Webinar on Environmental, Social Governance in the Finance Sector

The webinar’s poster

The Centre for Accounting, Banking and Finance (CABF) under the Faculty of Business and Finance organised a talk titled “Environmental, Social and Governance (ESG) in the Finance Sector” on 5 April 2023 via Microsoft Teams.

The talk was presented by Faculty of Engineering and Green Technology Deputy Dean Assoc Prof Ir Ts Dr Leong Kah Hon. The talk aimed to equip participants with practical knowledge about the ESG concept and its potential implementation in the industry, and prepare participants with the ability to describe and adopt the ESG concepts within their industry to contribute towards global sustainable development.

Dr Leong began his talk by defining ESG as Environmental, Social, and Governance factors that measure the sustainability and ethical impact of an investment in a company. He then introduced the audience to the 17 Sustainable Development Goals (SDGs) and explained how ESG is linked to achieving these goals, the evolution of ESG and how it became a critical factor in investment decision-making. He also further explained the concept of ESG and how it considers the impact of investment decisions on the environment, society, and governance.

The talk then delved into Green Finance, which is a new area of finance, emerging to support ESG investments. While discussing how Green Finance works and its role in promoting sustainable investments, Dr Leong said, “Green finance refers to loans or investments that support environmentally positive activities such as purchasing eco-friendly products or building green infrastructure. However, there are also challenges associated with green finance, such as the need for a standardised definition of “green” and a taxonomy of green activities to avoid “greenwashing”. In Malaysia, there are various green financing incentives available, including the MyHIJAU Mark, Green Income Tax Exemption, Green Investment Tax Allowance, and the Bursa Malaysia Voluntary Carbon Market. The government has also announced initiatives and incentives for reducing carbon emissions in the Budget 2022.”

“There are five ESG qualities that are crucial for companies to have, which are transparency, accountability, engagement, performance, and risk management. These qualities are essential in evaluating a company’s ESG performance,” he added.

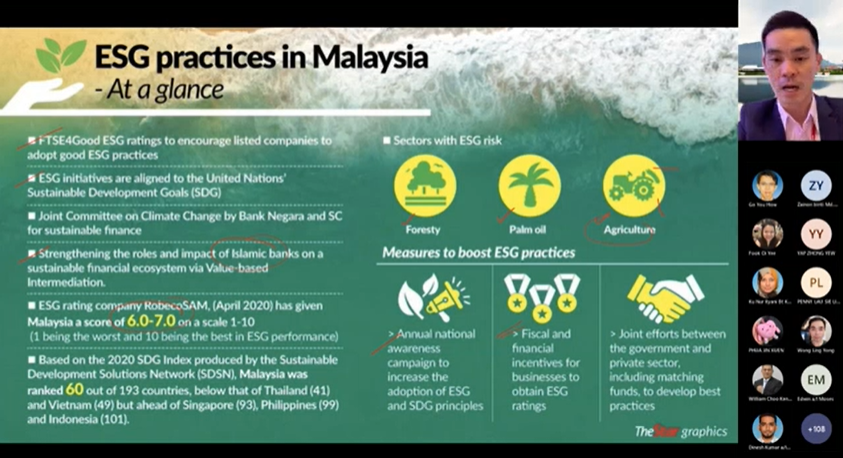

The talk concluded with a discussion of the current ESG facts. In addition, Dr Leong also shared statistics and trends that indicate the growth and importance of ESG investment, and stated ESG is no longer a niche area but a mainstream investment strategy. “In Malaysia, ESG practices are gaining momentum. The listed companies are encouraged to adopt ESG practices through FTSE4Good ESG ratings, while ESG initiatives are aligned with the United Nations’ Sustainable Development Goals,” he elucidated.

Overall, Dr Leong’s talk provided an insightful and informative overview of ESG investment. It highlighted the critical role ESG plays in sustainable investing and investment decision-making.

The talk was followed by a Q&A and group photo sessions.

Dr Leong is a certified HRDF trainer, an ASEAN chartered professional engineer and a professional technologist. He has previously won the AAET Green Award 2021 and has vast experience in conducting corporate training.

Ts Dr Leong defining about the ESG

Dr Leong summarising ESG practices in Malaysia

Top row, second from left: Dr Leong with participants

© 2023 UNIVERSITI TUNKU ABDUL RAHMAN DU012(A).

Wholly owned by UTAR Education Foundation (200201010564(578227-M)) LEGAL STATEMENT TERM OF USAGE PRIVACY NOTICE