutions and so on, but what people really concerned about

is its impact to their property; their housing prices. However, based on the

result of my study, there were different views on how people react to

noises. Fifty per cent of people gave positive comments, despite living

under the flight path with aircraft noises as they think it consumes less

time when commuting to work. Furthermore, some of the respondents feel

positive about aircraft development as it will lead to a more quality

housing development and there will be no high rise property or retail

development at the surrounding.”

He continued the discussion by

highlighting his research focus, giving seven comparisons. He compared

suburbs with reported noise complaints versus suburbs with no or minimal

noise complaints; suburbs located under the N70 24-hour noise contour versus

suburbs adjoining the N70 24-hour noise contour; lower value noise complaint

suburbs versus lower value no complaint suburbs; middle value noise

complaint suburbs versus middle value no complaint suburbs; higher value

noise complaint suburbs versus higher value no complaint suburbs; individual

suburb capital return and investment performance from 1990 to 2019 and

lastly the impact of development overlay and residential property

performance.

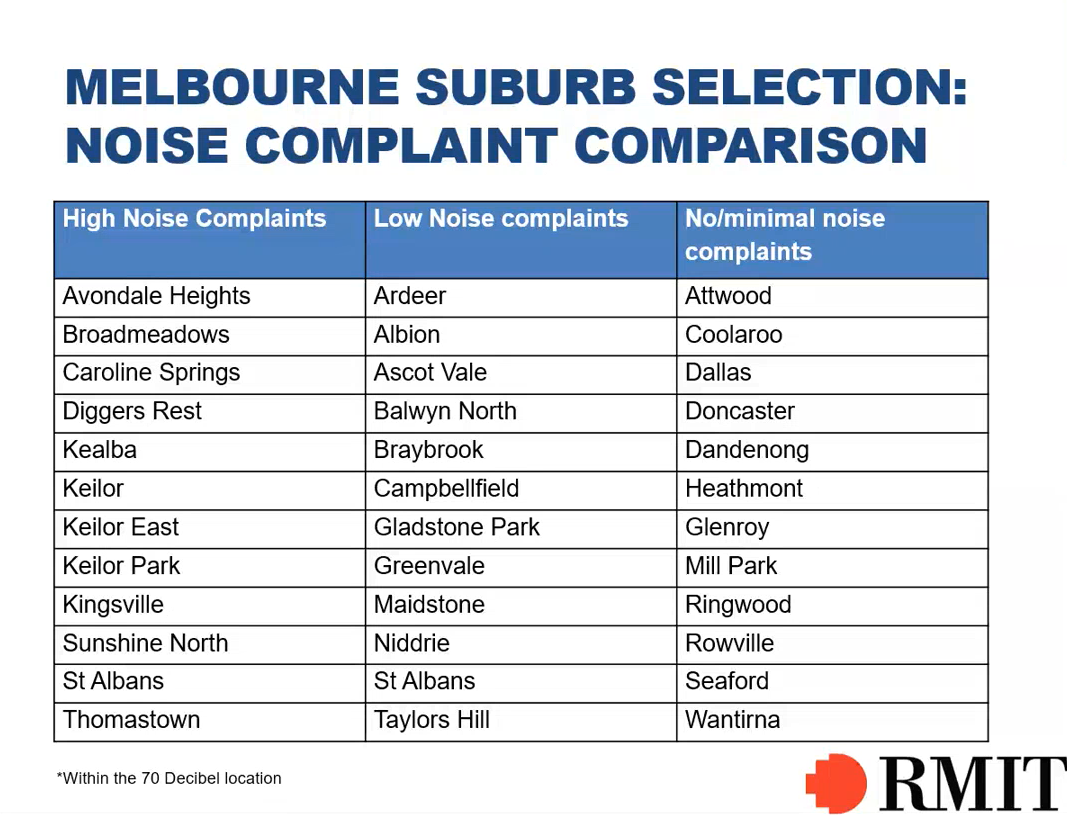

Prof Alfred showing

the suburb selection and comparing it with high reported noise complaints,

low noise complaints and no or minimal noise complaints

According to Prof Alfred, he had

chosen 36 suburbs to make the comparison. All the data he gathered on noise

complaints are from Airservices Australia. He identified it with three

categories, namely high noise complaints, low noise complaints and

no/minimal noise complaints. For the high noise complaints category, there

were six or more complaints on monthly basis; the low noise complaints

category consists of two to three per month and there are no complaints or

occasionally one per month for no/minimal noise complaints category.

