Powering Fintech Relationship with Gen Z and the Millennials

In collaboration with the Department of Banking and Risk Management of Faculty of Business and Finance (FBF), the Centre for Accounting, Banking and Finance (CABF) organised a virtual talk titled “Powering Fintech Relationship with Gen Z and the Millennials” on 7 April 2022 via Microsoft Teams.

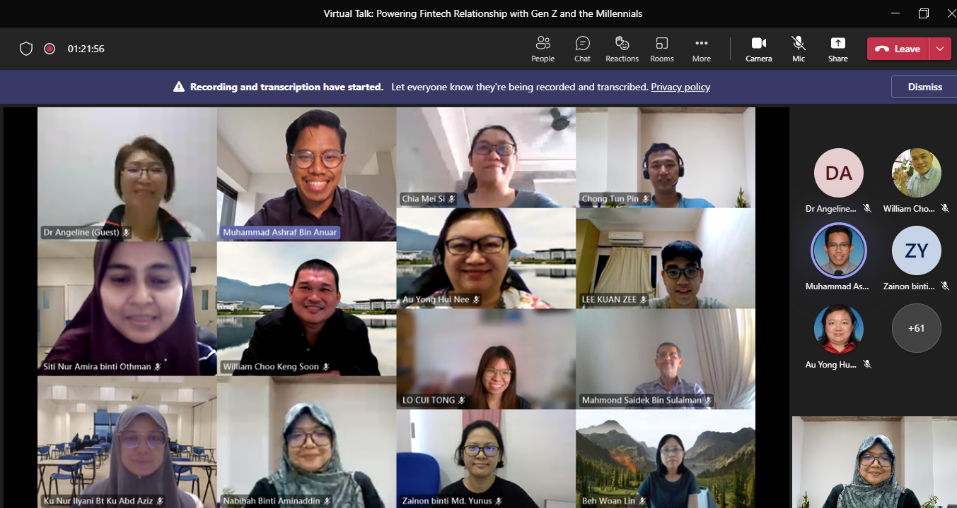

The talk was delivered by Dr Angeline Ng Siew Huan, head of Corporate Finance and Strategic HR at AI Holding Sdn Berhad. Present at the virtual talk were FBF Dean Assoc Prof Dr Au Yong Hui Nee, CABF Chairperson Dr William Choo Keng Soon, the FBF Department of Banking and Risk Management Head Chong Tun Pin, academic staff and students.

The webinar aimed to expose the importance of technology revolution in financial institutions; provide information on how to engage with millennials and Gen Z in the current contemporary financial market and explore the different factors affecting and influencing the financial and banking decisions of Gen Z and millennials.

Dr Ng (top) and her presentation topic

Dr Ng started the webinar by explaining the definition of fintech and its usages. She said, “Fintech or financial technology refers to the software, algorithms and applications to digitise financial services, while making use of mobile and computer tools. Since the pandemic, fintech has become increasingly relevant in many banks or financial institutions allocating more resources to developing fintech products and services. Currently, Malaysia ranks among the top 20 financial technology (fintech) hubs in Asia.”

Then, Dr Ng continued highlighting the importance of fintech in relation to Gen Z and millennials. “Being born in an era of mobile banking, the Gen Z is labelled as the “Touchscreen Generation”. The implication of the younger generation on fintech is that financial institutions are developing increasingly more products and services that can be accessed online. Services such as credit cards, savings account or insurance premium can be implemented online, compared to a few decades ago where such services had to be carried out physically with face-to-face contact and physical documents,” she added.

Dr Ng further explained that numerous banks were closing down their branches, not because of high operational costs, but because it has become more profitable for branches to consolidate due to digitisation. Nowadays customers are expecting convenient and hassle-free services, without the need to fill in excessive forms. Nevertheless, with high digital and mobile expectations, the result is better and smoother in-branch customer experiences. “Supported by responsive customer support, applying for housing loans or even investments has become seamless. In this way, the Millennials and the Gen Z are reshaping the landscape in the banking and insurance industry,” she enthused.

In addition, Dr Ng stated that banks were closing earlier and this had led to more customers resorting to online banking due to the pandemic. As such, the financial institutions had to upgrade their online and digital banking services, resulting in fintech products with customer-friendly solutions, marketed in a more modern way. This way, financial institutions are creating product that fits the needs of consumers, while also serving the underserved ones.

“The majority of fintechs are small businesses with only a few employees and a small sales team. They usually focus on only a few financial functions, such as insurance while other functions and services are outsourced to banks. Additionally, their expertise is limited to technology and thus, they may lack understanding of the banking regulations. Other downsides of fintech include threats from cyber-attacks, higher chances of failing, fierce competition between fintechs, and issues in raising funds. For the fintech to overcome these hurdles, it is necessary to integrate technology with other operational components such as human capital and marketing. Yet despite these drawbacks, the fintech industry has tremendous growth potential,” added Dr Ng.

Dr Ng concluded her talk with the topic Bitcoin and Blockchain, and their relation to fintech. She explained that bitcoin is the first decentralised cryptocurrency using the blockchain technology, and that the purpose of which is to facilitate payments and digital transactions. She mentioned that decentralised currencies are the money of the future, however there are conflicting attitudes towards cryptocurrencies. Thailand recently barred cryptocurrencies as a means of payments for goods and services with effect from April 2022, while China has begun trials of its central bank digital currency in several cities. Cryptocurrency is designed to be freely traded and provide anonymity. Because it connects people instantly without an intermediary, it is threatening to take away the central role banks play and thus, circumventing capital controls imposed by the government authority.

The enlightening talk was followed by a Q&A session and a closing speech by the Dean, Dr Au Yong. The session ended with a group photography.

(Top, most left) Dr Ng and the participants

© 2022 UNIVERSITI TUNKU ABDUL RAHMAN DU012(A).

Wholly owned by UTAR Education Foundation (200201010564(578227-M)) LEGAL STATEMENT TERM OF USAGE PRIVACY NOTICE