Actuary Today town hall meetings educate students on various informational topics

The technical team presenting the slides

From 4 to 6 October and 11 to 13 October 2020, the UTAR Actuarial Science Society organised the Actuary Today event, whereby programmes such as talks, workshops and townhall meetings took place. Overall, two townhall meetings were conducted across the few days, where several speakers were invited to have various discussions on specific topics with the participants. The first town hall meeting session was held on 6 August 2020 via Microsoft Teams, with the webinar revolving around the topic “Possibilities for Actuarial Science Students”.

Speaking at the first session were three knowledgeable and significant people in the world of Actuary Science. The first speaker was Institute and Faculty of Actuaries South-East Asia Representative (IFoA) Caryn Chua, while the second speaker was Hong Kong Federation of Insurers’ Life Insurance Council Member Simon Lam. The final speaker was President of the Actuarial Society of Malaysia (ASM) Sophia Ch’ng, and moderating the session was Actuarial Science student Kusaaliny Mahendran. The three speakers spoke about the same topic from their own perspectives, making the meeting even more insightful and enlightening.

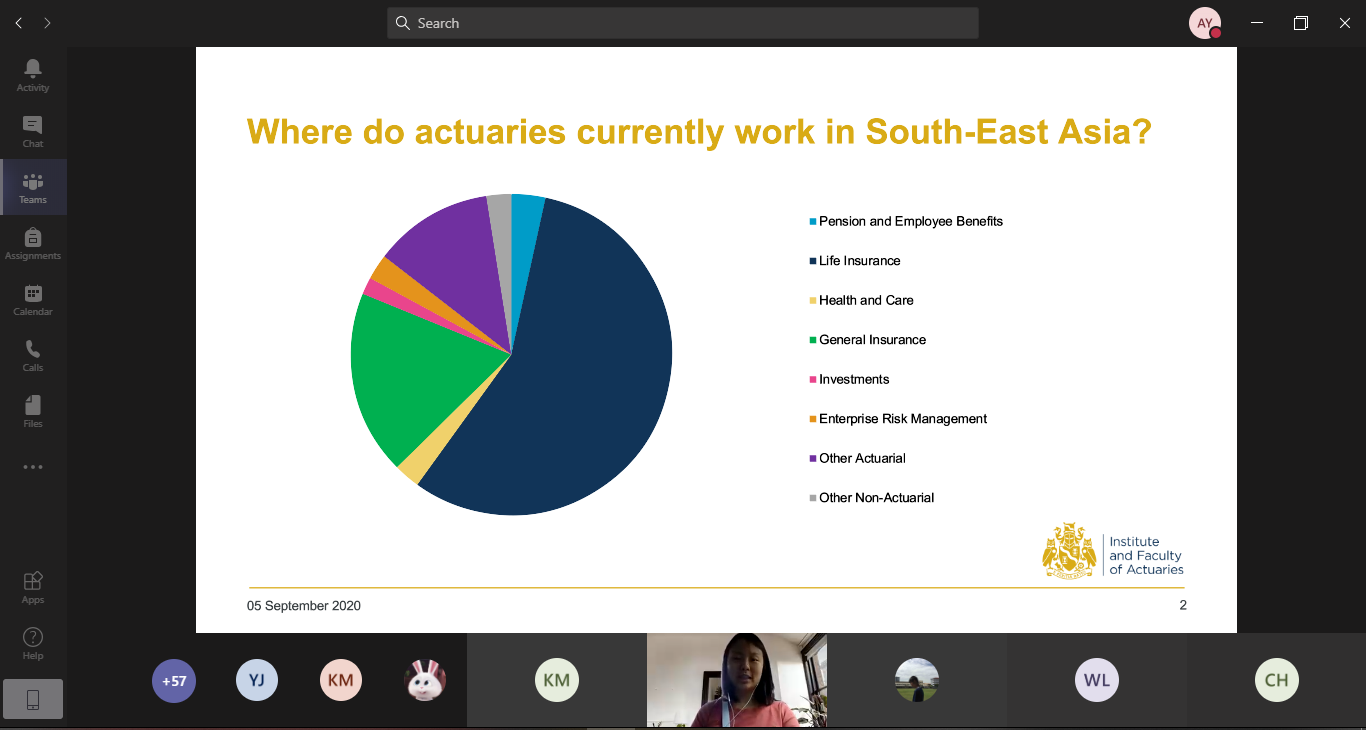

Caryn Chua began the session by speaking about the various sectors in which Actuarial Science students can venture into after graduating, including the current and new fields in South-East Asia. “Unsurprisingly, a lot of actuaries work in the life insurance and general insurance sectors, which is the most common fields to go into for Actuarial Science graduates. In particular, the life insurance sector has seen a growth in actuaries due to the Covid-19 pandemic; many people are looking for health and life insurances to prepare for the worst. There are also a number of new fields for Actuarial Science students to consider, such as asset management, banking, climate change and microinsurance,” said Caryn Chua, when explaining some of the areas of interest for an actuarial science student. After running a quick poll to see the participants’ preferred fields, she ended her part by introducing the IFoA’s new data science certificate.

