![]()

An online workshop titled “My

Money & Me 2022” was held on 3 December 2022 to focus on

sustainable finance for youths and improve their behaviour in managing their

finance. The workshop was jointly organised by the Malaysian Financial

Planning Council (MFPC) along with UTAR and Universiti Sains Islam Malaysia,

and supported by the Ministry of Finance of Malaysia, the Central Bank of

Malaysia, the Ministry of Youth and Sports of Malaysia and the Malaysian

Youth Council (Majlis Belia Malaysia).

In addition, the online workshop

was held in collaboration with financial planning providers and financial

services organisations, and along with the cooperation of relevant

regulatory authorities, such as Jaringan Pendidikan Kewangan (Financial Education Network - FEN),

Agensi Kaunseling dan Pengurusan

Kredit (AKPK), Suruhanjaya

Sekuriti Malaysia, InvestSmart®, Ombudsman for Financial Services (OFS),

Securities Industry Dispute Resolution Center (SIDREC), Federation of

Investment Managers Malaysia (FIMM),

Kumpulan Wang Simpanan Pekerja (KWSP), Persatuan Insurans Hayat Malaysia

(LIAM), Persatuan Takaful Malaysia (MTA) and Lembaga Hasil Dalam Negeri

Malaysia (LHDN).

Tan Sri Abdul

Wahid hoping the youths would pick up the importance and basic concepts and

skills of financial planning through the workshop

“My Money & Me 2022” commenced

with a remark from Chairman of Bursa Malaysia Berhad Tan Sri Dato’ Seri

Abdul Wahid Omar. He said, “The objective of this programme is to create

public awareness of the importance of financial planning as well as the

services provided by a financial planner or advisor. Besides, this programme

also establishes a forum for youths to get together and express their views,

knowledge and any other information pertaining to financial planning in

Malaysia.”

“I believe given the strong desire

among youths to fundamentally improve their respective socio-economic

levels, this programme is capable of providing more systematic guidance in

budgeting and better personal finance management, as it also has been

recognised by United Nations’ UNESCO. The positive financial behaviour of

youths can be improved by the application of financial knowledge by

following scientific programmes for some period of time,” he added.

Tan Sri Abdul Wahid concluded his

speech by saying, “I hope at the end of this programme, the youths will pick

up the importance and basic concepts and skills of financial planning. I

also hope they can analyse and understand their financial status, and

through such awareness make behavioural changes on money management.”

