Understanding Fintech and the impact of block chain in financial markets

UTAR Centre for Corporate and Community Development hosted Financial Technology (Fintech) and the Impact of Blockchain in Financial Markets on 20 January 2022. The purpose of the webinar was to enable participants to learn more about Fintech and how it works in today’s world. The invited speaker was Faculty of Information and Communication Technology (FICT) Specialist Su Lee Seng.

From left: FICT lecturer Dr Manoranjitham Muniandy and Su

Su began the webinar by explaining the term Fintech. According to him, Fintech is the combination of the terms “financial” and “technology”. It is a comparatively recent and frequently imprecise term that refers to any developing technology which helps customers or banking institutions offer financial services in newer and quicker ways. “Think about the difference between walking into a bank to request your balance and being able to pull up that information in real-time on your smartphone; you’ll have a good understanding of the Fintech’s influence,” Su added.

He went on to explain that everything from a consumer’s capacity to go online and check their financial activities to applications that allow one to PayPal to technologies that allow financial institutions to make speedy loan decisions are all part of the evolution of financial services. The capacity of investors to conduct their own research, choose companies, and monitor the success of their portfolio in real-time is another example of Fintech in action.

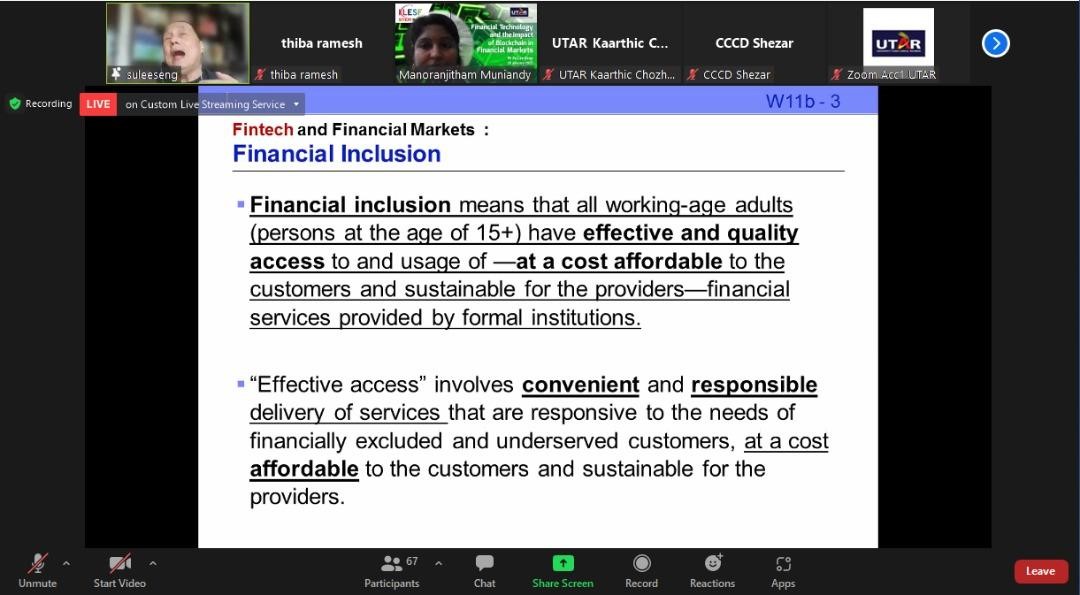

Su explaining financial inclusion

According to Su, financial inclusion means that individuals and businesses have access to useful and affordable financial products and services that meet their needs, such as transactions, payments, savings, credit, and insurance, and that these services are delivered in a responsible and sustainable manner.

“Fintech is popular right now because it provides new investment options for established financial organisations. Banks and insurance firms are increasingly investing in and purchasing Fintech startups as part of their investment portfolios, and some are even financing Fintech incubators to offer investment possibilities,” he said and added, “Fintech’s primary goal is to lower the total transaction costs. The widespread usage of digital payments has had just a minor impact on GDP and job growth. Fintech innovation in digital payments lowers prices and increases access to payment methods for new customers–individuals and merchants.”

The session concluded with a group photograph.

Top row, middle: Su with UTAR staff and students

© 2022 UNIVERSITI TUNKU ABDUL RAHMAN DU012(A).

Wholly owned by UTAR Education Foundation (200201010564(578227-M)) LEGAL STATEMENT TERM OF USAGE PRIVACY NOTICE