The poster

Faculty of Accountancy and Management (FAM) Department of Finance and Centre for Entrepreneurial Sustainability (CENTS) organised a webinar titled Investment Outlook in RCEP Markets on 12 April 2022.

Alan Low sharing his insight on RCEP markets

Invited to speak was Portfolio Manager of UOB Asset Management (Malaysia) Berhad Alan Low. Alan Low has eight years of investment-related experience in the financial industry. Prior to being an equity fund manager with UOB Asset Management, he was a fixed-income analyst at the Foreign Asset Management with research coverage across the Asian market. UOB Asset Management (Malaysia) Berhad is one of UTAR’s MoU partners.

The webinar aimed to keep UTAR staff and students aware and updated on the latest development in the global economic and business environment. The speaker also shared the industry experts’ view and analysis on Regional Comprehensive Economic Partnership (RCEP) financial markets and identified some sustainable investment opportunities.

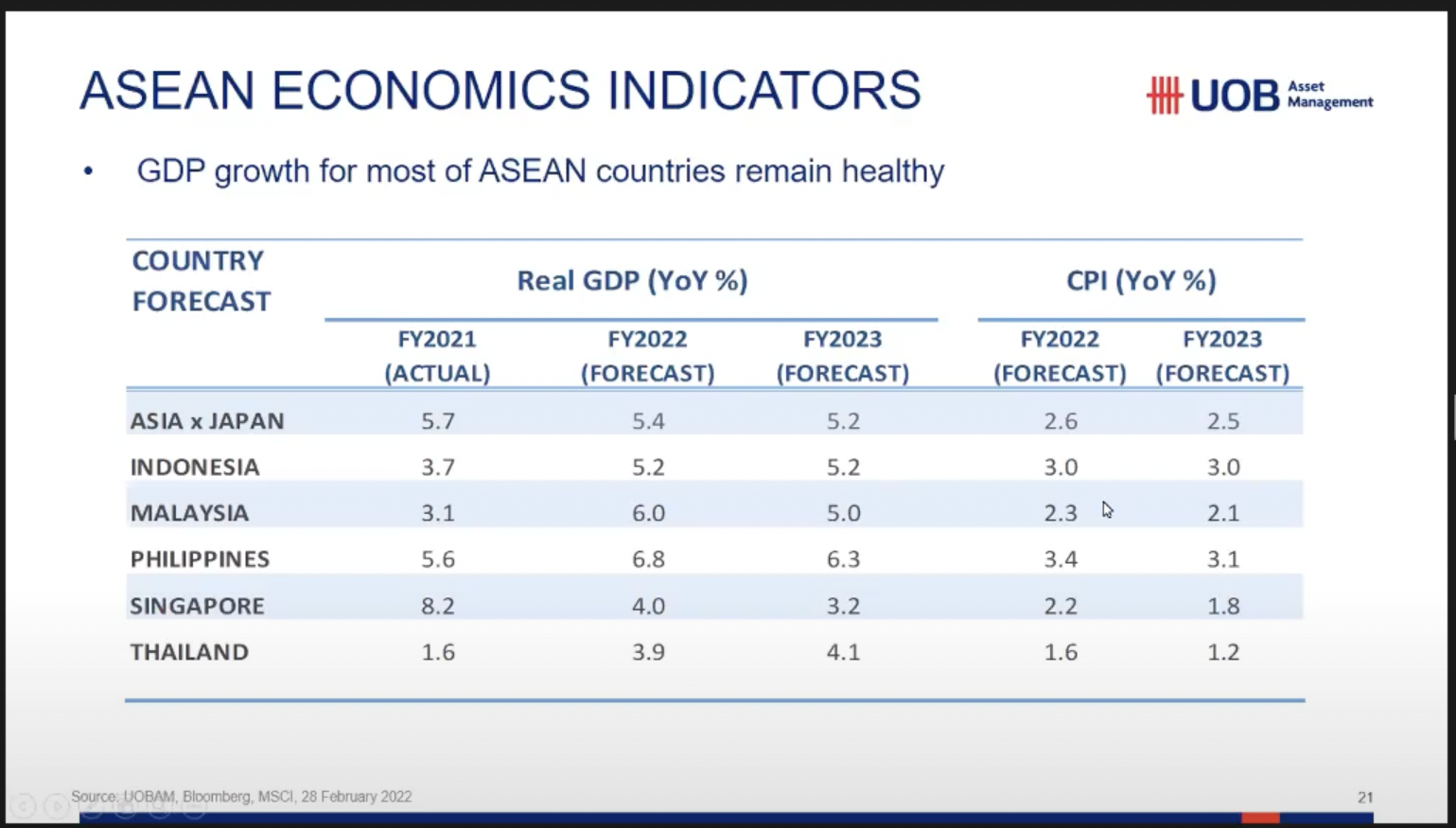

Among the topics covered at the webinar were the objectives of RCEP; tariff removal on 90% of goods; beneficiaries of RCEP; RCEP winners and losers; tariff concession; expected trade impact; exports and foreign direct investment (FDI) thriving; ASEAN economy reopening, commodity exporters stand out; stability boosts flow to ASEAN, ASEAN economic indicator and so on.

Alan Low kick-started the webinar by giving a quick overview of the RCEP market. He said, “RCEP is the world’s largest free trade agreement covering 10 ASEAN Economies and five ASEAN free trade agreement partners, namely China, Australia, New Zealand, Japan and South Korea.”

He also mentioned that RCEP created an integrated market among 15 economies, strengthening the regional supply chain in technology, manufacturing, agriculture and natural resources with the aim to power economic growth. “Most ASEAN tariffs are already low, hence there will be a limited incremental benefit. ASEAN will reduce tariff imports from China, Japan and Korea,” he said.

Alan Low showing the GDP growth of the ASEAN economies

Alan Low concluded, “RCEP is going to benefit ASEAN through the accelerated flow of finished goods and increased input and investments between ASEAN and APAC/Oceania trade partners. RCEP is going to create greater access to Asia’s biggest and strongest growth market. Malaysia and Vietnam stand to gain the most in terms of real income growth in ASEAN.”

The webinar came to an end with a Q&A session and a group photography session.

© 2022 UNIVERSITI TUNKU ABDUL RAHMAN DU012(A).

Wholly owned by UTAR Education Foundation (200201010564(578227-M)) LEGAL STATEMENT TERM OF USAGE PRIVACY NOTICE