![]()

“SMEs business sustainability during Global Pandemic”

On 24 August 2021, a webinar titled “Small and Medium-sized Enterprises

(SMEs) Business Sustainability during Global Pandemic” was jointly organised

by UTAR Faculty of Accountancy and Management (FAM) and

Centre for

Entrepreneurial Sustainability (CENTS) via Microsoft Teams.

Invited to be the speaker was Crowe KL Tax Sdn Bhd Tax Executive Director Dr

Voon Yuen Hoong. Dr Voon is a fellow member of ACCA, United Kingdom. She is

also a member of the Malaysian Institute of Accountants (MIA), Chartered Tax

Institute of Malaysia (CTIM) and Financial Planning Association of Malaysia

(FPAM). Besides, she is also a

licensed tax agent.

Dr Voon is involved in tax compliance for both domestic and multinational

clients. Having been in practice since 2003, she has diverse experience in

advising clients on corporate tax, tax incentives, pre-Field Audit, IRB

audit and tax investigation cases.

Her clients include a wide range of private, public listed and

multi-national companies engaged in a variety of industries.

From left: FAM Department of Accountancy lecturer Ezatul Emilia binti

Muhammad Arif (moderator) and Dr Sia

Speaking during the opening remarks, Faculty of Accountancy and Management

Dean Dr Sia Bee Chuan welcomed the participants and said, “Businesses have

been exposed to various challenges during the global pandemic and their

responses to this disruption have impacted their resilience as well as their

chances to overcome this crisis. SMEs are changing their business models in

order to adapt to this changing environment. Service-based industries have

been hit particularly hard. The sharing today is certainly relevant as we

will gain insight on how to approach the situation based on transformation

drivers, readiness to apply digital technology and of course not forgetting

from the accounting perspective that Crowe will provide today.”

She continued, “In UTAR, we believe our students should continue to keep

abreast with the industry needs and relevance as much as we always aimed to

produce graduates who are not only employable and not just work smart but

also street smart which is also the faculty’s mission— to be an outstanding

business and management faculty of educational and professional excellence

with transformative societal impact, nationally and internationally.”

Clockwise, from top left: Ezatul, Dr Sia, Dr Voon and Francisca Yeoh Suet

Yoong (moderator)

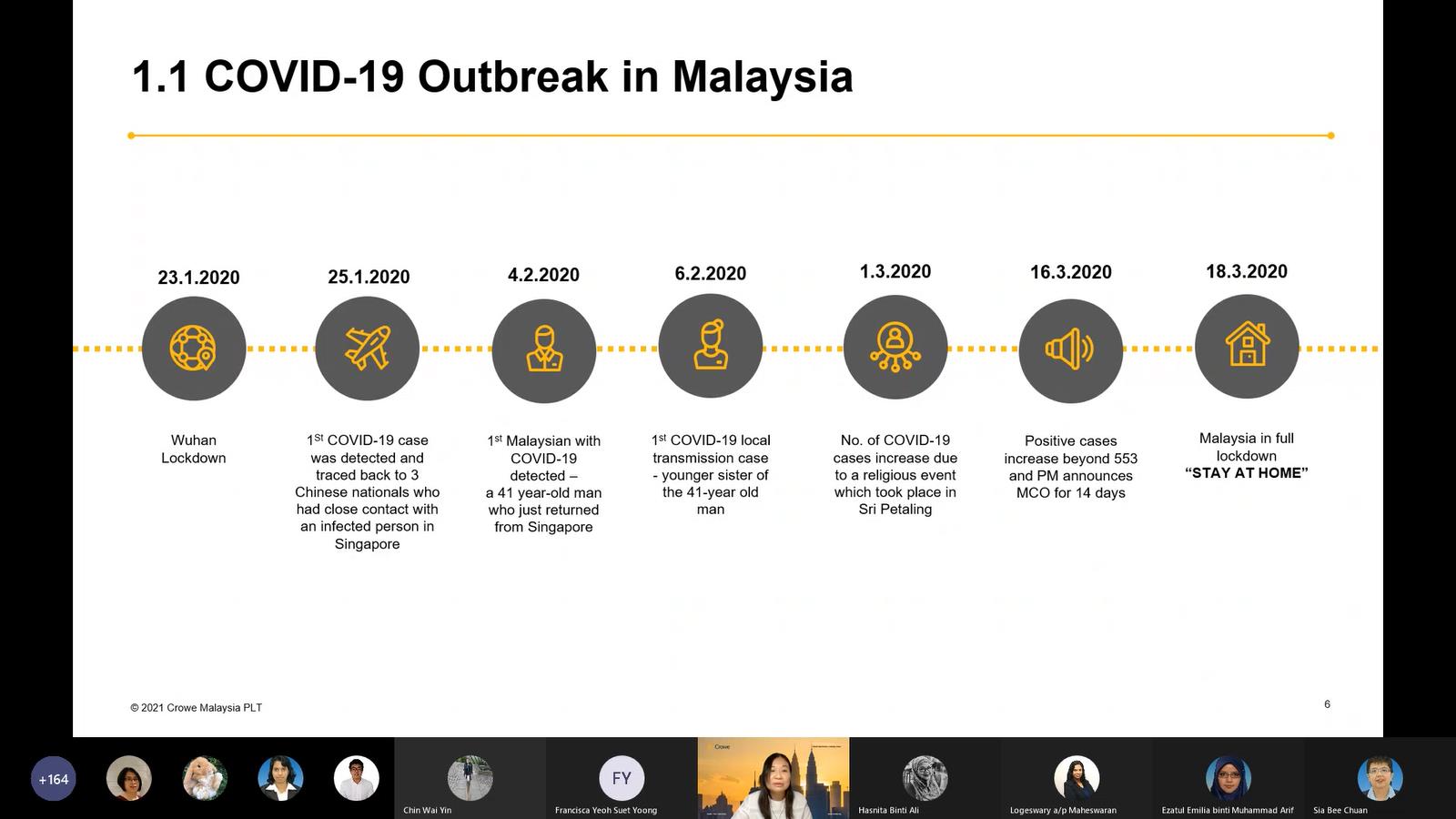

Dr Voon began her webinar by sharing the initial stages of the Covid-19

outbreak in Malaysia, the movement control order (MCO) by phase and the

Standard Operating Procedures (SOPs) of MCO which have become a standard

practice to everyone. She said, “The Covid-19 outbreak has hit a lot of

businesses during the MCO period. A lot of businesses were forced to close.

Only permitted activities as announced by the Ministry of International

Trade and Industry (MITI) were allowed to continue business operations. But

unfortunately under the SOP, most of the businesses were not allowed to

operate during the MCO period that is why I say that a lot of businesses

were affected. ”

The initial stages of the Covid-19 outbreak in Malaysia

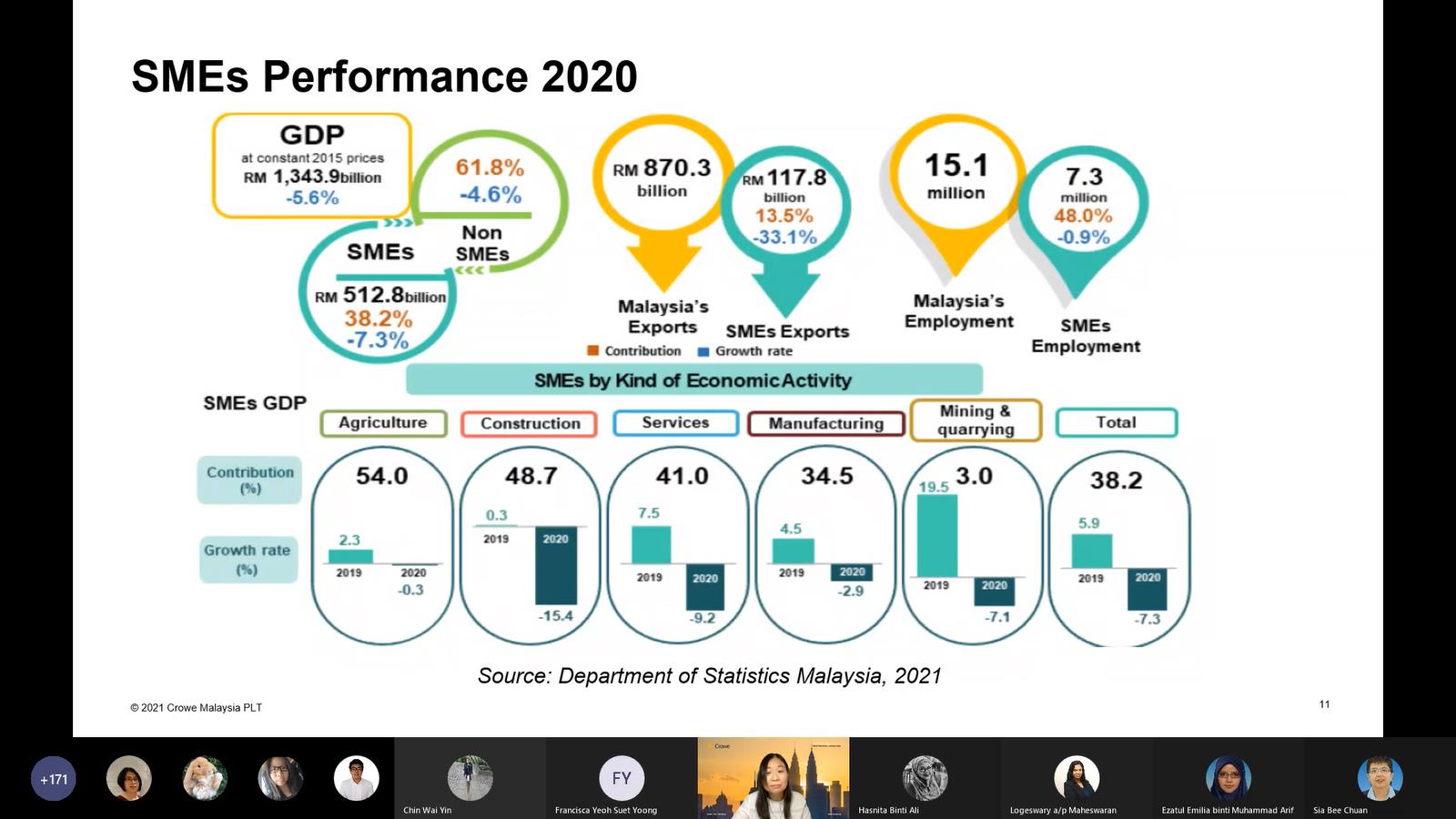

Sharing the challenges faced by the SMEs in Malaysia, Dr Voon said,

“According to the SME Corp Malaysia 2021, 98.5 per cent of the business

establishments in Malaysia are SMEs. So you can see how important SMEs are

to Malaysia’s economy. They play an important role and most of the SMEs are

micro-sized, we call it ‘Microenterprises’. Out of the 98.5 per cent,

Microenterprises stand about 76.5 per cent.” She then shared the SMEs’

performance in the year 2020 according to the Department of Statistics

Malaysia 2021. She said, “Most of the industries were experiencing a

concession period, which means their performance was not as good as those

days. Even in terms of exports or employment, their result is negative.”

