Edwin Lee

To highlight the outlook of the world economy in the second of quarter 2021

and the investment strategies to profit in a catch-22 situation between

worsening pandemic and post-pandemic, a webinar titled “3+1R” was

co-organised by

UTAR Faculty of Accountancy and Management (FAM), Centre for

Entrepreneurial Sustainability (CENTS) and UOB Asset Management (Malaysia)

(UOBAM) via Webinar Jam on 8 May 2021.

Invited to be the speaker for the webinar was UOBAM Senior

Director-cum-Chief Marketing Officer Edwin Lee Wai Kidd. It was moderated by

UOBAM Intermediary Distribution Team member Andrea Chan.

Andrea Chan

Edwin Lee explained, “3R in the first quarter of 2021 refers to

‘Recovering’, ‘Risk-on’ and ‘Rotation’. The next R in the second quarter,

‘3+1R’ refers to ‘Reflation’.”

1st R – Recovery

World economy recovery remains intact despite the uneven speed of

inoculations between develop and developing nations.

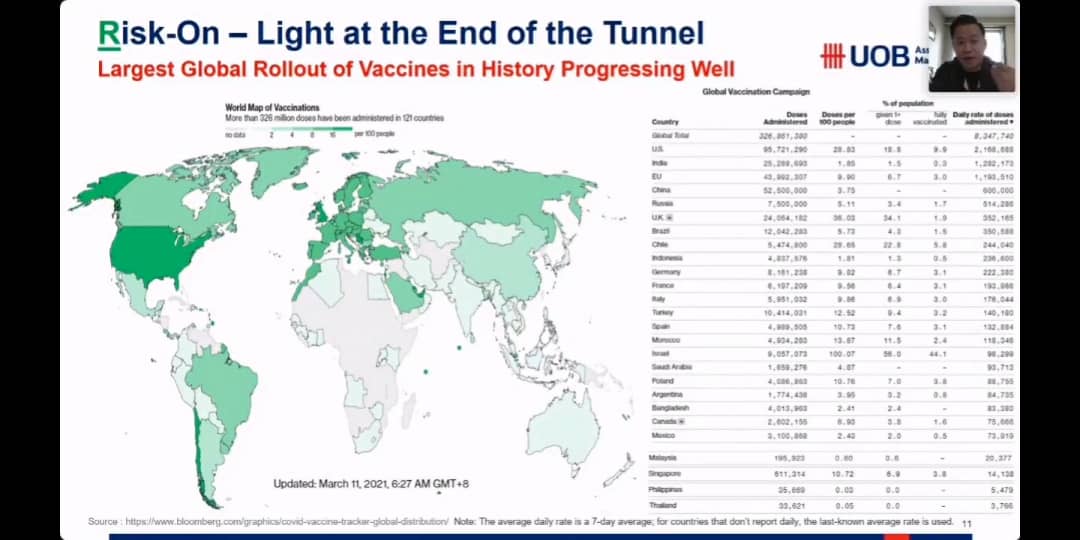

2nd R – Risk-on

Typically in an economy recovery mode, risky assets such as equity will

perform well and therefore it is not the right time to be defensive, not at

least in 2Q2021.

3rd R – Rotation

Despite equity performed well in 2020, it is tilted towards tech related

sector which benefits from pandemic play. However as the world is heading

towards herd immunity, there is a potential rotation from pandemic play to

post pandemic sectors which are the typical old economy sectors.

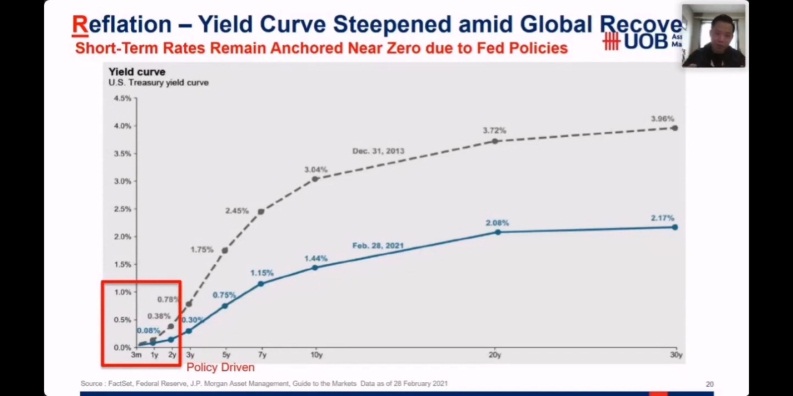

4th R – Reflation

Reflation is a stage of economy where the government is spending to prevent

its economy from falling into recession and deflation. Typically in this

situation, financial sectors like banks and insurance companies (which are

part of the old economy) will outperform.