Caryn Chua explaining the actuarial sectors in Malaysia

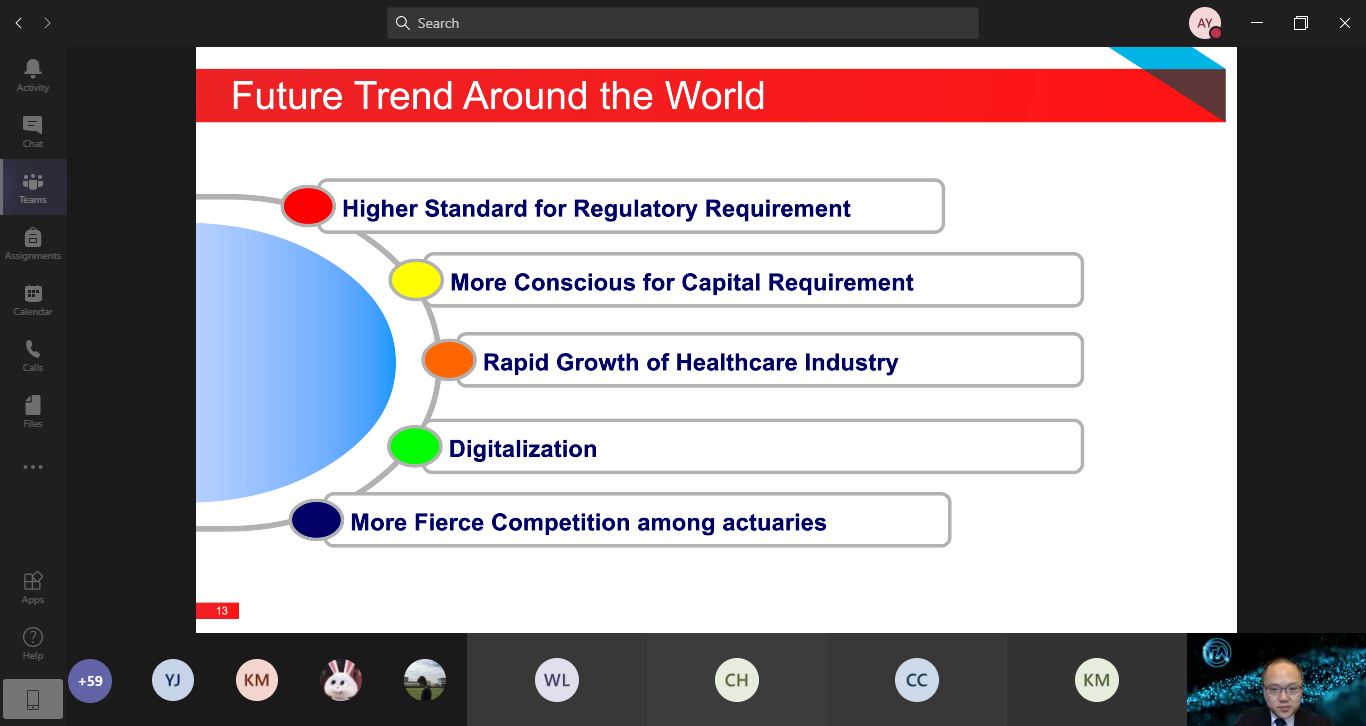

Simon Lam took the virtual stage next by focusing on a two-part agenda; the future trend actuarial science industry around the world and “how to catch the wave”. He explained on the former first, stating, “There is a higher standard for regulatory requirement in the industry from various perspectives, such as Solvency II, IFRS, ICP and other laws and regulatory standards. Another rising trend is that insurers are also much more conscious of capital requirement ever since the previous global financial crises. Not just that, the healthcare industry has been increasing non-stop, due to the growth of the global ageing population, which in turn increases the need for health insurance.” He added, “Since we are talking about ‘future trends’, then it would be no secret that digitalisation is considered as one. In the time to come, loads of insurance products will be sold through e-channels, and most of the work done in the actuarial science industry will be completed through technology, as there is a large need for digitalisation in most industries. Lastly, competition among actuaries will be increasingly intense, and as a result, each actuary needs to be distinct and stand out from their competitors with their own unique competitive edge.” Simon Lam also noted the ways Actuarial Science students can adapt and adjust to these new digital trends, quoting it as “catching the wave”. He finally concluded his part by advising the participants to combine their strengths and the opportunities they have to develop their unique proposition which will help them in the industry once they graduate.

