The Centre for Accounting, Banking and Finance (CABF), in collaboration with the Department of Banking and Risk Management under the Teh Hong Piow Faculty of Business and Finance (THP FBF), organised a talk titled Media and Corporate Bond Momentum at UTAR Kampar Campus on 26 August 2025. The event began with a group photo session, followed by an engaging session with the speaker, Dr Wang Junbo, Head of Finance in the Department of Economics and Finance, City University of Hong Kong.

Dr Wang is a renowned scholar in financial markets, asset pricing, and corporate finance, with research widely published in leading international journals. His insights are highly regarded in both academic and industry circles.

Dr Wang introduced the concept of momentum, first highlighted by Jegadeesh and Titman (1993), which describes the tendency of past winners—assets with strong past performance—to continue performing well, while past losers tend to underperform. While momentum has been extensively studied in equities, currencies, and commodities, its presence in the corporate bond market has received relatively limited attention.

He explained that momentum is considered a prominent anomaly in financial economics, often challenging traditional risk-based explanations. Behavioural finance provides valuable insights into this phenomenon: investor underreaction to information can delay price adjustments, whereas overreaction, driven by overconfidence and biased judgments, can lead to exaggerated price swings.

Building on this, Dr Wang shared his latest research examining how business media influences corporate bond momentum. He highlighted that the media not only disseminates information but also shapes investor perception, attention, and trading behaviour. Firms receiving greater media coverage often experience stronger momentum effects in the bond market.

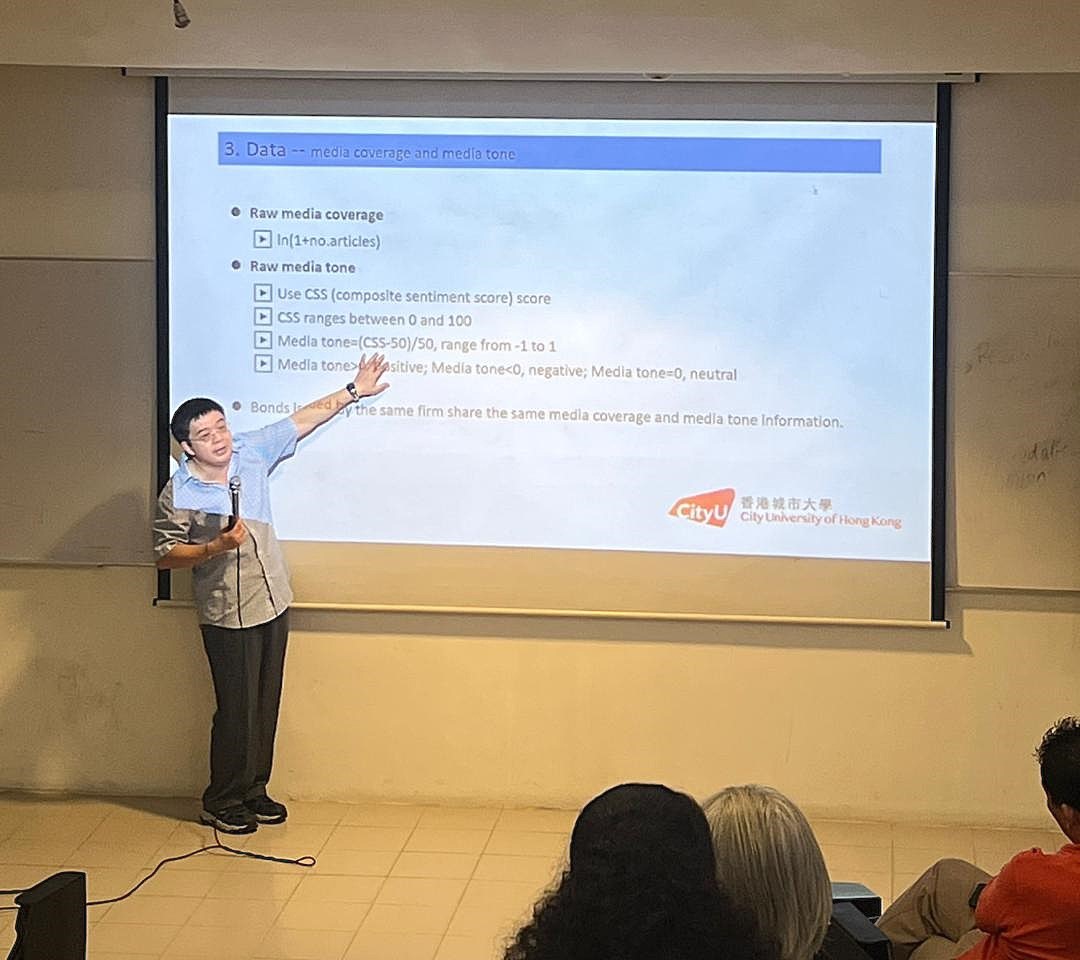

Using a dataset spanning 2000 to 2020, covering over 144,000 bond-month observations from 979 firms, the study showed that both media coverage and media tone significantly affect bond returns. Bonds of firms with higher residual media coverage exhibit stronger momentum, which eventually reverses in the long term, supporting the theory of investor overreaction. The tone of media articles, positive or negative, also amplifies these effects, reinforcing the behavioural explanation behind bond momentum.

The findings carry both practical and academic implications. For practitioners, understanding media influence on bond pricing can enhance investment strategies and risk management. For academics, the research contributes novel evidence to momentum literature, extending behavioural finance insights to the corporate bond domain.

Dr Wang also highlighted robustness checks across market states, bond ratings, and media types. Full-length articles generated stronger market reactions compared to short news flashes or press releases, underscoring the importance of credible and detailed information in shaping investor behaviour.

The talk attracted academics, researchers, and students from across the faculty, sparking lively discussions during the Q&A session. Participants praised Dr Wang for presenting complex econometric findings in a clear and engaging manner.

The event underscored UTAR THP FBF’s commitment to advancing scholarly exchange and promoting research at the frontier of finance. The faculty looks forward to further collaborations with distinguished scholars like Dr Wang, whose work bridges theory and practice in meaningful ways.

Dr Wang Junbo sharing his insights on media influence in corporate bond momentum

© 2025 UNIVERSITI TUNKU ABDUL RAHMAN DU012(A).

Wholly owned by UTAR Education Foundation (200201010564(578227-M)) LEGAL STATEMENT TERM OF USAGE PRIVACY NOTICE