Probing into the world of Actuaries with Actuary Today

UTAR Actuarial Science Society held an event titled “Virtual Actuary Today” which were spread across two sessions, from 4 to 6 October 2020 and 11 to 13 October 2020. For the event, three talks, featuring different topics took place. The purpose of these talks was to enhance the participants’ knowledge about Actuarial Science and provide an opportunity for them to understand the application of Actuarial Science knowledge in a working environment. The first talk titled “Journey of an Actuary” was held on 5 September 2020 via Microsoft Teams. The talk was given by former President of both Life Insurance Association of Malaysia (LIAM) and Malaysian Financial Planner Council (MFPC) Ng Lian Lu. The talk mainly centred on Ng’s journey of becoming an actuary.

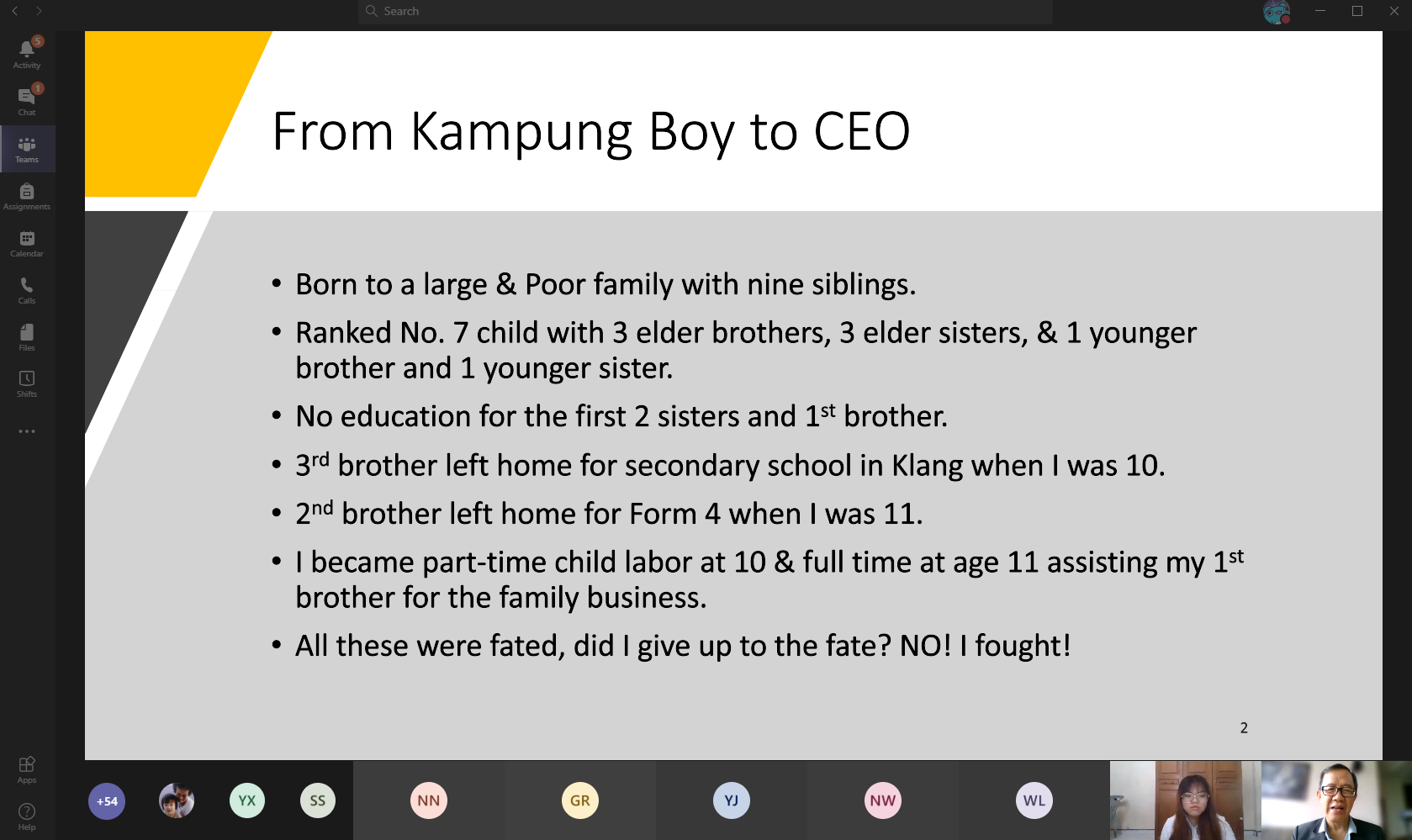

Ng shared the experiences and obstacles he faced while growing up, which were all outlined in detail in his book titled “From Kampung Boy to CEO” that depicted his journey of becoming a CEO. He explained some of the challenges and obstacles he persevered throughout his life, and also how he overcame all of them, chapter by chapter. “I was born in a large but poor family with nine siblings. I was the seventh child among three elder brothers and sisters, and I had one younger brother and one younger sister. So obviously, my family was constantly down with financial problems, as there were too many mouths to feed. This was why, while growing up, I was already working part-time to help my family make ends meet. To make matters worse, I was born with a respiratory problem where I had excessive mucus. Hence, I had the constant urge to cough. It was so bad that at times, I could not even focus on my studies,” said Ng.

Ng also noted that in his early school days, he was not the brightest, as he often got low marks in his exams. He particularly had trouble communicating due to his poor language skills, and it proved to be costly since it became an obstacle for him especially in his higher education and career building. He mentioned how he overcame this, quoting, “I decided to take matters into my own hands to be better at communicating and writing. I took up a part-time job while studying in the university, and at the same time, continued to polish my skills, and these have greatly improved my language skills. I did not give up; I recognised my shortcomings and worked hard. I did everything I could to become more proficient in writing and speaking.” In the end, all of Ng’s efforts paid off when he eventually rose to become the president of various companies.

During the talk, Ng also shared his motivations to become successful, and why he never faltered despite all the setbacks he faced. “My desire to succeed, to be valued and loved by the people that I care about pushed me to advance my studies and rise in the corporate world. My biggest motivation, however, was my parents. To see them being happy, proud and excited for me really pushed me to want to succeed in life. I did not want to let them down. Even though I have seen and experienced worse things than my siblings, I wanted to make something out of my life, so that my parents could be proud of me,” said Ng. Throughout the talk, he constantly dispensed life advice to the participants. The advice includes learning how to be motivated, recognising own strengths and weaknesses, learning how to combat fear, and other inspiring and handy advice.

