Talk on Malaysia Budget 2024 and its implications

The Centre for Accounting, Banking and Finance (CABF), parked under the Faculty of Business and Finance (FBF), organised a talk titled “Malaysia Budget 2024: Implications for Consumers, Benefits for Targeted Individuals” on 28 November 2023 via Microsoft Teams.

Invited to deliver the talk was FBF academic Dr Tan Swee Kiow. Dr Tan has vast experience in teaching since 2008, and her topics mainly focused on economic reforms, empowering the Rakyat and maintaining an expansionary budget.

The virtual talk aimed to synthesise the government’s taxation policies, specifically those that impose a financial burden on the Rakyat, and analyse the implementation of targeted subsidies, incentives, and cash assistance aimed at alleviating the cost of living for selected individuals.

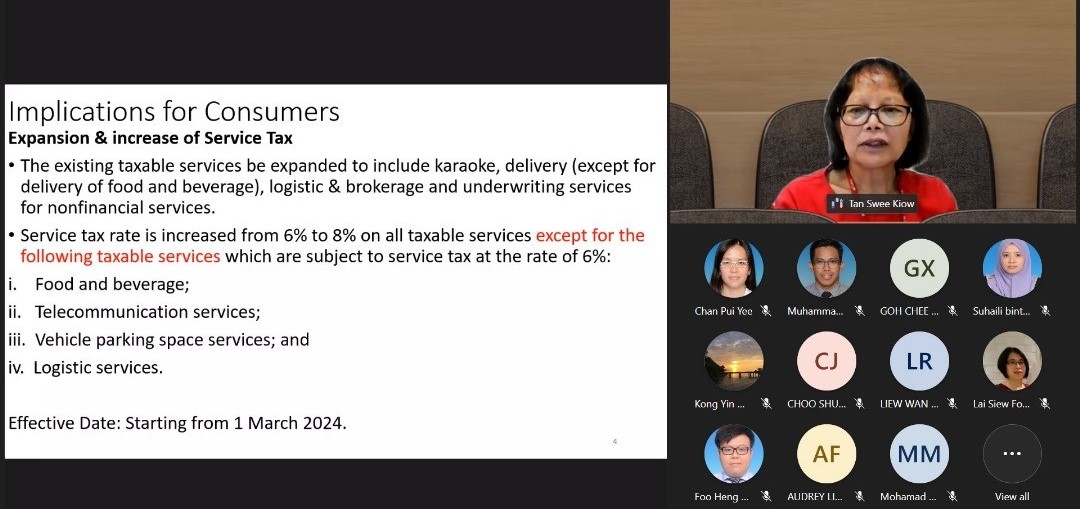

Dr Tan explaining the implications of service tax expansion

Dr Tan said, “The e-Invoicing aims to bolster tax compliance by implementing electronic transmission processes. The utilisation of Tax Identification Numbers (TIN) will be broadened to support this initiative, encompassing various transaction types, including Business to Business, Business to Consumer, and Business to Government.” Dr Tan mentioned that consolidated e-invoices would be restricted for specific activities to mitigate tax leakages.

Furthermore, she enlightened the participants about the expansion and elevation of the Service Tax, effective from 1 March 2024. “The scope of existing taxable services will now include karaoke, delivery (excluding food and beverages), logistics and brokerage, and underwriting services for non-financial sectors. While the service tax rate is slated to increase from 6% to 8% for most taxable services, specific categories such as food and beverages, telecommunication services, vehicle parking space services, and logistic services will maintain a 6% tax rate,” she added.

Delving into the consumer market, Dr Tan addressed the temporary lifting of price controls on chicken. Additionally, a tax on luxury goods, ranging between 5% to 10% on high-value items like jewellery and watches, is scheduled for implementation from 1 May 2024 onwards. Dr Tan also highlighted the imposition of excise duty on chewable tobacco products and an increased rate on ready-to-drink sugar-sweetened beverages, both effective from 1 January 2024.

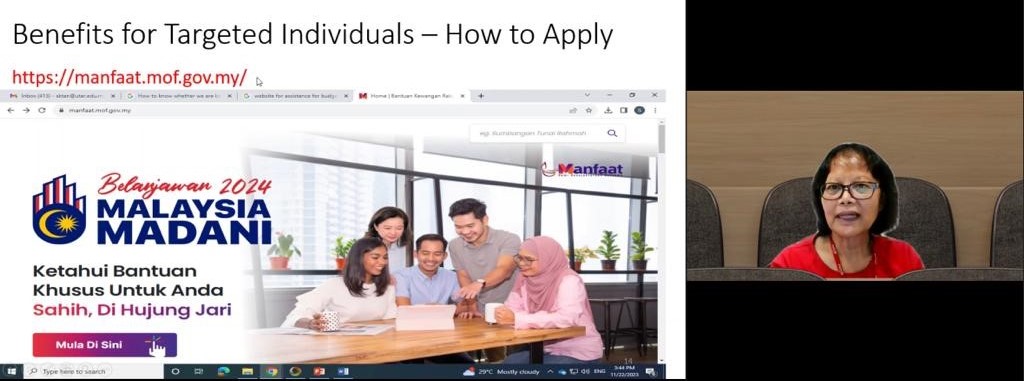

Dr Tan highlighting the benefits of Malaysia Budget 2024 for targeted individuals

She explained various budgetary initiatives for targeted individuals, including targeted subsidies for electricity bills, the rationalisation of diesel subsidies, and the introduction of an Electric Vehicle (EV) motorcycle scheme with rebates for qualifying individuals. Meanwhile, the FLYsiswa programme, offering an RM300 flight subsidy for eligible students, was presented with detailed application procedures and redemption guidelines. “The Rakyat can anticipate financial benefits through e-wallet credit, increase in the government’s matching incentive for the i-Saraan programme, and the extension of the i-Suri programme for housewives. The introduction of the cash assistance programme, Sumbangan Tunai Rahmah, with new applications starting in November 2023, further adds to the benefits,” she added.

Dr Tan’s presentation concluded with the topic on tax reliefs, encompassing relief on medical treatment and care for parents, childcare allowances, and relief for lifestyle, sports activities, and study fees.

The insightful talk ended with Q&A and group photograph sessions.

Dr Tan (second row, middle) with participants

© 2023 UNIVERSITI TUNKU ABDUL RAHMAN DU012(A).

Wholly owned by UTAR Education Foundation (200201010564(578227-M)) LEGAL STATEMENT TERM OF USAGE PRIVACY NOTICE