Simon Lam speaking about future trends in the industry

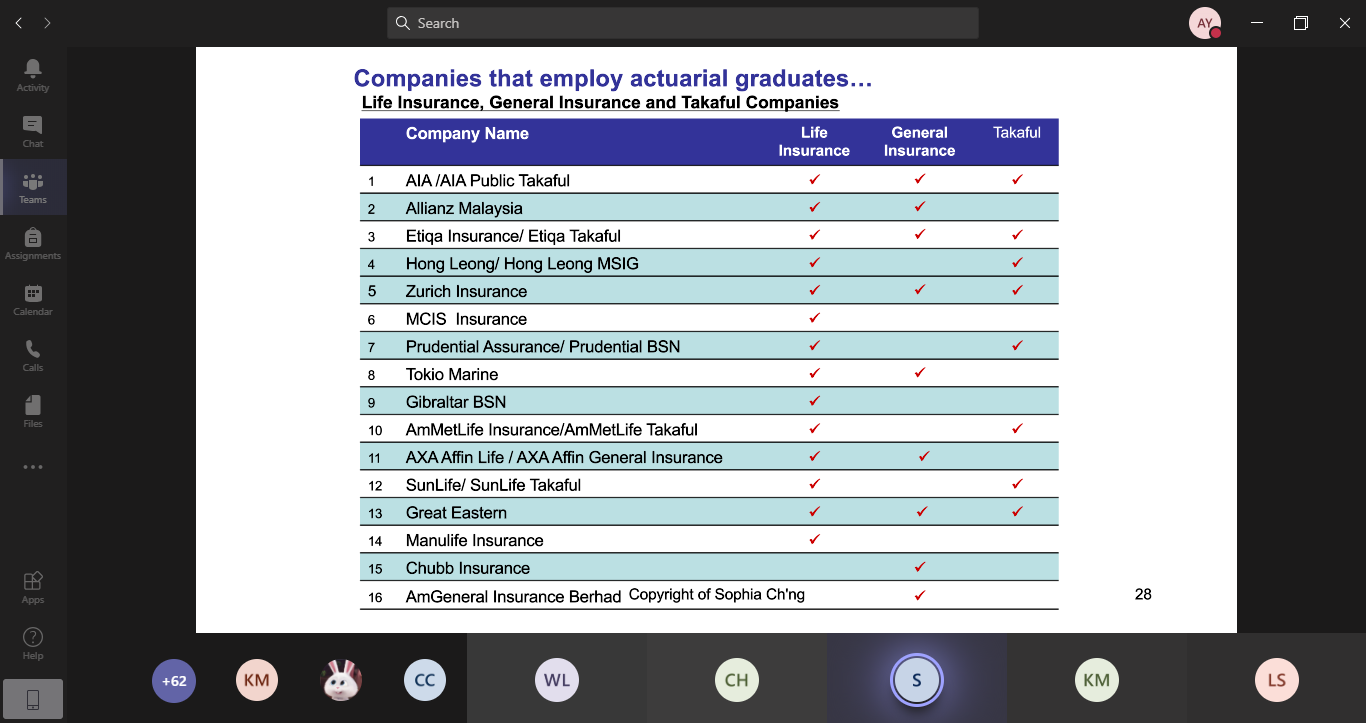

The third speaker, Sophia Ch’ng emphasised on the career options available to the participants, however, she took a different perspective, in which, she shared about some companies that are currently hiring actuarial graduates. After briefly giving the participants a glimpse of her past careers such as her credentials and her previous jobs, she showed a list of companies that are currently employing actuarial graduates. Among the list of companies were life insurance, general insurance and Takaful companies, reinsurance and retakaful companies. There were actuarial consulting firms and audit firms with actuarial practices as well, and by showing a list of all these types of companies, she enlightened the participants on the type of and the specific companies they can join once they graduate. Moving on, she spoke on the new job opportunities available in the Actuarial Science industry, and she finally ended her part by advising the participants on the key steps to nail an interview, should they be keen on pursuing a professional actuarial career.

The talk wrapped up with a brief Q&A session.

Some of the companies that are hiring actuarial graduates

Sophia Ch’ng (Second row, middle), Simon Ang (Second row, far right) and Caryn Chua (Third row, far left) with the participants

