Secrets to building a successful career post-pandemic

The webinar poster

The Centre for Accounting, Banking and Finance (CABF) and the Department of Finance under the Faculty of Business and Finance (FBF) organised a webinar titled “Building your career competitive edge for post-pandemic rush” on 19 March 2021 via Microsoft Teams. The webinar recorded a total of 107 participants.

The invited speaker was SK-iWealth Sdn Bhd Managing Director Oo Huei Ying. Oo is also the Director of Phillip Wealth Planner Sdn Bhd, Industrial Advisor to AIMST University and UTAR FBF, and the Chairlady for ACE (Accelerated Career Excellence), an on-going career coaching programme between University Sains Malaysia and Rotary Club of Penang.

Present at the webinar were FBF Department of Finance Head Dr Kuah Yoke Chin. The webinar was moderated by FBF Department of Commerce and Accountancy Head Sonia Johanthan.

The talk aimed to provide an overview of the current pandemic situation and highlight the steps and key areas for post-pandemic career success.

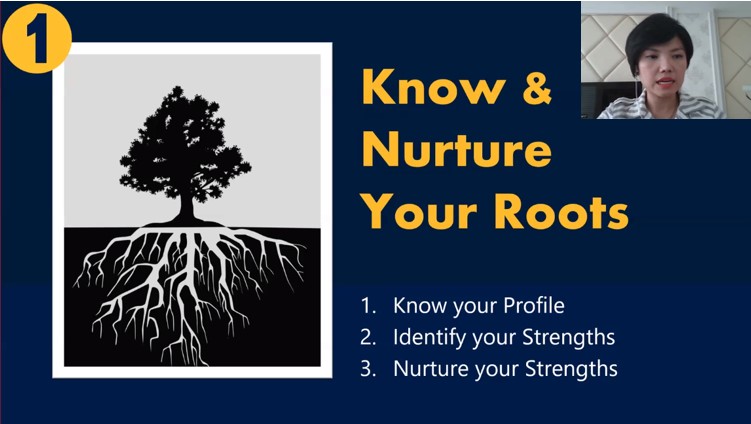

Oo started the webinar by highlighting three key areas that employers look for before they employ a staff into their organisation. The three key areas include knowing and nurturing your roots, working hard and working smart, and practising applied finance for financial savings and financial backup.