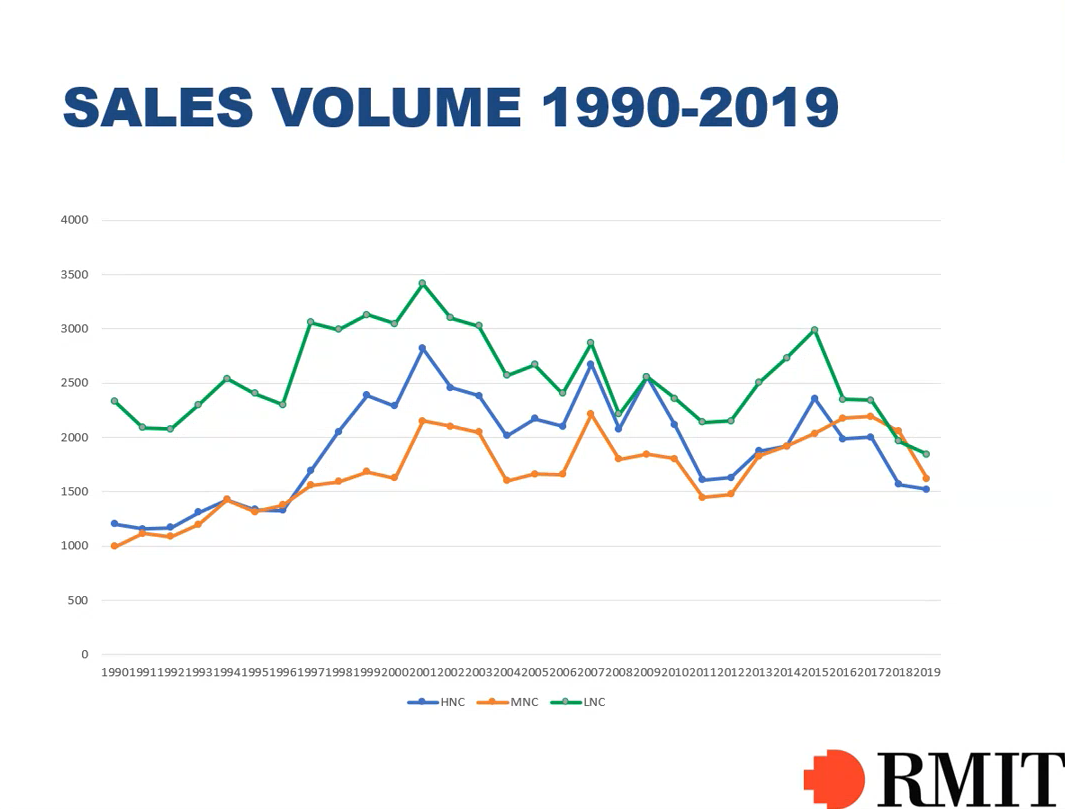

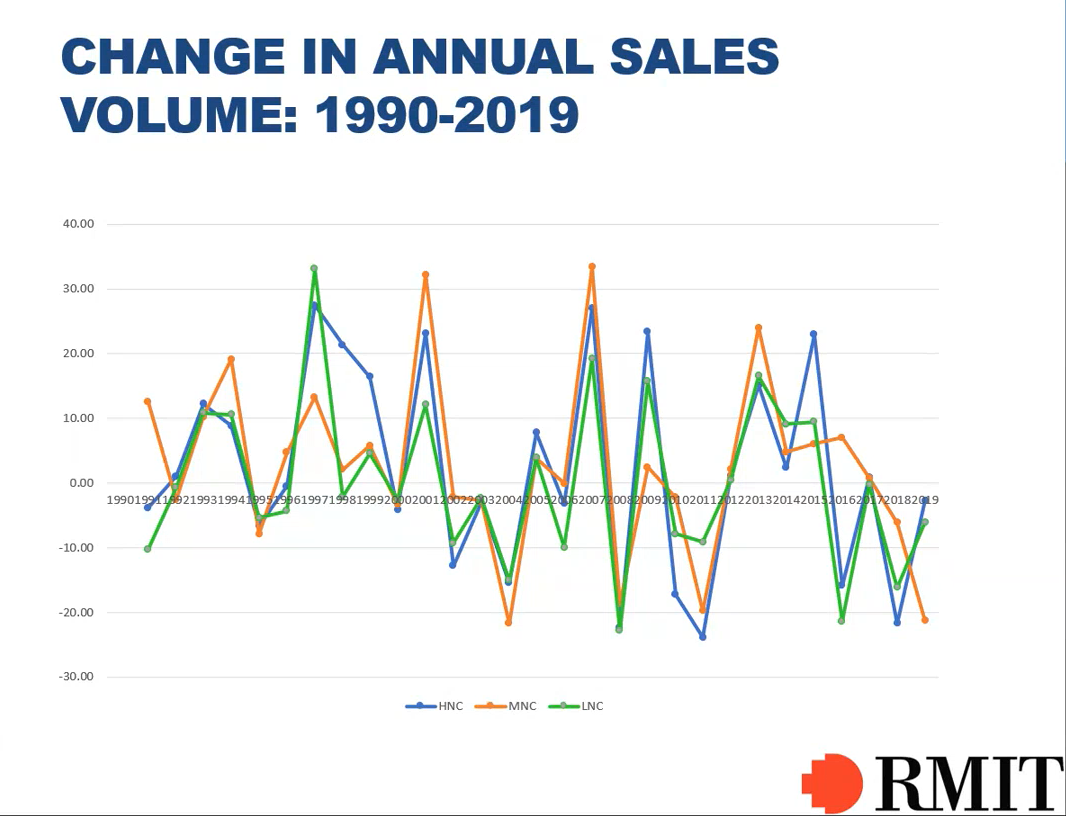

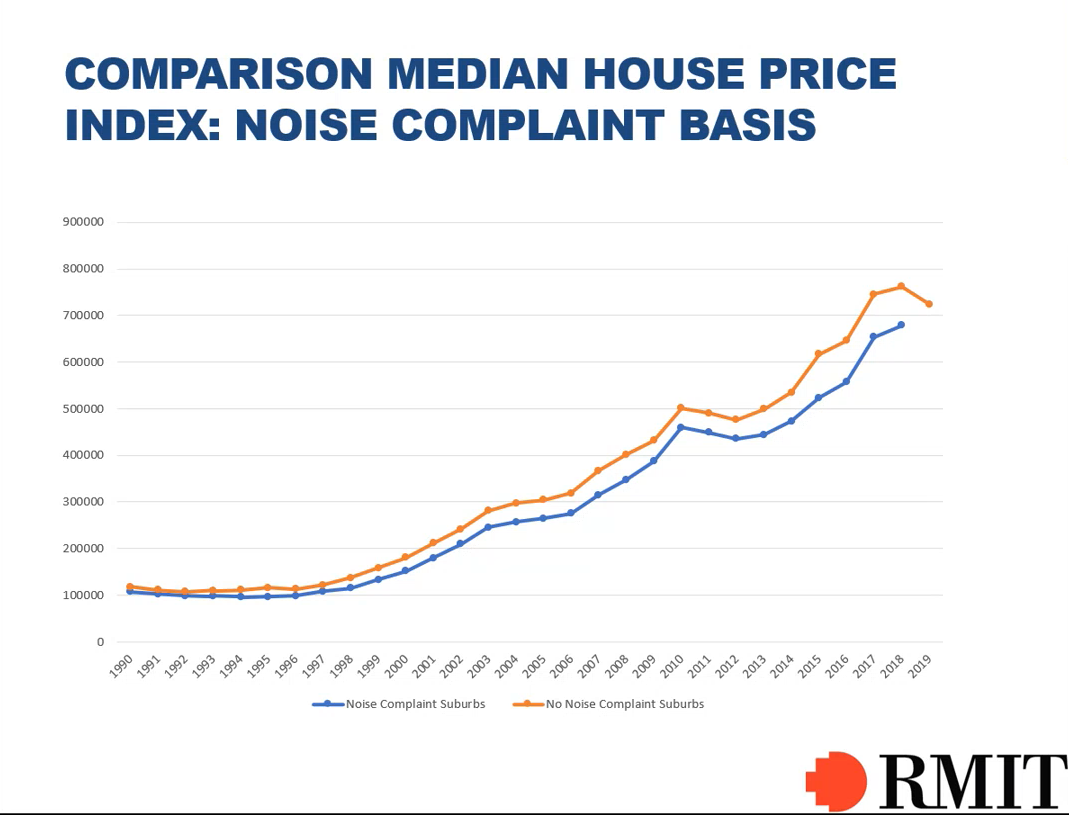

The graphs showing

the comparison of sales volume of low noise complaint location, moderate

noise complaint location and high noise complaint location (left) and also

the changes in annual sales volume (right) from 1990 to 2019

Graph showing the

comparison of investment performance on median house price index and average

house price index on noise complaint suburbs and no noise complaint suburbs

Prof Alfred described, “Looking at

the graph on the investment performance of median house price index on noise

complaint suburb and no noise complaint suburb, the trend of house price

movement is quite similar and does not see any significant drive that

impacts the performance of the particular market. There are only minor

differences shown especially in the average house price index.”

