The Digital Tax laws in Malaysia

The Faculty of Business and Finance’s (FBF) Department of Commerce and Accountancy collaborated with the Centre for Accounting, Banking and Finance and the Centre for Business Management to organise a talk titled “Digital Tax in Malaysia” on 28 October 2021.

The talk was presented by Tax Director at PKF Malaysia Fan Kah Seong. Fan has more than 35 years of tax experience, and is a fellow member of CPA Australia, Malaysian Institute of Accountants (MIA), and Chartered Tax Institute of Malaysia (CTIM). Additionally, he is also recognised by the International Tax Review as the Indirect Tax leader in the country.

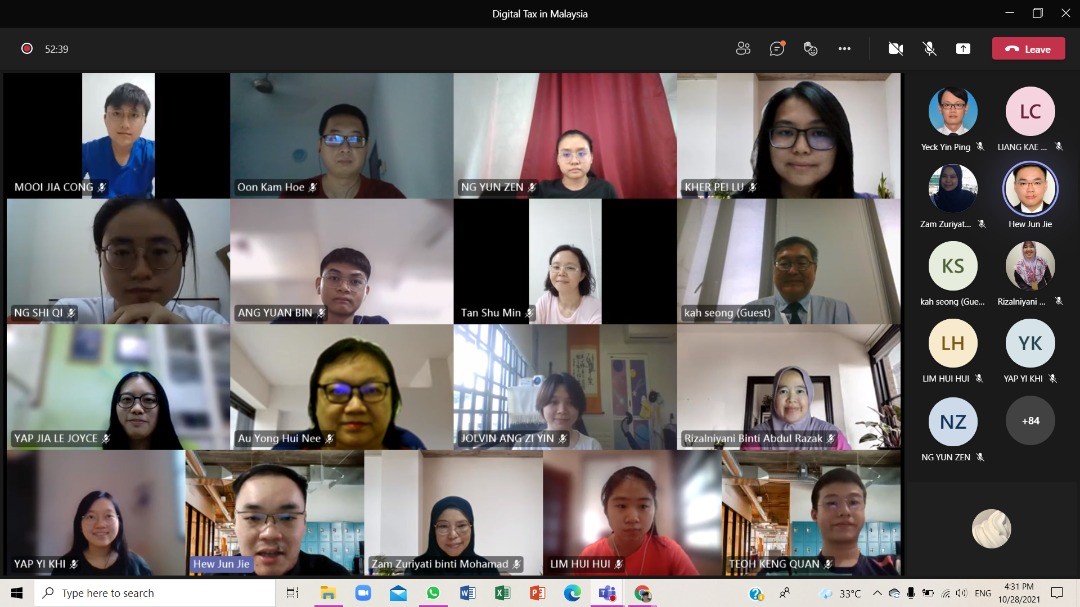

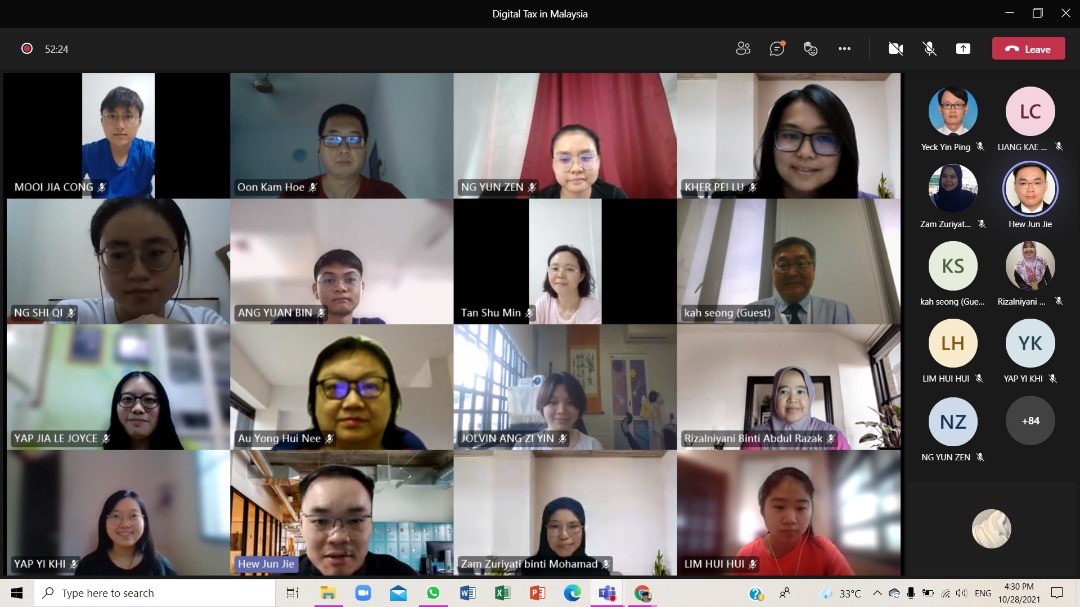

Throughout his tax career, his engagements have covered various industries such as plantation, trading, construction, property development, IT services, logistic, food and beverage and manufacturing. The talk was held online using the Microsoft Teams platform and was attended by FBF academic Dr Zam Zuriyati binti Mohamad, lecturers and students.

The speaker started the talk by defining the digital economy as economic and social activities that involve the production and use of digital technology by individuals, businesses and government. To promote the digital economy in the country, the government established the Multimedia Super Corridor (MSC) in 1996, as the first step for transforming Malaysia into an advanced nation by introducing high-technology business districts and special economic zones. He then shared the importance of ICT to the economy in 2019 with its 19.1% contribution to the country’s GDP. Within the ICT sector, he highlighted that services include the ICT related activities of manufacturing, trade, and content and media. In terms of employment, the ICT industry has also brought employment opportunities to over 1 million individuals, making up 7.5% of the total employment.

Next, Fan explained the digital tax laws in Malaysia, specifically the Service Tax (Digital Service) Regulations 2019 which imposes a 6% service tax on the importation of digital services from 2020. Certain definitions were expanded and amended. For instance, taxable services were expanded to include IT services on the distribution or reselling of information technology services, and on the provision of electronic medium and other digital services. Other taxable services include the provision of digital telecommunication and advertising services. Additionally, the definition of royalty was amended to add the word “software”, potentially including digital services and applications such as Microsoft Teams or Zoom, and expanding the range of payments to non-residents being subject to withholding tax of 10%.

He remarked that digital tax is not new and that it has been implemented in many other countries which have enacted laws on digital services. Nevertheless, to address the challenges of taxation in the digitalisation of economy, Malaysia with other 130 countries in July 2021 approved a framework for the reform of the international tax rules. Proposals include using a two-pillar approach. Pillar one reallocates profits of large companies to market countries, bypassing reference to physical presence. Pillar two seeks to set a global tax rate for multinationals with annual gross revenue exceeding €750million. These changes are to take effect from 2023 onwards.

The talk ended with a lively Q&A session where participants asked various questions ranging from collecting taxes imposed on foreigners to possible tax plans to reduce digital tax.

Speaker and participants during the talk

© 2021 UNIVERSITI TUNKU ABDUL RAHMAN DU012(A).

Wholly owned by UTAR Education Foundation (200201010564(578227-M)) LEGAL STATEMENT TERM OF USAGE PRIVACY NOTICE