![]()

Many times people do not realise the importance of estate planning and will

writing until it is too late. The deceased would leave their heirs and

families in dispute when no proper advice is left for them to handle the

wealth. To address this issue, UTAR Centre for Entrepreneurial

Sustainability (CENTS) collaborated with the Faculty of Accountancy and

Management (FAM) to organise a webinar titled “Start with Estate Planning,

End with Wealth Planning” on 5 November 2021 via Microsoft Teams. The

speaker was Rockwills Senior Estate Planner-cum-Hong Leong Assurance Unit

Manager Billy Yong.

“Estate planning is a part of financial planning. Due to the lack of

knowledge, there is currently RM60billion worth of unclaimed money

reported,” said Billy Yong.

Citizens and governments alike are seeming to lack knowledge in estate

planning. The lack of expertise in this area may lead to estates falling

under the wrong hands, thus shrinking the assets’ value. On an individual

level, one would end up going through complicated and time-consuming

procedures, aside from having the possibility of exhausting the estate value

in a short period of time due to the lack of good planning on how to utilise

the money.

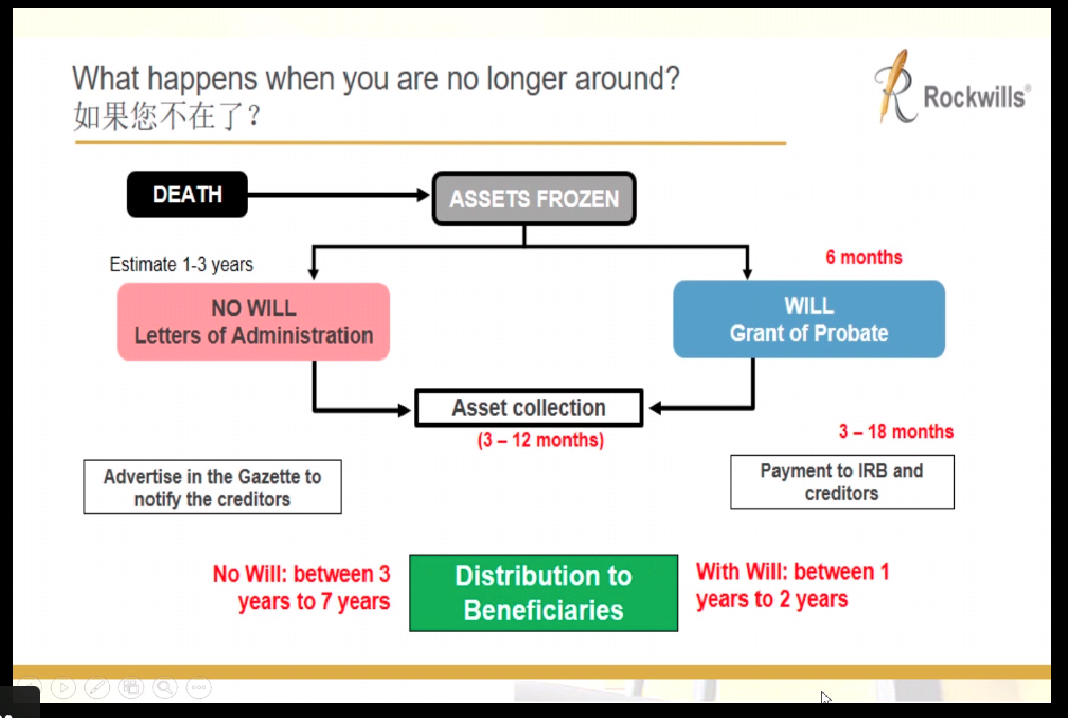

Early estate planning and will writing can evade the complicated and

time-consuming process of asset distribution

The chart shows the differences between assets distribution with and without

a will

In recent days, due to the pandemic, more people have realised its

importance and have encouraged themselves and family members to write wills.

A study by Rockwills showed that more young people are inclined towards

writing wills than before.

“Imagine what would happen if there is no proper planning for your legacy?

Will there be a dispute between family members or business partners? If

there is no planning, it will be difficult for business partners to continue

the business when one of them perishes. What would happen if the parents or

a single parent meet their end, leaving minor children, elderly family

members, or special needs children behind? Another concern would be the

possibility of poor management by the children when they receive the

assets,” said Billy Yong, addressing the concerns that may arise if the

asset planning is not done early.

“Wills have the power to decide who gets what; what to give and who to take

care of. It also ensures the estate is preserved for the family in the

future,” he added.

With more than 100 participants, the webinar touched on issues related to

assets planning including having a trustworthy executor, the importance of

keeping wills in good condition and many more.

Wholly owned by UTAR Education Foundation (200201010564(578227-M)) LEGAL STATEMENT TERM OF USAGE PRIVACY NOTICE