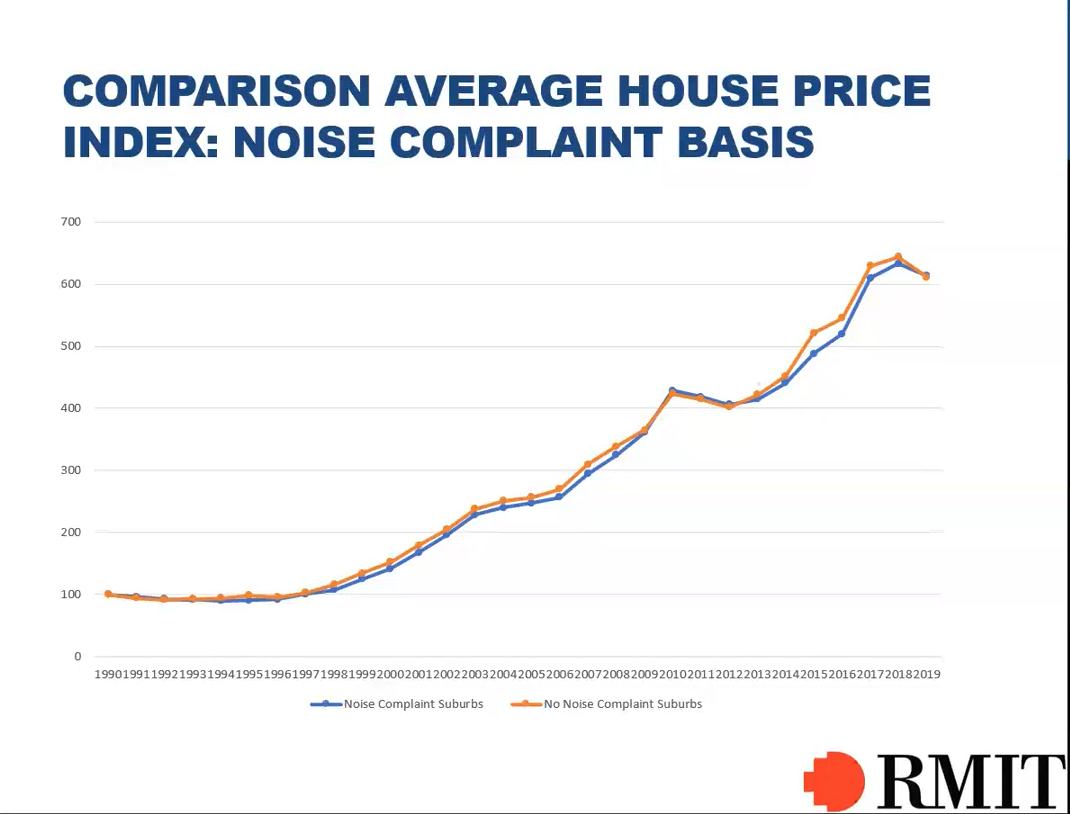

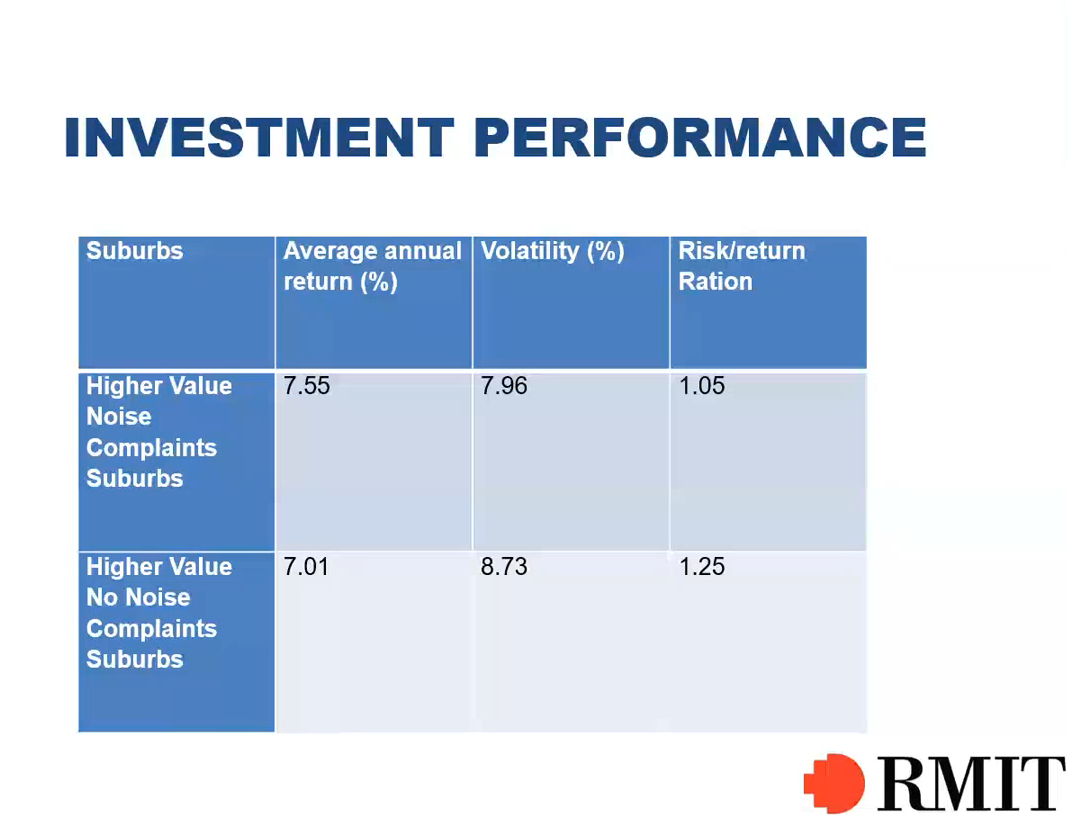

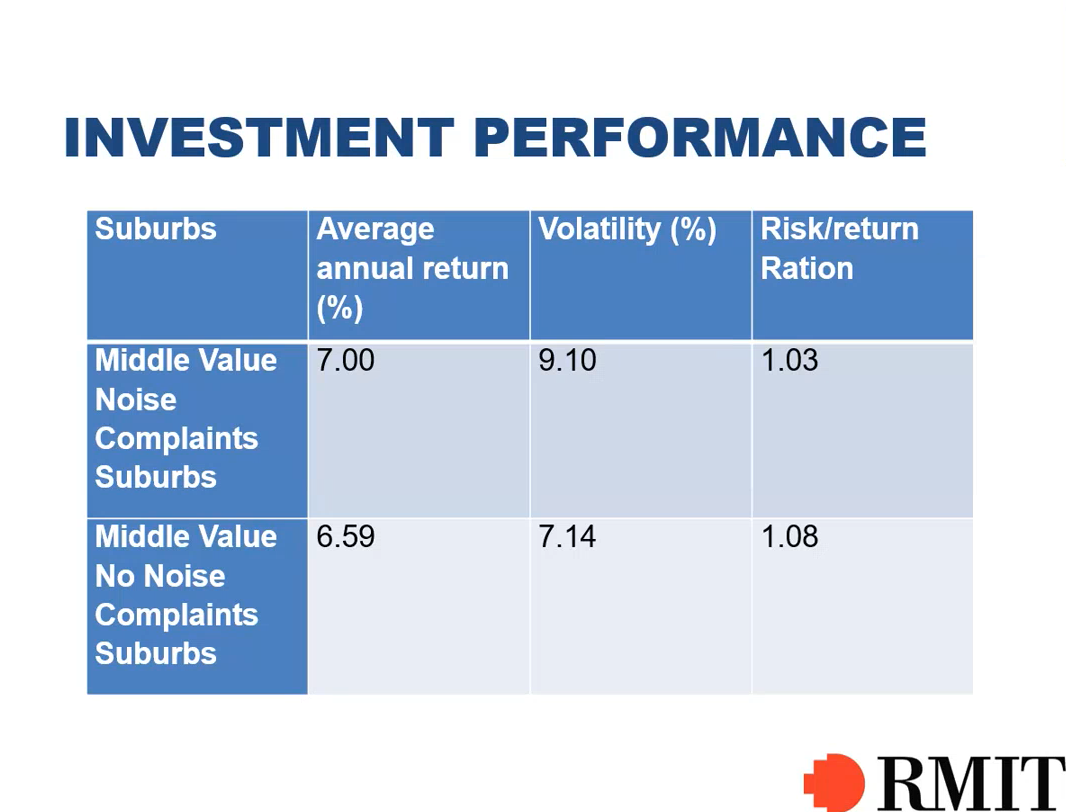

