Webinar on risk management

The webinar’s poster

The Centre for Accounting, Banking and Finance (CABF) organised a virtual talk titled Risk Management Identification, Planning & Execution on 16 June 2022 via Microsoft Teams. The webinar attracted a total of 128 participants in attendance.

Present to deliver the talk was Great Eastern Life Group Manager and Founder of I-Gen XYZ Financial Group Colan Kong. To date, Kong has more than 20 years of experience in financial planning.

The virtual talk aimed to identify, evaluating and mitigate risk management process in a firm. At the end of the webinar, the participants will be able to learn how to develop a risk mitigation plan to reduce the risk impact in an organisation.

The virtual talk started with Kong introducing the concept of risk management. He said, “Risk management is the process of analysing and managing risk exposure. This process involves identifying and quantifying risk exposures; responding to risks; monitoring and reporting the results. Broadly, risk management involves avoiding, transferring, reducing or accepting risks.”

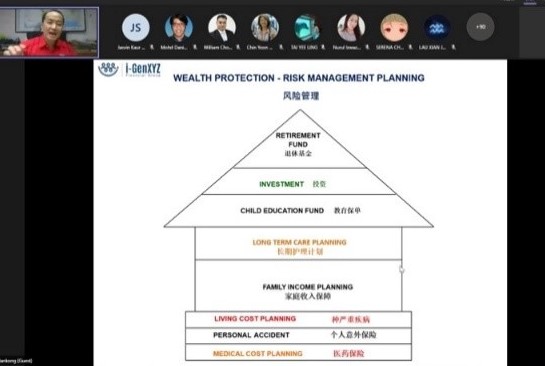

Highlighting personal financial planning and its relation to risk management, Kong said, “Personal financial planning covers wealth protection, wealth accumulation and wealth distribution.” He further explained, “Wealth protection strategies include reducing income tax, managing risks, handling cash flow and managing debt. Wealth accumulation is built through savings and investment, education funds and retirement plans, while wealth distribution is the distribution of an individual’s assets to selected people or entities. This is done through estate planning.”

Kong mentioned that the risk management for wealth management is provided in various plans such as medical cost planning, living cost planning, personal accident, retirement fund, child education fund and others. He explained that financial planning is essential for wealth protection to anticipate needs and prevent financial shock. However, it is not widespread in Malaysia. He also highlighted that only 54% of Malaysians are covered by insurance while in Singapore and Taiwan, the penetration rate is 250%.

In addition, Kong emphasised that medical cost planning has become increasingly essential due to the growing medical costs of hospital care, medical technology and physician fees. On average, the gross medical inflation for Malaysia was 15.3% in 2018, 16.1% in 2019 and 14% in 2021. The study by ASEAN Costs in Oncology (ACTION) by the George Institute for Global Health showed that expensive treatments have caused a financial crisis for many cancer patients. Due to this crisis, most of the patients were unable to afford payments after the first year of diagnosis while others discontinued their treatments due to lack of funds. Kong advised participants that medical cost planning can significantly reduce medical costs for cancer patients, and gave examples of cancer patients who only needed to pay a fraction of the medical costs while the balance is covered under their medical cost plans.

Next, Kong presented the suitability of long-term care planning for individuals who require long-term care for their daily activities such as dressing, bathing, eating, toileting, continence, transferring and walking. Kong also listed the facilities covered under such planning which included personal care, respite care, medical escort and post-surgery care. “Due to the growing ageing population, long-term care planning is becoming more pertinent. Individuals aged 60 and above made up 10% of the population in 2020 and are estimated to reach 15% of the total population by 2030,” he added.

Before ending his talk, Kong elaborated on the I-Gen XYZ Financial Group vision which was to become an established brand in the financial planning industry with the mission to deliver happiness and harmony by providing financial protection to families in Malaysia.

The insightful talk was followed by a Q&A and group photograph sessions.

Kong introducing his topic

Kong highlighting the wealth protection categories

Third row, second from right: Kong and participants

© 2022 UNIVERSITI TUNKU ABDUL RAHMAN DU012(A).

Wholly owned by UTAR Education Foundation (200201010564(578227-M)) LEGAL STATEMENT TERM OF USAGE PRIVACY NOTICE