![]()

With the aim

to learn about money management techniques,

a financial education webinar titled “I, Save in PRS: The #YOLO Style”

was co-organised by UTAR

Faculty of

Accountancy and Management (FAM), Centre for Entrepreneurial Sustainability

(CENTS) and Private Pension Administrator Malaysia (PPA) via Zoom on 2

September 2021.

Invited to be

the speaker was PPA Learning and Engagement Manager Mohamed Farith Mohamed

Jamal. He is a Shariah

registered financial planner (Shariah RFP) and certified training

professional (CTP) holder with years of experience in financial services and

the capital market industry. In

addition, he is a former member of the Malaysia Shariah Financial Planning

Development Committee.

Mohamed Farith

“PPA is the

central administrator for the PRS industry. It acts as a one-stop centre for

retirement learning and PRS and provides services with any of the eight PRS

Providers. The initiative that PPA do to grow the industry includes

marketing campaigns, digitalisation via PRS online service, continuous

retirement education and financial literacy initiative and collaboration

with stakeholders, for example with the universities,” said Mohamed Farith.

Defining YOLO

(You Only Live Once), he said, “Some people would define YOLO as ‘living

life to the fullest’. Some might say YOLO is ‘living in the moment’ and also

‘doing the things they love the most’. Because no one knows what is going to

happen tomorrow. Living in the moment brings more joy into our lives. In

short, YOLO is all about now and nothing else matters.”

Sharing about

financial literacy among youths (age below 35), he said, “Thirty per cent of

youths use three or more e-wallets, while 93 per cent own at least one

e-wallet. Twenty-nine per cent only realised the importance of emergency

funds since the MCO started and sixty per cent cannot survive only on

savings beyond three months. Forty-seven per cent spend exactly or more than

what they earn and last but not least, the most worrying part— fifty per

cent have not started retirement planning.” He advised the participants to

pay attention to their money, make sure they have enough money when the time

comes.