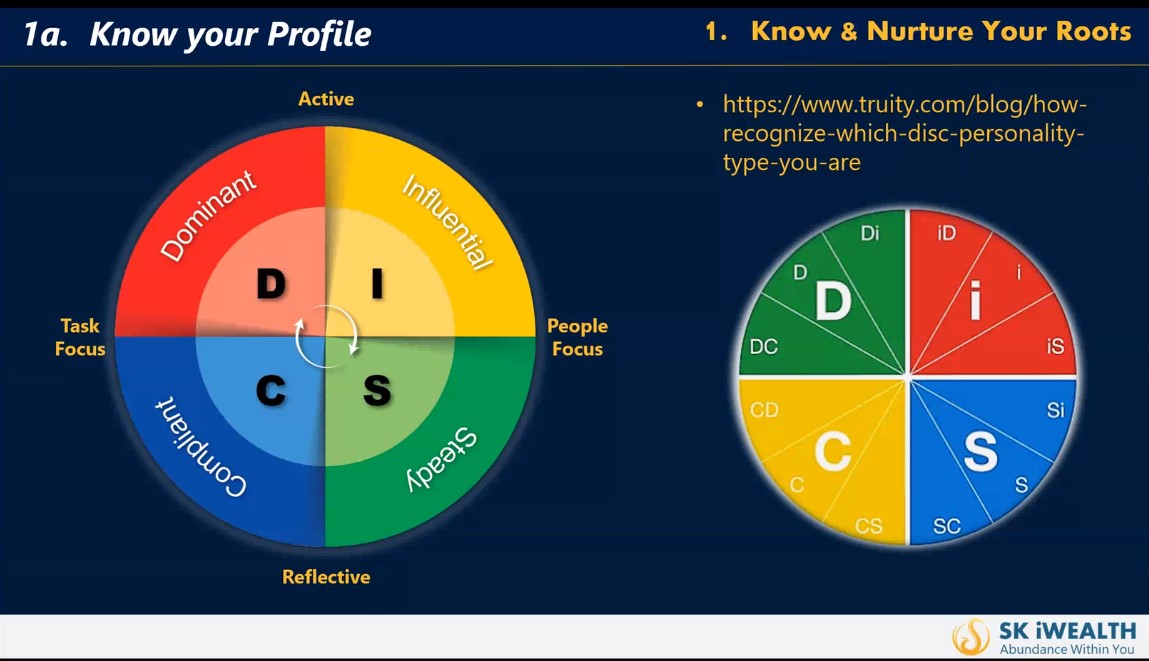

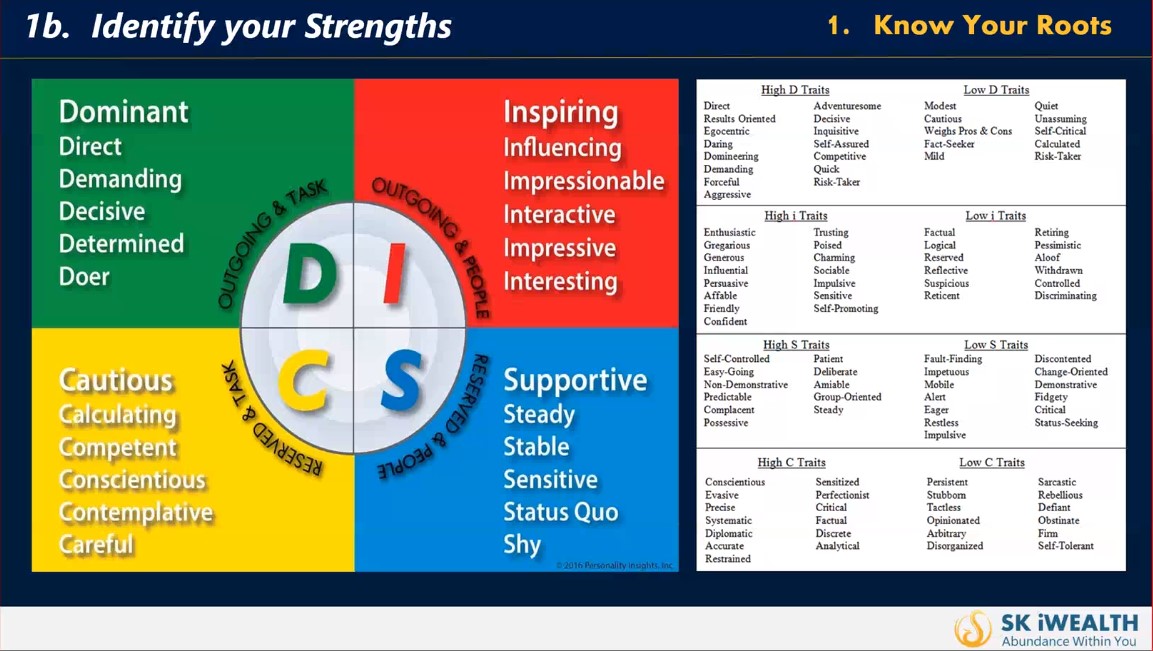

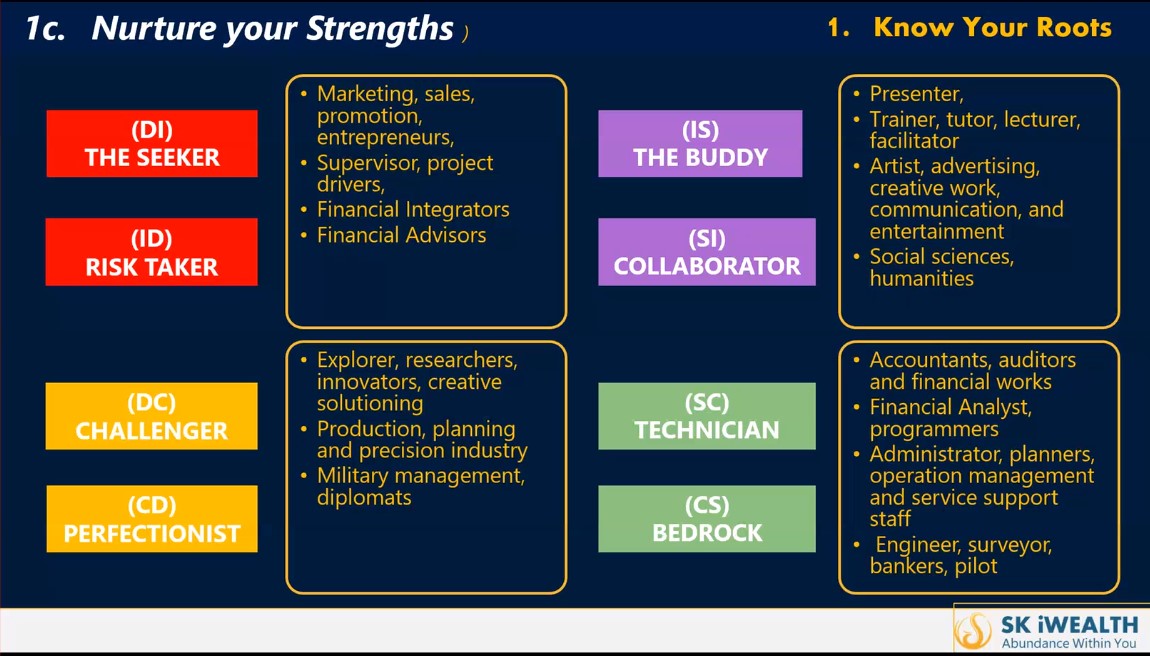

She said, “The first key area is knowing and nurturing your roots. You need to know your own profile, identify your strengths and at the same time nurture your strengths. The profiles are categorised as Dominant, Influential, Steady and Compliant. From the profiles, we need to understand each of their strengths. The Dominant candidates’ strengths are labelled as direct, demanding, decisive, determined and doer. Besides, the Influential candidates’ strengths are labelled as influencing, impressionable, interactive, impressive and interesting. Meanwhile, Steady candidates’ strengths are regarded as supportive, stable, sensitive, status quo and shy, and lastly the Compliant candidates’ strengths are categorised as cautious, calculating, competent, conscientious and contemplative.”

Moreover, Oo also added that Influential and Steady candidates are human-oriented, hence they enjoy a two-way communication approach. They are also talented in interacting with people. Dominant and Compliant candidates, on the other hand, are more objective and task-oriented, hence they enjoy doing data analysis and would usually involve facts and figures in their works.

