![]()

![]()

A group photo marking the successful conclusion

of the talk

On 11 September 2024, the Centre for Entrepreneurial Sustainability (CENTS),

together with the Faculty of Accountancy and Management (FAM) Department of

Finance and the Financial and Technology Society, jointly organised a talk

titled Investment Thought Process: Case Study on How AI/ Data Centre Drives

Investment Opportunities in Malaysia at UTAR Sungai Long Campus.

The talk featured Mr Chan Wai Loon,

Portfolio Manager of UOB Asset Management (Malaysia) Berhad. An

engineer-turned-investment professional, Mr Chan is currently actively

involved in managing ASEAN portfolios at UOB Asset Management (UOBAM). The

talk aimed to raise awareness of the transformative influence of AI in

driving new investment opportunities. It also aimed to share an industry

expert’s view and analysis of Malaysia and other ASEAN markets and identify

some sustainable investment opportunities with unit trusts.

Mr Chan Wai Loon

In his talk, Mr Chan provided a comprehensive overview of the general

investment approach, emphasising the growing demand for data centres in the

ASEAN region. He mentioned that power availability, land availability, and

domestic market size are the most critical factors for data centre site

selection, according to the Cushman & Wakefield, due to their impact on

operational efficiency, reliability, and scalability. “Singapore and

Malaysia stand out as the best locations for data centre construction in

Southeast Asia due to their robust power and telecom infrastructure,” said

Mr Chan as he explained why Malaysia is compelling for data centres.

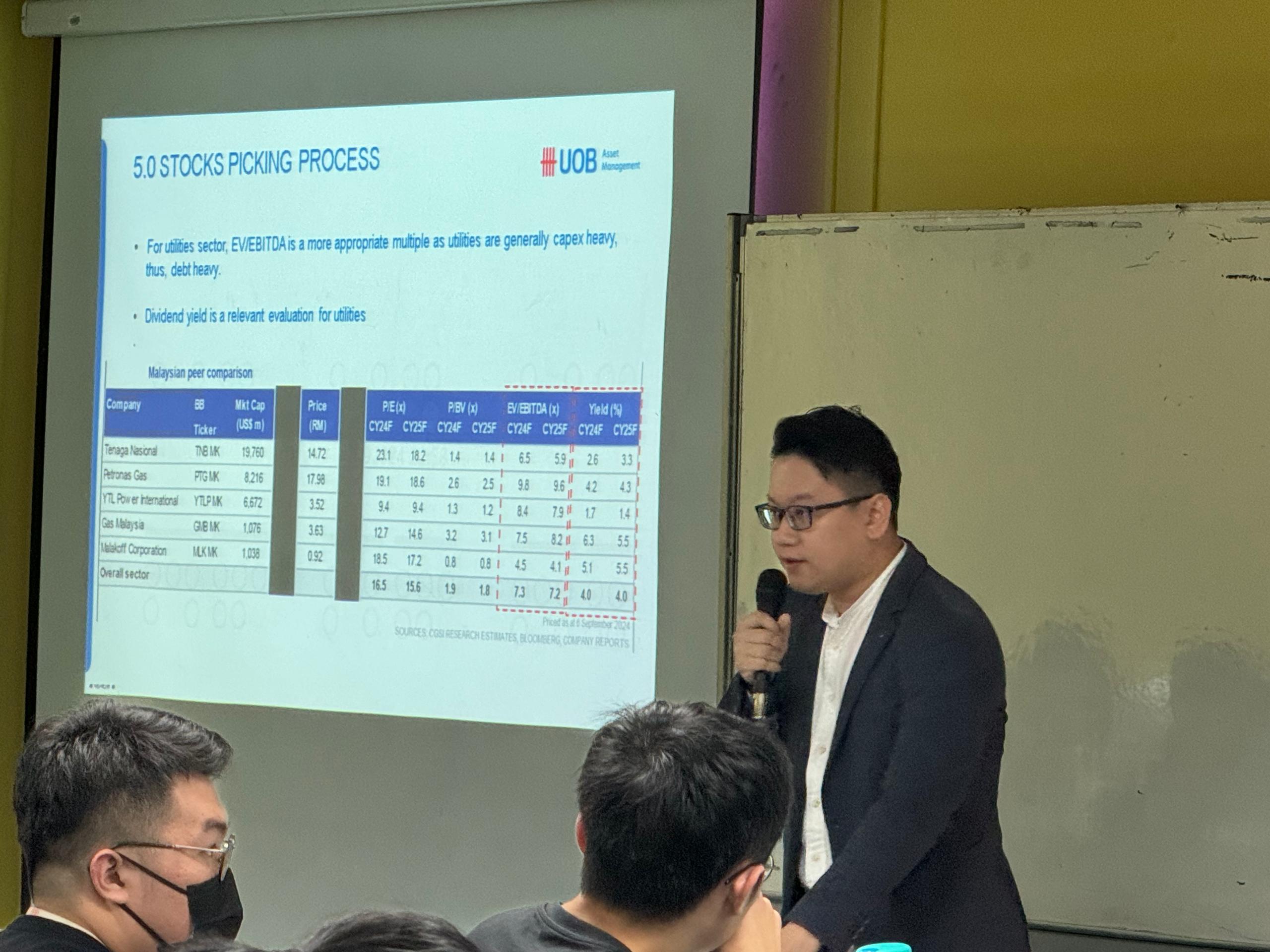

Mr Chan sharing the stocks picking process

Mr Chan also highlighted the sectors benefiting from data centre investment

and detailed the stock-picking processes used to identify promising

opportunities in this evolving market.

He concluded, “Investment is very dynamic. There is no fixed method but

appropriate methods. We need to use logical thinking to make sense of an

investment. In the case of data centre investments in Malaysia, driven by

global demand, especially from the US for large language models (LLM), we

will see an increase in AI spending. This spending will spill over into

Malaysia, and as investments grow, it will benefit related local players.”

The talk ended with an interactive Q&A session and a group photo session.

FAM Department of Finance Head

Dr Lim Boon Keong (left) presenting a token of

appreciation to Mr Chan

Students listening attentively to Mr

Chan

A student posing a question during the Q&A session

© 2023 UNIVERSITI TUNKU ABDUL RAHMAN DU012(A).

Wholly owned by UTAR Education Foundation (200201010564(578227-M)) LEGAL

STATEMENT TERM

OF USAGE PRIVACY

NOTICE