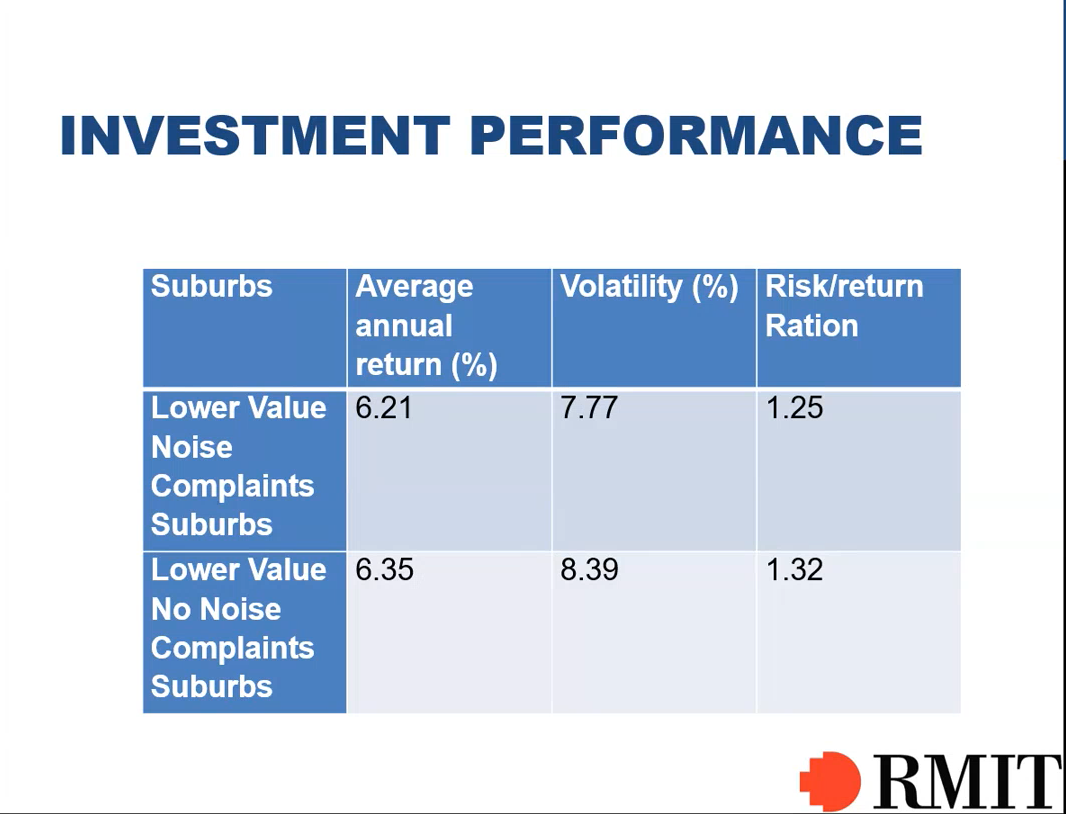

The average annual return of all noise complaint suburbs are higher than all no noise complaint suburbs