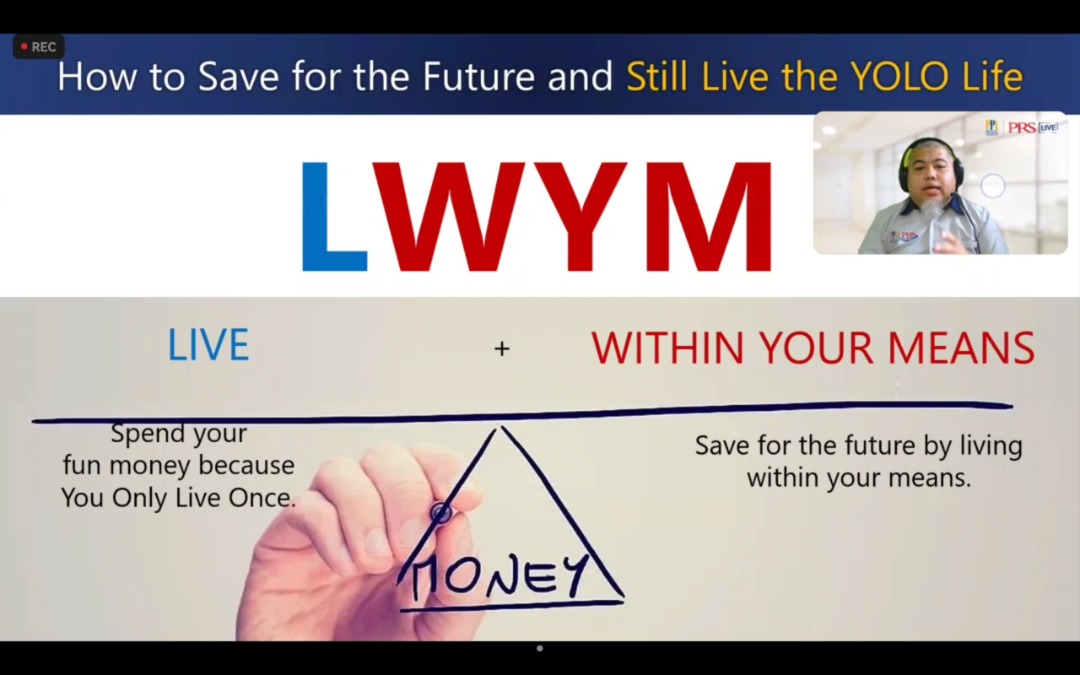

LWYM

As he spoke

about financial management for young graduates, he explained how one can

save for the future and still live the YOLO life with LWYM (Live + Within

Your Means). He also emphasised the three key areas from short-term to

long-term financial planning that one should take note of, namely Money

Management, Debt Management and Retirement Planning. He said, “Financial

management refers to the efficient and effective usage of money which can be

done by understanding the difference between your needs and wants. Needs are

goods and services that you require to survive; while wants are goods and

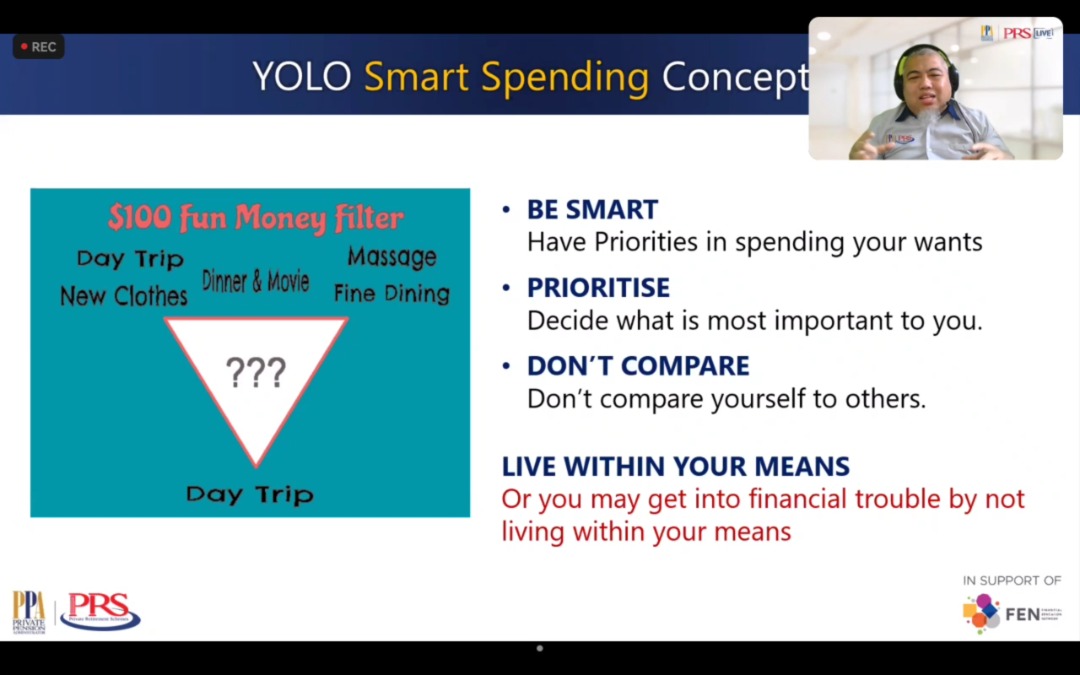

services that are not necessary but you desire for.” He then shared the YOLO

smart spending concepts, namely Be Smart, Prioritise, Don’t Compare and Live

within Your means.