The meeting’s speakers and moderator

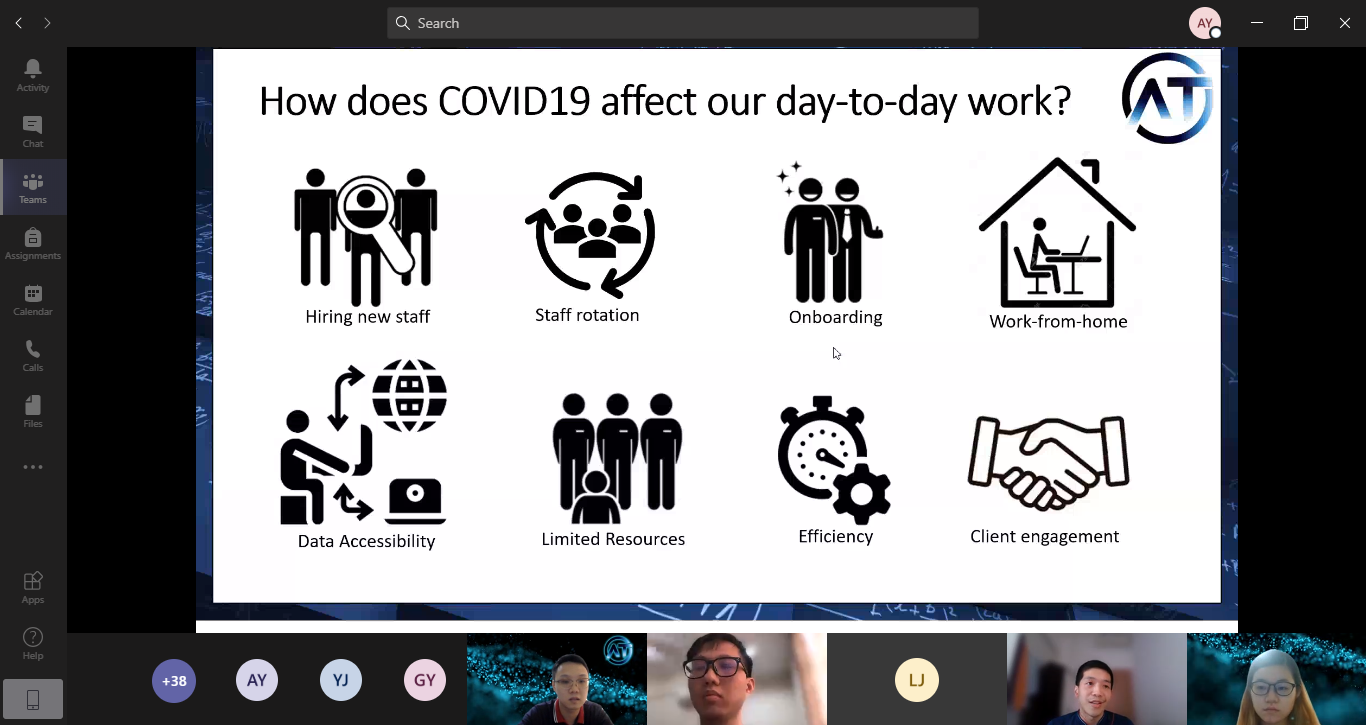

Across the globe, the Covid-19 pandemic has affected every existing industry and the Actuarial industry was not an exception. Yet, the questions lingering in an actuary’s mind remain unanswered; to what extent is the industry affected and what does the future hold for the industry? Thus, to resolve this question, the second town hall meeting for the Actuary Today event titled “Impact of Covid-19 towards Actuarial Industry” was held on 13 September 2020 via Microsoft Teams.

The talk was moderated by Sompo Holdings Asia Senior Actuarial Analyst Audrey Loh, while there were three speakers at the event; Regional P&C Swiss Re Asia Innovation Manager Alston Yong, Hong Leong MSIG Takaful Berhad (HLMT) Assistant Manager Dennis Tan and Peak Re Hong Kong Senior Associate in Reserving Team Raymond Hii. The talk was conducted in an unconventional pattern, where the three speakers shared their opinions by answering the participants’ questions on topics surrounding the title of the workshop.

There was an abundance of questions directed to the speakers. One question that the three speakers took turns to answer was “How has Covid-19 affected our day-to-day work?”. Alston Yong mentioned that due to the pandemic, employees from every company has been forced to work from home. Whilst this has helped them to be in a relaxed environment, it also had its own issues, such as unstable Internet connectivity. Dennis Tan and Raymond Hii added their own points as they shared about the challenges of limited resources and staff rotation. “During the Recovery Movement Control Order (RMCO), most companies had a staff rotation system in place, like two employees enter the office each day while the rest work from home. This was certainly useful, however, it was difficult for us to get used to it at first. Moreover, there is the problem of limited resources. For example, some companies allow their employees to borrow the companies’ laptops, however, there might not be enough laptops to give away for everyone to use especially during the MCO,” they explained.