Ng sharing his childhood experience

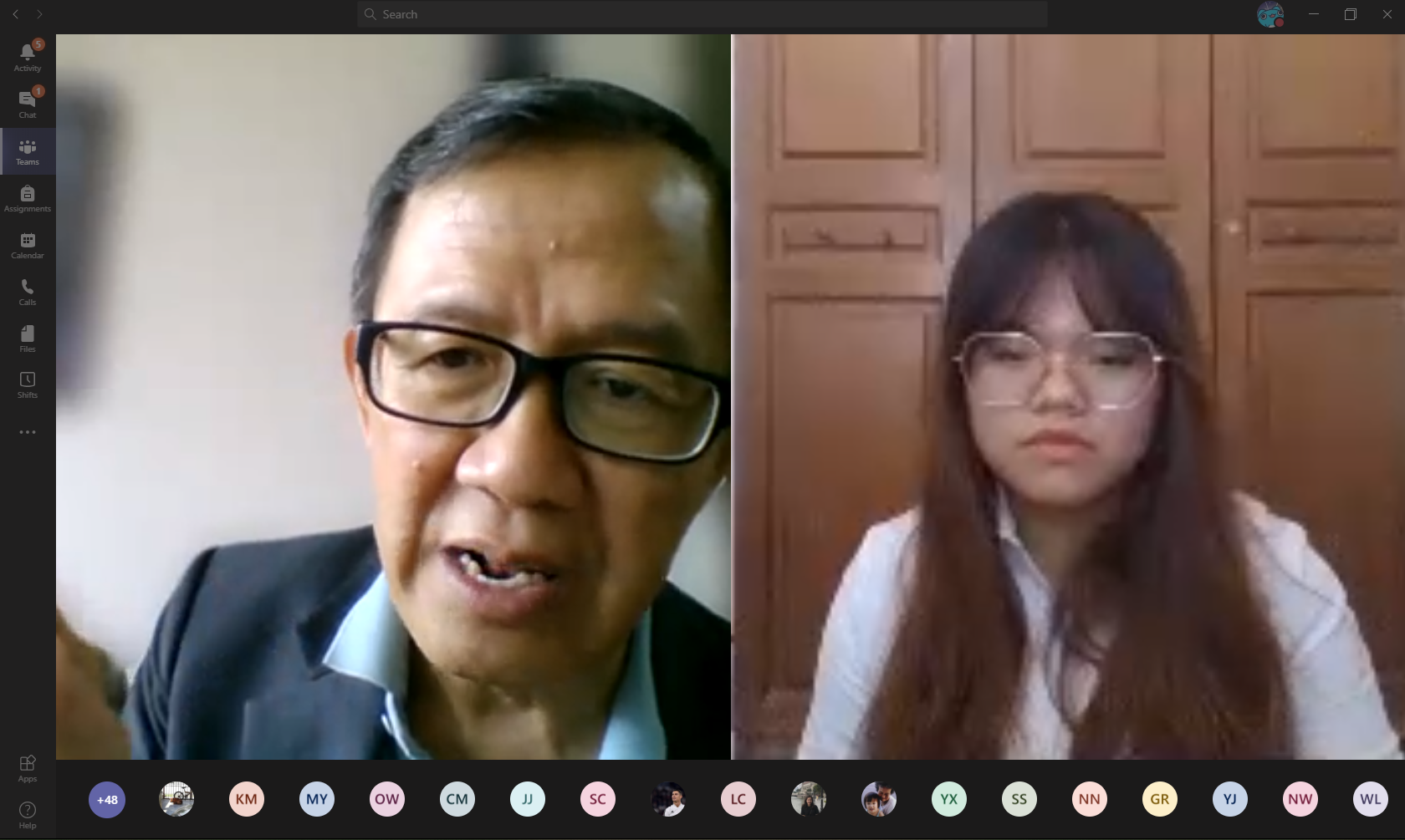

First row, second from left: Ng, with the other participants

A lucky draw session was also held

An insightful Q&A session in progress

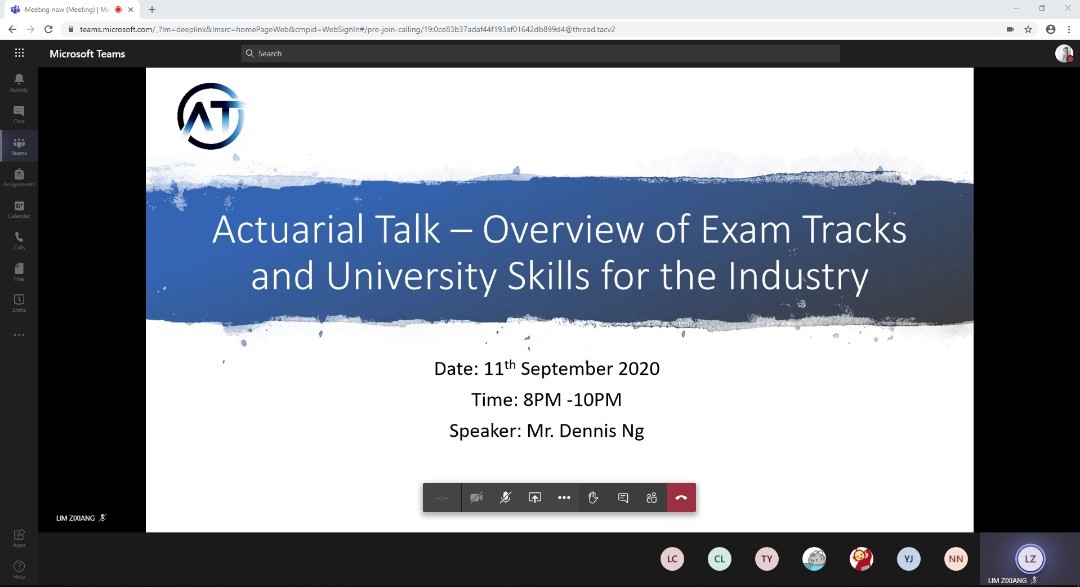

The second talk was titled “Actuarial Talk- Overview of Exam Tracks and University Skills for the Industry”. It took place on 11 September 2020 via Microsoft Teams. It was given by Hong Leong Assurance Actuarial Executive Dennis Ng, who was also a former UTAR lecturer. As its title suggests, the talk’s pivot was to provide an overview of exam tracks and skills that have to be trained and conducted in the university. There were a total of 131 participants who attended the talk.

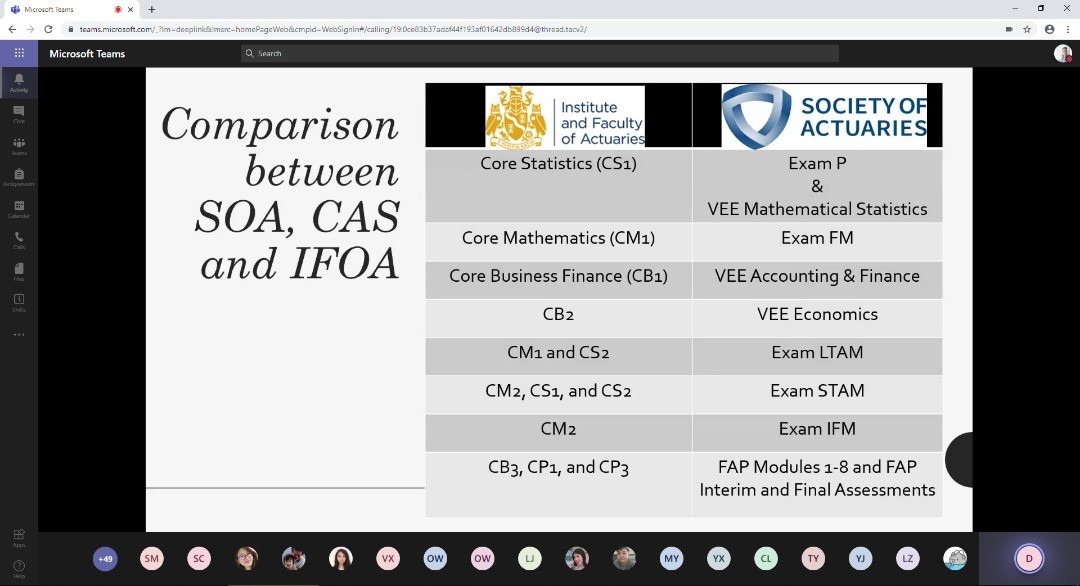

Dennis Ng listed the three main global actuarial societies, namely Society of Actuaries (SOA; US), Casualty Actuarial Society (CAS; US) and the Institute and Faculty of Actuaries (IFOA; UK). He compared the difference between these three societies in terms of their subjects and exams. From there, he moved on to explain the three pathways that a student may consider to become an actuary. According to him, the three pathways are the Associate of Society of Actuaries (ASA) pathway, the Fellow of the Society of Actuaries (FSA) pathway and the Casualty Actuarial Society (CAS) pathway. The ASA pathway is meant for people who want to become an associate of SOA, whereas those who want to become a fellow of SOA, need to take the FSA pathway. Meanwhile, students taking the CAS pathway are most likely aiming to become an associate or fellow of CAS.