YOLO smart spending concepts

Managing money by budgeting

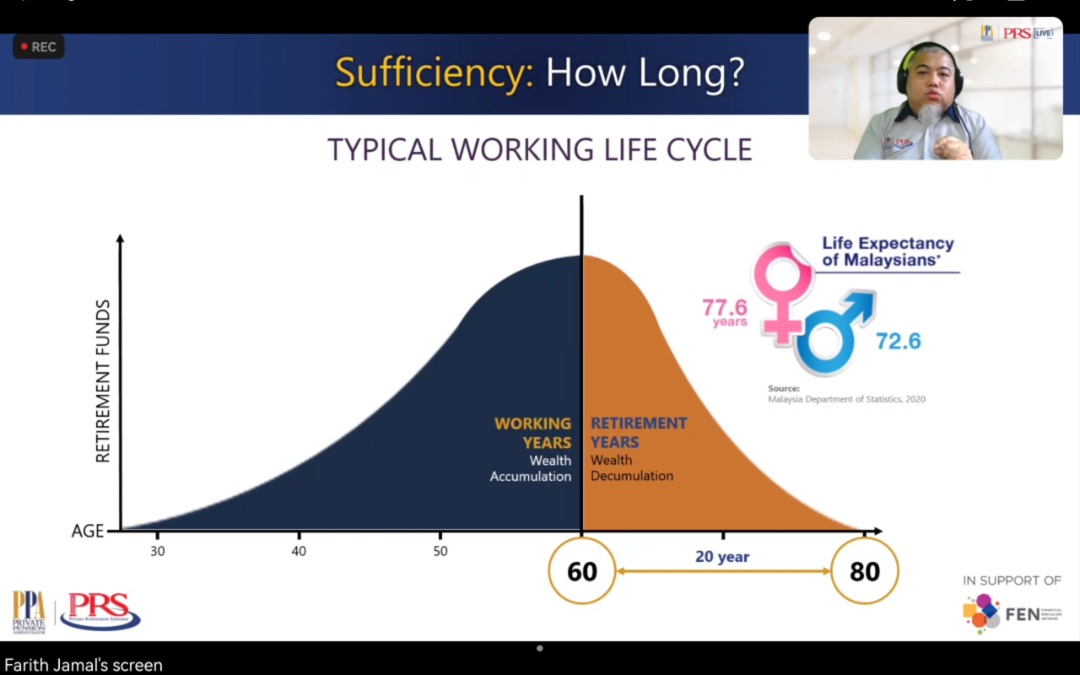

As he explained the short term financial plan— money management, he advised, “Try to minimise inflating spending after you begin to work.” He then proceeded with the medium-term financial planning which is debt management. A short video on good debt vs bad debt was played to understand its differences and to have a better understanding of debt management. He then continued, “So after money management and debt management, now it’s time to talk about the retirement planning for young adults. Most importantly when you start working you need to ask yourself, how much do you actually need to sustain your YOLO lifestyle and retirement?” A short video on “Retirement Planning & Savings with PRS—Episode 1: The Additional 10% with PRS” was played to understand the three key factors, namely adequacy, sufficiency and sustainability.