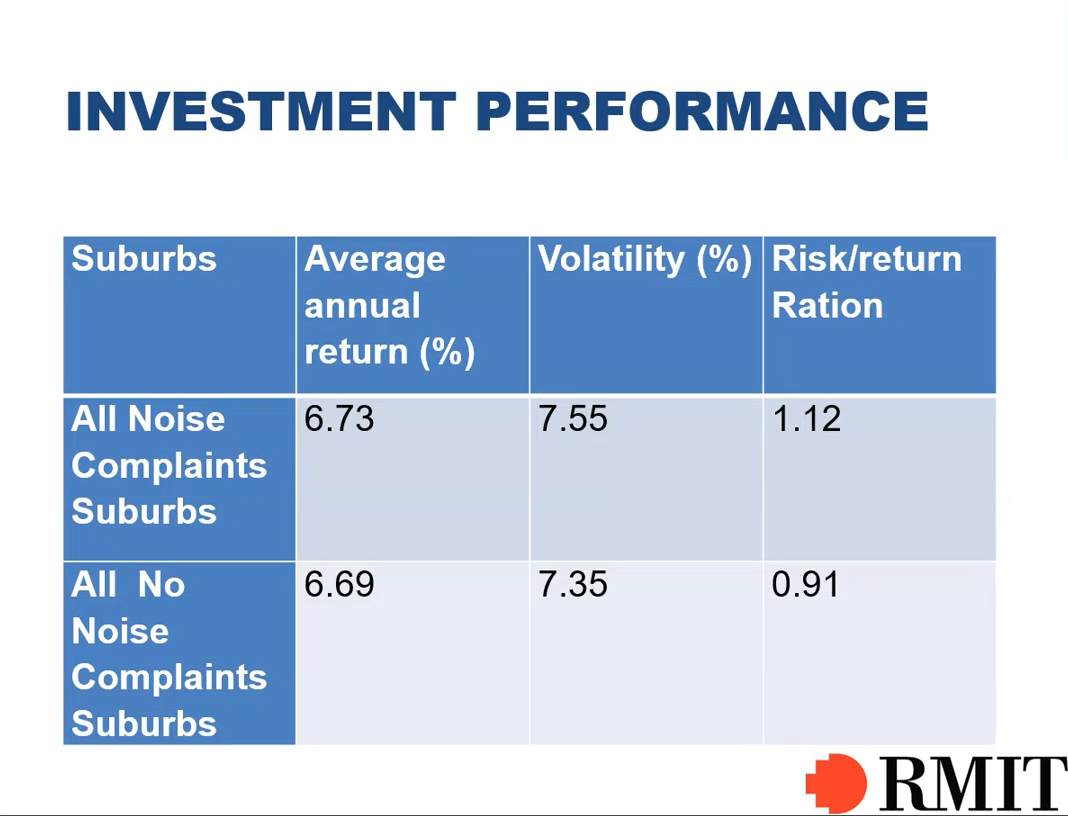

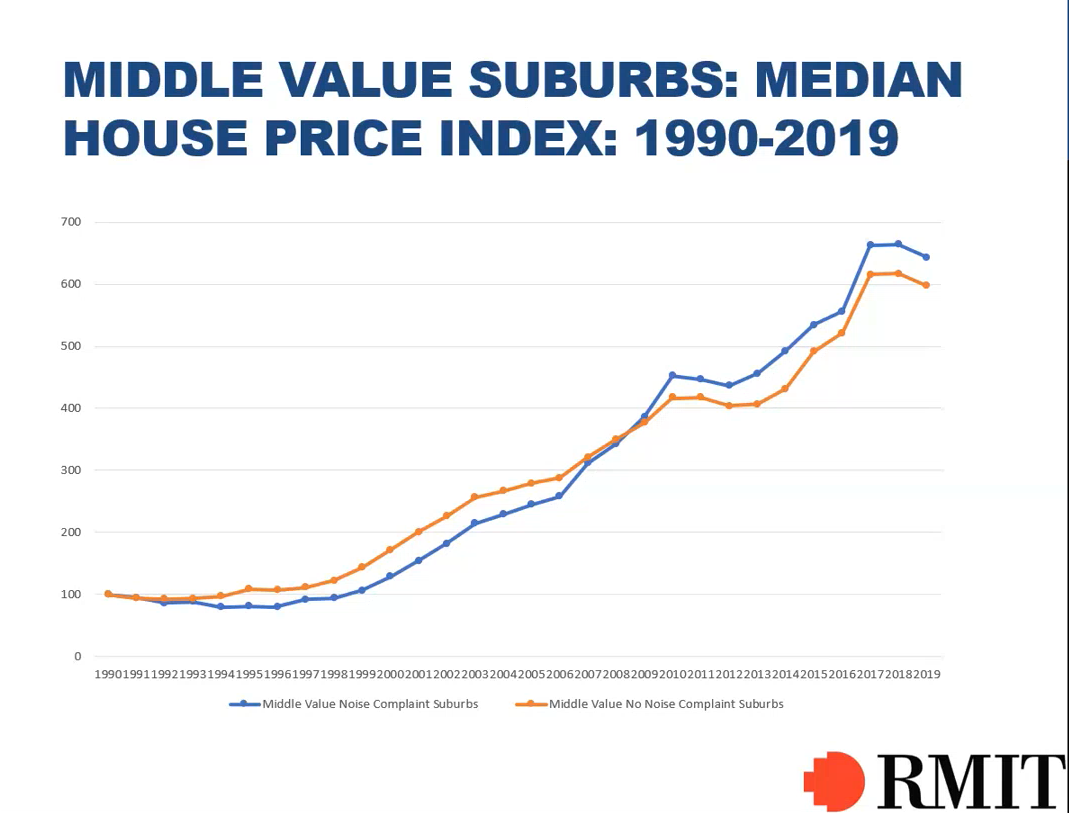

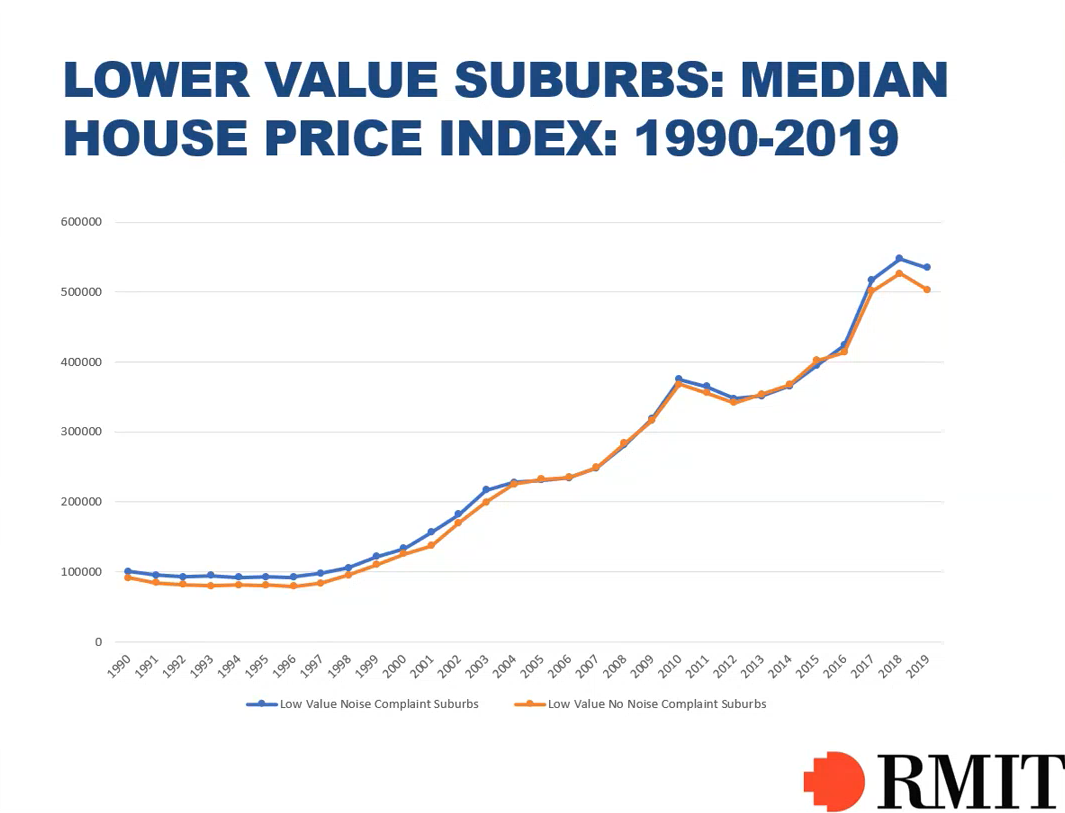

Graph showing the comparison of median price index from 1990-2019 for higher value suburbs, middle value suburbs and lower value suburbs on noise complaint versus no noise complaint

