Disruptive technologies and implication of Covid-19 towards accounting education and research

UTAR Centre for Accounting, Banking and Finance (CABF) under the Faculty of Business and Finance (FBF) organised an online talk titled “Disruptive Technologies, Covid-19 and the Changing Landscape of Accounting Education and Research” on 1 September 2022 via Microsoft Teams.

The talk was delivered by Senior Research Fellow at the Accounting Research Institute, Prof Dr Normah Omar. Prof Normah also serves as a board member for Companies Commission Malaysia (SSM) and UiTM Holdings Ltd. Her list of impressive research projects includes the Corporate Governance Rating with the Malaysian Institute of Corporate Governance (MICG), Corporate Integrity Assessment System with the Malaysian Institute of Integrity, Compliance and Effectiveness of Anti-Money Laundering Regime with the Association of Malaysian Banks and Compliance Officers Networking Group (CONG), and Assessment of Non-Profit Organisations for Money Laundering and Terrorism Financing, with the Registry of Society and Companies Commission, Malaysia. In 2020, Prof Normah was recognised as the Top Most Influential Women in Islamic Business and Finance by the Cambridge International Financial Advisory, UK.

The online talk aimed to help participants understand the concept of disruptive technologies and the implication of Covid-19 towards accounting education and research. It also aimed to expose participants to the changing landscapes of accounting education and research due the IR4.0 and examine the possible solutions and mitigations in embracing the technologies into accounting education and research.

Prof Normah began her talk by explaining the concept of disruptive technology which refers to technological innovations that improve a product or service in unexpected ways, displacing the market incumbents. She said, “Society 5.0 aims to achieve comfort, vitality and quality of life through the use of technology. Society 5.0 also envisions mothers working from home, collaborations across international borders, and unmanned vehicles on the roads. Likewise, with the rapid advances of digital technologies, Education 5.0 is driving educational institutions to re-evaluate online learning and institutional infrastructures.”