Understanding the three key factors

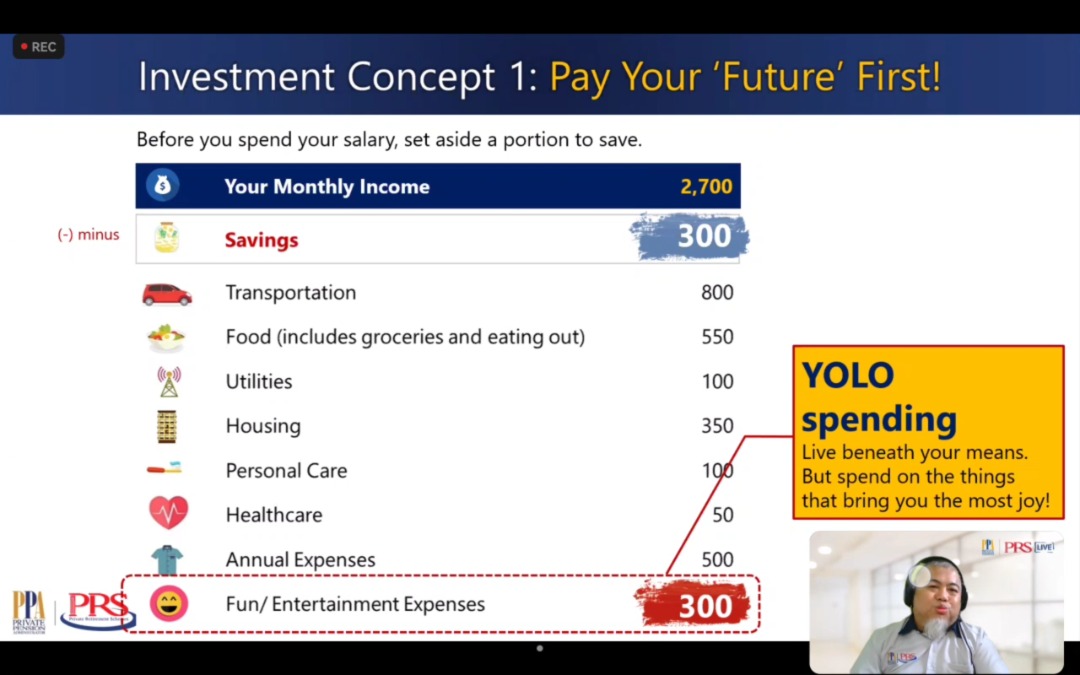

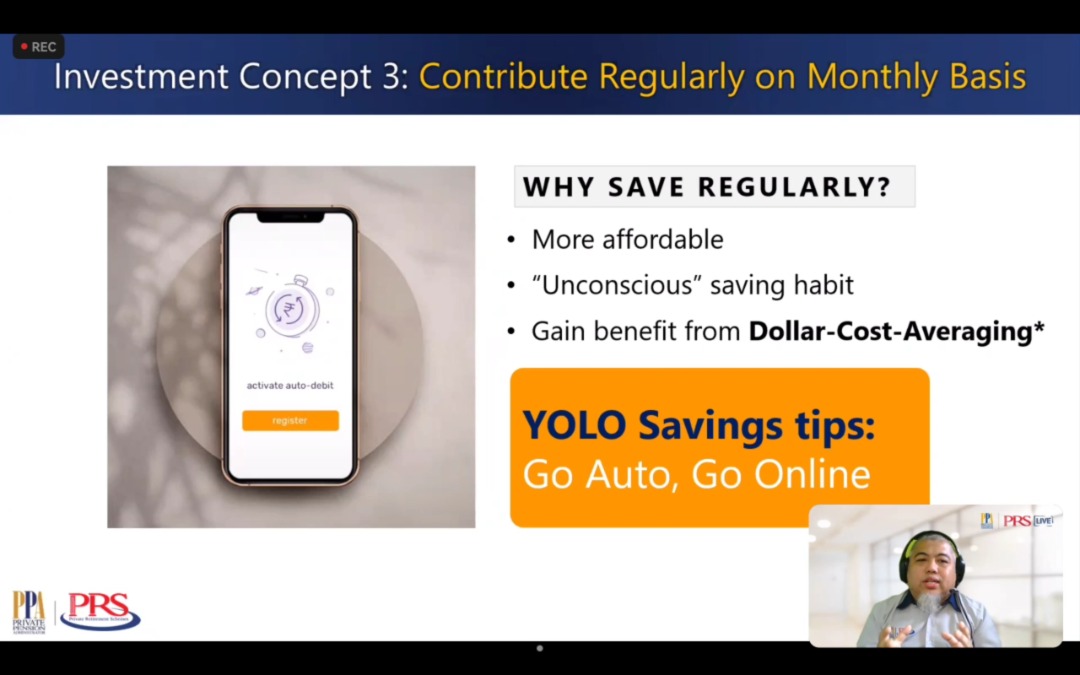

Moving on to

the smart investment concept “I, Save in PRS”, he explained the three smart

investment tips that one can consider when it comes to retirement planning

which was Pay your ‘Future’ first, Power your savings and Contribute

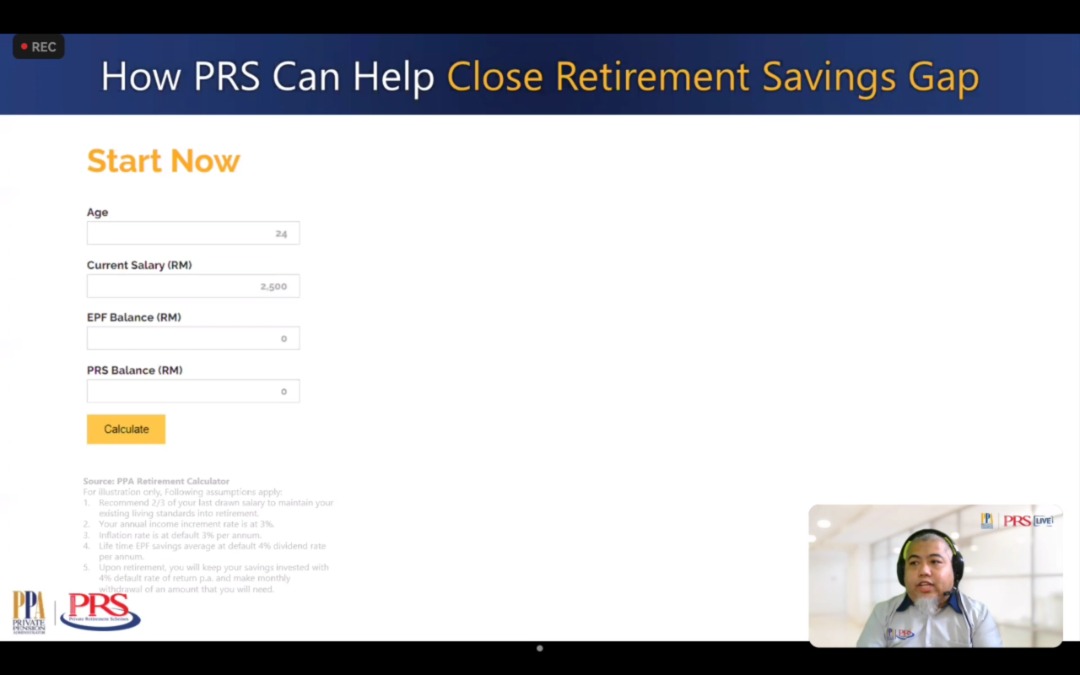

regularly on monthly basis. He then explained how PRS can help to close the

retirement savings gap and advised the participants to “start small and

start now”.

The three smart investment tips

How PRS can help to close the

retirement savings gap

A short video

on “Retirement Planning & Savings with PRS—Episode 2: The Introduction of

PRS Industry” was played to provide a further understanding on the features

of PRS, its benefits and the flexibility it offers to the public. He said,

“PRS is a voluntary long-term saving and investment scheme designed to help

individuals save more for their retirement. PRS also intends to enhance

long-term returns for members within a well-structured and regulated

framework. The PRS regulatory framework is comprised of five key parties,

namely Securities Commission Malaysia, PRS Distributors & Consultants, PPA,

PRS Providers and Scheme Trustees.”