Prof Alfred showing the investment

performance of average annual return for higher value noise complaint

suburbs, middle value noise complaint suburbs and lower value noise

complaint suburbs

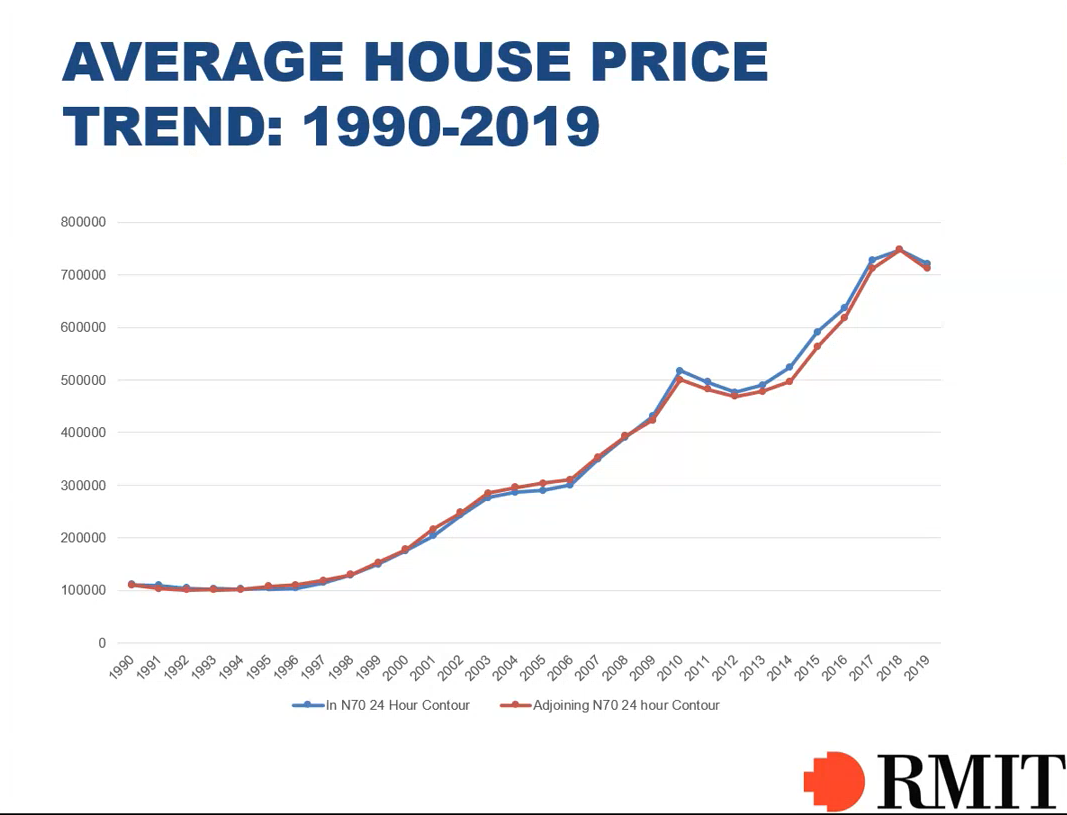

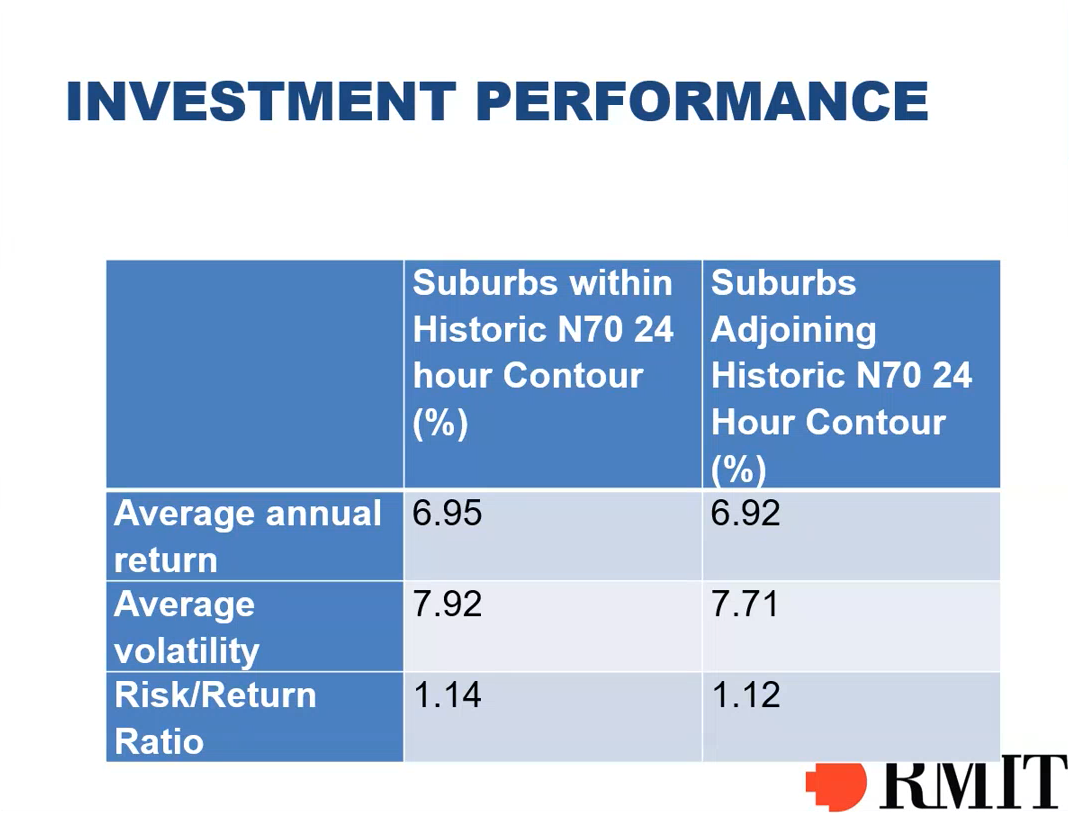

Graph presenting

average house price trend from 1990-2019 and the investment performance

comparison on N70 24-hour contour and adjoining N70 24-hour contour

Prof Alfred said, “The trend of

the average house price sales and movement within the N70 24-hour contour

compared to the adjoining N70 24-hour contour is very similar, the average

annual return for suburbs within historic N70 24-hour contour is slightly

higher and outperformed than suburbs adjoining historic N70 24-hour contour.

Therefore, in this situation, we can conclude that the aircraft noise does

not have an impact on people making their purchase and investment decision.”

Nearing the end of the one-hour

talk, he shared about development potential, “Development potential is where

overlays come in. There are two overlays. The first one is Melbourne Airport

Environs that overlays one; it refers to the actual airport precinct itself.

The second one is Melbourne Airport Environs that overlay two covers. There

are a lot of the developments outside the airport precinct that takes in

quite a number of suburbs that have housing development that is subject to

the development of overlays.”

Prof Alfred concluded, “The trend

in the annual volume of sales had been very similar for the 36 suburbs

analyses on a noise complaint basis when the change in volume from year to

year is compared. It has also been confirmed that the length of

homeownership is not linked with aircraft noise with high noise impacted

suburbs in Melbourne. We see evidence that people who live near the airport

are quite happy to stay in that environment compared to being away from the

airport. It can be interpreted that locations in suburbs subject to aircraft

noise complaints will have minimal impact on the rate of sales compared to

non-affected property.”

He emphasised, “In Brisbane,

suburbs like Highgate Hill and Holland Park maintain strong price growth

through airport developments due to their renowned prestige, good schools

and proximity to the Sydney Central Business District, despite being near

the flight paths. It was found that the variation in median house price

trends and long-term investment performance reduced and still falls within

very tight ranges regardless of location and exposure to aircraft noise.

These very similar investment performance results again confirmed that the

residential property purchaser considers a range of factors when purchasing

and valuing houses. These factors include price, views, location to

services, distance to work and transport, reliability of transport,

recreational facilities, health facilities and schools, as well as negative

factors, such as road noise, aircraft noise, crime and poor environmental

factors.”

The one-hour discussion then saw

an active interaction between the speaker and the participants. The talk

concluded with an extensive yet insightful Q&A session.

A group photo at the end of the webinar

![]()

![]()

Wholly owned by UTAR Education Foundation Co. No. 578227-M LEGAL STATEMENT TERM OF USAGE PRIVACY NOTICE