SMEs’ performance in the year 2020

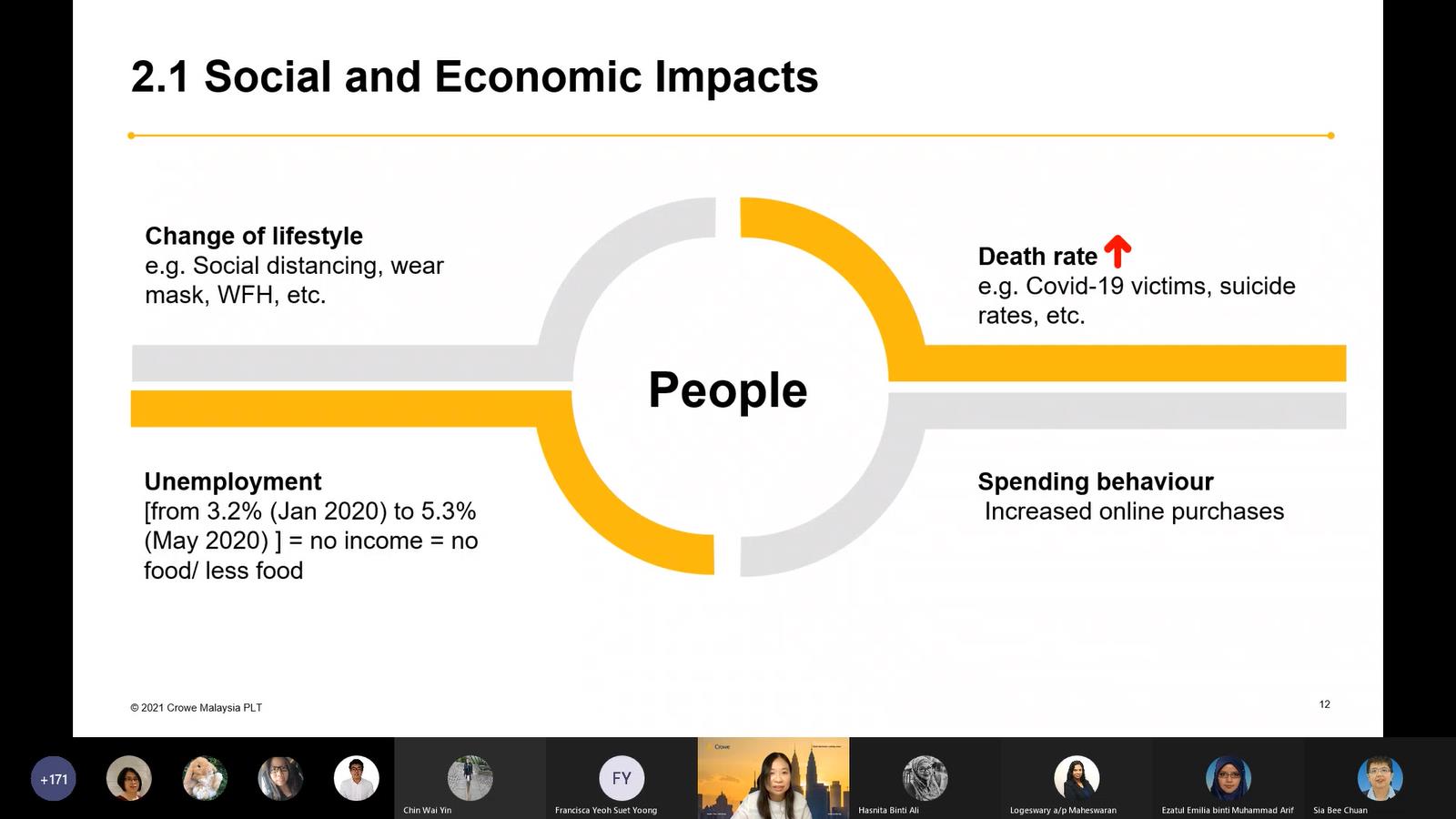

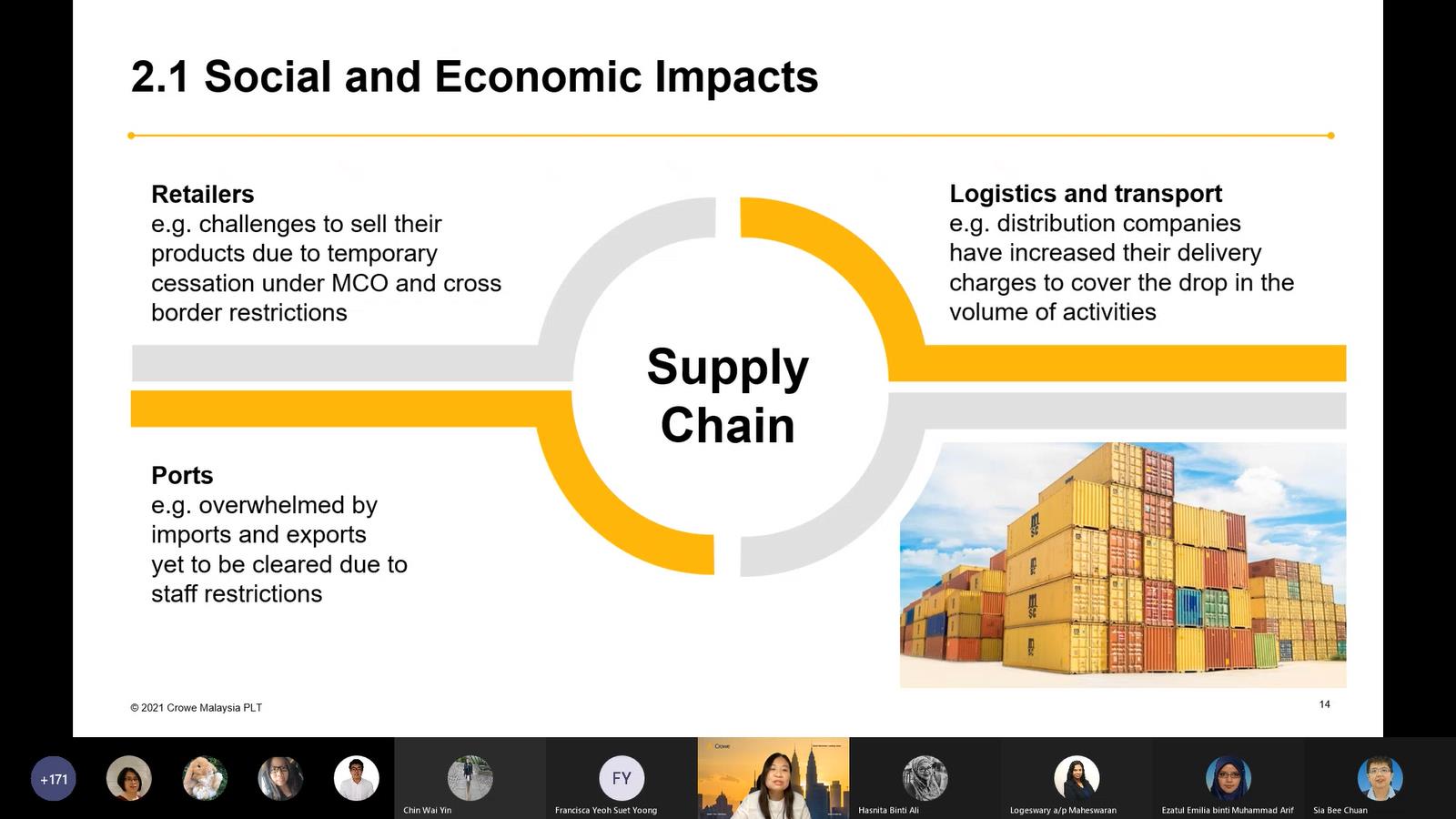

Dr Voon explaining the

social and economic impacts of SMEs

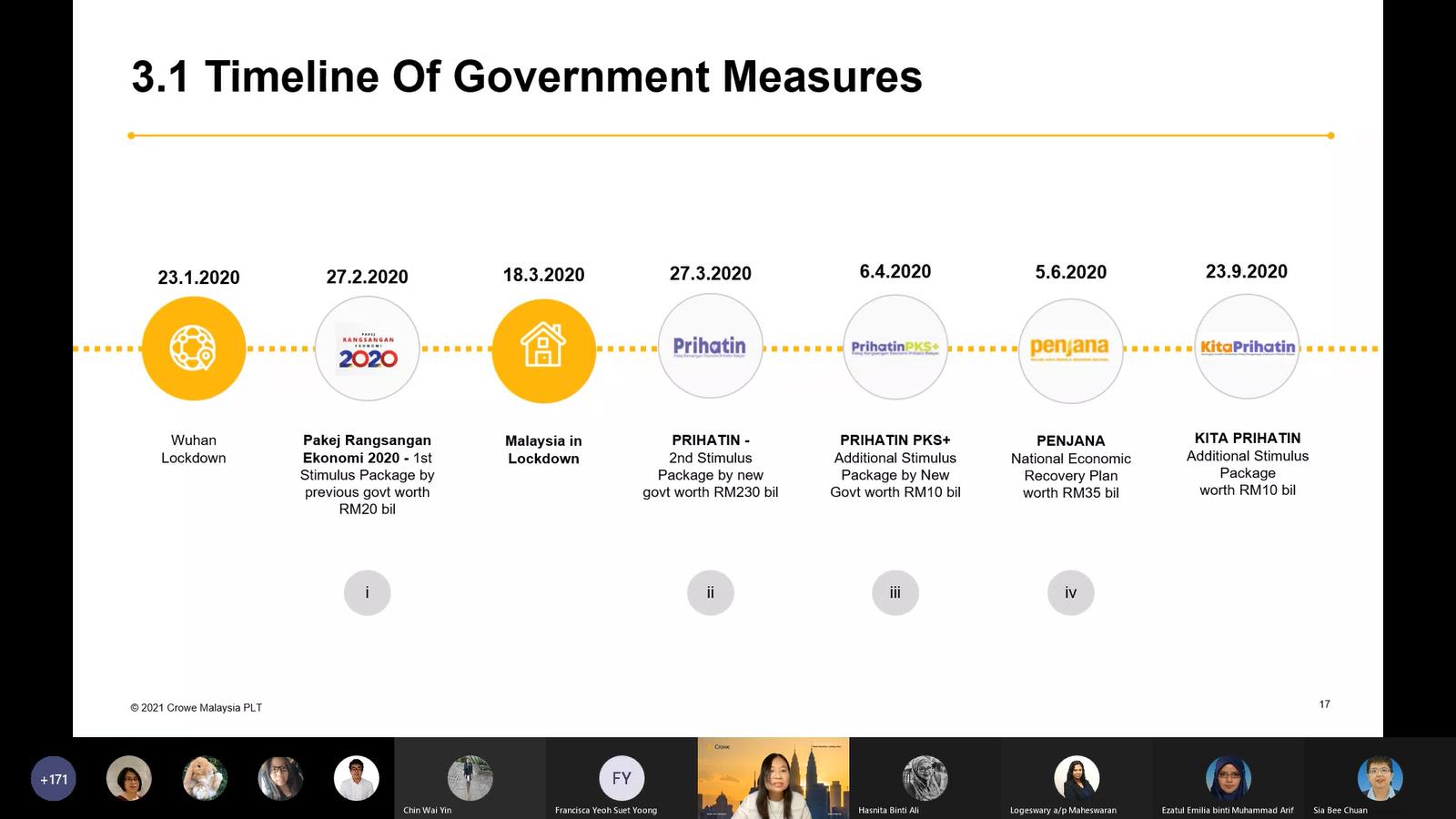

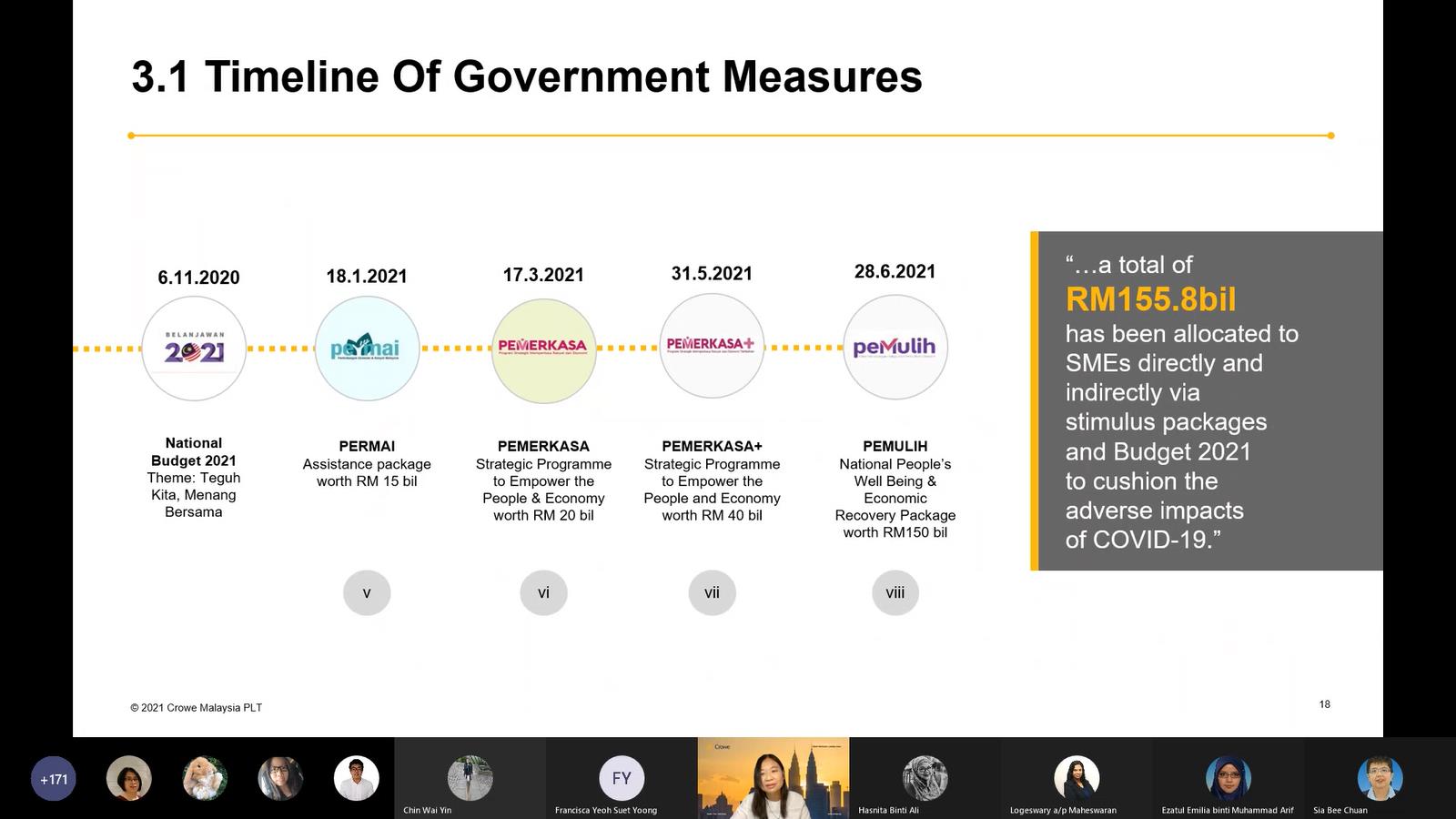

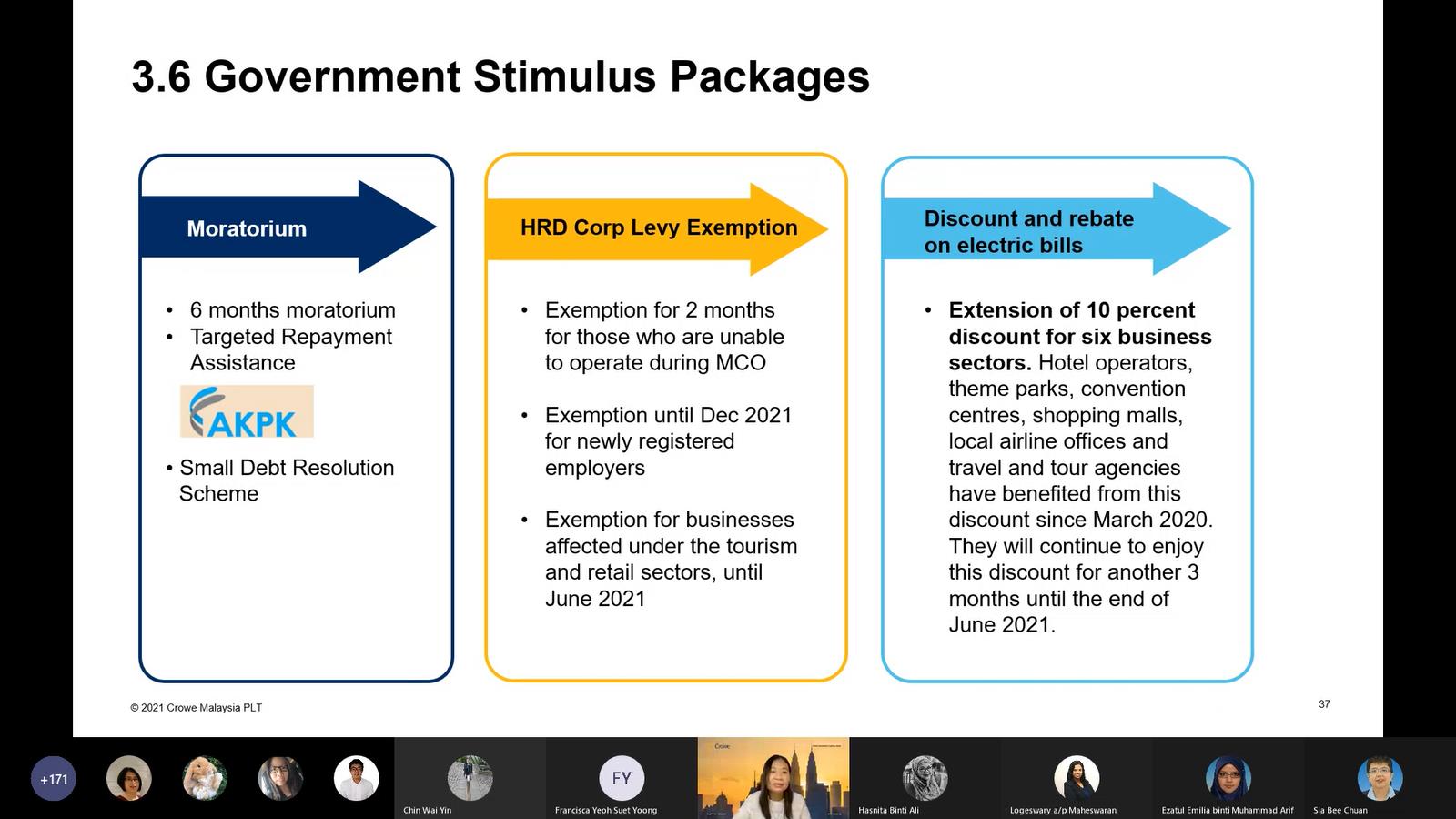

Moving on, she shared the government’s financial measures, and said, “Due to

the many impacts on those businesses out there, our government also

considered the difficulties and challenges faced by the businesses. They

have come out with different measures either financial or tax measures to

assist the businesses. In total, they allocated about RM155.8 billion to

those SMEs whether directly or indirectly via Economic Stimulus Packages and

Budget 2021.”