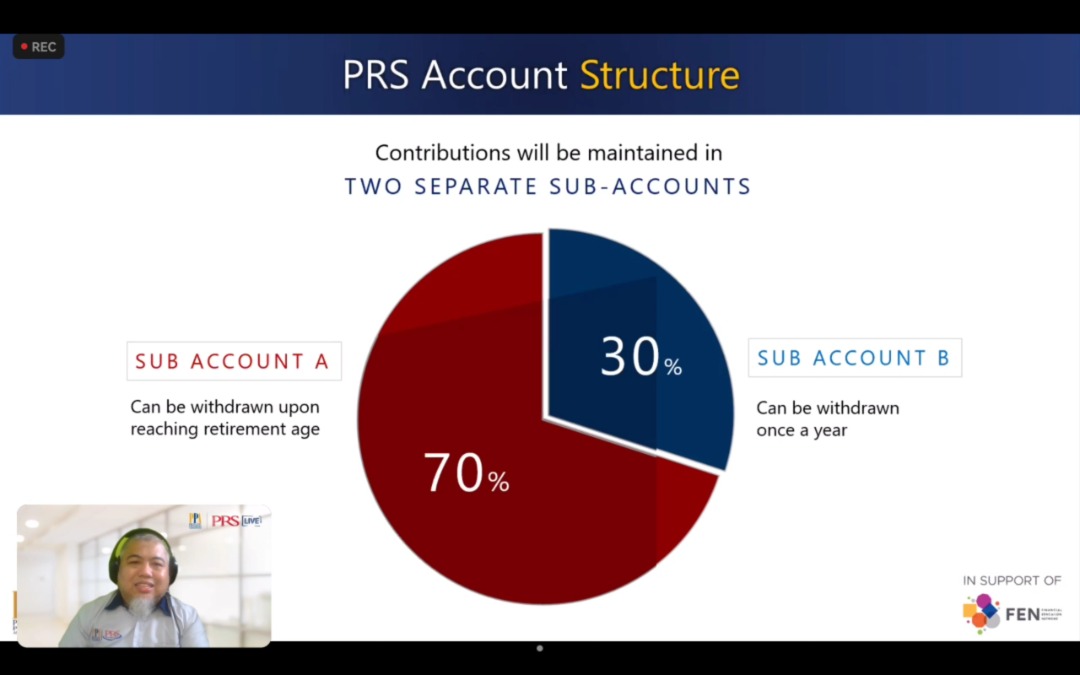

PRS Account Structure

The Eight PRS Providers in Malaysia

“These eight

PRS Providers provide a total choice of 58 PRS Funds, available both in

Shari’ah and Conventional schemes. The selection depends on whether you have

specified or preferred PRS funds. If you are familiar with any of the

specific funds, you can opt for self-selected funds. If a potential member

is unsure, they may choose the default option funds where savings will be

allocated based on the member’s age group,” said Mohamed Farith.

