Introduction to e-invoicing in Malaysia

Technology advancement has transformed traditional practices in the dynamic realm of business. To foster the development of the digital economy and improve the efficiency of Malaysia’s tax administration management, Electronic invoicing (e-invoice) has been introduced as one of the strategic thrusts for digital transformation in taxation.

In conjunction with the e-invoice implementation, the Department of Commerce and Accountancy of the Faculty of Business and Finance (FBF), UTAR together with the Malaysian Association of Company Secretaries (MACS) brewed up an insightful talk, titled “Digital billing revolution— An introduction to e-invoicing in Malaysia” on 27 June 2024 with 75 internal and external participants.

Course leader, Dr Annie Ng Cheng San kick-started the event with a welcome speech, highlighting the talk’s significance in raising e-invoice awareness and readiness. She explained “Malaysia is gradually introducing the e-invoicing and making it mandatory for all firms, regardless of turnover, starting in July 2025 to strengthen Malaysia’s tax system. E-invoicing promotes operational effectiveness as well as the accuracy and efficiency of tax reporting. Hence, ensuring the readiness and awareness of stakeholders about the implementation of e-invoicing is crucial. It was against this backdrop that the talk was organised.”

The talk was delivered by Mr Low Mun Yao, who has been a registered Chartered Accountant under the Malaysia Institution of Accountants (MIA) since the year 2014. He is an expert in accounting software and is recognised as a leading dealer in Malaysia. Consistently, he has ranked among Malaysia’s Top 10 Autocount Dealers since the year 2019 and was the winner of the Emerging Eagle Award in the year 2022.

Later, Department of Commerce and Accountancy Head Ms Sonia Johanthan and Mr Phan Ooi Tong from Phan Management Services presented the appreciation token to Mr Low.

Ms Sonia (left) and Mr Phan (right photo, third from right) presenting souvenirs to Mr Low

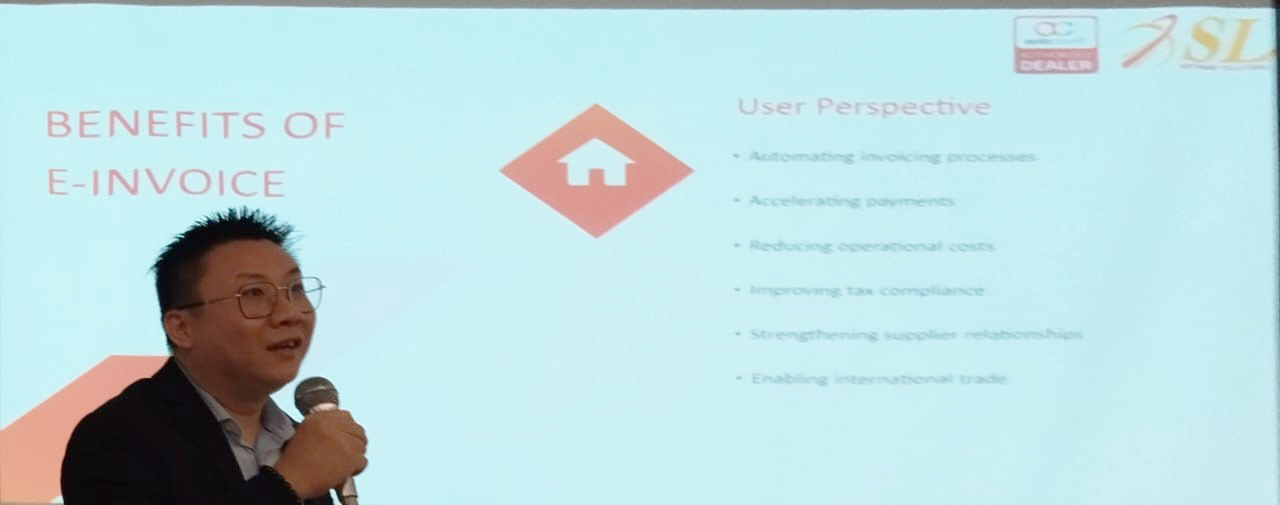

Mr Low began his talk by emphasising the significance and benefits of e-invoices. He explained that the implementation of e-invoice aims to unify the invoicing process by streamlining the document creation and submission electronically to the Inland Revenue Board Malaysia (IRBM). It aids in enhancing the transparency of the invoicing process and the accuracy of information transmission. Furthermore, he shared the overview of the e-invoice flow and the types of e-invoice available in Malaysia.

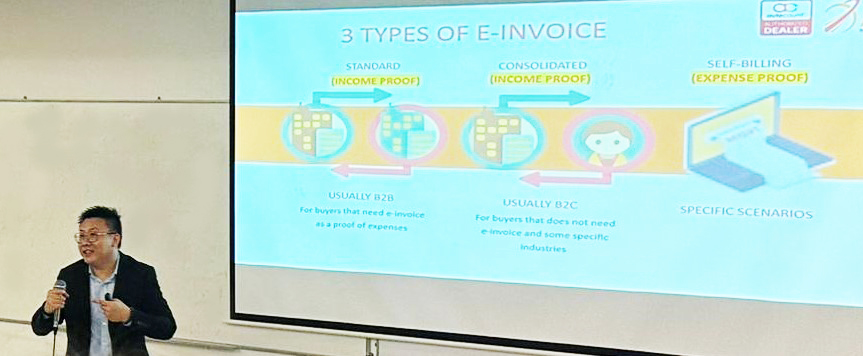

Additionally, Mr Low enlightened the participants on three different types of e-invoice, namely standard e-invoice, consolidated e-invoice and self-billing e-invoice.

Mr Low sharing important notes on e-invoice mechanism

Lastly, Mr Low concluded the talk by discussing the challenges of e-invoices and offences for failing to comply with e-invoices. The insightful talk ended with a Q&A session.

A memorable group photo concluded the talk

© 2024 UNIVERSITI TUNKU ABDUL RAHMAN DU012(A).

Wholly owned by UTAR Education Foundation (200201010564(578227-M)) LEGAL STATEMENT TERM OF USAGE PRIVACY NOTICE