Foreign exchange reserves management in Malaysia

UTAR Faculty of Business and Finance (FBF) Department of Economics, Centre for Economic Studies, and Financial Economics Society jointly organised a talk titled Management of Exchange Reserves, Some Practical Perspectives on 5 July 2022 at UTAR Kampar Campus.

Front row (second from left) Thavamalar, Tan Sri Muhammad and Dr Au Yong with UTAR staff and students at the end of the talk

Delivered by the former Governor of Bank Negara Malaysia Tan Sri Muhammad bin Ibrahim, the two-hour talk aimed to enlighten UTAR staff and students on the management of foreign exchange reserves in Malaysia. Also present at the talk were UTAR FBF Dean Assoc Prof Dr Au Yong Hui Nee, Head of FBF Department of Economics G. Thavamalar, UTAR FBF academics, UTAR staff and students. The talk was attended by more than 150 UTAR staff and students.

In her opening remark, Dr Au Yong thanked the speaker Tan Sri Muhammad for contributing to UTAR and its students by sharing his valuable and vast experiences in the management of exchange reserves.

Tan Sri Muhammad sharing his vast knowledge on foreign exchange reserves management

Tan Sri kick-started the talk by introducing himself, “I had been with the central bank for 34 years. The central bank is responsible for wider and more diverse areas. Its core responsibilities are the monetary and financial stability of the country. The central bank is also responsible for the payment system, foreign exchange administration, the financial markets, the banking system, insurance, Islamic finance, issuance of currencies, as a financial and economic advisor to the government and of course, the management of the international reserves.”

In his talk, Tan Sri also quoted a speech that he delivered in 2017 and said, “The main purpose of international reserves is to serve as a buffer against external shocks. This reduces the likelihood of the balance of payment crisis thereby preserving monetary and financial stability, and orderly market conditions. The sheer magnitude of funds flowing through the financial markets has currently grown to a staggering level.”

He added, “This is further complicated by the rapid pace at which these transactions may occur because of technological advancements. In such a period, changes in the level of international reserves should respond accordingly. We should be mindful that international reserves, which serve as a buffer against potentially disruptive volatile financial flows, should increase and fall accordingly in the open market. A decline in reserves during periods of capital reversal is not a new phenomenon. In contrast during periods of capital inflows, it is natural for reserves to be accumulated. Reserves play a role in both circumstances to manage adjustments in the financial markets. This includes preserving the stability of the exchange rate, therefore maintaining an orderly market condition.”

Tan Sri also explained, “Malaysia’s foreign exchange reserves are at the level that is adequate for our stage of economic development, domestic market structure and external positions. Malaysia’s reserves are well within the adequacy range, placing us in a comfortable position relative to regional peers and fulfilling recognised global standards.”

He also said, “A strong international reserves can act as a shock absorber from any potential shocks to the system. Given that our financial and equity markets are very open, and occupied with a liberal foreign administration rule, the financial flows can be challenging, at times. Huge capital flows will cause volatility and uncertainty in the exchange rate, and if it is not properly managed, could cause a crisis of confidence. This will in turn impact the financial markets. A country’s sizable and adequate reserves could bolster confidence in the nation’s management of monetary and exchange rate policy.”

He concluded, “For an open economy, like Malaysia, where exports and imports totalled more than 130 per cent of gross domestic products, where financial markets participants are free to enter and exit, having a sizeable and adequate reserve also serves as an ‘insurance’ and a formidable defence against shocks in the financial markets. Studies had shown that countries with strong and deep reserves can prevent speculative flows and protect the economy from external shocks.”

