A practical insight about theories for researchers

The Centre for Accounting, Banking, and Finance (CABF) parked under the Faculty of Business and Finance (FBF) organised a webinar on 14 October 2021 via Microsoft Teams.

Titled “Theories – Meaning, Elements and Principles for Critique”, the talk was presented by Dr Philip Thiagan Sinnadurai, a lecturer from the Department of Accounting and Corporate Governance at the Macquarie University, Australia. His research interests include corporate accounting and disclosure, earnings quality and earnings management, and corporate governance. Present at the webinar were lecturers and students from FBF.

Dr Philip commenced the presentation by highlighting that all research is based on theory and that the research would be more rigorous if the underpinning theory is critiqued. A critique of the theory refers to identifying its various components and arriving at a balanced assessment of strengths and weaknesses. Comprising of three critical components of assumptions, analysis and hypotheses, a theory is an attempt to explain phenomena and human experience.

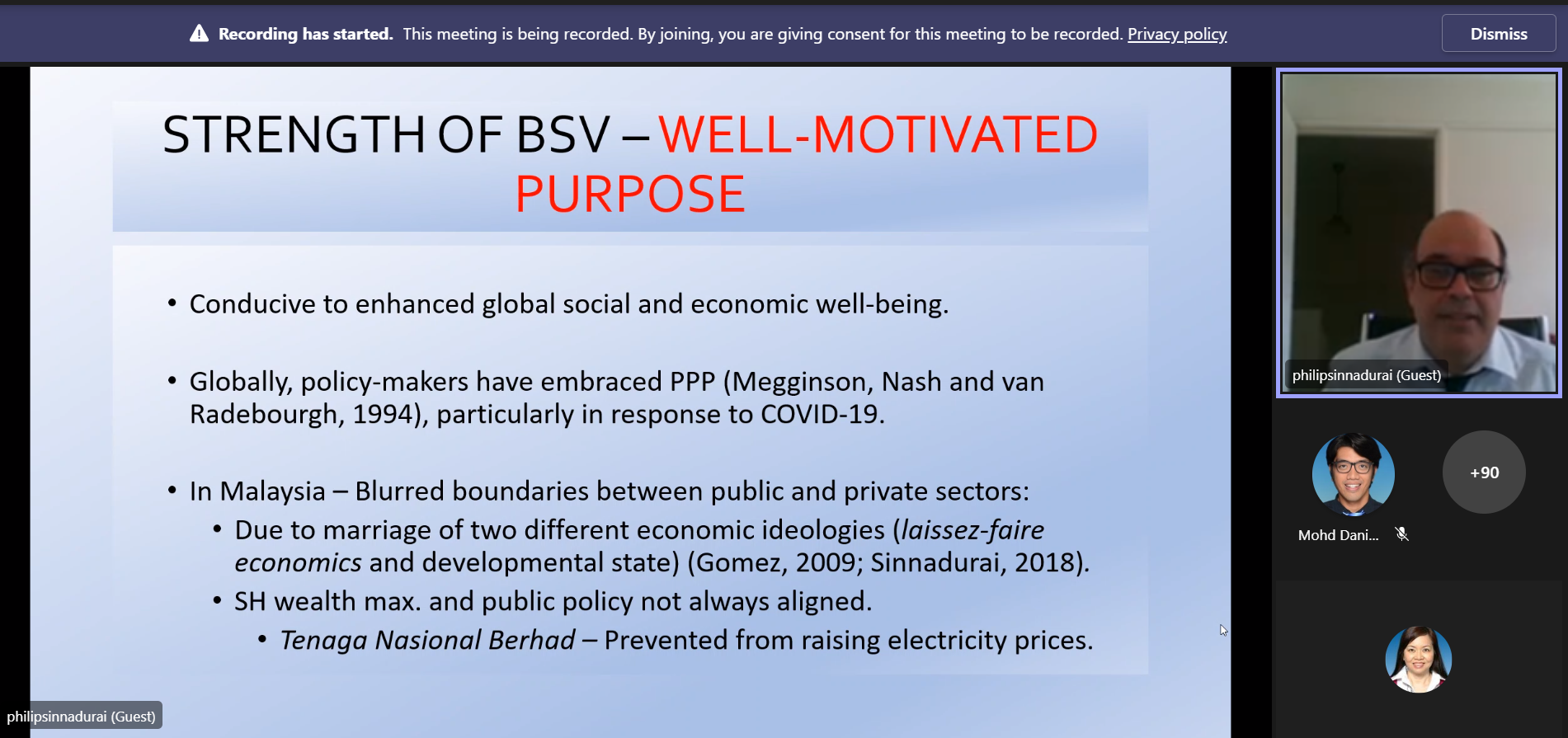

Next, Dr Philip stated that the purpose of a theory is to determine the phenomena that it is seeking to explain. Using the theory by Boycko, Shleifer and Vishny (1996) (BSV theory) as an illustration, Dr Philips provided a critique of the theory in the Malaysia setting, stating that the model was a good fit for the Malaysian environment which is conducive to enhancing global, social and economic well-being. The BSV theory explains circumstances in which government subsidisation is conducive to shareholder wealth maximisation. In the global setting, the theory is relevant as policymakers have embraced public-private partnerships in response to the Covid-19.

For Malaysia, the BSV theory is appropriate as boundaries between the public and private sectors in the country are blurred. For instance, government policies combine the two opposing economic ideologies of laissez-faire economics and the developmental state. In the developmental state, the government is unconvinced of the unregulated market and intervenes to guide the market towards equilibrium. The degree to which these ideologies differ also depends on the various government settings, resulting in government investment in listed companies in the country. Dr Philip noted that the types of subsidisation in the country tended to be industry-specific and facilitated vertical and horizontal integration.

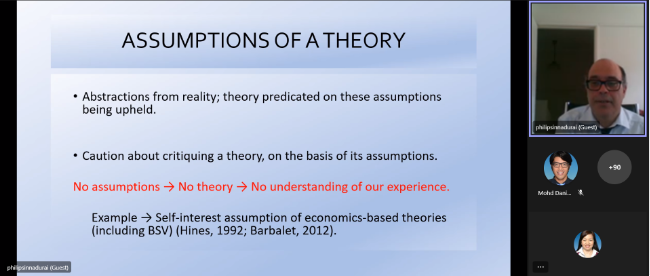

Dr Philips then highlighted that a theory’s assumptions are abstractions from reality, with the theory predicting these assumptions. He emphasised the importance of assumptions when critiquing a theory, as the absence of assumptions would result in absence of theories and consequently the lack of understanding of our experience. In analysing a theory, tools typically employed are verbal reasoning, statistics, mathematics and microeconomics. The predictions of a theory are the outputs or statements of conjecture, and should be capable of empirical testing. He concluded his presentation by remarking that in critiquing the outputs of a theory, Popper’s falsification is often used which essentially provides that while no one can prove a theory is true, it is easy to prove the theory false.

The webinar ended with a lively and informative Q&A session.

Participants and Dr Philips during the talk

© 2021 UNIVERSITI TUNKU ABDUL RAHMAN DU012(A).

Wholly owned by UTAR Education Foundation (200201010564(578227-M)) LEGAL STATEMENT TERM OF USAGE PRIVACY NOTICE