Promoting tax compliance and creativity through AES Tax Compliance Poster Contest

UTAR Faculty of Business and Finance’s Department of Commerce and Accountancy, in collaboration with the Chartered Certified Accountants (ACCA) in Malaysia, successfully organised the AES Tax Compliance Poster Contest at UTAR Kampar Campus on 11 September 2023.

Aimed at fostering creativity and critical thinking skills among students by creating posters that encourage tax compliance, the AES Tax Compliance Poster Contest also served as a platform to support the Inland Revenue Board’s (IRB) mission to promote the AES approach.

Department of Commerce and Accountancy Head Sonia Johanthan opened the event with her welcome speech, highlighting the event’s significance in raising tax compliance awareness and thanking distinguished guests, Yong Chee Keong and ACCA Malaysia representative Peter Gabriel respectively for their presence and valuable contributions. Sonia explained, “Tax compliance plays a crucial role in revenue collection. However, according to the Inland Revenue Board (IRB) report in 2022, there was an estimated tax loss of RM665million due to taxpayers who did not declare their income. To address this critical issue, IRB has launched the AES (Awareness, Education, and Services) initiative to enhance tax literacy and awareness within society. It was against this backdrop that the AES Tax Compliance Poster Contest was organised.”

Sonia delivering her welcome speech

There was a total of 129 students who participated in the contest and 27 posters were submitted. The competition saw ten finalist groups presenting their AES-themed tax posters, followed by rigorous Q&A sessions with a panel of four judges well-versed in taxation matters. The judges were comprised of Yong and FBF lecturers, Dr Zam Zuriyati binti Mohamad, Wong Tai Seng and Choy Johnn Yee.

From left: Sonia, Choy, Wong, Dr Zam Zuriyati, Yong, and Dr Annie Ng (Chairperson)