The speakers answering one of the questions

Another question that they resolved was “What are some of the reputational risks that insurance companies could face in the future?”. For this particular inquiry, the three speakers agreed on the same four risks that might impact an insurance company’s image, which are, the rejection or delaying of claims payment, policy wordings, product innovation and fraudulent claims. Alston Yong, Dennis Tan and Raymond Hii all concurred that the first risk, rejection and delaying of claims payment can greatly affect operations and reputation at the same time. Meanwhile, for policy wordings, they noted, “It refers to the fact that most insurance policies do not include “pandemic” as part of their coverage. Nevertheless, during the outbreak, these insurance companies gave the insurance regardless of the exclusion of the word in the contract, as a sign of goodwill. From the perspective of a life & health insurance company, this is a great opportunity for them to build up reputation, as it shows that they care for their customers.” They added that fake claims might become increasingly prevalent especially in travel and general insurance which too can disrupt business operations and negatively impact the company’s reputation.

The meeting continued for the next two hours with the three speakers answering many more questions from the participants and the moderator herself. The session ended with a group photo session.

First row, far left & middle: Dennis Tan & Audrey Loh; Second row, far left & middle; Raymond Hii & Alston Yong

© 2020 UNIVERSITI TUNKU ABDUL RAHMAN DU012(A).

Wholly owned by UTAR Education Foundation Co. No. 578227-M LEGAL STATEMENT TERM OF USAGE PRIVACY NOTICE