The timeline of government measures

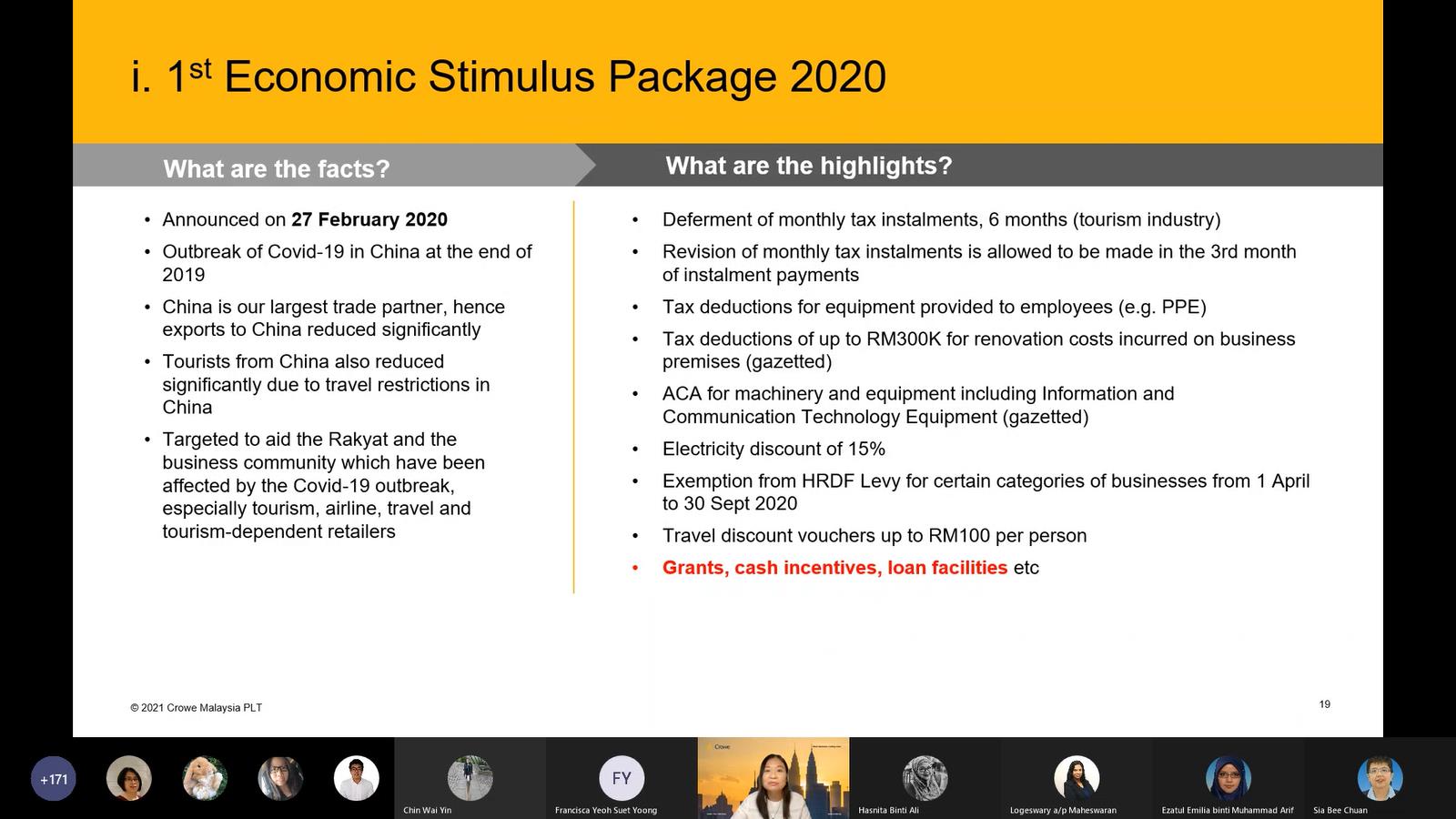

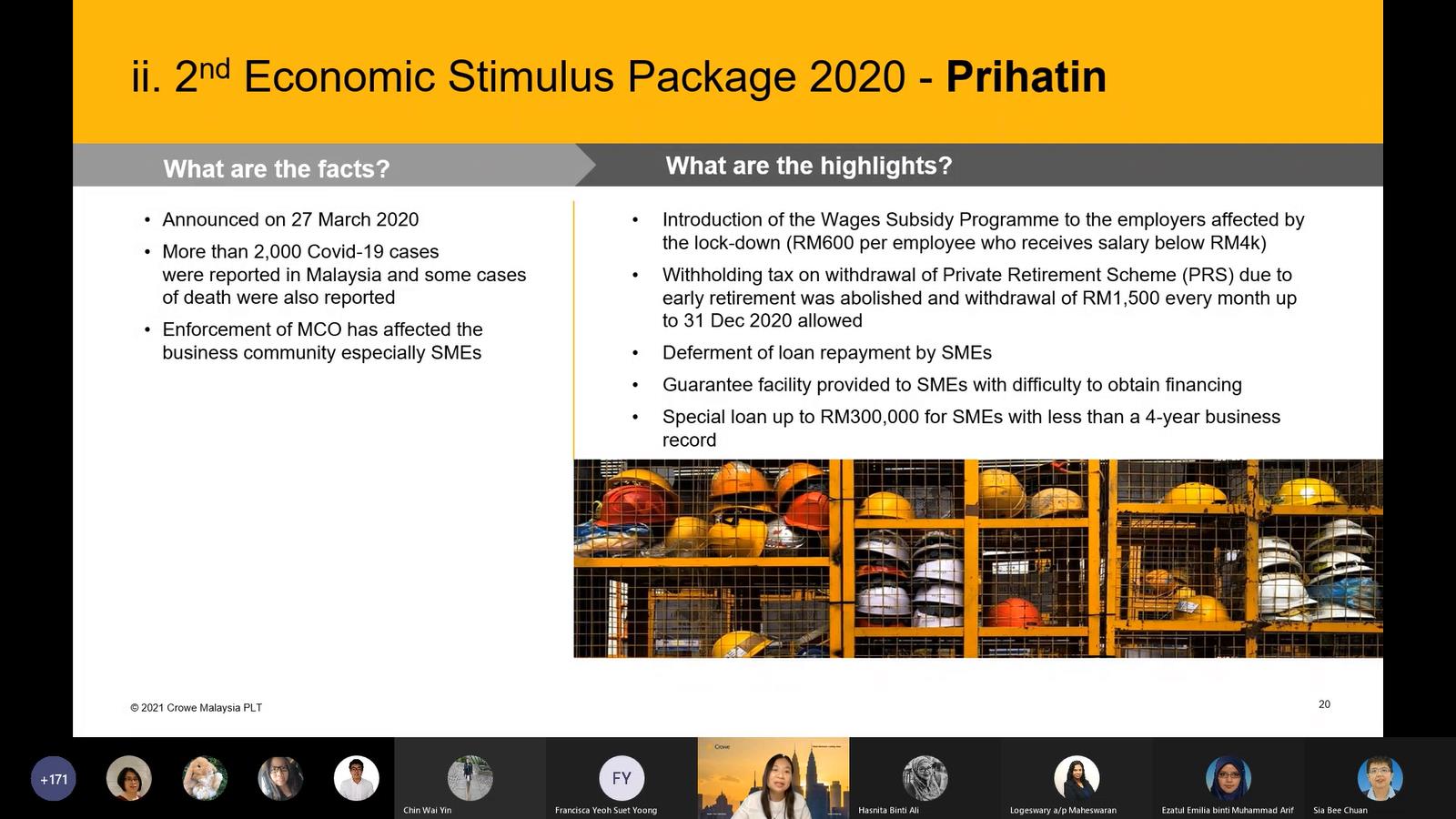

Dr Voon sharing the facts and highlights of the Economic Stimulus Package

She continued to share about the SME loans where the SME owner can consider

applying for loans from a financial institution, or government funding or

grants if they can fulfil the terms and conditions (T&Cs) set by the

government to ease their cash flow burden. She also explained the feature of

BNM’s financing facilities announced by the government to assist Malaysian

SMEs.