Themed ‘Build

Your Future: Be Smart About Money’, the online workshop was divided into

four main components of financial planning, namely Asset Accumulation, Asset

Protection, Asset Management and Asset Distribution. It also featured 10

renowned speakers, namely Encik Kamarul Rozmaz from

Suruhanjaya Sekuriti Malaysia,

Encik Shahrul Nizam Zainol from FIMM, Encik Muhammad Nizam bin Muhammad from

Bank Negara Malaysia, Puan

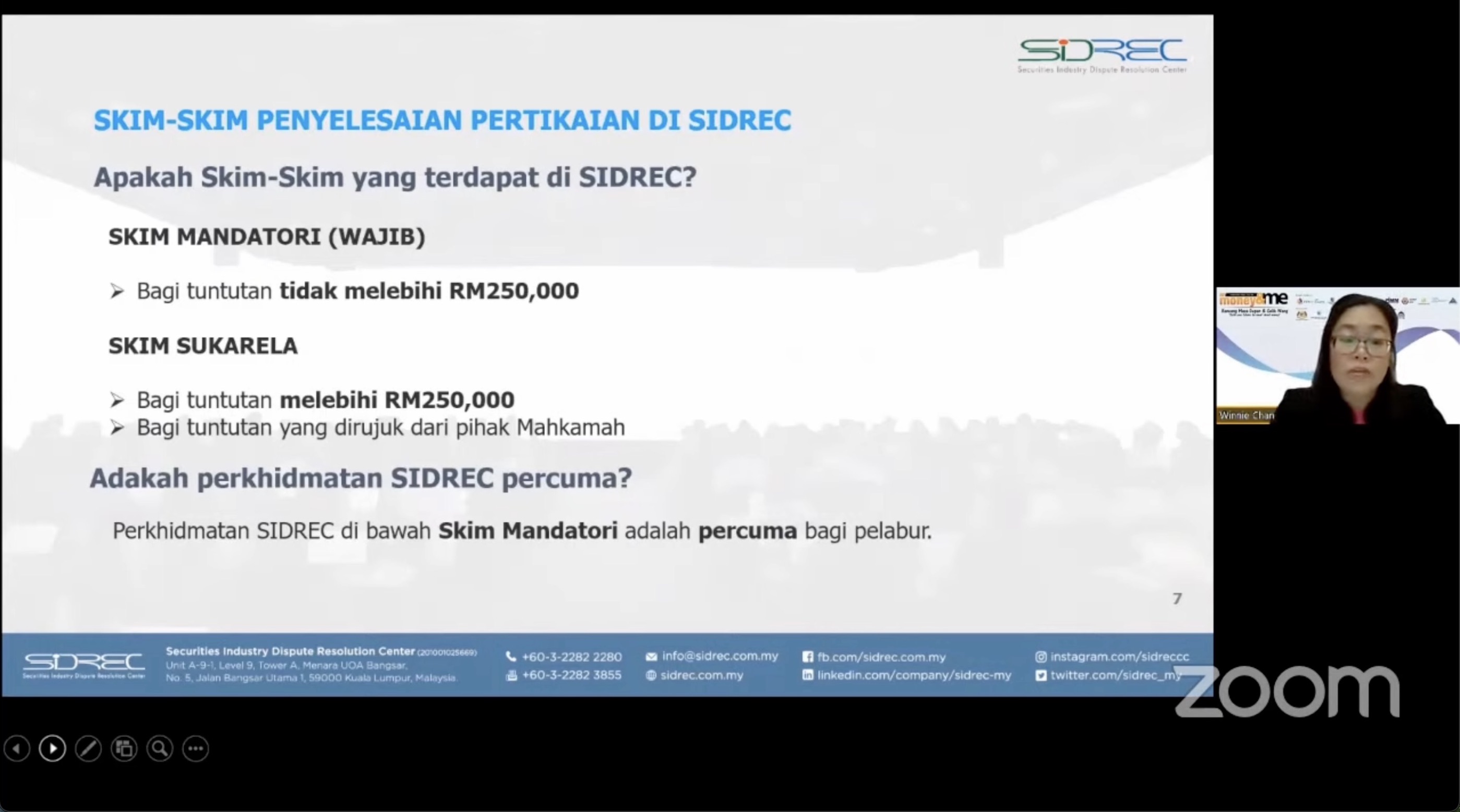

Kamsimah binti Mohamed and Puan Winnie Chan Shiau Fang from OFS and SIDREC,

Puan Rohanizam binti Talib from AKPK, Encik Mohd Yusnizam bin Yusof from

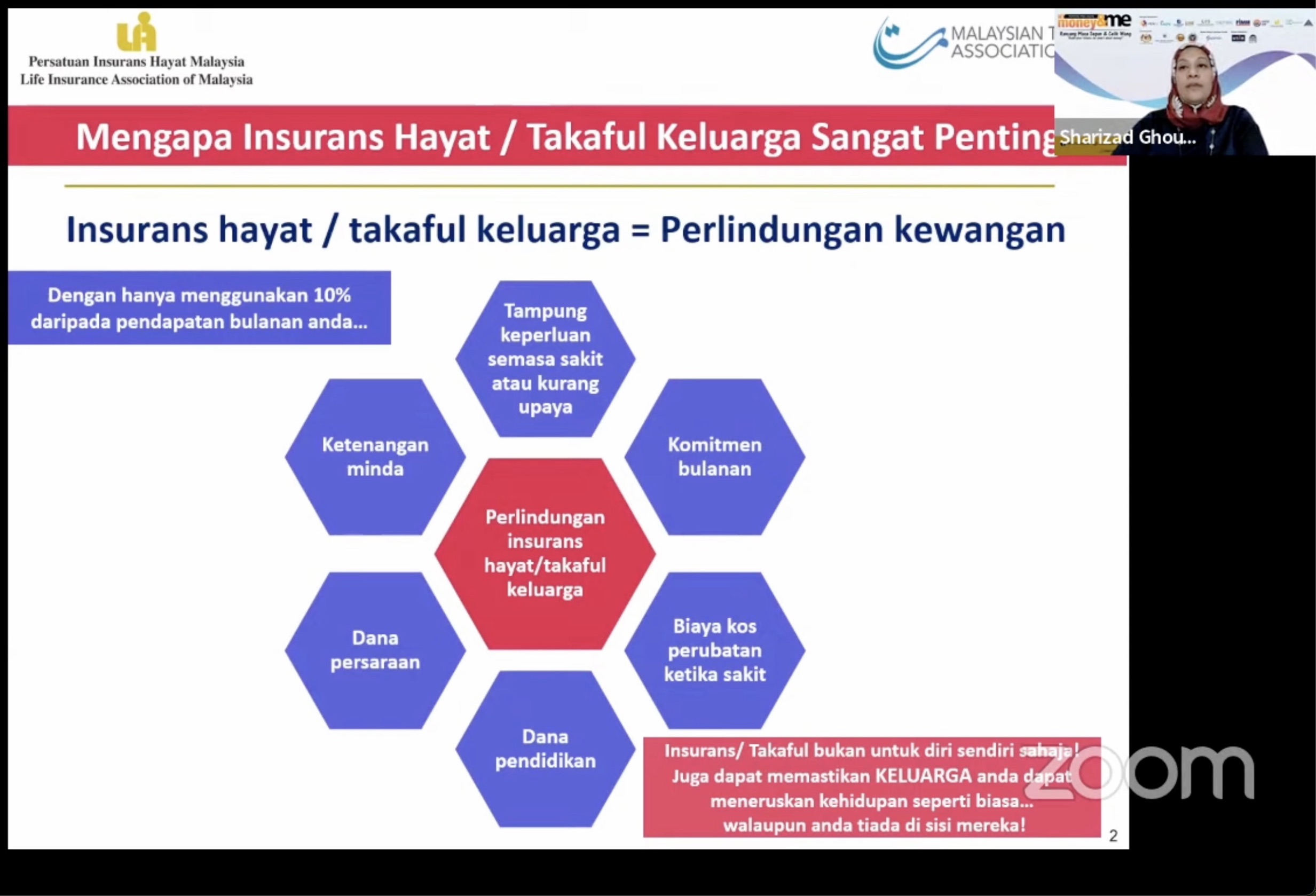

LHDN, Puan Mogana from KWSP, Cik Sharizad Ghouse from LIAM and MTA and Tuan

Hj Rafie bin Omar from MFPC.

Clockwise from right:

Encik Kamarul Rozmaz, Encik Shahrul Nizam Zainol,

Encik Muhammad Nizam bin Muhammad, Puan Kamsimah binti Mohamed and Puan

Winnie Chan Shiau Fang presenting their respective topic

During the “Asset Accumulation”