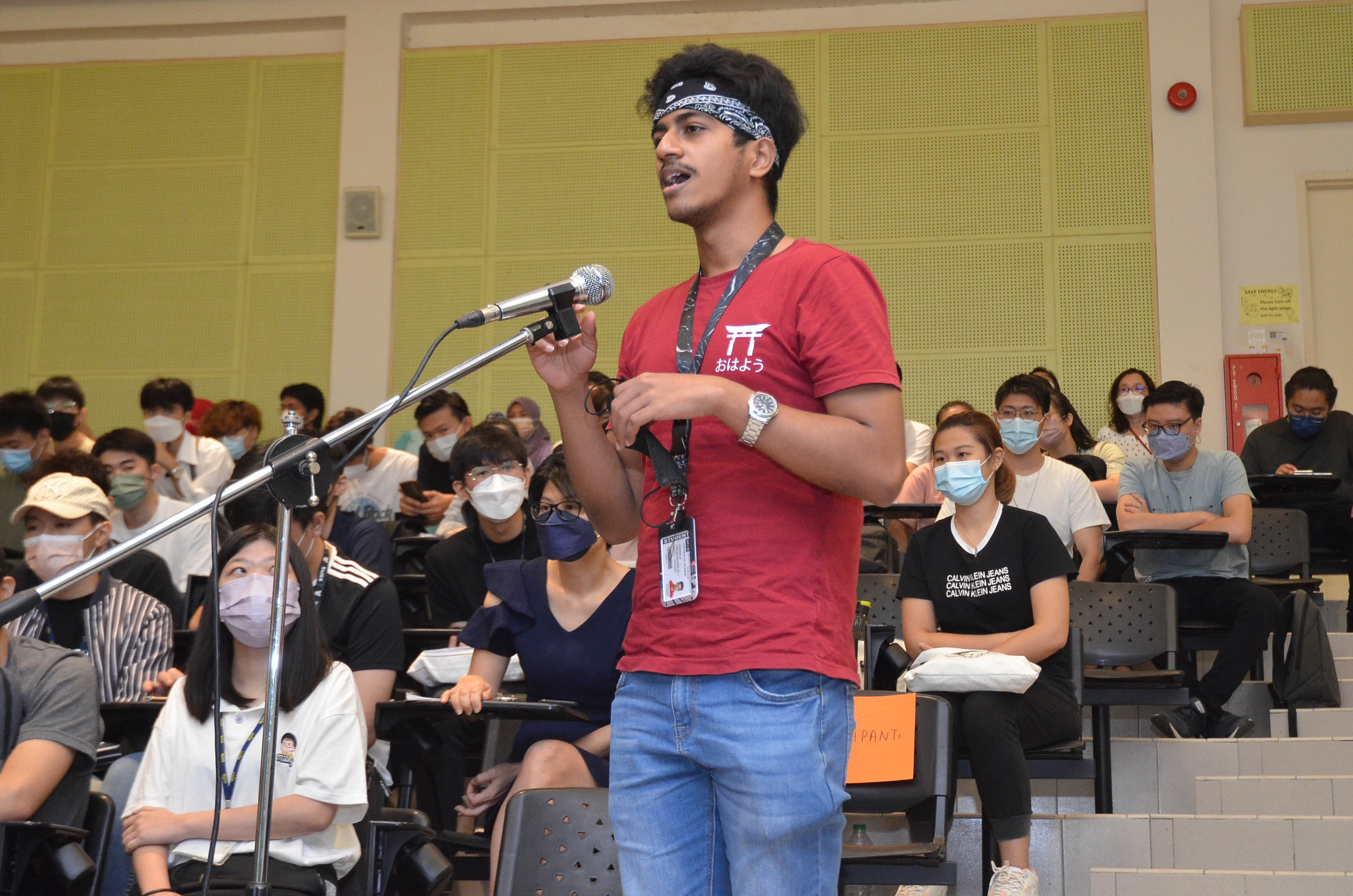

The talk ended with an interactive Q&A session.

Tan Sri Muhammad is the chairman of GDeX Berhad and an Adjunct Professor at the International Islamic University. He is an accountant by training and has wide experience in economic and financial matters. Tan Sri Muhammad’s areas of expertise include financial markets, foreign exchange, investment of international reserves, payment systems, banking and insurance matters.

Dr Au Yong (left) presenting a certificate of appreciation to Tan Sri Muhammad

UTAR staff and students during the Q&A session

© 2022 UNIVERSITI TUNKU ABDUL RAHMAN DU012(A).

Wholly owned by UTAR Education Foundation (200201010564(578227-M)) LEGAL STATEMENT TERM OF USAGE PRIVACY NOTICE