Default Option Funds

He said, “PRS

members can switch or transfer their funds. The difference between switching

and transferring is ‘Switching’ occurs when a member shifts their PRS

savings to another PRS fund of the same PRS Provider while ‘Transfer’ occurs

when a PRS member shifts their PRS savings to another PRS fund of another

PRS Provider. However, you need to know that transfers can only be

instructed between Providers after the first year of subscription to the PRS

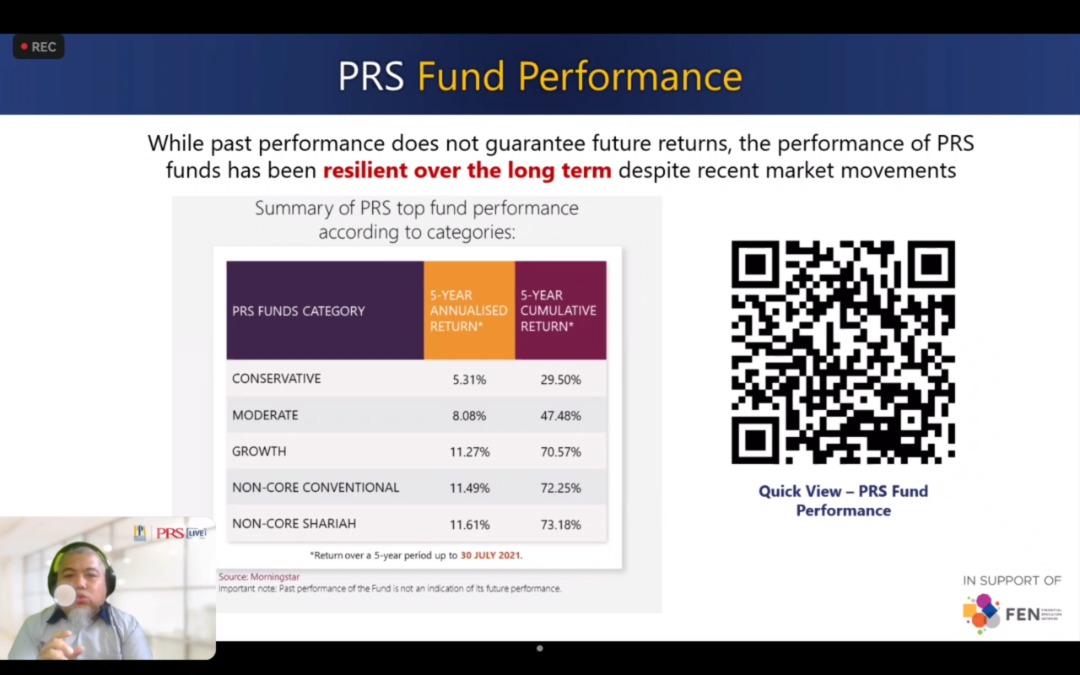

from the date of the first contribution.” He then shared the top PRS fund

performance according to each fund category from its inception until 30 July

2021.