SME loans that the SME owners can opt to apply

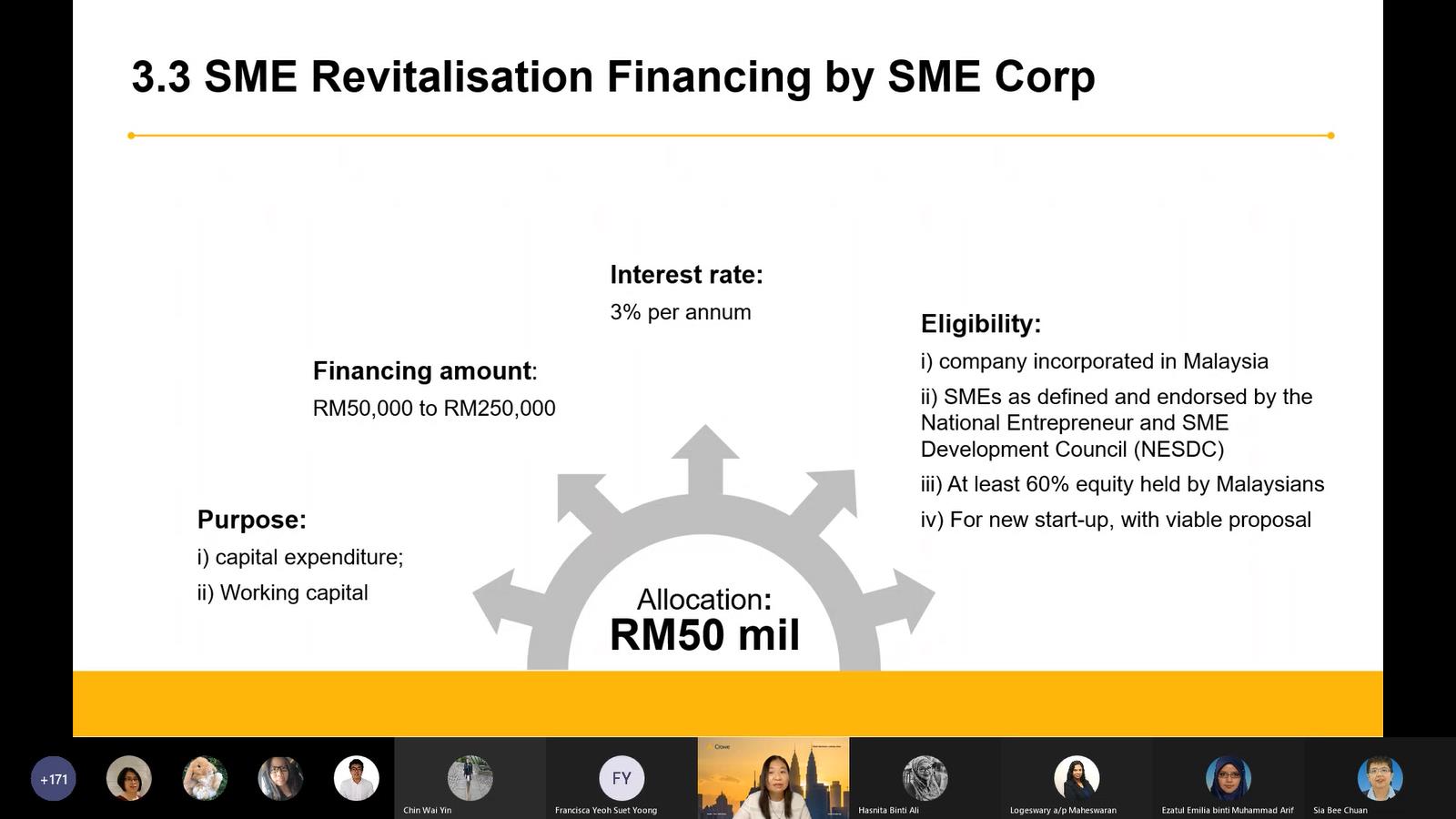

SME Revitalisation Financing offering by SME Corp

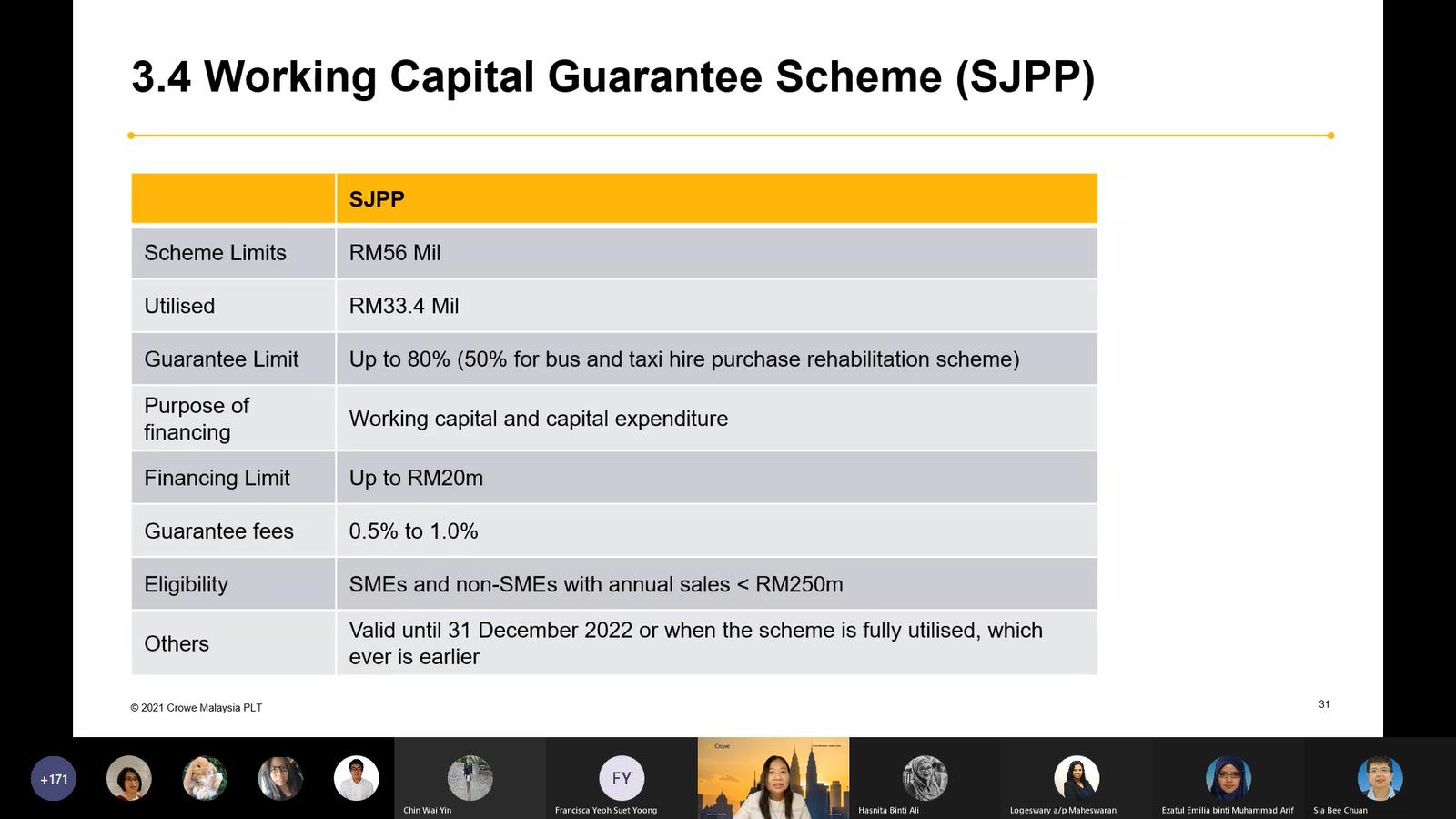

Working Capital Guarantee Scheme offered by the government for SMEs and

non-SMEs that have annual sales of < RM250m

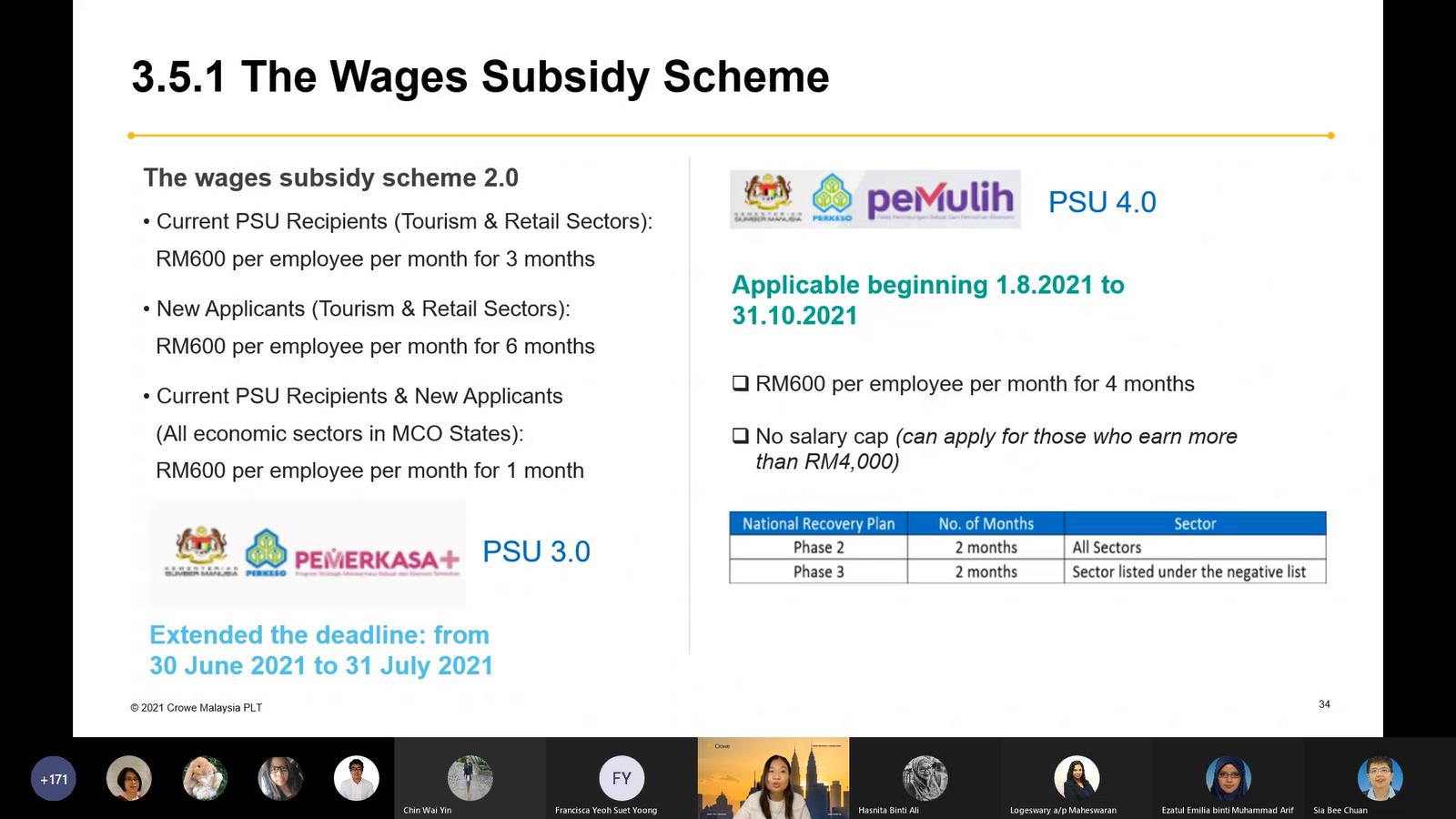

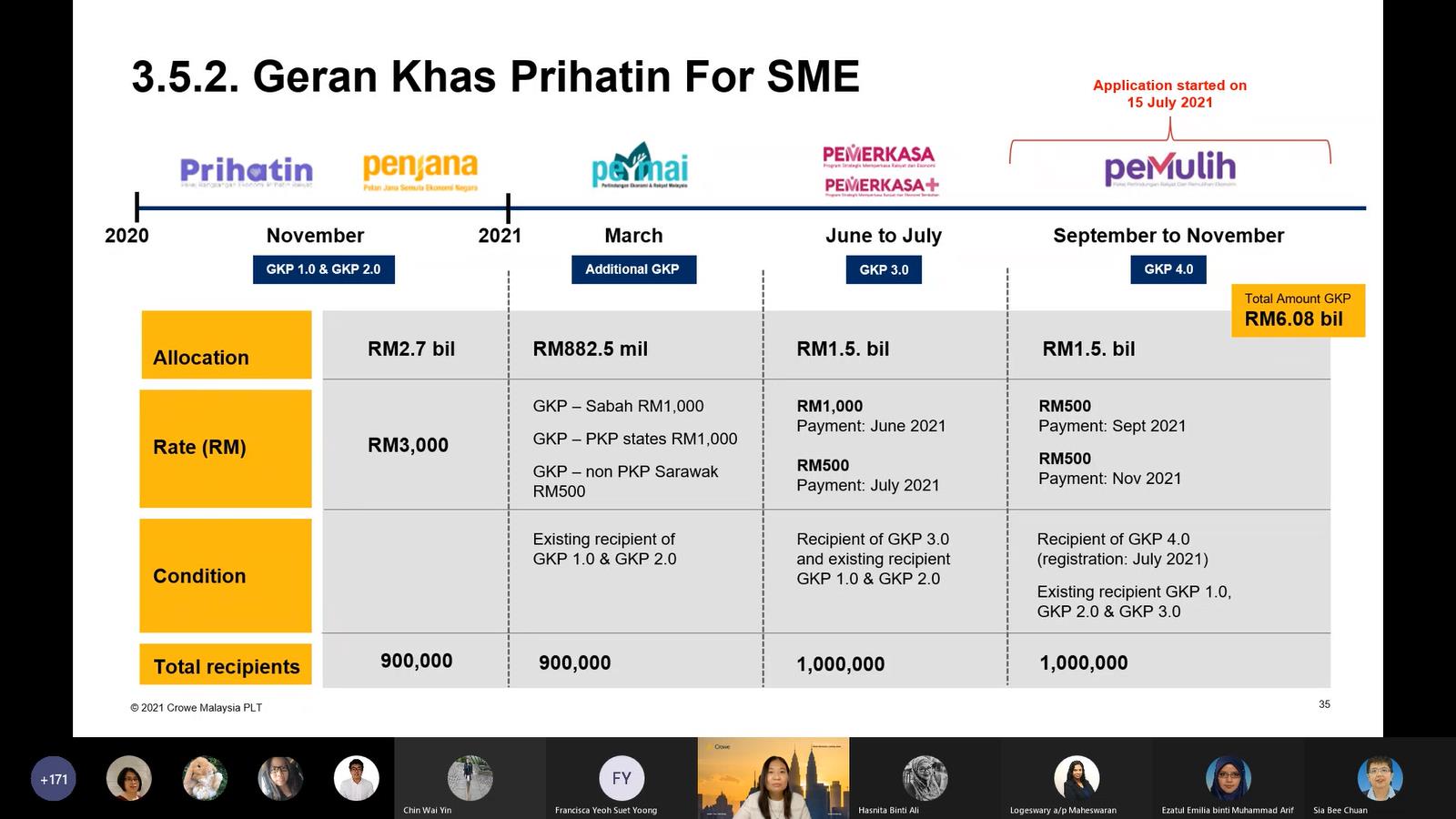

Furthermore, she explained the grant or subsidy offered by the government; the wages subsidy scheme, Prihatin special grant for SME (Geran Khas Prihatin for SME), government stimulus packages and one-off assistance to selected sectors and groups especially the Canteen Operator, Private Kindergarten, Childcare Centre, OKU and Sports Facility Operator who were affected due to the full lockdown.