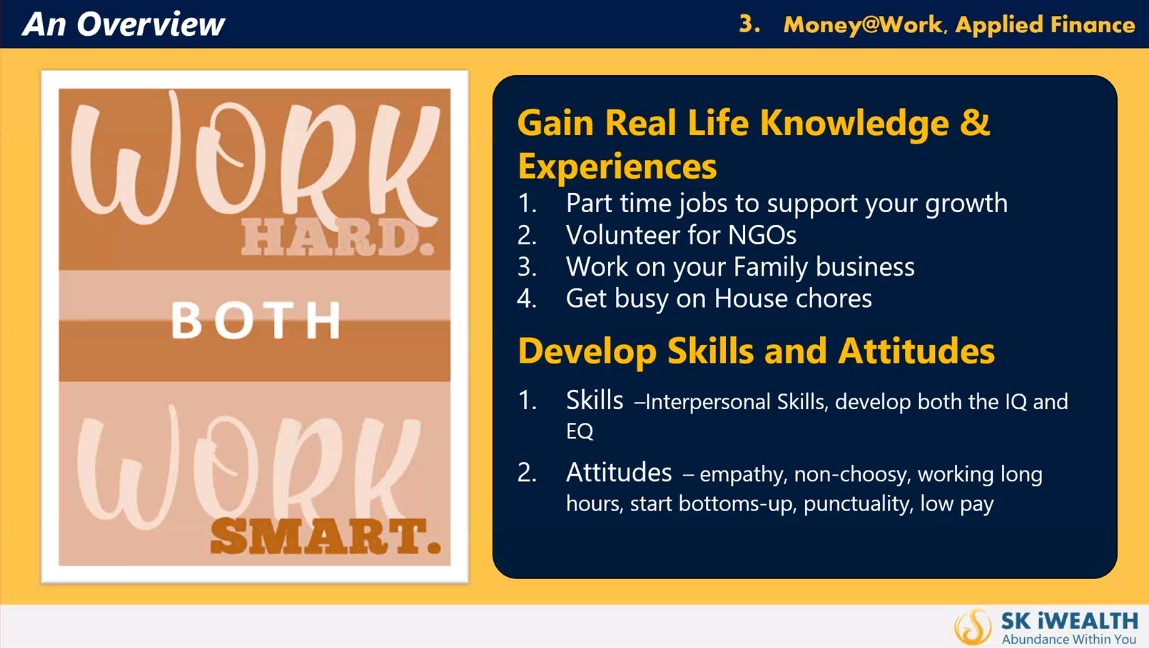

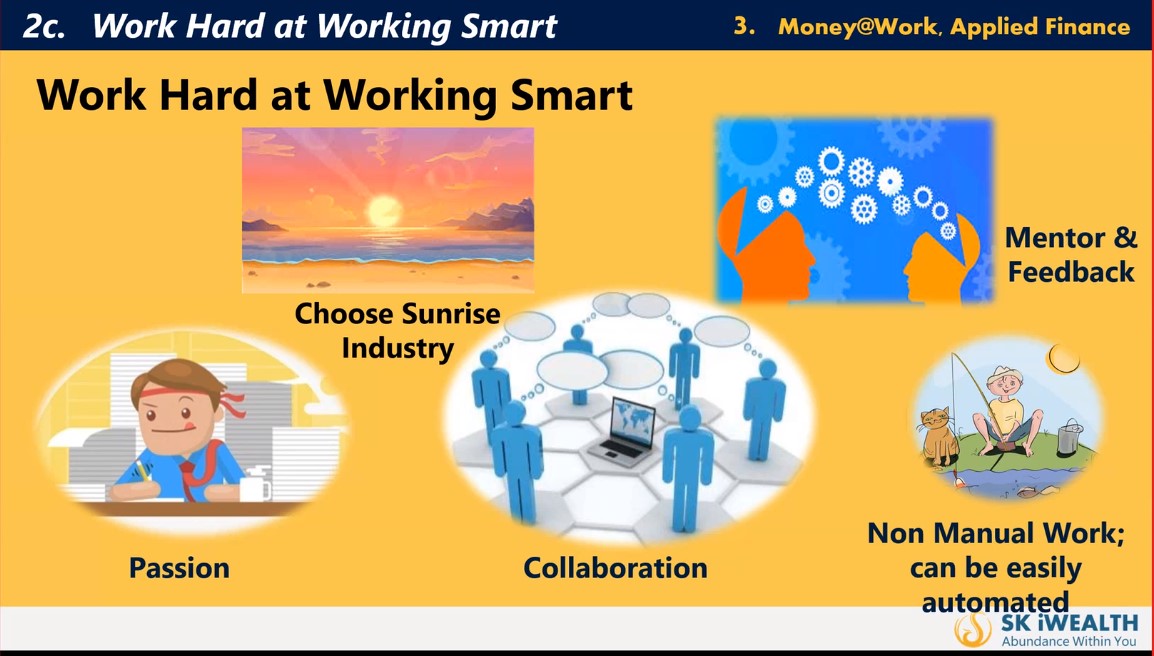

Although excellent grades and GPA are important in education, Oo explained that employers usually seek something beyond before they make the final decision to employ the staff. “Besides excellent academic skills, the second key area is working hard and working smart. Working smart is not about having multiple jobs, it is about gaining real-life knowledge and expanding your horizon to support your growth, skills and attitudes in your working career. Being able to work as a team with your colleagues and management, developing interpersonal skills, IQ and emotional skills, and being more empathetic and compassionate are also essential skills in the organisation. Every job scopes require different skills; you need to position yourself well, and nurture and showcase your talents, then you will excel in your career,” she said.

