Talk raises awareness of commercial crime and financial fraud

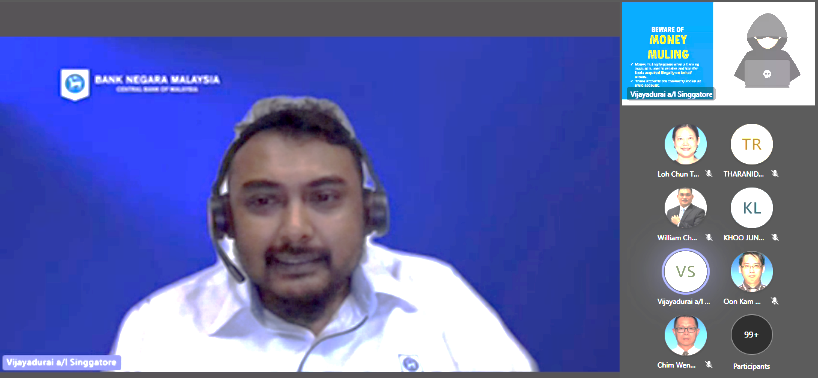

Vijayadurai introducing his presentation topic

A talk titled “Commercial Crime and Financial Fraud Awareness” was organised by the Centre for Accounting, Banking and Finance (CABF) of UTAR Faculty of Business and Finance (FBF) on 29 March 2023 via Microsoft Teams and Zoom. The two-hour talk attracted a total of 308 participants in attendance, including academic staff and students from various faculties.

The talk aimed to provide information on the latest scam threats and new modus operandi, tips to identify and avoid financial scams, and information on the relevant act and punishments for financial fraud.

Invited to deliver the talk was Manager of Link & Bank Negara Malaysia (BNM) Vijayadurai Singgaptore. Vijayadurai holds a Bachelor of Law degree from the University of Malaya. He is also a HRDF certified trainer, certified mediator, certified contact centre manager and coach. Furthermore, he has served in BNM for nearly 15 years and has exposure to a diversity of job scopes, from handling complaints and appeals to conducting awareness briefings and involving in national agenda initiatives.

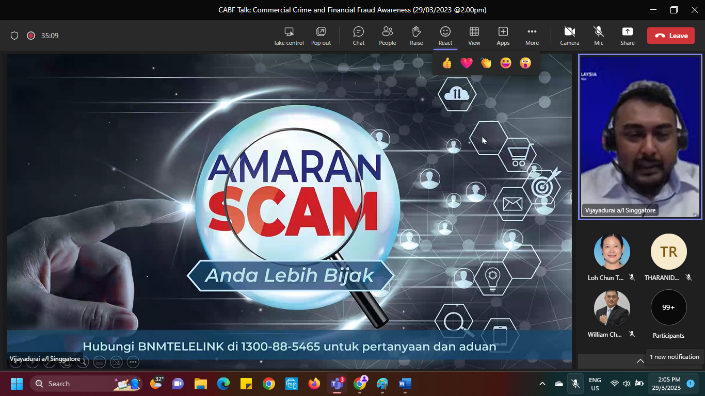

Vijayadurai started his talk by outlining who has the potential to fall victim to scams, emphasising that no one including students is excluded from the possibility of falling prey to a particular scam type. He said, “Normally, the victims easily fall prey to scams due to fear, greed, and ignorance. There are currently numerous scams active in the marketplace; the first one is phone scams. Phone scams have been on the rise all over the world. The syndicates tap on the advancement of ICT to reach potential victims via spoofing or masking techniques with the motive of inflicting fear. Next is money muling scheme. For this, the victims are usually misled to mobilise their funds for syndicates, targeting their bank accounts by transferring funds to unknown third parties or engaging in money laundering. Other financial fraud schemes are Online Job Scam, Android Package Kit Scheme, etc.”

The speaker also mentioned that the victims who fall prey to scammers are sometimes blamed for commercial crimes. This is because the implications of being a money mule are formidable to the extent of committing criminal offences; this causes legal actions to be taken against the victims. Among the actions taken include imprisonment, huge fines, account and asset freezing, and being blacklisted by banks or government agencies. He continued to share practical tips on how to identify the “red flags” of scams and push the “kill switch” when facing one. He also shared BNM’s 3s formula— Soal, Sekat, and Sebar to prevent financial fraud.

Before ending the talk, Vijayadurai advised participants to be cautious when they encounter situations like this in the future. He hopes that this talk can increase awareness of scam activities and prevent people from becoming scam victims; most significantly, he hopes this session will provide participants with valuable guidance on who and how to reach for assistance to recover the financial losses if they fall prey to scams.

The insightful talk ended with a Q&A session.

Vijayadurai highlighting the types of scams

Vijayadurai accentuating the steps and preventive measures

Third row, second from left: Vijayadurai with participants

© 2023 UNIVERSITI TUNKU ABDUL RAHMAN DU012(A).

Wholly owned by UTAR Education Foundation (200201010564(578227-M)) LEGAL STATEMENT TERM OF USAGE PRIVACY NOTICE