Grants and subsidies offered by the government

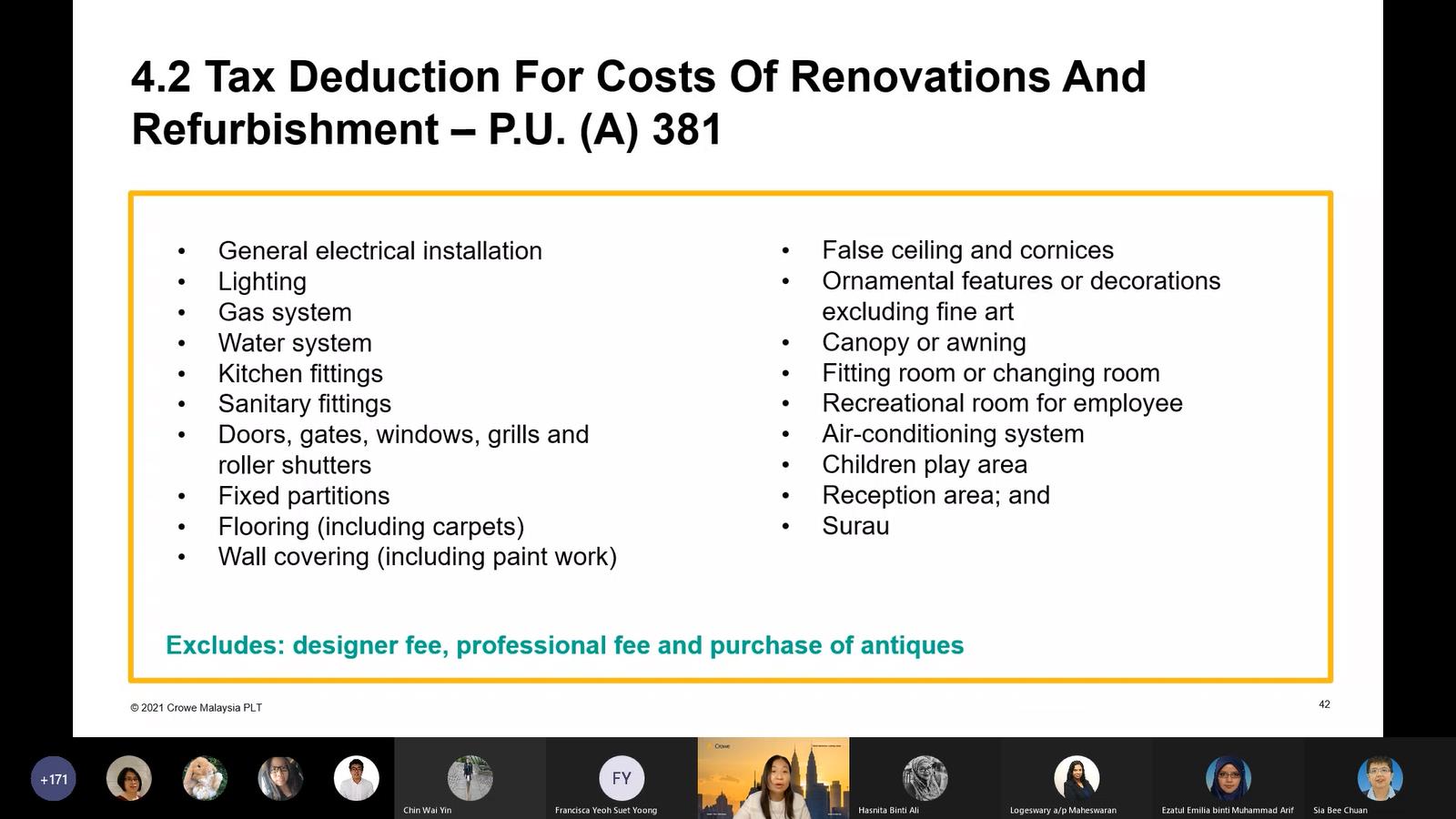

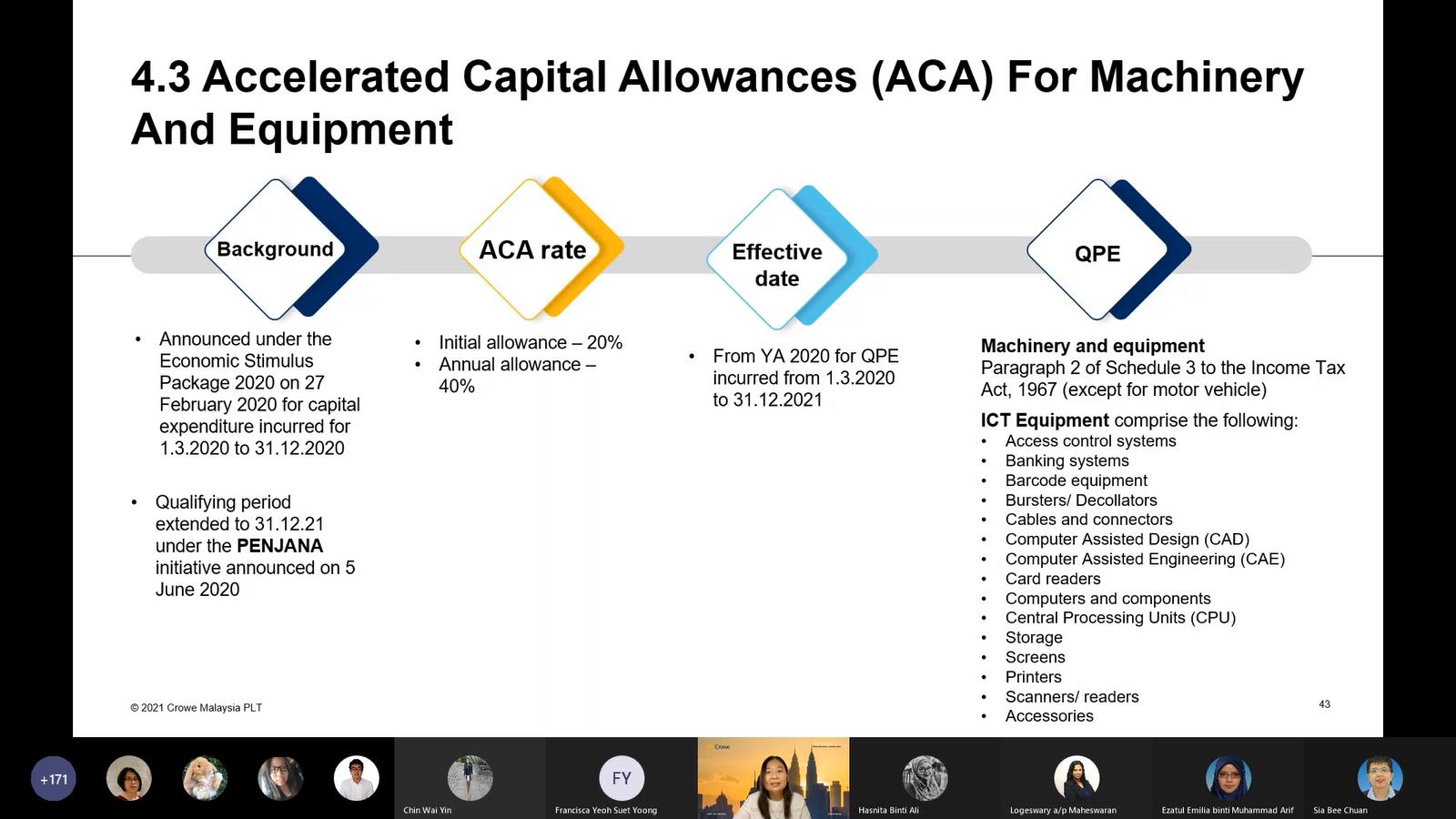

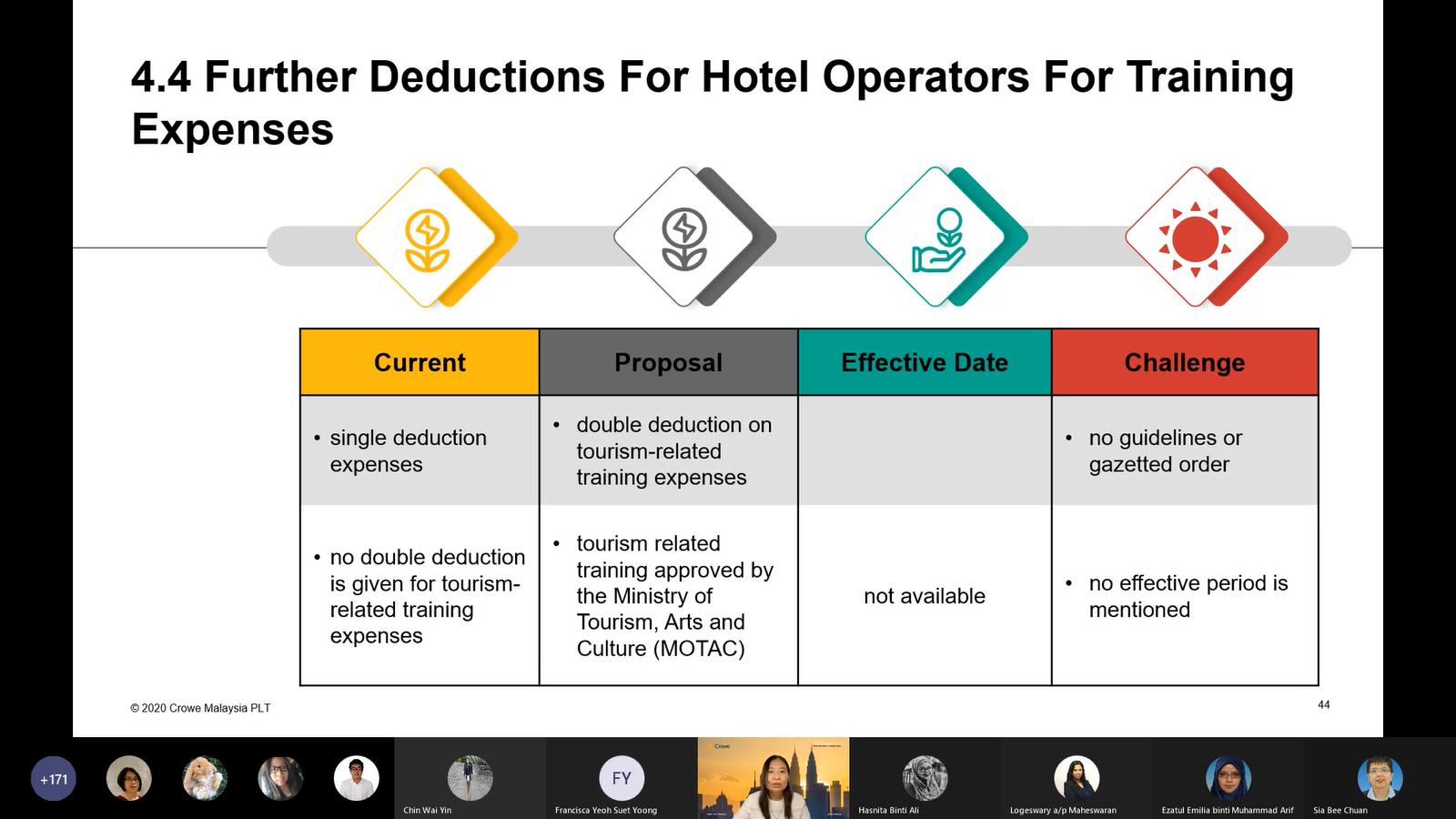

As she addressed the importance of tax measures which is very useful to the

SMEs, she shared about the reinvestment allowance which was specifically

offered to manufacturing and selected agricultural activities (T&Cs apply)

