Webinar on money management for youth

The Centre for Accounting, Banking and Finance (CABF) of the Faculty of Business and Finance (FBF) organised a webinar titled Money Management for Youth on 25 August 2022 via Microsoft Teams. The webinar attracted a total of 120 participants in attendance. Present at the webinar were CABF Chairperson Dr William Choo Keng Soon, academic staff and students from various faculties.

The webinar aimed to bring awareness to youth on the importance of practising good cash planning and management so that they will have a strong sense of value in managing their finances. It also aimed to teach participants how to control their financial positions to achieve their financial goals.

Invited to deliver the webinar were two senior lecturers from UOW Malaysia KDU Penang University College, namely Dr Tan Kock Lim and Dr Tan Hong Hooi . Before joining the academic industry, Dr Tan Kock Lim was a banker with more than 10 years of experience in credit management. Currently, he is also an associate member of the Asian Institute of Chartered Bankers (AICB). Meanwhile, Dr Tan Hong Hooi is a CIMA member with 10 years of vast experience in the audit and accounting industry. She is also the programme leader for the School of Business, UOW Malaysia KDU.

The first session of the webinar began with Dr Tan Kock Lim outlining the essential skills required to achieve effective money management. He said, “The money management applications range from cash budgeting and planning to liquidity managing, large purchases financing, assets/incomes investing and protection. Besides, the excess cash is the direct outcome of good debt management. You must know how to plan the budget and finance for large purchases according to one’s lifestyle with the excess cash, and not fully from financing. Nowadays, youths have wide access to various sources of credit for financing large purchases, hence, it is essential to weigh between the costs and benefits of each source to avoid falling into a debt trap.”

Dr Tan Kock Lim also shared some tips and guides for young working adults. He explained how to manage their finances, how to establish emergency funds and how to be organised with good filing and safekeeping practices. He also spoke about study loan repayment patterns, one’s attitude towards credit card usage and payments, and one’s attitude towards saving and protection for the future. “Youth should be aware of the Debt Service Ratio (DSR), a method commonly employed to assess one’s credibility when applying for financing and how to keep the DSR at a healthy level, which includes monitoring one’s CCRIS and CTOS records,” he added.

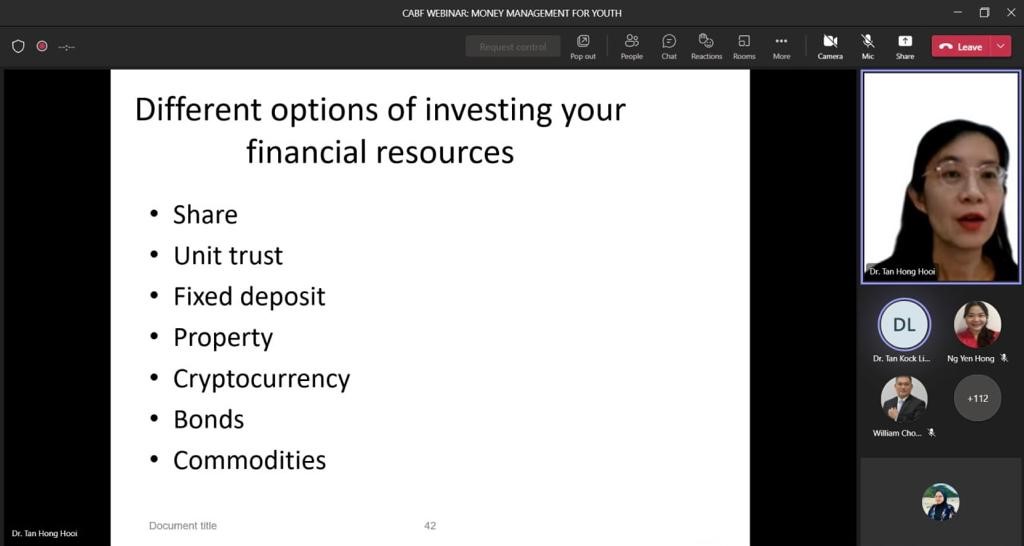

The second session of the webinar continued with Dr Tan Hong Hooi. She spoke about wealth building and risk management, and the forms of financial resources available to invest in the marketplace. In addition, Dr Tan Hong Hooi also shared her insights on the performances of various instruments and how their values were affected or driven by world events, government actions and investors’ sentiments. Dr Tan Hong Hooi also shared instruments that are worth investing in the current investment environment.

“The key to investing wisely is to assess the rate of returns from investments (ROI) that should commensurate with the level of risks inherited in the investment instruments. To the least, the ROI should at least be able to cover any rise in inflation”, she enthused.

The insightful webinar ended with a Q&A and group photograph session.

Dr Tan Hoong Hoi introducing the options for investing financial resources

Dr Tan Kock Lim (Top row, most left) and Dr Tan Hoong Hooi (second row, most left)

with participants at the end of the webinar

© 2022 UNIVERSITI TUNKU ABDUL RAHMAN DU012(A).

Wholly owned by UTAR Education Foundation (200201010564(578227-M)) LEGAL STATEMENT TERM OF USAGE PRIVACY NOTICE