The expected world GDP growth rate in 2021 will be the highest growth ever

since 1973

The green zones showing the rollout of vaccines including Malaysia

Data as of 28 February 2021 showing K-shaped recovery

Graph showing the ten-year yield and the inflation outlook in the economy

Edwin Lee then moved on to share the three strategies to invest in the

second quarter, namely the Rotation strategy, the Barbell strategy and the

Evergreen strategy.

“In the ‘Rotation strategy’, we have been advocating ‘United Global Durable

Equity Fund’ ever since the early fourth quarter last year when the

vaccination started to roll out. This particular fund has a strategy that

capitalises on economies re-open play as well as reflation play. What makes

it special is that, unlike all the global equity funds Durable is the only

global equity fund that mainly invests into old economies sectors. This is

because one of the investment criteria stated that it can only invest into

those companies that have proven resilient cash flows across the business

cycle,” said Edwin Lee.

He then continued, “Barbell Strategy is for those people who want to invest

in the post-pandemic play-old economy such as construction, tourism,

hospital and the funeral service, and the new economy-pandemic play

(technology). That is what we call the Barbell strategy in which ‘United

Malaysia Fund’ is invested in.”

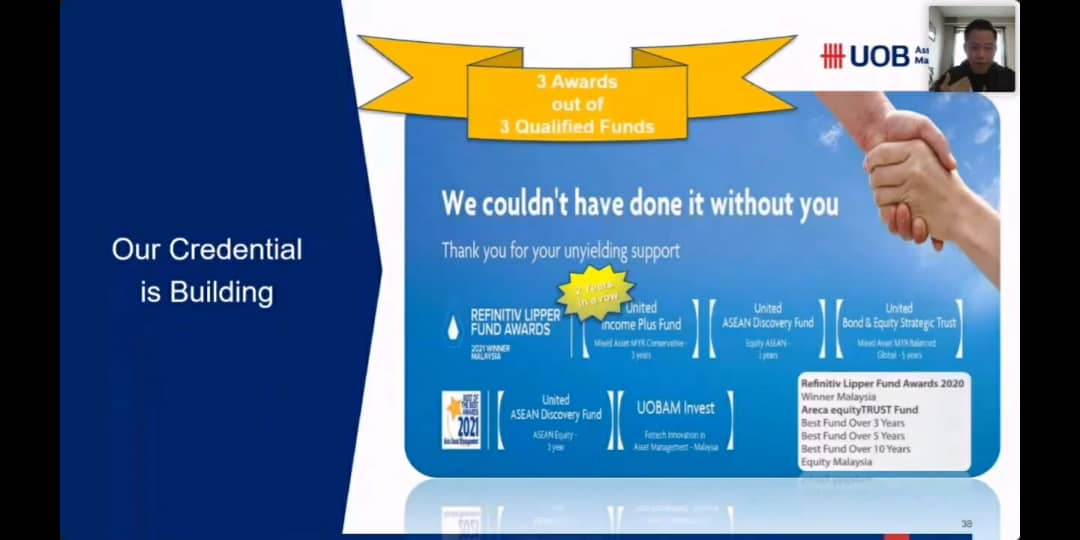

Edwin Lee explaining the three quality funds managed by UOBAM

“Last but not least is the Evergreen strategy. The term evergreen strategy

refers to the ‘United Global Healthcare Fund’. It is a strategy that invests

into healthcare companies that produce or about to produce an innovative

drug or treatment. Unlike many who believe that Healthcare is a pandemic

play, United Global Healthcare is a strategy that focuses beyond Covid-19 as

the three main killer diseases of the world are still the likes of heart

related disease, cancer and stroke. These are the so-called evergreen

diseases that kill more mankind in the world than Covid-19,” said Edwin Lee.

During the webinar, he also shared the types of companies that the funds

invest and the past performance of the funds.

The informative webinar then ended with an interactive Q&A session.

Edwin Lee joined UOBAM in October 2018. He has more than 20 years of

experience in the finance and banking industry. Edwin Lee has been a regular

speaker by invitation in various public seminars, especially on his forte of

China Economy and One Belt One Road forum. He has also been invited by the

Securities Industry Development Corporation (SIDC) of the Securities

Commission (SC) Malaysia as the facilitator to provide insights on China's

economy.

![]()

Wholly owned by UTAR Education Foundation (200201010564(578227-M)) LEGAL STATEMENT TERM OF USAGE PRIVACY NOTICE