and the tax deduction for costs of renovations and refurbishment under the

exemption order P.U. (A) 381 with the condition that they must get the

certification from a licensed auditor. She also shared the Accelerated

Capital Allowances (ACA) for machinery and equipment, further deductions for

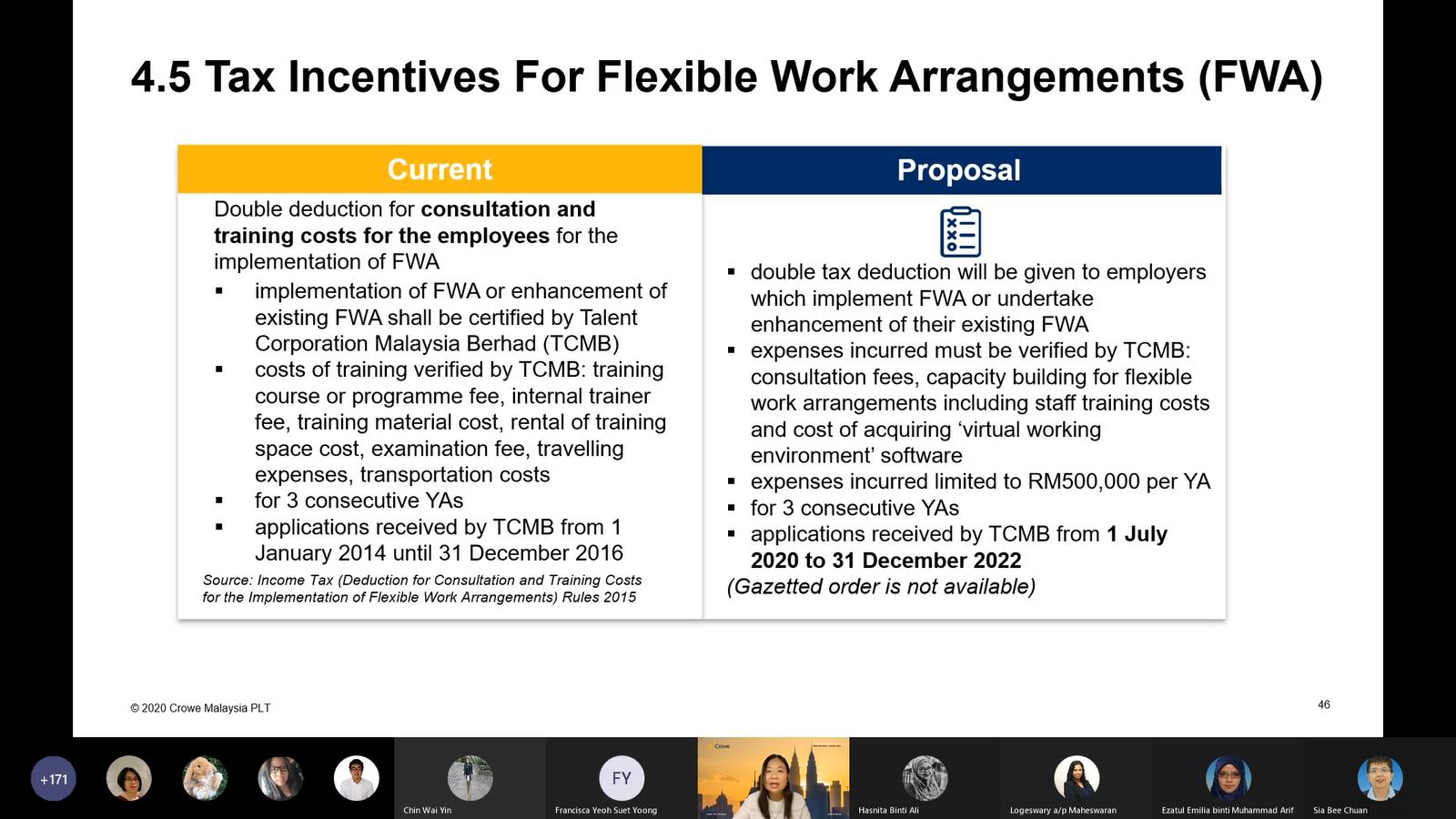

hotel operators for training expenses, tax incentives for flexible work

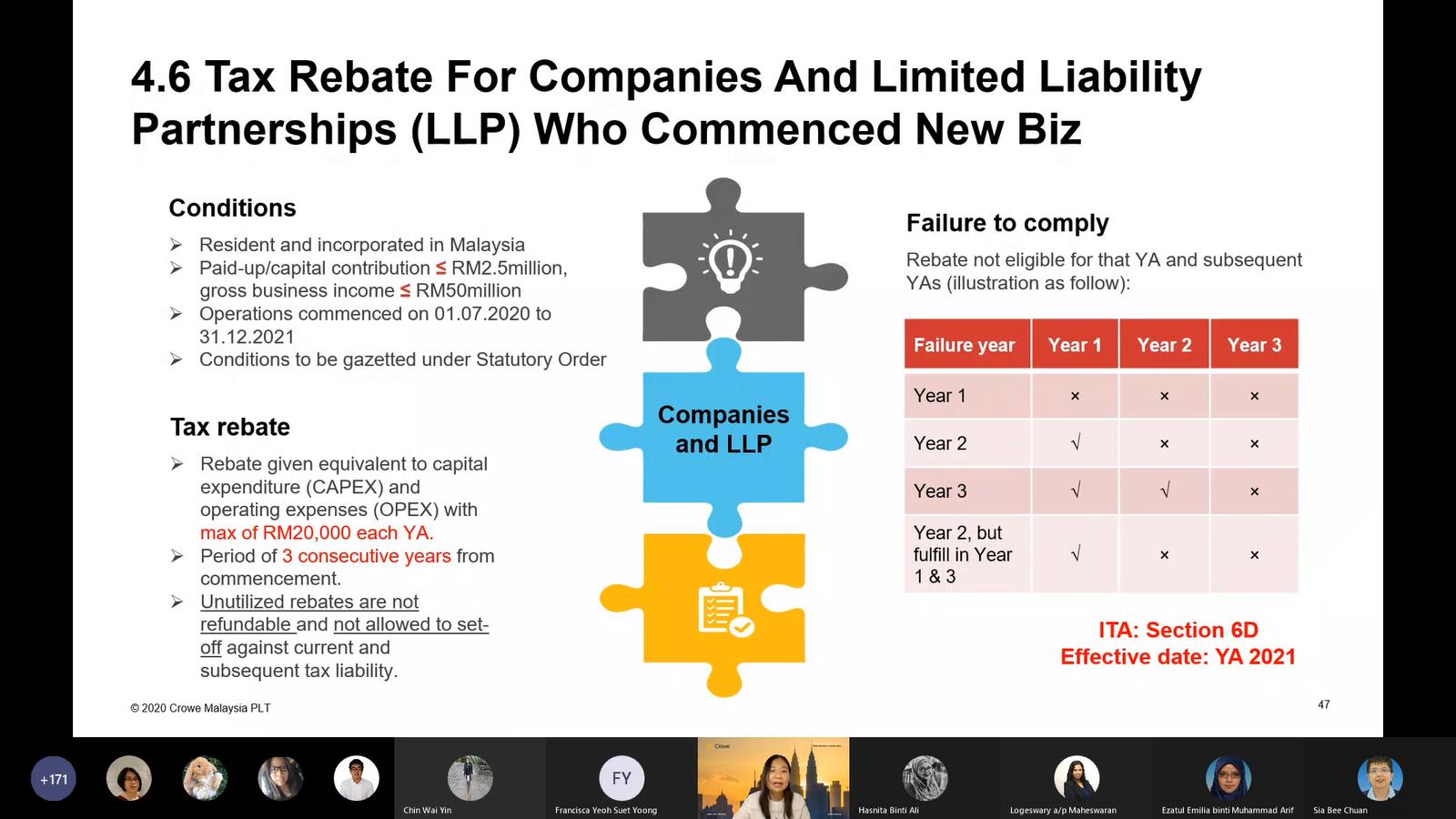

arrangements (FWA), tax rebate for companies and limited liability

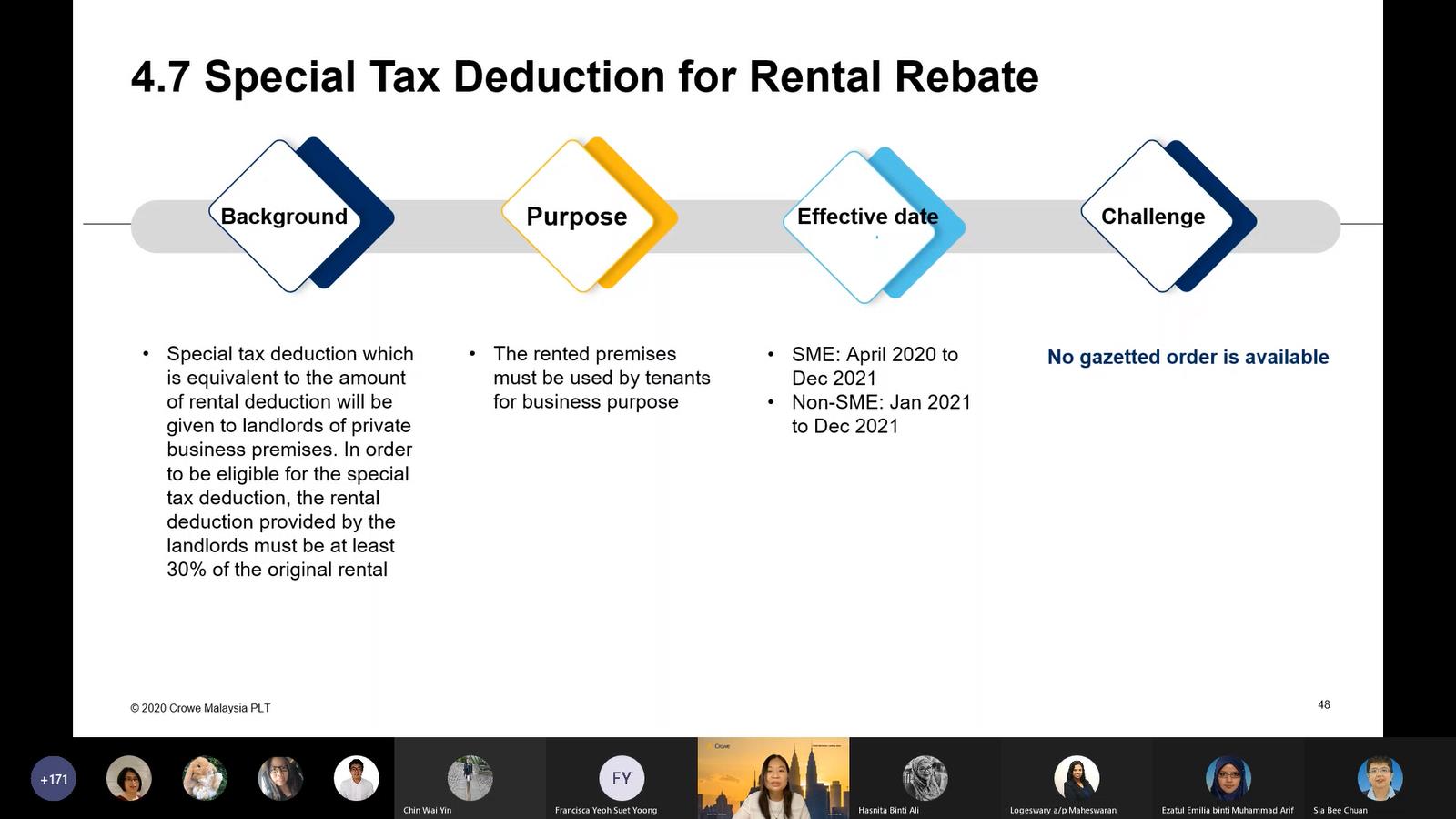

partnerships (LLP) who commenced new business, a special tax deduction for

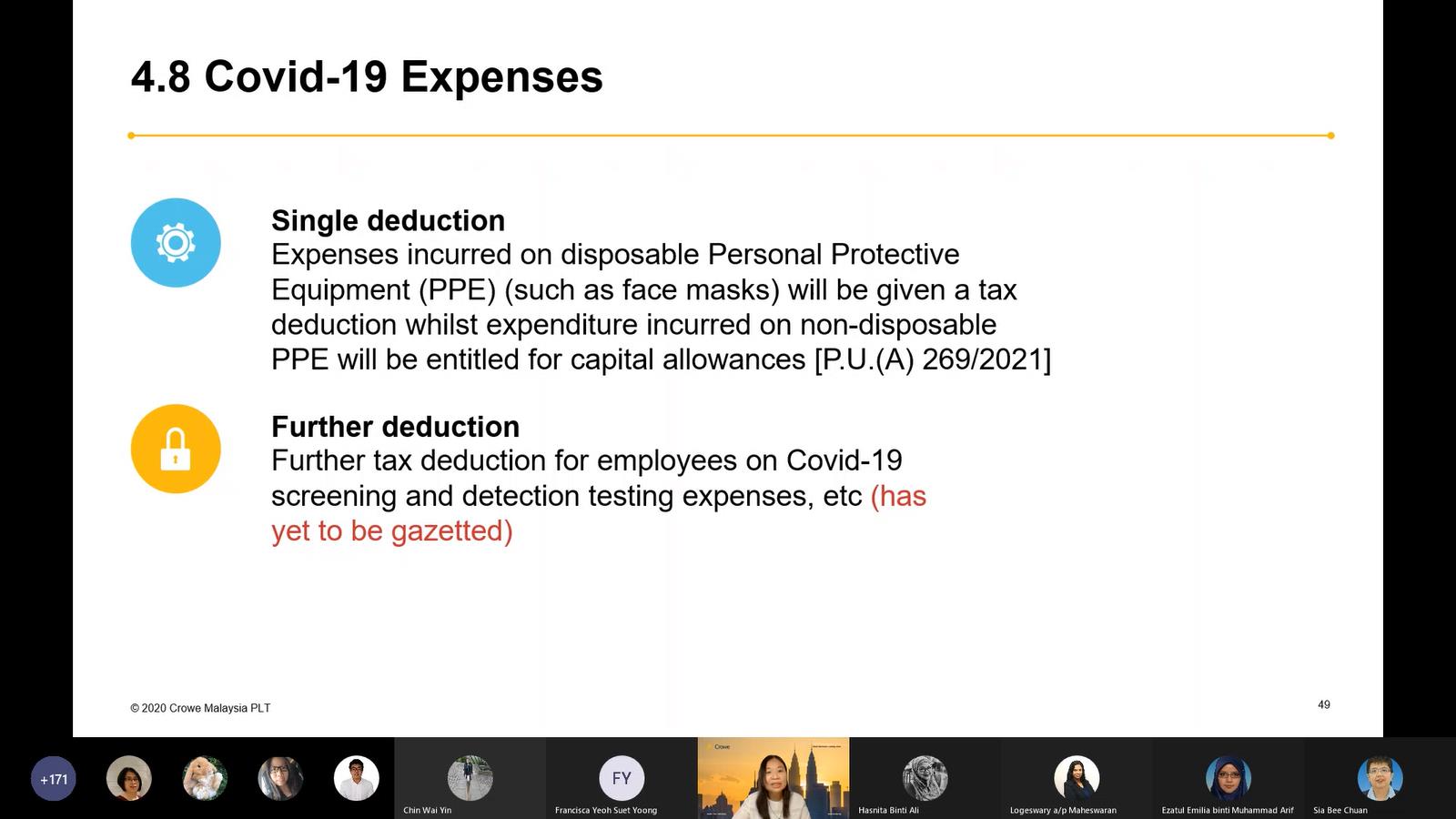

rental rebates (for SMEs and Non-SMEs) and the Covid-19 related expenses.

List of qualifying expenditures that can be claimed under the special tax

deductions

ACA for machinery and equipment

Further deductions for hotel operators

Tax incentives for FWA

Tax rebate for companies and LLP new business

Special tax deduction for rental rebates for SME and Non-SME

Covid-19 expenses

Sharing on how SMEs benefit from the tax measures under the stimulus

packages, she said, “From the tax compliance perspectives, our government

mentioned that they can defer some instalment plan if they want to pay for

penalty payment or instalment plan for the outstanding tax. So under these

circumstances, they have to estimate the tax payable as precise as they can

to avoid paying excess tax credit to the Inland Revenue Board (IRB) in order

to save on cash flow. Lastly, all the businesses especially the SMEs must

try to comply with all the tax regulations and submit the income tax return

on time although they are not doing well because, for late submissions, the

penalty range is from RM200 to RM200,000 per return.”