He then explained about the actuarial science exams in detail. Regardless of the pathway one takes, they generally have to sit for the same five types of exam. He said, “There are five main exams for actuarial science. Firstly, there are fundamental exams which are Probability and Financial Mathematics exams. The former as the name implies, centres around probability and theoretical statistics, whereas the latter concentrates on cash flow with interest. Next comes the Data Analysis exam that has three major areas of focus which are linear regression, predictive modelling, and time series and forecasting. Another main exam is the Accounting exam that basically tests students on a series of topics such as balance sheets, profit and loss accounts, and cash flows.” He added, “The penultimate exam is the Finance exam which is quite similar to the Accounting exam. It focuses on financial topics, including investment performance, portfolio management and bonds, equities, shares and interest rates. Last but not least, the Economics exam is one of the main exams that an actuary has to undertake. It focuses on macroeconomics and microeconomics topics.”

Finally, Dennis Ng also mentioned the skills that the students should pick up in the university, some of which are finance terminology, programming and communication. He also advised the participants on the importance of having the right attitude, which includes discipline, responsibility, honesty and eager to learn. Besides that, Dennis Ng also shared some other information during the talk, such as actuarial careers, the types of insurance and other comparisons between SOA, CAS and IFOA.

Dennis Ng presenting his slides

Dennis Ng introducing the Global Actuarial Societies to the participants

Dennis Ng explaining the comparison between SOA, CAS and IFOA

First row, far left: Dennis Ng with the participants

The third and final talk, dubbed “Artificial Intelligence VS Actuary talk”, was held on 12 September 2020 on Microsoft Teams. The talk’s focal point mainly revolved around the question— “Is the actuarial industry affected by Artificial Intelligence (AI)?”. Discussing this contemporary topic was Debbie Ooi, who used to work as an actuarial analyst in Nicholas Actuarial Solutions and assisted in the traditional actuarial work such as reserving, pricing and conducting risk management for insurers and takaful operators in Bahrain and Labuan. Currently, she is studying towards attaining a Fellowship of IFOA.