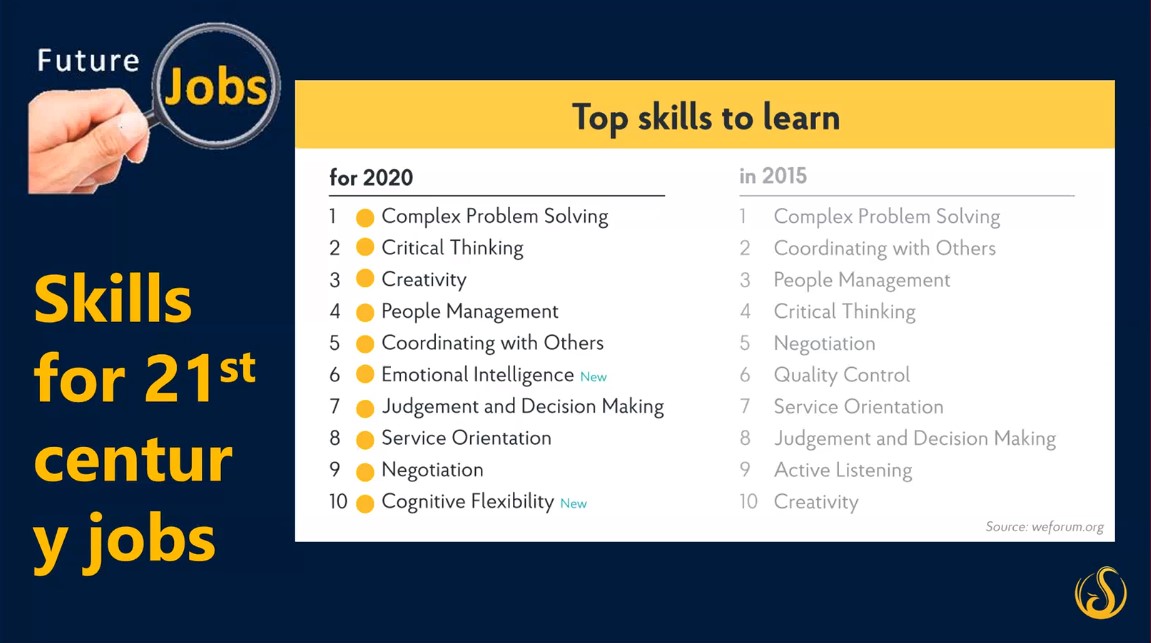

She also listed the top skills that new job seekers need to learn in this 21st century based on company employers’ requirements. They are complex problem-solving, critical thinking, creativity, people management, coordinating with others, emotional intelligence, judgement and decision making, service orientation, negotiation and cognitive flexibility.