“In terms of tax credits, a company can apply for a tax refund but, bear in

mind, that tax refund will take some time. Another option for you is to

request for offset as long as you fulfilled the T&Cs.

Otherwise, you may just keep the tax credits with the IRB if you

don’t have any cash flow problem and offset against your future estimate of

tax payable,” said Dr Voon.

She continued, “Another thing that SMEs can look into is the unutilised

business losses. The cumulative business losses can be used to set up

against the taxable income in the future. Our government actually announced

quite a number of special tax deductions. Try to claim it and keep the

losses but the life span of the tax losses is capped at seven years. You can

keep the tax deduction by now and set off again with the future taxable

income in order to save the cash.” She then listed the deductibility of

business expenses. She added, “If there are any penalties imposed by the

IRB, they allow you to pay in instalment and you can even submit the appeal

letter to the IRB to get the waiver or partial waiver on that.”

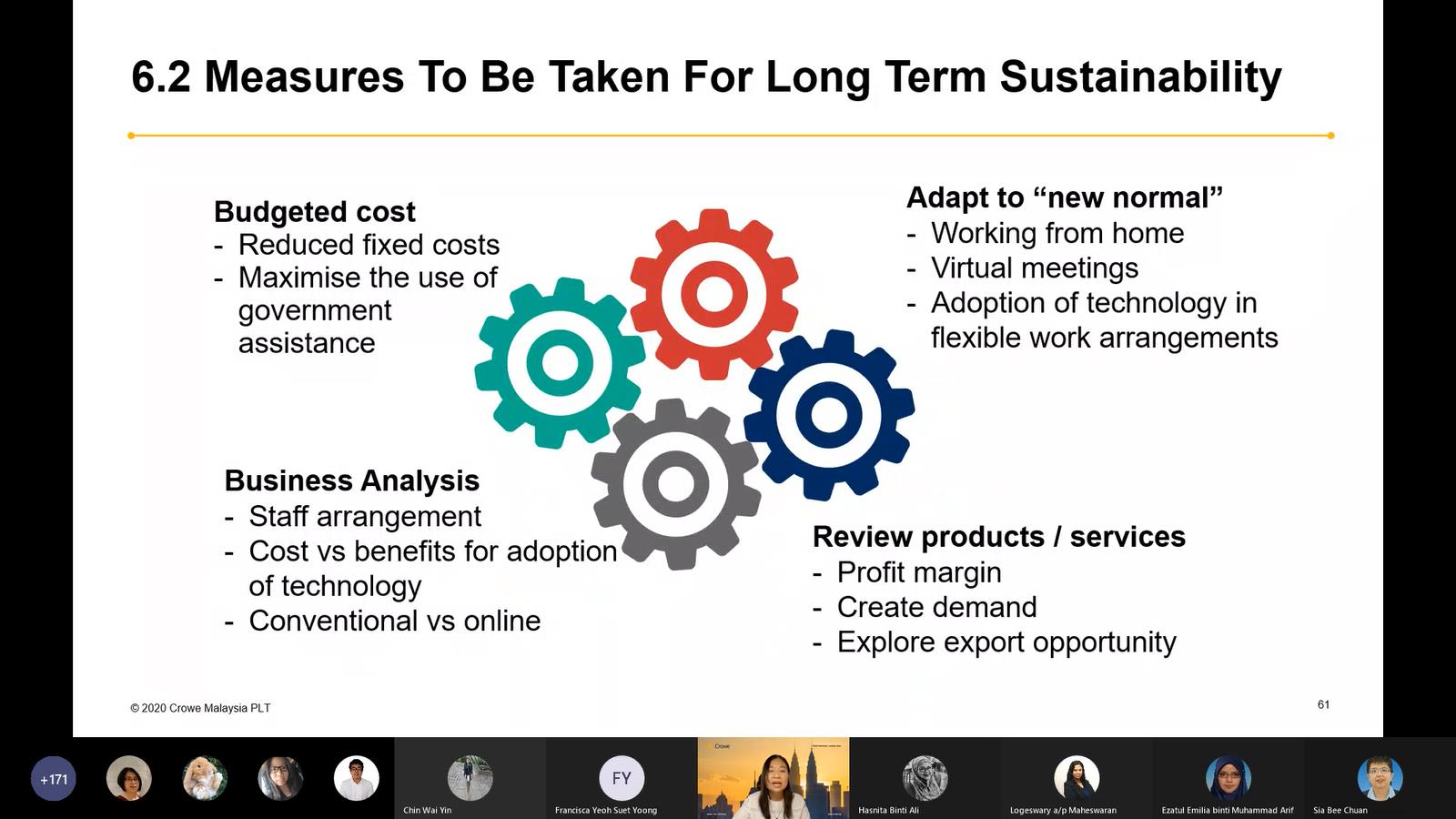

She summarised her webinar by giving a recap on the economic stimulus

packages announced by the government and encouraged the SMEs to take a look

at any new policy announced by the government and apply to the relevant

authority to overcome the challenges they face during this pandemic period.

Some measures that can be taken for long term sustainability

The webinar ended with an interactive Q&A session and a group photo session.

A certificate of appreciation was presented by FAM and CENTS to Dr Voon.

A certificate of appreciation to Dr Voon

The webinar attracted more than 200 participants

Wholly owned by UTAR Education Foundation (200201010564(578227-M)) LEGAL STATEMENT TERM OF USAGE PRIVACY NOTICE