PRS Fund Performance

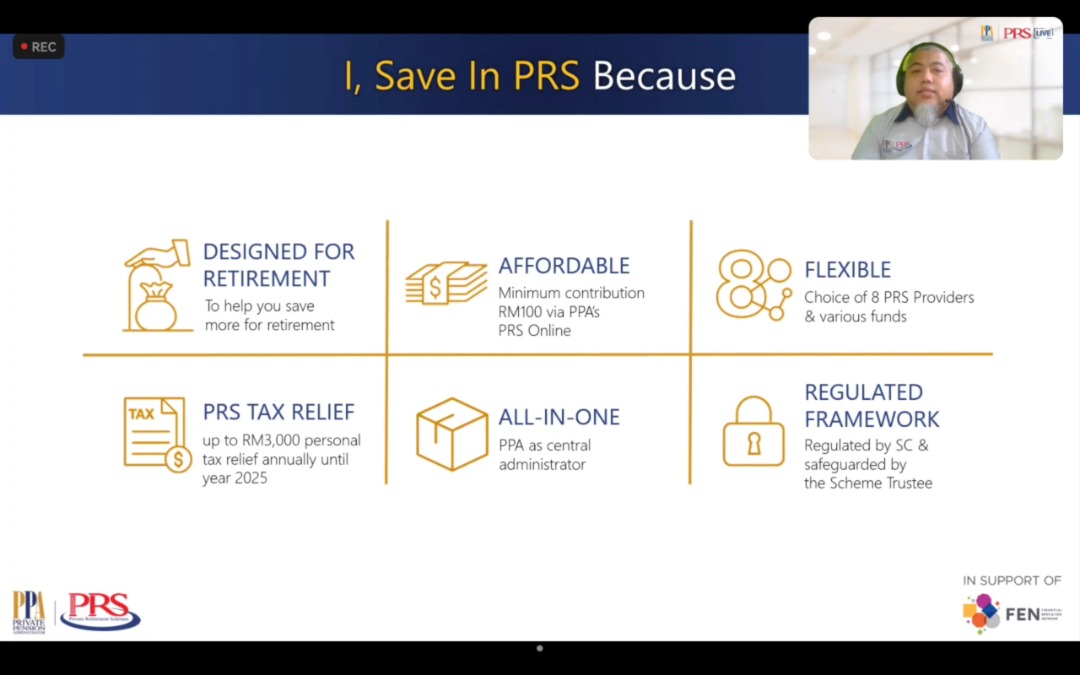

The value propositions of I, save in

PRS

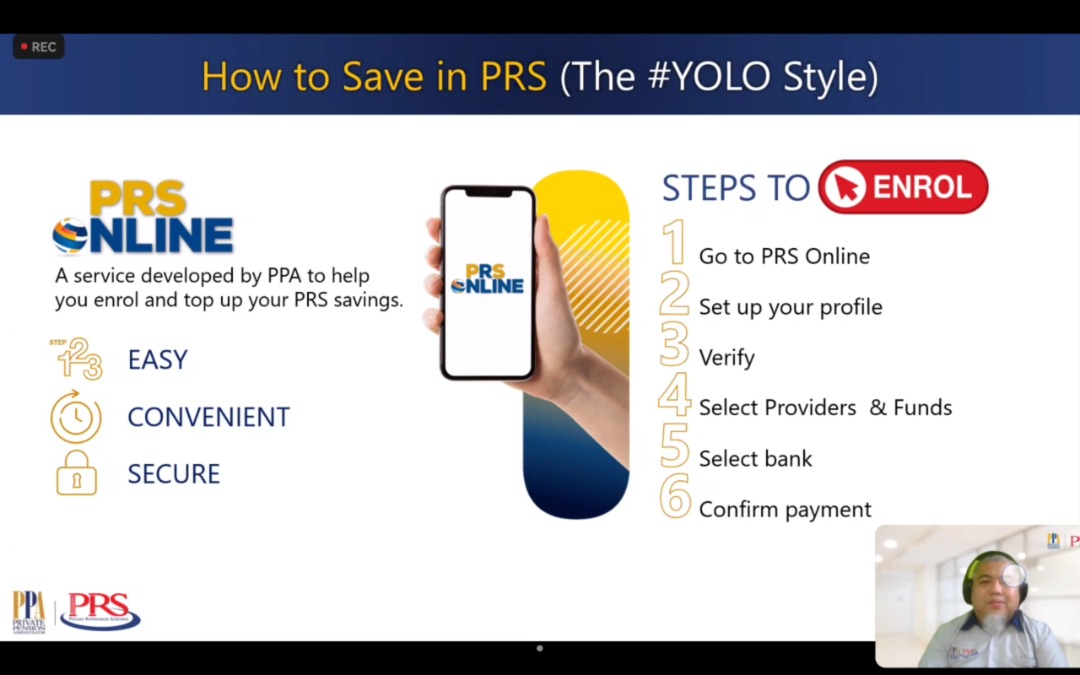

“To open a PRS

account, you can either directly go to the Providers; contact a PRS

Consultant or Distributor or deal via PRS Online Service. Most people would

think that they need a large amount of money to start saving. On the

contrary, savings for your future in PRS does not require a large amount of

money, you can start building your retirement savings now via PRS Online

from as small as RM100,” said Mohamed Farith”

How to save in PRS

#ISaveinPRS Treats Contest run by PPA

He concluded

his webinar by listing the benefits of PRS. He said, “I, Save in PRS now so

I can LWYM, to save for the future lifestyle that I want, and at the same

time spend my money today because of YOLO; to have sustainable living for at

least 15 to 20 years after I stop working because I know I need to have 2/3

of my last drawn salary to maintain my standard of living when I retire; and

to have choices of eight PRS Providers and various funds to match my unique

investment profile and risk appetites. I, Save in PRS now because I can

start as low as RM100 to enrol and top up my PRS savings via PRS Online

Service. I, Save in PRS now because PPA will provide lifetime account

management and reporting, plus online access to my PRS accounts and treat

myself with monthly and grand PRS treats in #ISaveinPRS Treats Contest. In a

nutshell, I save in PRS now to live the life that I want to live with.”

Check out PPA Malaysia Facebook Page

for more information

Wholly owned by UTAR Education Foundation (200201010564(578227-M)) LEGAL STATEMENT TERM OF USAGE PRIVACY NOTICE