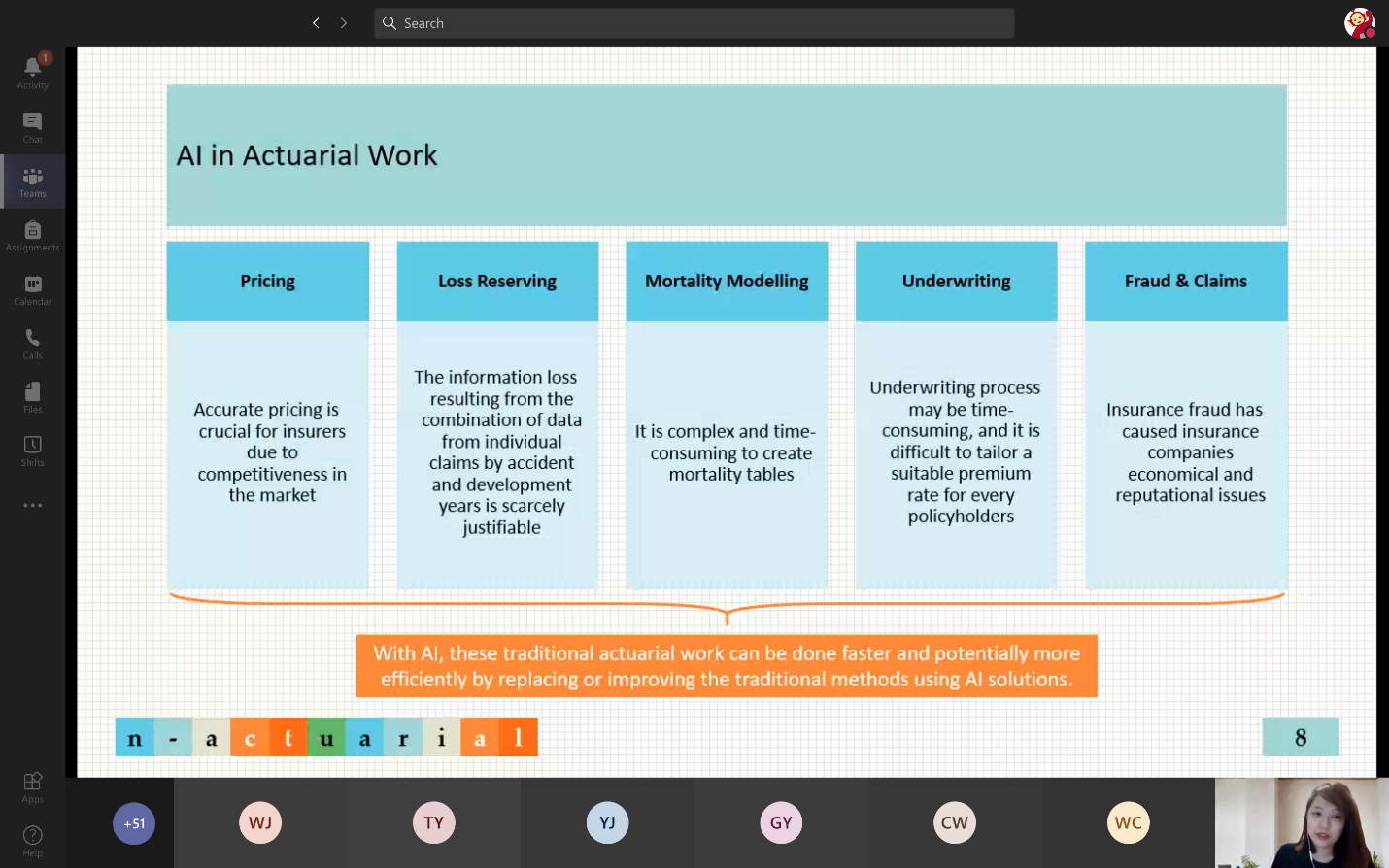

She began the talk by first defining AI as a wide-ranging branch of computer science concerned with building smart machines capable of performing tasks that typically require human intelligence. She then directed the participants’ attention to a question commonly asked in the actuarial industry— How does AI contribute to actuarial work? Answering this question, she said, “AI is able to perform certain specific actuarial tasks that would otherwise be complex and time-consuming if done by a human actuary.” She also mentioned that with AI, traditional actuarial work such as pricing, loss reserving, mortality modelling, underwriting, and fraud and claims can be completed faster and efficiently, by replacing or improving traditional methods with AI solutions.

She went on to explain other areas of interest in regards to the topic of using AI in actuarial work, such as its benefits, drawbacks, the challenges of implementing it into the industry, and the obstacles faced by the human actuaries in using AI. However, one interesting topic that was pointed out by Debbie Ooi was the essential skills required by Actuarial graduates who are interested in the AI field. For this, she said, “An Actuarial graduate needs five skills if they want to venture into the AI field in the actuarial industry. You need to have excellent interpersonal and communication skills, analytical and problem-solving skills, mathematics, research and computer skills.”