component, Encik Kamarul Rozmaz shared his topic titled

Silap Labur Duit Lebur while

Encik Shahrul Nizam Zainol

presented on Skim Amanah Saham dan Skim Persaraan Swasta untuk Pelaburan Masa Depan.

As for “Asset Protection” segment, Encik Muhammad Nizam bin

Muhammad emphasised on Elak Penipuan Wang while Puan Kamsimah binti Mohamed and Puan Winnie

Chan Shiau Fang spoke on Perlindungan

Pengguna Kewangan: Peranan OFS and SIDREC dalam menyelesaikan Pertikaian

Kewangan.

Clockwise from right:

Cik Sharizad Ghouse, Encik Mohd Yusnizam bin Yusof, Puan

Mogana, Puan Rohanizam binti and Talib Tuan Hj Rafie bin Omar during the

workshop

The workshop continued with the

presentation on “Asset Management”. It saw Puan Rohanizam binti Talib

presenting on Pengurusan Kewangan Berhemat, Encik Mohd Yusnizam bin Yusof sharing

on Manfaat Cukai untuk Kemakmuran

Bersama, Puan Mogana sharing on

Perancangan Persaraan and Cik Sharizad Ghouse presenting on

Kepentingan Perlindungan Insurans &Takaful dan Kepentingan Penamaan.