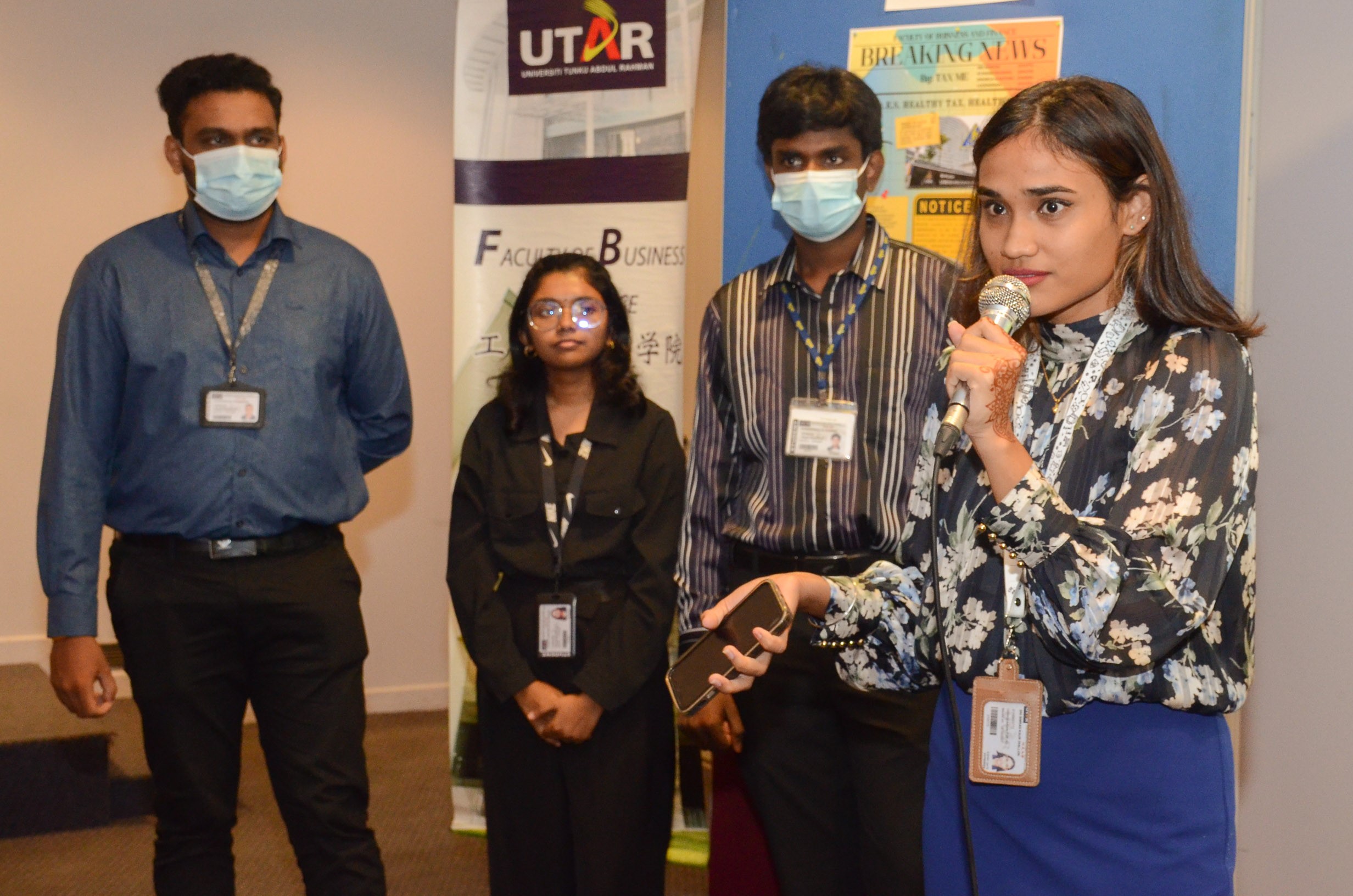

Presentation from students

After the presentations and Q&A sessions, Yong shared his fascinating experience on the topic of “Life as a Tax Practitioner”, while Gabriel gave valuable insights into the benefits of pursuing ACCA qualifications and the ACCA Accelerate Programme, under the topic “Getting ahead with ACCA”. Both sharing sessions were positively received by the audience, as evidenced by their enthusiastic response and attentiveness.

Yong (left) sharing his experience as “Life as a Tax Practitioner” and Gabriel (right) sharing the important notes on “Getting ahead with ACCA”