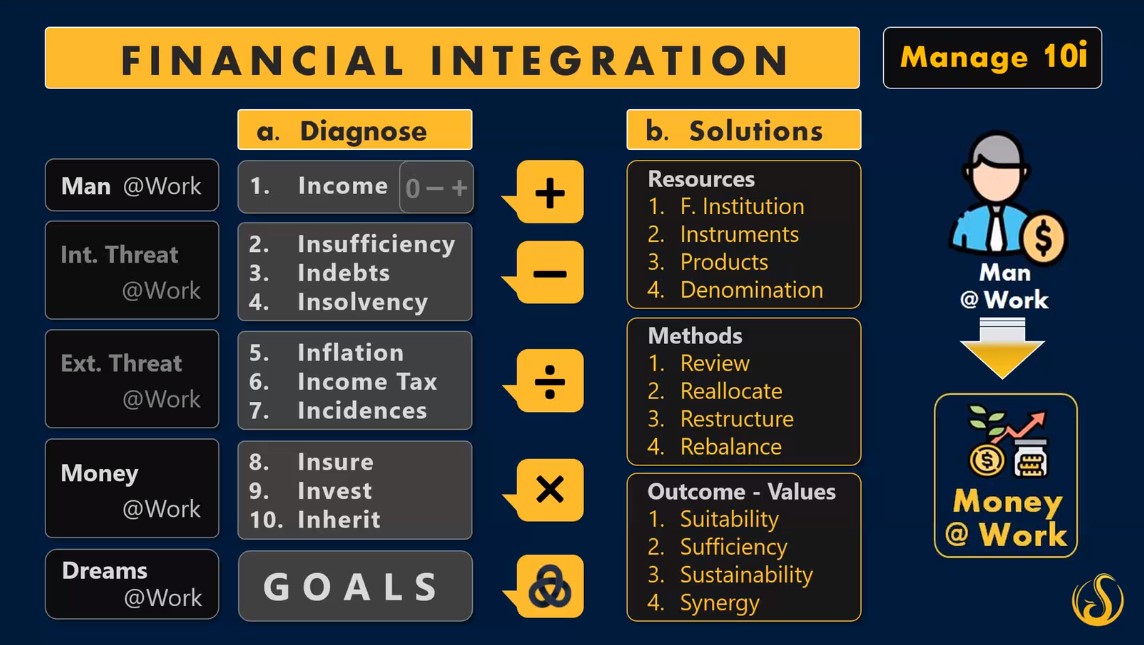

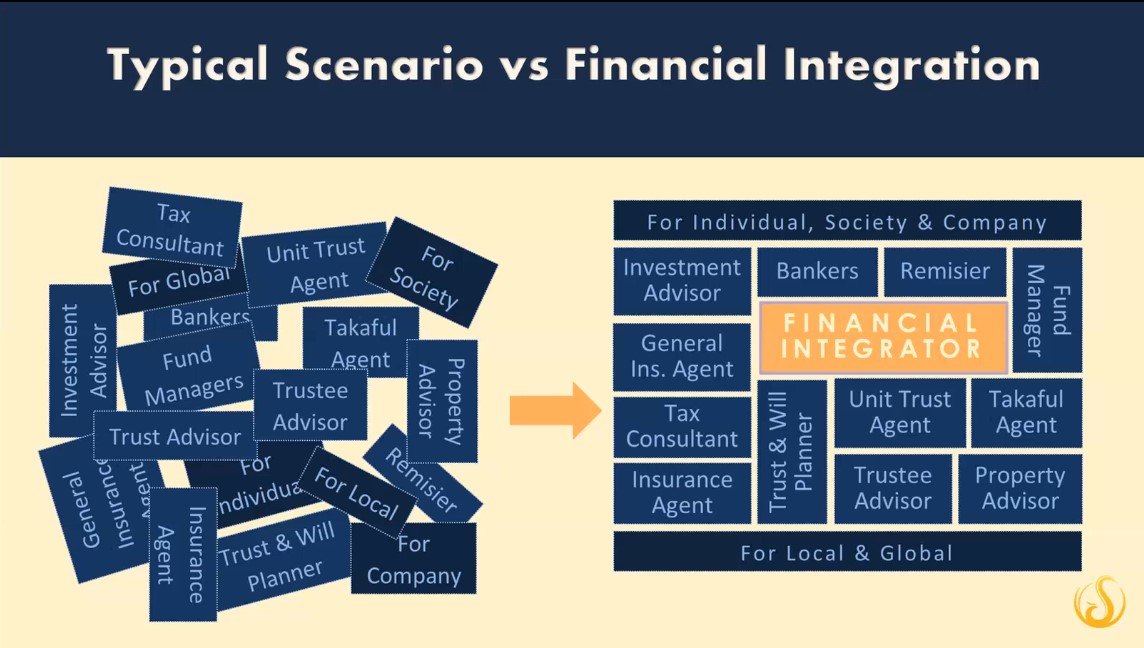

Apart from that, Oo talked about the third key area which is money@work or applied finance. “There are ten financial integration diagnoses, namely income, insufficiency, indebts, insolvency, inflation, income tax, incidences, insure, invest and inherit, and three financial integration solutions which are resources (financial institution, instruments, products, and denomination), methods (review, reallocate, restructure and rebalance), and lastly the value outcomes (suitability, sufficiency, sustainability, and synergy),” she explained.

Furthermore, Oo emphasised that most of the people did not have financial backup when the pandemic hit because they did not have financial savings as they were not equipped with proper financial knowledge. Thus, they suffered from financial stress. She also said that economic uncertainty and downturn could lead to financial constraint, and this will impact an individual’s work performance and family relationship. Therefore, she encouraged the participants to have a backup financial saving to support their lives during an unpredictable situation. She also advised the participants who wished to go for a career change to adjust their lifestyles and commitments accordingly.

Before ending the webinar, Oo advised the participants to be aware of the reality today and to reflect and reposition themselves to find a suitable career because the employers are always looking for something new besides excellent academic skills. She also encouraged the students to be prepared to take a risk for a post-pandemic career by seizing or taking opportunities to learn and develop knowledge, experiences and skills as good opportunities will only be given to those who are ready to venture into this working environment.

The interactive webinar ended with a Q&A session and a group photograph session.

Oo explaining the current scenario faced by companies and job seekers

Oo explaining the root profiles and highlighting each of its strengths

Oo explaining how to work hard and work smart

Oo explaining the financial integration management and its solutions

![]()

![]()

© 2021 UNIVERSITI TUNKU ABDUL RAHMAN DU012(A).

Wholly owned by UTAR Education Foundation Co. No. 578227-M LEGAL STATEMENT TERM OF USAGE PRIVACY NOTICE