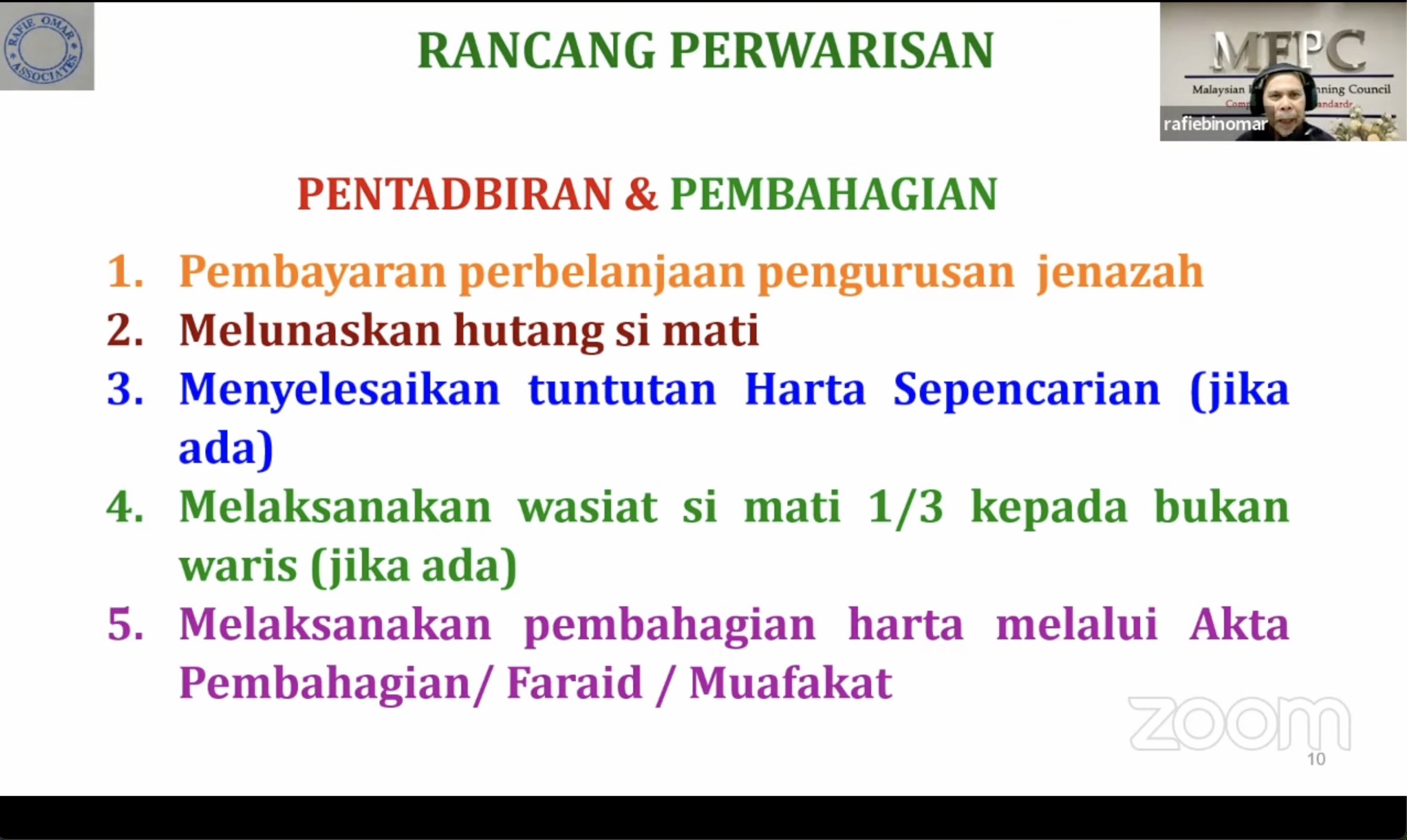

Lastly for the “Asset Distribution” segment, Tuan Hj Rafie bin Omar

discussed about Perancangan Perwarisan.

During the workshop, the youths

were presented with an opportunity to virtually meet with experts from the

Employees Provident Fund, while for those who are debt-ridden, the financial

counsellor from the Agency Credit Counselling and Management offers

counselling services in debt management. The MFPC is also organising various

programmes throughout the year, including a free financial consultation

session.

Wholly owned by UTAR Education Foundation (200201010564(578227-M)) LEGAL STATEMENT TERM OF USAGE PRIVACY NOTICE