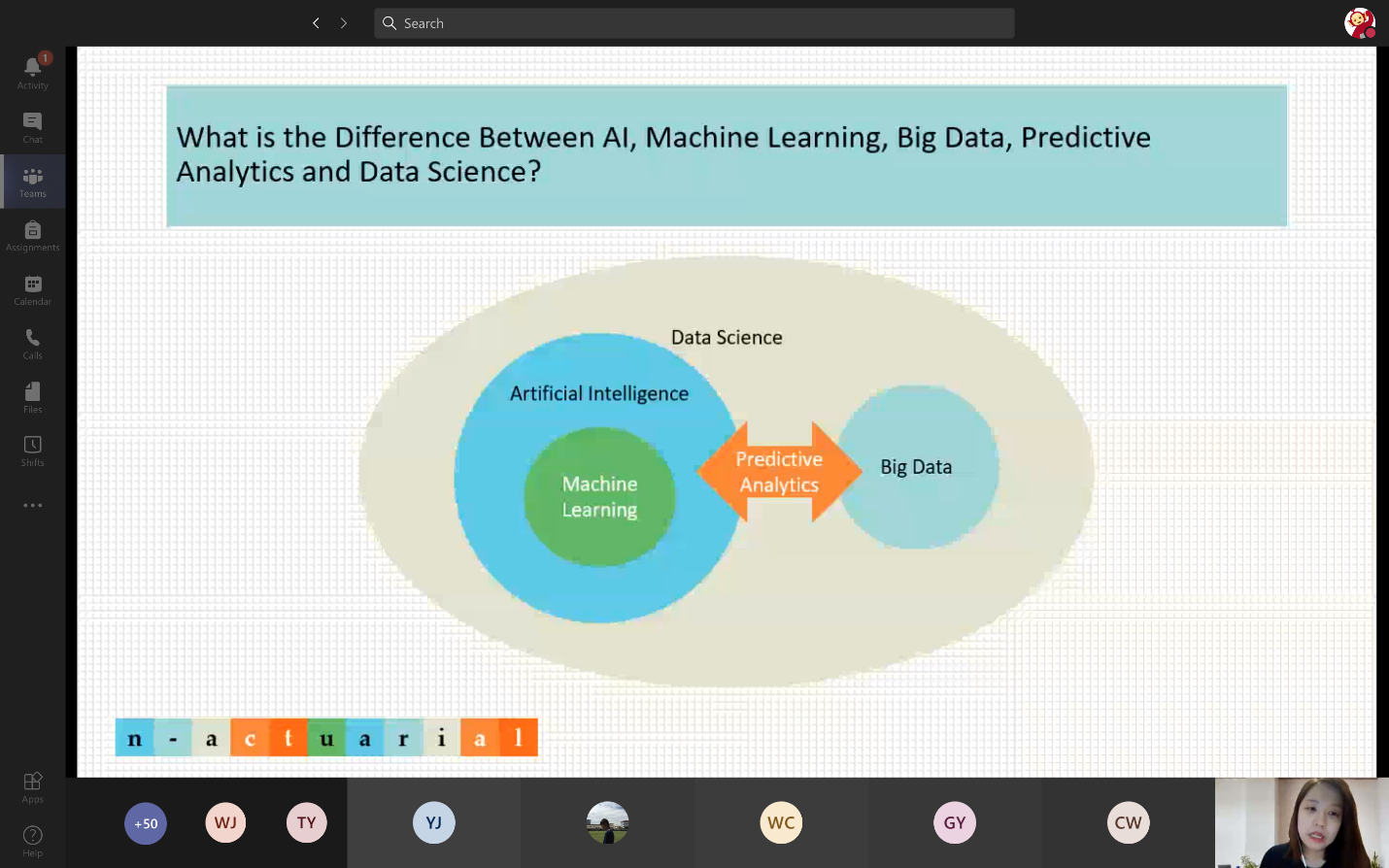

Debbie Ooi spent the final part of the talk explaining the InsurTech industry, which is an amalgam of the word “insurance” and “technology”. “Insurance Technology is a set of innovative business platforms that brings in a new customer experience by applying innovative technologies in the world of insurance. It brings four benefits; it improves customers’ experience, enables human capabilities, increase efficiencies and helps create new products,” said Debbie Ooi when defining InsurTech. She also explained how InsurTech has changed the insurance industry, the types, and the InsurTech industry in Malaysia. Finally, she noted the differences between artificial intelligence, machine learning, big data, predictive analytics and data science.

Each talk wrapped up with a brief Q&A session.

Top row, second from left: Debbie Ooi with participants

Debbie Ooi defining AI

Debbie Ooi explaining the difference between artificial intelligence, machine learning, big data, predictive analytics and data science

Debbie Ooi explaining the role of AI in Actuarial work

Q&A session in progress

To view articles regarding the other Actuary Today programmes, please click Workshops or Townhall Meetings.

© 2020 UNIVERSITI TUNKU ABDUL RAHMAN DU012(A).

Wholly owned by UTAR Education Foundation Co. No. 578227-M LEGAL STATEMENT TERM OF USAGE PRIVACY NOTICE