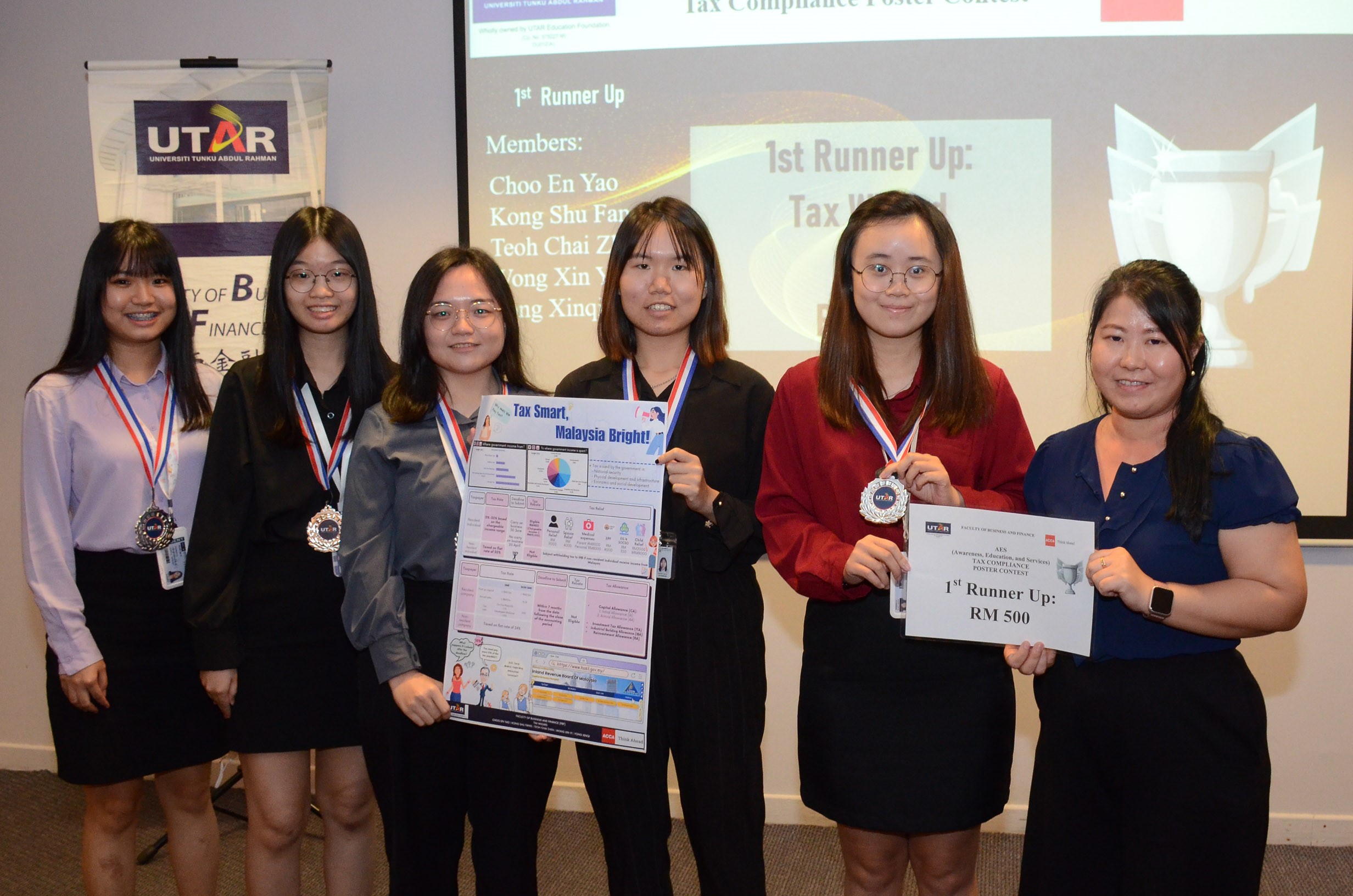

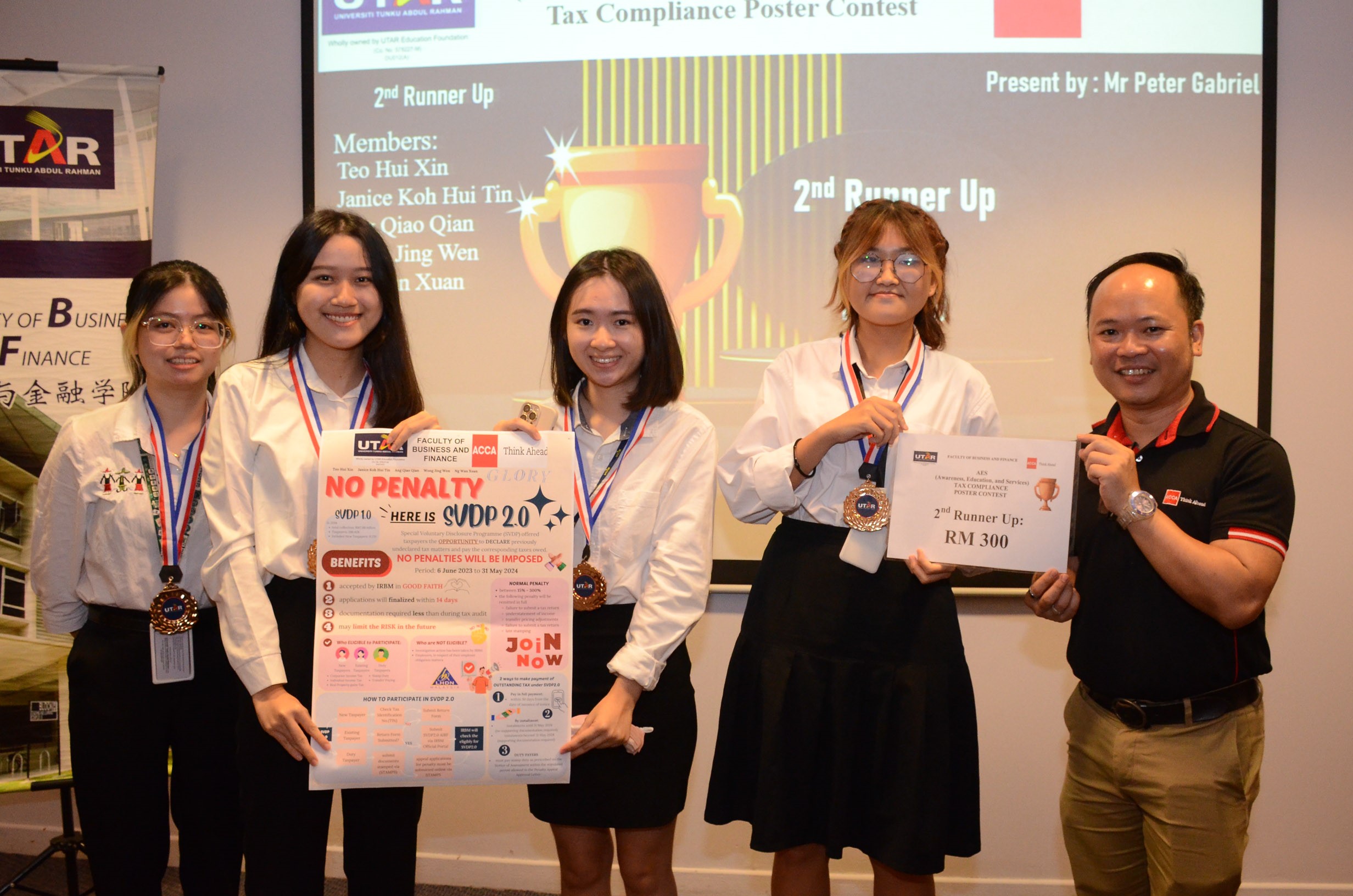

A prize-giving ceremony followed, where the top prizes were awarded to the most outstanding teams for their presentations. The teams “Infinity”, “Tax Wizard”, and “Glory” claimed the Champion, first runner-up and second runner-up prizes respectively, for their winning designs on tax-related issues. The team “Elite Team” was honoured with the Best Presentation prize for their exceptional delivery, while other finalist teams received consolation prizes in recognition of their commendable efforts to promote tax awareness and education. The awards were presented by Sonia, Yong, Gabriel, and Dr Annie Ng.

From left: Infinity (champion) and Tax Wizard (first runner-up) with Dr Annie Ng

From left: Glory (second runner-up) with Peter Gabriel and Elite Team (best presentation) with Yong

Dr Annie Ng concluded the event with a closing speech, where she expressed her sincere appreciation and gratitude to the distinguished guests. She also praised the students for their efforts and dedication, and the committee members who worked diligently to plan, organise, and execute the event smoothly.

Group photo at the end of the event

A group photo was taken at the end of the event where students also eagerly took the opportunity to take pictures among themselves with their certificates and posters, as memorabilia of the event.

To conclude, the event provided a platform for interaction and collaboration among participants while reinforcing the vital message of tax compliance. With light refreshments and networking opportunities, the event was a success and left a lasting impression on all attendees, reiterating the importance of promoting a tax-literate and responsible society through the AES approach.

© 2023 UNIVERSITI TUNKU ABDUL RAHMAN DU012(A).

Wholly owned by UTAR Education Foundation (200201010564(578227-M)) LEGAL STATEMENT TERM OF USAGE PRIVACY NOTICE