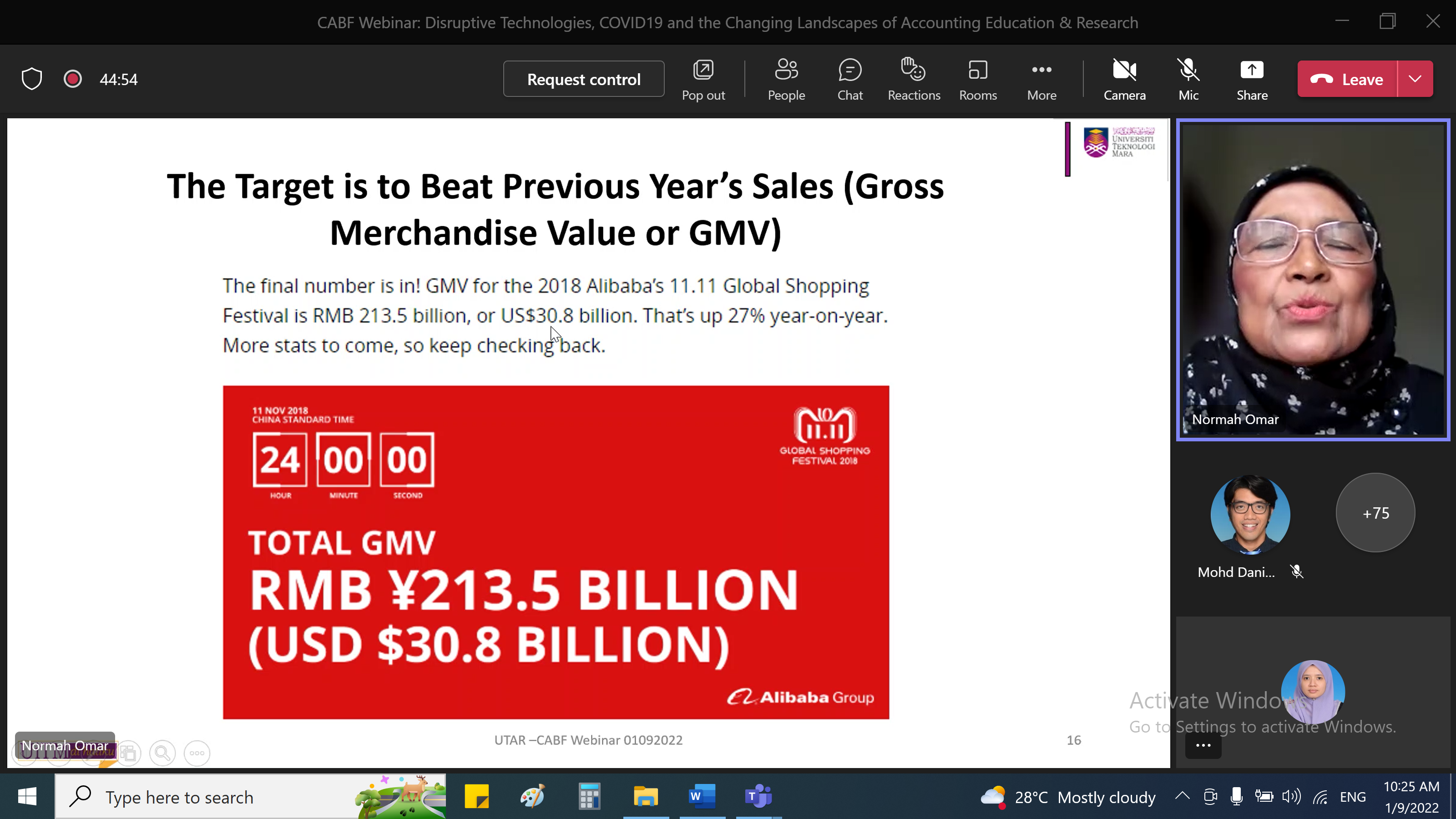

In addition, Prof Normah highlighted a report by McKinsey Global Institute (2013) that predicted the current phenomenon of how disruptive technologies could transform life, business and the global economy. Prof Normah explained that the report estimated the potential economic impact of technologies on applications such as mobile internet, 3-D printing, advanced robotics and the cloud. She then proceeded to provide an example of how cloud computing was employed in Alibaba’s 11.11 Global Shopping Festival. By utilising big data and cloud computing, she explained that Alibaba was able to track its Gross Merchandise Value (GMV) minute by minute and the GMV of the top 10 countries.

“Realising the potential impacts of disruptive technologies on accounting education, PWC published a report in 2015, highlighting the opportunities for universities to stay relevant. Some examples of such technologies include cloud computing, artificial intelligence, blockchain, smart contracts and advanced analytics.” She then emphasised the relevance of advanced analytics for one to become more marketable.

“Meanwhile, leading the way in digital technology for accounting education is the Rutgers State University of New Jersey. The university has set up an accounting web for research, a digital accounting library and data for data analytics. In 2016, the university launched a professional online accounting centre providing online courses with some classes having more than 5,000 students. Another initiative of digital technology was offered by the free university ‘42’. The school is based on the concept of open education where there are no teachers, books, curriculum, or grades. While it is free, it is highly competitive to get in,” she added.

Prof Normah added that Covid-19 affected the preparedness of teachers and students, as well as, students’ mobility and launched online learning and teaching on a wide scale. After the Covid-19 disruption, higher education witnessed a dramatic increase in blended learning which caused some changes from physical to online education.

Before ending her talk, Prof Dr Normah suggested that due to the disruptive trends in the accounting industry, the accounting education curriculum should include data entry automation, cloud computing, big data, and self-education. “Some teaching techniques for accounting courses may include using videos and PowerPoint presentations, case studies, games, running a real-life business, peer tutoring, and creating personal budgets. For accounting research, new perspectives include a focus on societal issues, interdisciplinary research, quantity and speed of publications, enhanced research ethics requirement, and virtual interactions,” she enthused.

The informative talk was followed by a lively Q&A session.

Prof Normah highlighting the pandemic as a catalyst of change for higher education

Prof Normah explaining the Gross Merchandise Value

© 2022 UNIVERSITI TUNKU ABDUL RAHMAN DU012(A).

Wholly owned by UTAR Education Foundation (200201010564(578227-M)) LEGAL STATEMENT TERM OF USAGE PRIVACY NOTICE